April Market Review: Unprecedented Moves

At month-end, we will review market moves and macro themes driving them.

April was a dismal month for US equities, with the three major indexes finishing down with new lows for 2022: The S&P 500 -8.8%, DJIA -4.9% and tech-heavy NASDAQ -13.3%. Friday April 29th, the last trading day, was especially bad as DJIA fell more than 900 points and the NASDAQ was down 4% that day alone as AMZN had its steepest one day loss since 2006. A number of headwinds weighed on US equities and market sentiment throughout the month including: high inflation, rising interest rates, the ongoing war between Russia/Ukraine and growth and supply chain worries stemming from the COVID outbreak and lockdowns in China.

On the FX-front: USD had a VERY strong April, and outperformance was most extreme in the final week of the month. JPY continued to weaken dramatically in April, reaching a 20 year low vs USD on April 28th, when USDJPY broke topside 130.00. We are being asked if FX intervention is close in Japan. But we think for now there is little purpose of FX intervention, while YCC is in place. Unusually, USDJPY moved approximately 3% higher in a 24 hour period over April 27th - April 28th. That day, April 28th, EURUSD fell to a 5 year low of 1.0500, propelling the DXY index (as EUR is its largest component) to a 5 year high of 103.67. The drop in EURUSD on Thursday occurred despite a big reversal higher in Eurozone yields. Over the month, EUR received no relief from downward pressure vs USD - not even when Emmanuel Macron won the French presidential election on April 24th, as dramatic CNY weakening continued to dominate the price action (see China section below). EURUSD finished down 4.8% for the month. GBP fell 4.5% vs. USD in April, with its recent low of 1.2452 coming on April 28th as well.

AUD weakened over 6% vs USD on the month but, at the time of writing, is holding above .7000. AUD was negatively impacted by the COVID outbreak in China and lockdowns there to mitigate the spread (see China section below) and risk off sentiment in US equity markets. NZD was also sharply lower vs. USD on the month, falling just over 7% in April. The 50bp rate hike by the RBNZ on April 13th failed to support NZD vs USD as the rate hike was largely priced and the RBNZ did not change its forecasted peak in its policy rate.

The broad dollar’s outperformance (relative to interest rate differentials) accelerated further last week. This marks roughly the 8th week of growing broad dollar strength. Up until the last week or two this outperformance was largely in line with the signal from risk assets, but last week, dollar strength was over and above what one would expect based on the beta to SPX. (see chart below - yellow triangle).

Kicking off May, the market expects a 50bp rate hike by the FOMC, which would be the first 50bp hike since May 2000; an either 15bp or 40bp rate hike by the RBA, and a possible 25bp rate hike by the BoE.

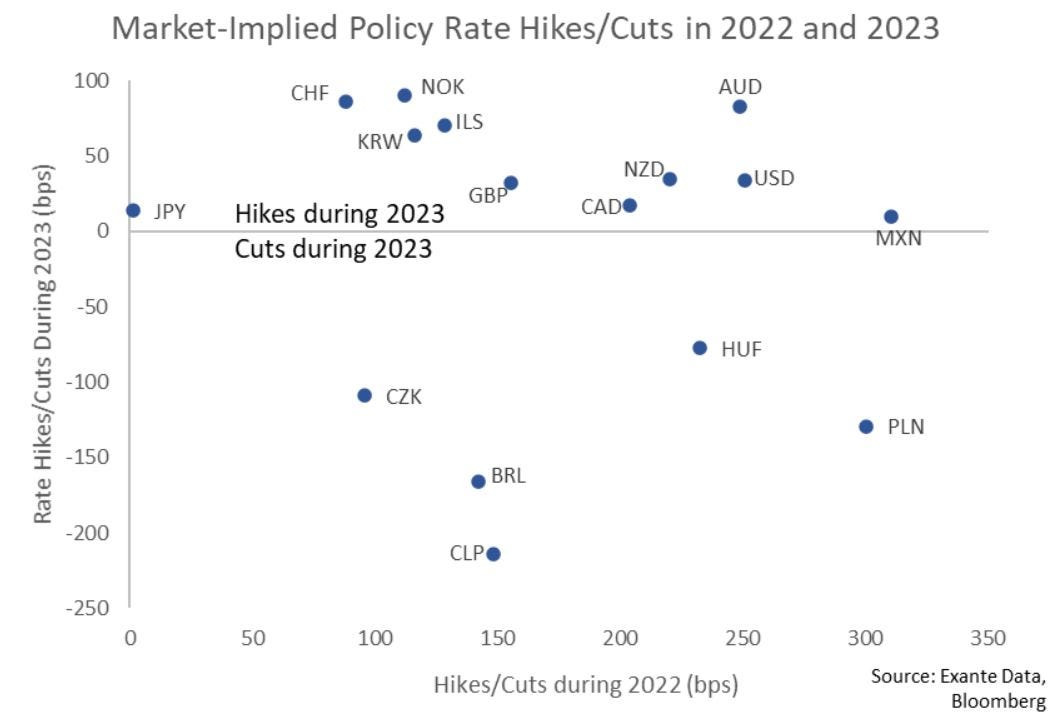

The chart below shows market implied policy rate hikes or cuts in 2022 and 2023 for different economies. While some economies are at the start of their hiking cycles, others are more advanced and market have begun to price cuts next year. See here for how rate hikes have been priced in relatively quickly for the Fed since October 2021.

China: CNY

The Exante Data Team on CNY:

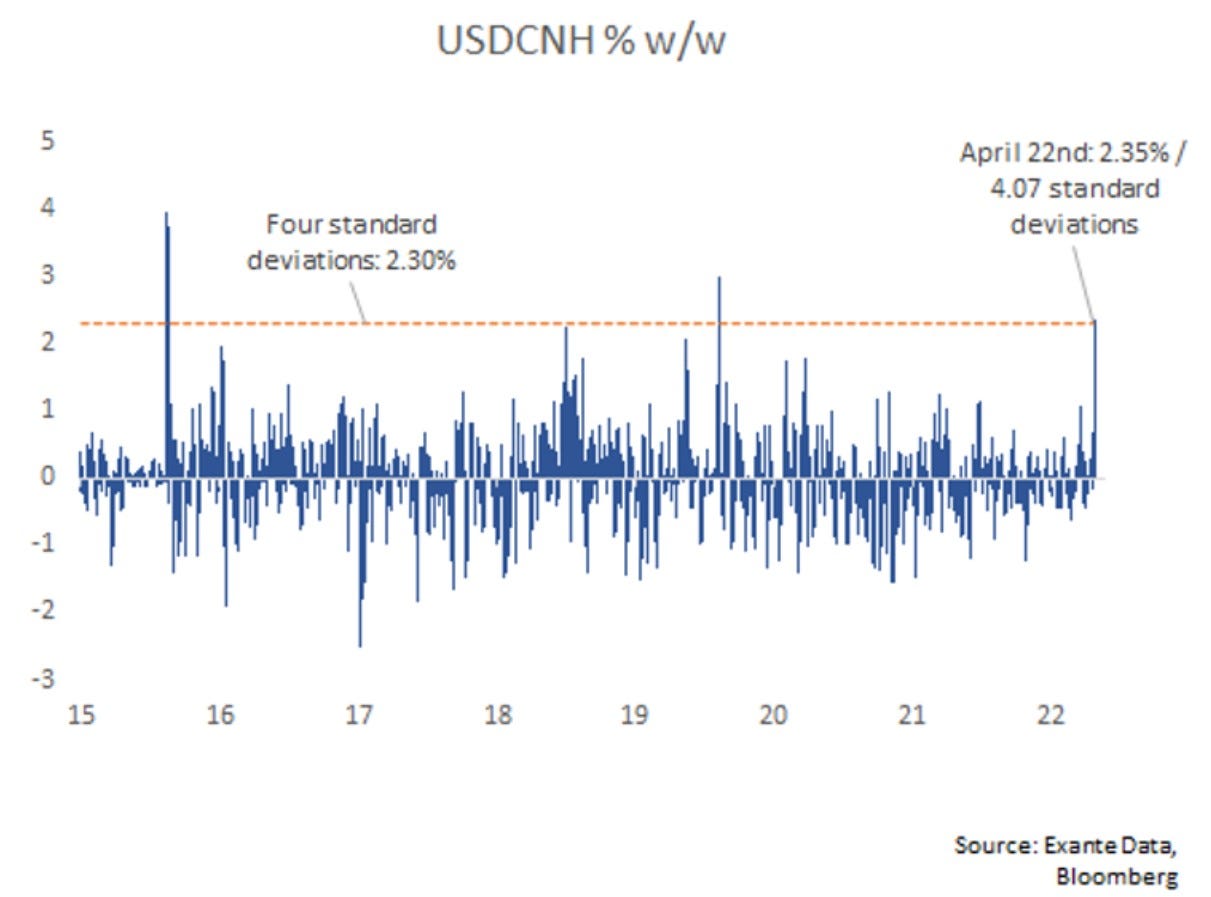

"The CNY weakened dramatically recently (chart below), and authorities seem to be encouraging the move (which is logical in relation to the CNY level vs key trading partners, KRW, JPY, EUR). Under the surface, our intervention analysis suggest that the intervention buffer was exhausted by March, and that further BoP weakness in April is starting to map more directly into CNH weakness. Given that the level of CNY is still firm, we think some addition depreciation will likely be tolerated by the PBOC and we see 6.80 as a realistic trading objective, and one that the PBOC would not be concerned with."

See Founder Jens Nordvig discuss with Bloomberg TV, the dramatic move in CNY here and what CNY level Beijing could be concerned about here.

For a brief history of the Chinese Currency (RMB,CNY,CNH), see this thread by Jens.

Chart: USDCNH % w/w - April 22nd was the largest CNY depreciation since the COVID shock and the 2015 tension

China: COVID

China is currently undergoing its largest COVID outbreak ever. Strategist Martin Lynge Rasmussen has been leading our China COVID coverage and has been focused on mobility.

Notes from Martin: "China's mobility began to decline quickly at the national level towards the end of the week of April 4th. Until then, national mobility had held up relatively well despite the strict lockdowns in Shanghai and Jilin province. On a positive note, new COVID cases in Shanghai appear to be topping out, and most new cases are identified among people in isolation. This may hopefully allow for a slow easing of the city’s lockdown. However, COVID community spread is happening all over China, and authorities have become more aggressive and pre-emptive in implementing lockdowns. As such, our base case is now that China will implement harsh and rolling lockdowns until one or more of three factors lead to a de facto COVID strategy shift: 1/ better treatment options and vaccine immunity, 2/ unpalatable logistical challenges and/or 3/ severe citizen dissatisfaction."

See here for China - Share of GDP by Province (%, April 20th): "Shanghai's COVID19 wave could impact broader Chinese activity and trade further if its outbreak spreads. Zhejiang and Jiangsu provinces, for example, border Shanghai and make up 17% of GDP and 30% of exports."

The chart below shows the significant drop in Shanghai Subway Passenger Volumes (April 27th), which still remain near zero

The content in this piece is partly based on proprietary analysis that Exante Data does for institutional clients as part of its full macro strategy and flow analytics services. The content offered here differs significantly from Exante Data’s full service and is less technical as it aims to provide a more medium-term policy relevant perspective.

Exante Advisors, LLC & Exante Data, Inc. Disclaimer

Exante Data delivers proprietary data and innovative analytics to investors globally. The vision of exante data is to improve markets strategy via new technologies. We provide reasoned answers to the most difficult markets questions, before the consensus.

This communication is provided for your informational purposes only. In making any investment decision, you must rely on your own examination of the securities and the terms of the offering. The contents of this communication does not constitute legal, tax, investment or other advice, or a recommendation to purchase or sell any particular security. Exante Advisors, LLC, Exante Data, Inc. and their affiliates (together, "Exante") do not warrant that information provided herein is correct, accurate, timely, error-free, or otherwise reliable. EXANTE HEREBY DISCLAIMS ANY WARRANTIES, EXPRESS OR IMPLIED.