Are Bitcoin ETFs cannibalising other assets?

US Bitcoin ETFs have attracted $5.2bn of inflows...

SINCE LAUNCH on January 11th, US Bitcoin ETFs have attracted a cumulated $5.2bn of inflows. This is smaller but comparable to the $9.4bn of inflows into the top three S&P 500 ETFs during the same time (see chart below).

How large is this flow?

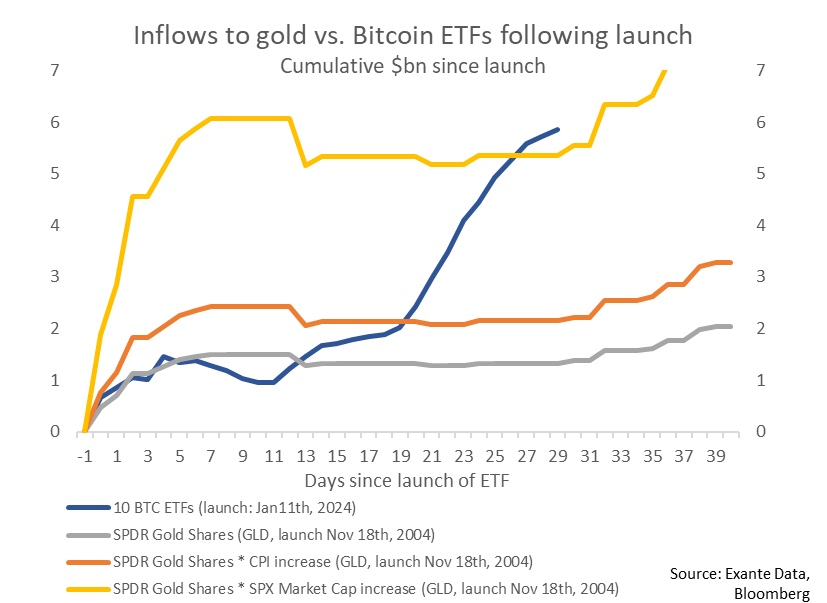

Another way to illustrate the large scale is to look at the size of inflows to the first US-listed gold ETF (GLD) when it was launched in 2004. If we scale the inflows to the growth in SPX market cap, then the flows to the Bitcoin ETFs have been around the same scale, though inflows to BTC ETFs have been much larger if we do not scale (4.4x as big) or scale by CPI (2.7x).

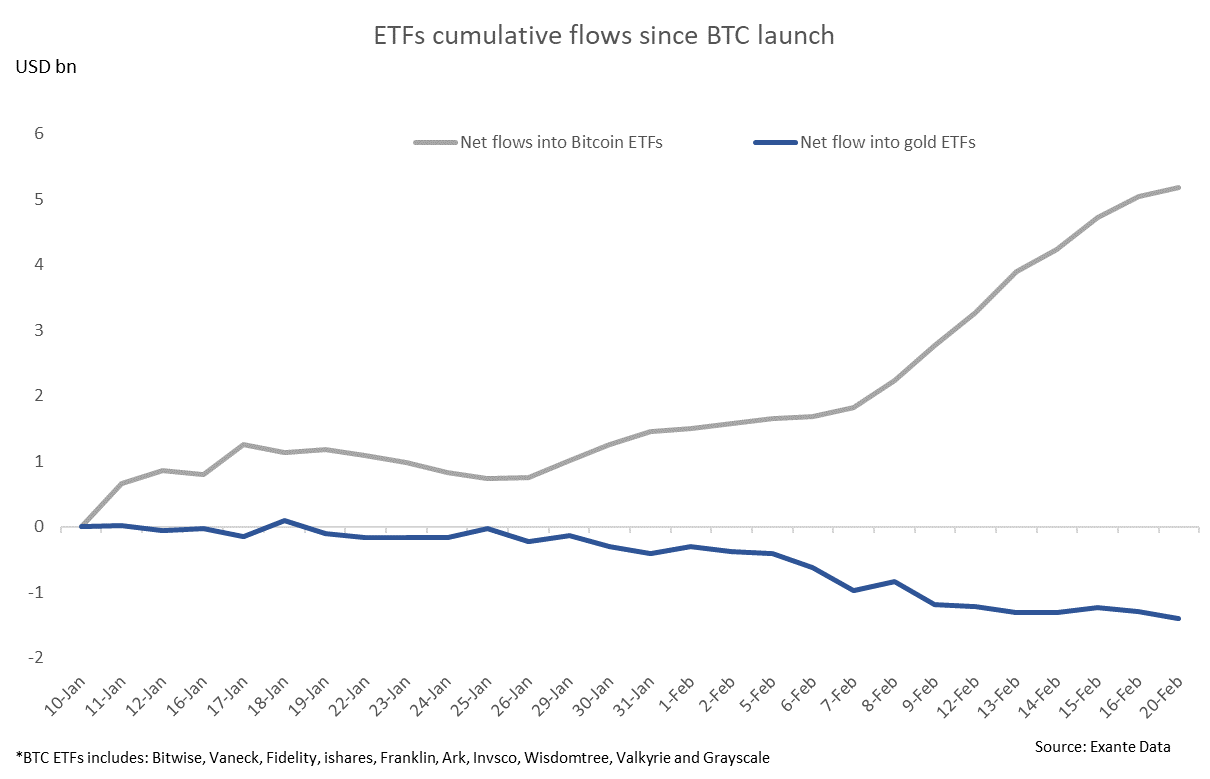

At the same time, gold ETFs flows have turned negative, and hint that Bitcoin ETFs may have cannibalized flows from gold. (The “BTC including Grayscale” in the below chart is the best measure of “net” flows to BTC).

To be sure, flows into BTC ETFs have moderated in the past week after surging in the week prior.

Meanwhile, outflows from gold ETFs have got smaller in the last week, suggestive that any cannibalisation has eased.

The below chart shows that there is some degree of correlation between flows and prices. In the ten days or so after launch (Jan 11th-23rd), Bitcoin fell 15% and therefore might have held back inflows. In the following three weeks, however, Bitcoin rose around 30% and drove large inflows.

More on Bitcoin and gold flows

Below we look at whether there is evidence that the launch of Bitcoin ETFs is hurting gold and its flows from four angles:

1/ Daily ETF flows: flows to gold ETFs have been weak since BTC ETFs. But flows improved (turned less negative) just as Bitcoin ETFs had been launched. Having said that, there is some visual evidence that BTC might have influenced flows in the second weak of February, when flows to BTC ETFs picked up and flows to gold turned negative.

2/ Flow percentiles: another angle is to look at the percentile of flows to take into account the historical levels of inflows. The percentile of flows to gold were were low ahead of the launch of Bitcoin ETFs on Jan 11th, and could possibly have been influenced by some investors withdrawing holdings in gold ETFs in order to purchase BTC ETFs at the launch.

But in the two weeks following the BTC ETF launch, gold ETF flows improved and therefore does not provide strong evidence that gold flows are suffering. For example (IG funds were weaker than gold in late Jan, in percentile space).

3/ correlations. What complicates the analysis is that the correlation between gold and Bitcoin is influenced by overall risk sentiment. VIX has, when smoothed, declined since BTC ETFs were launched, for example, and would imply that the correlation between gold and Bitcoin prices ‘should’ have declined even absent the launch of Bitcoin ETFs. But this is the same effect that we would expect if gold ETF holdings were converted into BTC ETF holdings.

In the below chart we show the correlation between Bitcoin prices and gold across three different metrics: ‘raw’ gold returns, gold factor model residuals and ETF gold holdings.

The correlation between gold factor model residuals and Bitcoin prices have not moved much since the launch of Bitcoin ETFs. But correlations for raw gold prices and ETF gold holdings fell notably immediately after Bitcoin ETFs were launched, in line with the cannibalization thesis. From this point of view there is some evidence that the launch of Bitcoin ETFs might have impacted gold. (See the appendix for another chart on rolling correlations between BTC returns and gold factor model residuals).

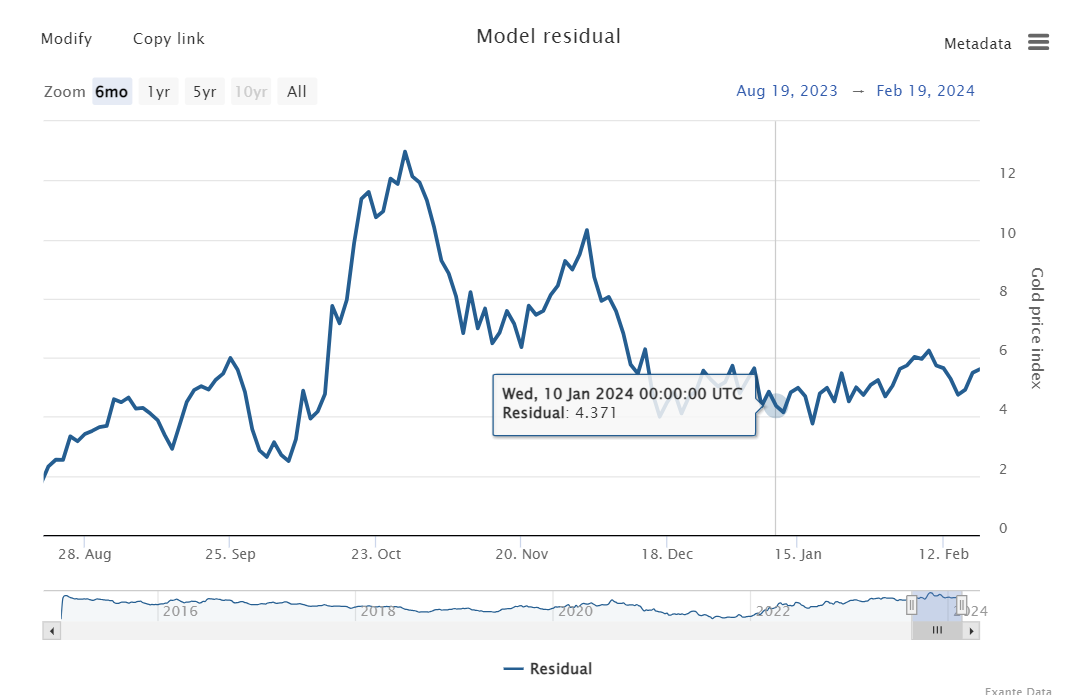

4/ factor model residuals. Gold has outperformed our simple (but robust) gold factor model (link). Gold has outperformed the USD and 10y TIPS by 1.2%-pts since the day prior to the launch of Bitcoin ETFs. This suggests that, whatever impact BTC ETFs have had on gold, hasn’t been enough to lead to underperformance

The content in this piece is partly based on proprietary analysis that Exante Data does for institutional clients as part of its full macro strategy and flow analytics services. The content offered here differs significantly from Exante Data’s full service and is less technical as it aims to provide a more medium-term policy relevant perspective. The opinions and analytics expressed in this piece are those of the author alone and may not be those of Exante Data Inc. or Exante Advisors LLC. The content of this piece and the opinions expressed herein are independent of any work Exante Data Inc. or Exante Advisors LLC does and communicates to its clients.

Exante Advisors, LLC & Exante Data, Inc. Disclaimer

Exante Data delivers proprietary data and innovative analytics to investors globally. The vision of exante data is to improve markets strategy via new technologies. We provide reasoned answers to the most difficult markets questions, before the consensus.

This communication is provided for your informational purposes only. In making any investment decision, you must rely on your own examination of the securities and the terms of the offering. The contents of this communication does not constitute legal, tax, investment or other advice, or a recommendation to purchase or sell any particular security. Exante Advisors, LLC, Exante Data, Inc. and their affiliates (together, "Exante") do not warrant that information provided herein is correct, accurate, timely, error-free, or otherwise reliable. EXANTE HEREBY DISCLAIMS ANY WARRANTIES, EXPRESS OR IMPLIED.