Argentina and the SDR rate

Argentina could pay more than USD20bn in interest to the IMF over the next decade.

The SDR interest rate now exceeds 3% on global policy tightening—and above 6% including surcharges; for Argentina, this means paying more on IMF support than the coupon yield on restructured debt;

The latest IMF report projects Argentina will pay in excess of USD20bn on this support over the next decade, nearly double that projected less than 12 months ago—a heady amount for a country living on the edge;

Official interest relief on this burden will be necessary—at some point.

JUST AS a growing list of countries turn to the IMF for balance of payments support in the post-pandemic world, the cost of such official support is becoming increasingly unwieldy—as developed market central banks continue to tighten monetary policy.

Indeed, the fact that the IMF lends at a variable rate linked to the global monetary cycle is something that is seldom remarked. But it could decide the fate of a number of frontier market countries in coming years—debt distress or recovery?

But what is this variable rate?

SDR rate

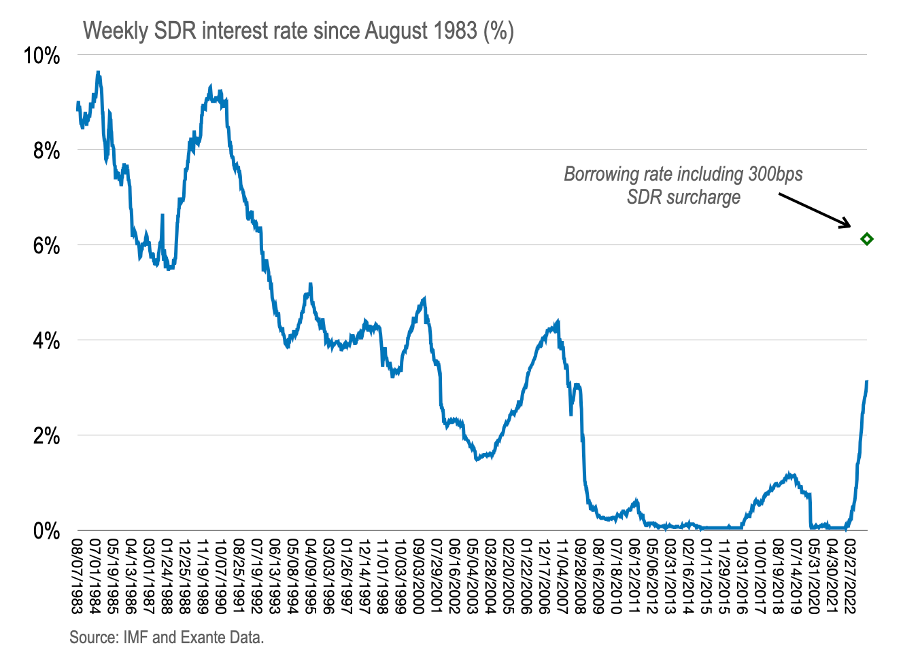

The weekly SDR rate, taken from the IMF website, is shown in the chart below. This chart begins in 1983, although data is available quarterly, prior to this, back to 1969, but not shown.

A number of things stand out.

First, the peak SDR rate has been typically below the prior peak as the global cycle has ebbed and flowed—but the average interest has drifted lower. However, unusually, this cycle has seen the SDR rate increased to above 3%—well above the post-GFC peak—and likely has further to run.

Second, there is an additional charge for large borrowers. Indeed, for those accessing above (roughly) twice quota, an extra 200bps surcharge is applied—and for those borrowing for more than 3 years another 100bps is added.

This (combined) surcharge of 300bps is shown at the end point of the chart.

For those countries borrowing for extended periods and multiples of quota, the marginal interest on IMF borrowing (“purchases”) now exceeds 6%.

A useful list of countries subject to the surcharge (in one form or another) from roughly a year ago is provided here.

But more than any other country, this means the interest rate charged to the world’s leading deadbeat borrower, Argentina, is now above 6% and rising.

We discussed Argentina’s puzzling debt buyback proposal earlier this week. Lowering the SDR rate would be far more consequential for sustainability—but we’ll come back to this point.