US Equity indexes fell in August: The S&P 500 -4.2%, DJIA -5.3%, and NASDAQ -1.3% on the month. US equities strung together a series of down days post Fed Chair Powell's hawkish speech at Jackson Hole on Friday, August 26th. Since then, US Treasury yields have moved higher, led by shorter maturities.

Both the Fed's Powell and the ECB's Schnabel spoke at Jackson Hole. Founder Jens Nordvig noted that there was one common theme in their messages: Pain is needed as both took a hard stance on inflation. Key quotes from the two policymakers included:

Fed's Powell: "Reducing inflation is likely to require a sustained period of below-trend growth."

ECB's Schnabel: "On this path, monetary policy responds more forcefully to the current bout of inflation, even at the risk of lower growth and higher unemployment."

US Payrolls for August continued to reflect a resilient labor market. Employers added 315k jobs. In this thread, Founder Jens Nordvig notes that many key US labor market indicators are very strong (close to the high end of the distribution observed since 2010) and how some softer indicators have bounced lately.

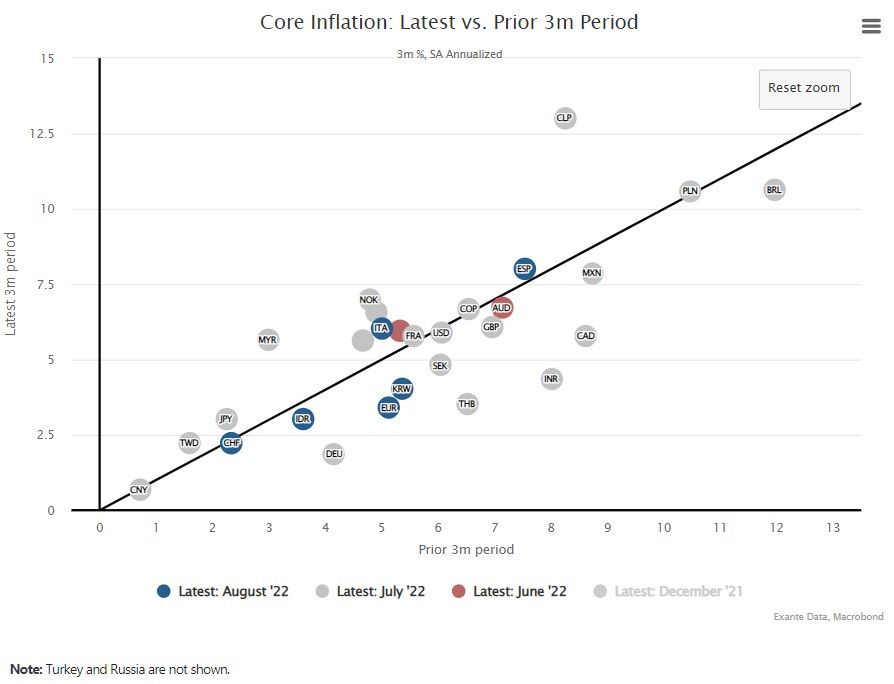

Chart: Global Core Inflation: Latest vs Prior 3m Period

Just under half (45%) of the countries we track are seeing accelerating core CPI momentum (latest vs. prior 3m SAAR). A month ago, two-thirds of countries were seeing accelerating momentum. What’s more, the global median core CPI has begun to decline.

On the FX-front:

The USD remained strong in August. After ranging 105.03 - 106.60 in the first half of the month, the USD resumed a strengthening path in mid-August. The DXY Index reached a new high on September 1st, breaking topside 109.00.

EURUSD moved below parity to a low of 0.9941 on August 22nd. In this latest week, however, EUR outperformed relative to peers vs. USD. This likely reflects the support from ECB rate pricing as well as the decline in natural gas prices (~30%) from their peak on August 25th. The ECB policy meeting is September 9th. Ahead, EUR could take a further knock from the news on gas discussed below.

GBP saw no respite from weakness during the month of August, falling 4.5% vs USD and 2.9% vs EUR. GBPUSD reached a low of 1.1511 on September 2nd. At the time of writing, EURGBP was holding just under 0.8650 support. The UK faces difficult challenges and uncertainty ahead - a cost of living crunch, a large increase in the energy price cap on October 1 - see here and here, and a Conservative leadership PM vote - winner announced September 5th.

JPY was down 4.1% vs USD in August. With the rise in US yields post Powell's Jackson Hole speech, USDJPY resumed its upward march, breaking topside 140.00 on September 1st. This prompted some verbal intervention from MoF officials but apparently didn’t elicit any discussion at Friday’s G7 meeting.

Our structural view remains that the USD will only peak once global growth bottoms (and/or the Fed stages a dramatic pivot).

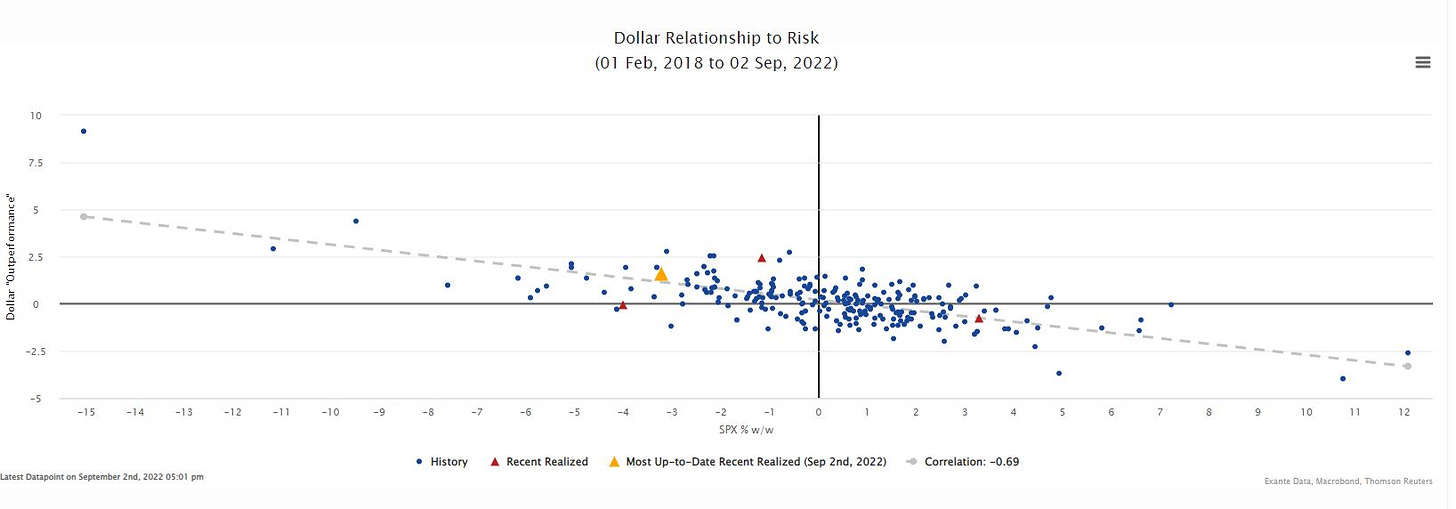

For the week ended September 2nd, the USD performed in line with the weakness in SPX (chart below)

Chart: USD relationship to risk. USD "Outperformace" vs SPX w/w%. Yellow dot is Sept 2. Red triangles are recent weekly results for August 12th, 19th and 26th.

European Gas Situation

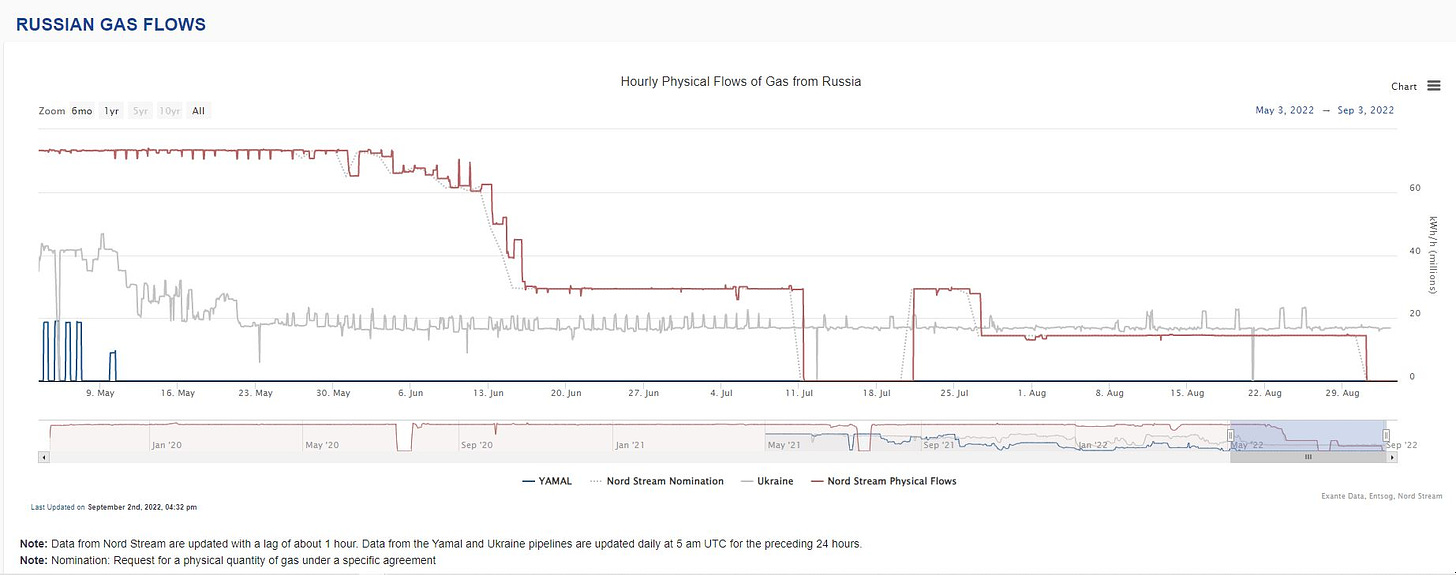

After a shutdown for a maintenance period, the Nordstream pipeline resumed flows to Europe on July 21st, though at a reduce rate. Post the July maintenance period shutdown, flows operated at 29-15% capacity until the very end of August/start of September when they dropped to zero (chart). On August 31st, Russia stopped the flow of gas via the Nord Stream 1 pipeline, citing the need to carry out repairs. In a further blow to Europe, on Friday, September 2nd, Russia announced a delay to the reopening of Nord Stream 1. Read more in this reporting by Reuters.

In addition, late Friday, September 2nd, Bloomberg energy and commodity columnist Javier Blas tweeted an announcement from Gazprom in which he said, "Gazprom seems to imply here that the only operating turbine at Nord Stream 1 pipeline can only be repaired now at one of (overseas) Siemens Energy specialised workshops, and until that happens, the pipeline won’t re-start (in other words, it’s down for good)."

As Jens tweeted: Russia "is actively trying to create an energy crisis in Europe. This is not about turbines. It is a war!"

Media and Announcements

Our Substack: Petrodollars: Where are the surpluses? Part 1 by Alex Etra and Shekhar Hari Kumar was recommended by The Financial Times Alphaville column in "Further Reading".

Jens Nordvig joined Yahoo Finance on August 11th to talk US CPI, tail risk for FI markets, low inflation in China, US goods prices vs. services prices, and the ECB's dilemma re energy prices.

In an interview released on August 23rd, Head of Political Risk Analysis Wouter Jongbloed spoke with Andreas Steno Larsen on Real Vision about about Europe's energy crisis and its impact on the German economy. You can see clips here and here.

The content in this piece is partly based on proprietary analysis that Exante Data does for institutional clients as part of its full macro strategy and flow analytics services. The content offered here differs significantly from Exante Data’s full service and is less technical as it aims to provide a more medium-term policy relevant perspective.

Exante Advisors, LLC & Exante Data, Inc. Disclaimer

Exante Data delivers proprietary data and innovative analytics to investors globally. The vision of exante data is to improve markets strategy via new technologies. We provide reasoned answers to the most difficult markets questions, before the consensus.

This communication is provided for your informational purposes only. In making any investment decision, you must rely on your own examination of the securities and the terms of the offering. The contents of this communication does not constitute legal, tax, investment or other advice, or a recommendation to purchase or sell any particular security. Exante Advisors, LLC, Exante Data, Inc. and their affiliates (together, "Exante") do not warrant that information provided herein is correct, accurate, timely, error-free, or otherwise reliable. EXANTE HEREBY DISCLAIMS ANY WARRANTIES, EXPRESS OR IMPLIED.