Bank of England balance sheet shrinkage (Part 1)

How fast? And when might HM Treasury's indemnity be triggered?

The Bank of England announced in August the intention to undertake balance sheet shrinkage as part of the next tightening cycle. But how fast might this normalisation be? Under passive balance sheet rolloff, we estimate that—once it begins—roughly 8 years will be needed to unwind the last 18 months of pandemic-related expansion. But is this fast enough for the MPC? In any case, when might the Bank incur losses on monetary income as rates rise, triggering the secretive HM Treasury indemnity? Bank Rate above 114bps would imply zero net monetary income over the life of the program, while above 170bps would deliver negative income already over the next 3 years.

The Bank of England’s (BoE) revised policy sequencing strategy, announced early August, foresees balance sheet shrinkage at various Bank Rate thresholds upon policy tightening. Once Bank Rate touches 50bps, the MPC could cease reinvesting maturing Gilts, allowing passive balance sheet roll-off; at 100bps they might sell, implying active downward management.

This new strategy, discussed here and in a companion piece, raises numerous questions for market participants and the UK taxpayer—issues the Monetary Policy Committee (MPC) might wish to clarify at some point.

Here we attempt to answer two such questions: How fast will downward balance sheet adjustment be under the passive regime? And under this regime, when might the HM Treasury indemnity for the Asset Purchase Facility losses be triggered?

In part two we will question the logic of active balance sheet adjustment and ask: when should the Bank sell gilts?

The asset purchase facility portfolio

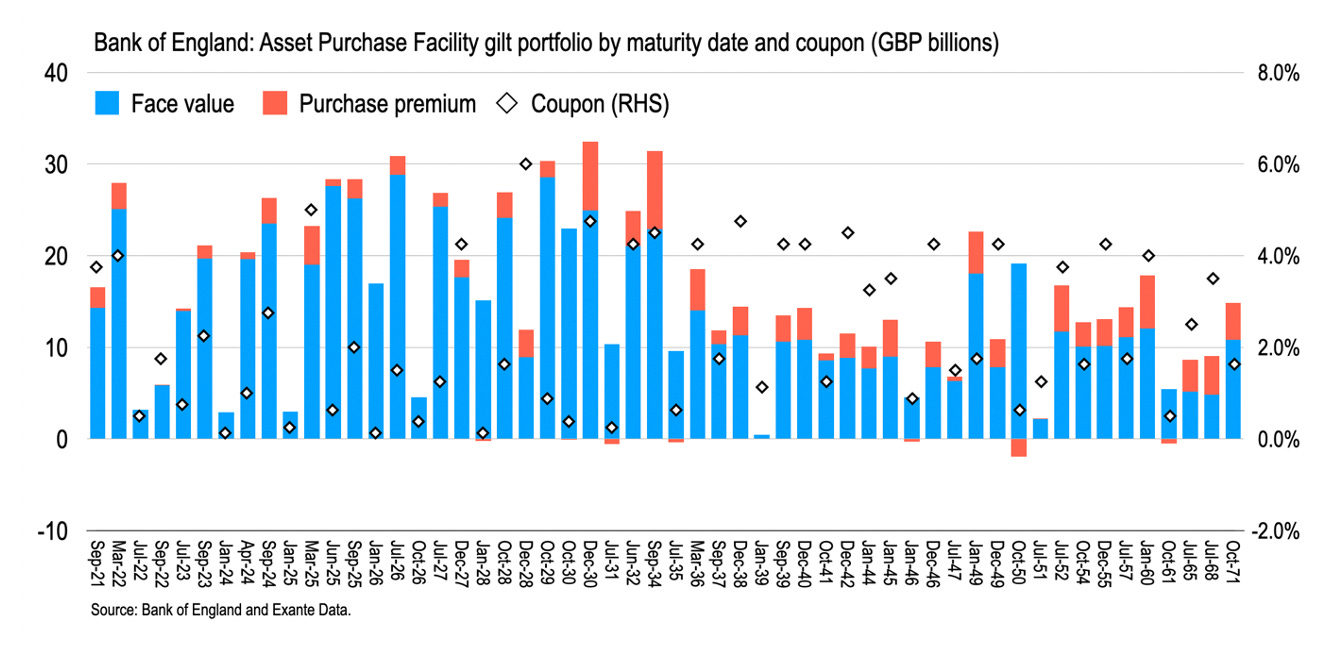

Under the Asset Purchase Facility (APF) BoE has created base money associated with the purchase of a portfolio of 54 gilt securities* amounting to about GBP825bn (plus GBP20bn in corporate securities.) The face value of these gilts is GBP710bn implying a weighted average purchase price of 115.8—most securities were purchased over par, the principal at maturity being less than the price paid.

However, the cumulative coupons on this portfolio still allow BoE to redeem the outstanding base money created in full while making a profit—at current Bank Rate.

The maturities of this portfolio run from Sept 2021 to Oct 2071; the weighted average maturity is exactly 13 years with a median coupon of 1.75%.

The Bank’s share of these gilt maturities range from 68% of the outstanding issue (July 2026) to only 7% (Jan 2039). Of the roughly GBP1.6 trillion in gilt issues outstanding in which the APF has some position, 46% is held by the Bank of England as counterpart to reserve money creation.

Passive balance sheet shrinkage

We begin by benchmarking how fast the Bank’s balance sheet would shrink absent principal reinvestment—that is, passive shrinkage. Such an assumption is equivalent to a hold-to-maturity strategy in managing APF gilts—meaning mark-to-market losses can be ignored (something we contemplate in Part 2).

We wish to avoid projecting forward the balance sheet, including assigning the reinvestment of maturing bonds across the yield curve, until some future date when balance sheet adjustment might begin. So, as a short-cut, we simply assume balance sheet adjustment begins now to generate an illustrative baseline.

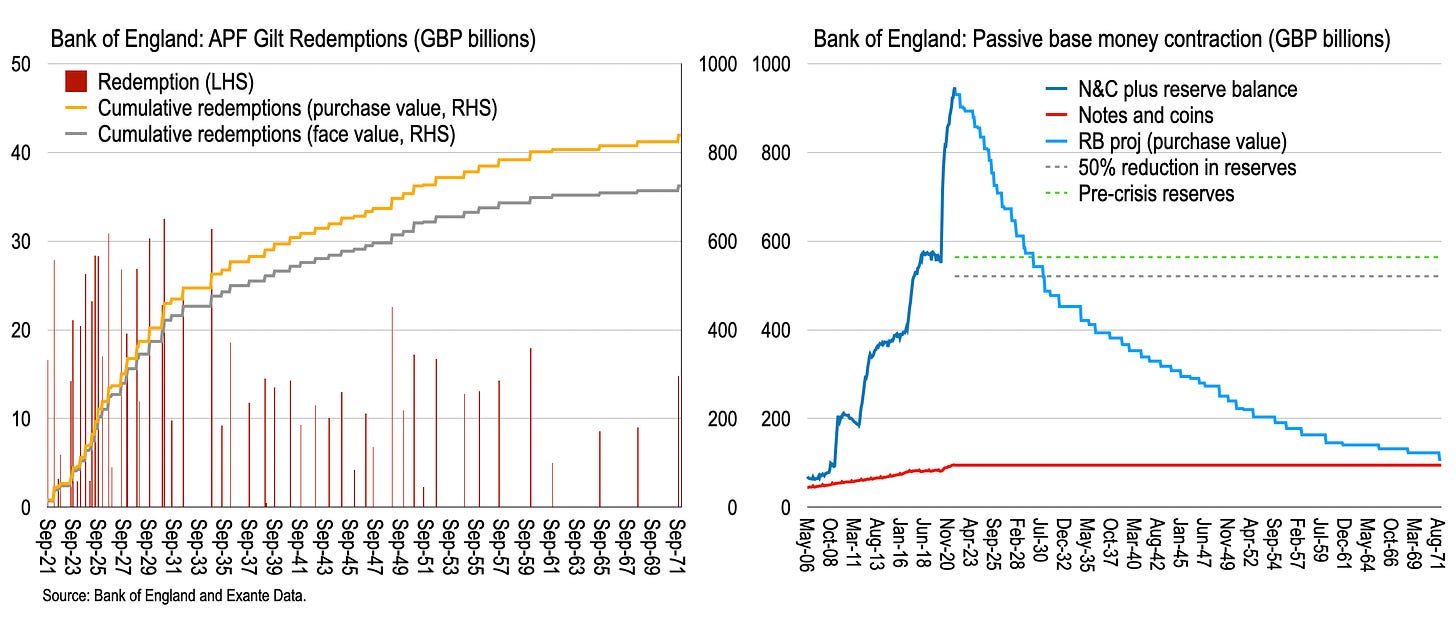

The chart below shows, on the left, the redemption schedule for APF gilt holdings and cumulative redemptions and, on the right, outstanding base money assuming notes and coins in circulation remain constant. Total base money outstanding falls below GBP800bn in April 2025, below GBP600bn in Oct 2028, and below GBP400bn in March 2036.

Reserve base is reduced in half, to GBP426bn, by Oct 2030, while the pre-pandemic reserve base is restored one year prior to this, in Oct 2029.

The monthly average passive contraction of the balance sheet would be close to GBP4bn, while the monthly average increase since March 2020 has been about GBP24bn. Of course, while the monthly average is small, the balance sheet contraction is lumpy, with two or so large maturing amounts each year.

We conclude that the balance sheet expansion over the past 18 months would take at least 8 years to unwind under passive balance sheet adjustment. Is this too fast? Or too slow? Speaking at the Treasury Select Committee last week, Governor Bailey recalled how, in light of two crises in the past 15 years, there is a need to normalise the balance sheet—allowing for rapid expansion as unknown future contingencies require. In which case, would the reversal of pandemic-related balance sheet measures over only 8 years—which doesn’t begin to touch prior balance sheet expansion post-GFC—be considered too slow?

Coupon flows and monetary income

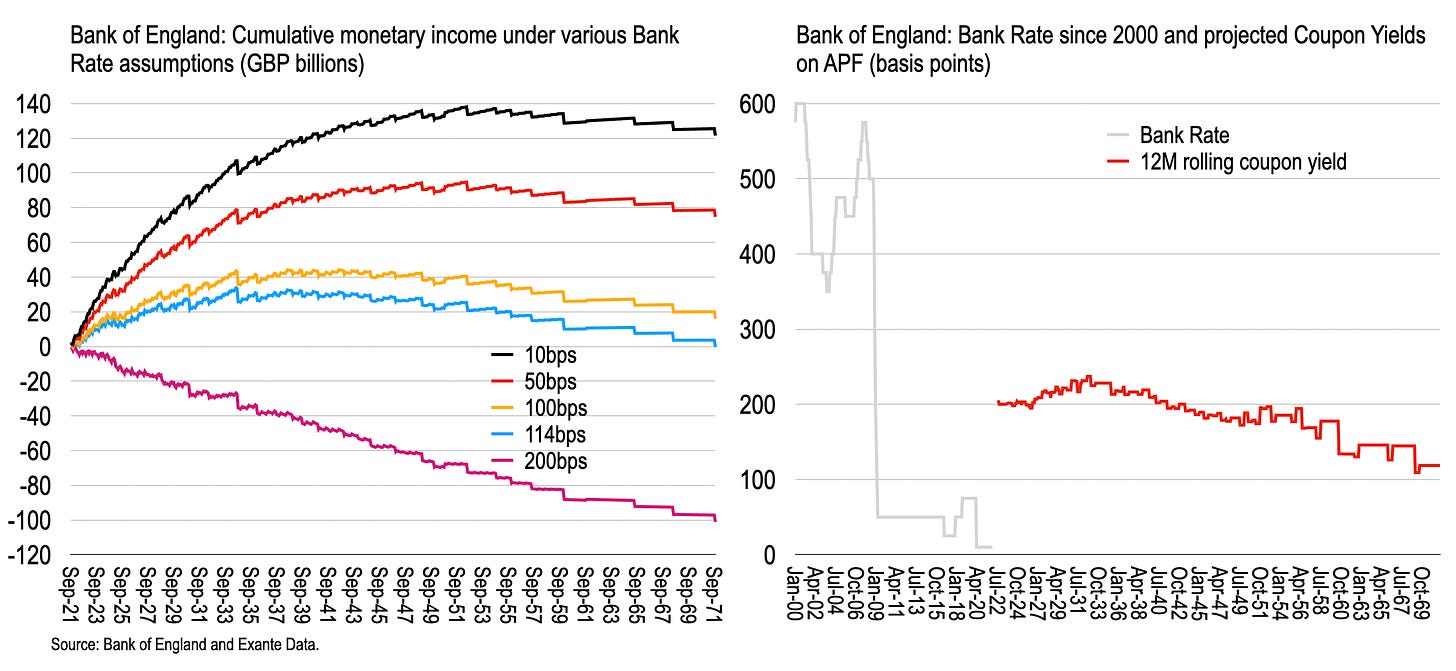

The next chart shows the coupon flow associated with the APF when held until maturity. APF will generate just short of GBP250bn in coupons over the next 50 years. This contrasts with cumulative interest paid on the reserves, at current Bank Rate, of only GBP11½bn. As a result, allowing for fact that most gilts were purchased above par (roughly GBP115bn) to be recovered from the coupon flow, APF makes GBP121bn in monetary income (profit for HM Treasury) through 2071.

In addition, this calculation does not capture the income accumulated to date—only prospective coupon flows. For example, the Bank’s 2021 balance sheet includes a further GBP3.2bn in retained earnings not yet distributed to HM Treasury.

Bank Rate and the indemnity

However, this scenario overlooks the fact that Bank Rate will adjust up before any balance sheet reduction occurs. The next charts therefore illustrate cumulative monetary income under various scenarios for Bank Rate—assuming it increases immediately and stays constant.

With Bank Rate at 100bps permanently, for example, APF will still generate positive monetary income of about GBP20bn over the next 50 years. The “breakeven” Bank Rate over the entire program is 114bps.

Should Bank Rate reach 200bps, however, APF would deliver a loss over the course of the program of GBP100bn. Given that BoE total equity as of 2021 is only GBP5.8bn, such losses easily outsize the existing financial buffer—and would do so already by the mid-2020s.

This exercise side-steps the growing demand for currency (on which no interest is paid) as well as the fact that future asset purchases, after interest normalisation, would also generate greater coupon income. In other words, complete inter-temporal balance sheet analysis will easily find sources of seigniorage. But it is illustrative. And given the particular focus in the UK right now on the quasi-fiscal implications of BoE balance sheet actions, this suggests a reason why.

Is it only a coincidence that the Bank is contemplating active balance sheet roll-off when Bank Rate reaches 100bps—as we approach the breakeven rate? Is there the perceived need to actively contract the balance sheet due to the optics of losses?

Absent the HM Treasury indemnity on APF, to pay Bank Rate on reserve money in this scenario BoE would have to print money—pushing capital and reserves negative! Such lack-of-control is the stuff of nightmares on Threadneedle Street and is precisely why this issue is generating such excitement amongst the chattering English classes.

What is reasonable for Bank Rate?

But how realistic is it that Bank Rate could exceed, say, 150bps any time soon? Nothing can be ruled out, of course. From the vantage-point of 2019 an increase in the policy rate to such levels seemed unlikely. But recent concern with post-pandemic price pressures have changed the narrative somewhat. Indeed, until 2008 Bank Rate above 400bps was the norm. Since 2008, 100bps seems high.

The future is fundamentally uncertain, of course. If one possible outcome of the pandemic is a durable escape from the liquidity trap and shift to a regime of permanently higher average inflation and interest rates rates, then losses on the APF could be considerable indeed. In which case, the mysterious HM Treasury indemnity would indeed come into play—big time.

And if we were to enter such regime, then the MPC might contemplate moving beyond passive adjustment and begin active downward balance sheet adjustment to front run the monetary income losses on gilts. But should they even sell gilts? That will be the focus of Part 2.

* This analysis is based on gilt holdings as of 4th September, so is chasing a moving target.