In a recent post, we described China's unprecedented success at realizing a demographic dividend starting in the 1990s until around 2010. We discussed the confluence of factors that made this dividend possible. In this post, we look at present conditions and try to discern what is in store for the future. We use our usual approach and look at the three main pillars of wealth creation: Demographics & Health, Innovation & Productivity, Society & Governance.

Demographics & Health

The first thing that is evident is that demographics is no longer a positive vector of economic growth.

The tailwinds created by a falling dependency ratio have died down and are now expected to turn into headwinds (see chart in our first post). The dependency ratio fell between 1970 and 2010 and was a key driver in the country's GDP acceleration in that it opened a window of opportunity to realize a demographic dividend. China was able to realize that dividend because 1) it had liberalized its economy and opened up to trading with the world, and 2) it had improved its levels of education and infrastructure. As things stand today, the dividend has been fully realized and is behind us. There is instead a risk of a reverse demographic dividend, in which deteriorating demographics create a drag on growth, if China is unable to implement counteracting measures.

This risk is illustrated in the first chart below which shows the Chinese population by age groups. The population aged 15 to 64, aka the working-age population, soared between 1965 and 2015 and is now set to decline, slowly for the next decade but more rapidly thereafter. Meanwhile the population aged 65 and over will more than double between now and 2055. Finally, the youngest group aged 0-14 will taper off for decades to come.

Using the same data, the next chart shows the difference between the number of workers (those aged 15 to 64) and the number of dependents (those aged less than 15 and more than 64). The coming decline is as dramatic as the rise was in past decades. In 2015, there were 636 million more workers than dependents. But by 2055, this figure will fall to 189 million, or about the same as in 1980. Yet during this period, 1980-2055, the total Chinese population will have grown from 1 billion to 1.37 billion. (See in this article how the working-age population of other countries will have evolved between 1960 and 2050).

In addition to the longer term rise in the dependency ratio, China is seeing more recently a decline in its birth rate. China's total fertility rate (TFR) fell to 1.09 children per woman in 2022, a new low in a recent downtrend that started after 2017. The next chart shows the evolution of the TFR since 1950. Note that it had fallen from over 6.0 to 2.75 before China enacted its one-child policy in 1980. Between 1991 and 2019, the TFR hovered between 1.5 and 2.0 but it fell below 1.5 in 2020 and fell again in 2021 and 2022.

The TFR was falling before covid but the pandemic played a role in the most recent decline in 2020-22, just as it did in other countries. In theory, there will be a rebound in the TFR now that lockdowns have lifted and the economy has reopened. However, if the experience of other countries is an indication, the post-covid recovery in births will be tepid and will not immediately return the TFR to its pre-pandemic levels.

Some commentators have pointed to the most recent decline in China's births as further evidence that the economy will be facing significant headwinds. It is true that this demographic degradation could have a negative impact in the mid to long term. However, the lower TFR of 2018-22 is in fact marginally helpful to the economy in the interim, between now and 15 years from now, because a smaller number of dependents (young children in this case) means a lower dependency ratio than was projected when the TFR was higher. As noted in the last post, a lower dependency ratio means more money that can be diverted toward discretionary spending, savings and investments, all of which are helpful to the economy. Conversely, if China had been successful in boosting its birth rate, the new dependents would have added a near-term burden on the economy.

There are many reasons why people defer or forego having children. These reasons include job insecurity and the state of the economy, the cost and complexity of raising children, the wish to focus on one's career, concerns about climate change or the general state of the world, a desire to maintain a childless lifestyle of travel and other experiences etc. These all apply in the case of China. In particular, the unemployment rate among young people has steadily deteriorated in recent years, making it more difficult for young couples to start a family.

For most economies, there is one more way in which the dependency ratio can decline and that is with greater numbers of women joining the work force. In the case of China, female participation in the labor force is estimated by the World Bank at 61%, compared to 56% in the United States and 67% in the European Union. There is some room for China's female labor participation to increase but it is already at a level that compares well with the US and Europe.

In conclusion, the first pillar of wealth creation, Demographics & Health, is essentially spent for the foreseeable future. There are possible gains to be made on the health front, for example by extending China's life expectancy, but these gains would in theory be negative - or at best neutral - for the economy because they would extend the lives of elderly dependents.

If the first pillar is lame or inoperable from a policy perspective, this leaves the other two as possible levers to counteract the worsening demographic picture. Does China have the right levers in Innovation & Productivity or in Society & Governance to overcome its demographic disadvantage?

Innovation & Productivity

If we go by the Global Innovation Index, China was the 11th most innovative economy in 2022, after Denmark and before France. This ranking should raise a flag to Westerners who glibly dismiss China's innovation as mere copying - or stealing from - the West. Such occurrences of copying and stealing have been documented elsewhere. But there is no denying that China has made strong progress with its own research and development in several areas. Nikkei Asia recently reported that

China leads advanced technological research in 80% of critical fields including hypersonic and underwater drones... Out of 23 technologies analyzed by the Australian Strategic Policy Institute (ASPI), China leads research in 19.

In 2021, the Chinese government released its 14th Five Year Plan, in which it identified seven S&T (science and technology) priorities: artificial intelligence, quantum information, integrated circuits, life and health sciences, brain science, bioengineered breeding, aerospace technology, and deep earth and deep sea (for more details, see Article IV, pages 11-14).

China has stated its goal to become the global leader in Artificial Intelligence. A March article in the Harvard Gazette argues that China’s brand of governance is more conducive to faster advances in AI:

Authoritarian regimes tend to trail more democratic and inclusive nations in fostering cutting-edge, innovative technologies, such as robotics and clean energy. Artificial intelligence may prove an exception, at least in China, owing to dovetailing interests.

Harvard Economics Professor David Yang spoke to the outsized success of China’s AI sector at a recent dean’s symposium on insights gleaned from the social sciences about the ascendant global power. As evidence, he cited a recent U.S. government ranking of companies producing the most accurate facial recognition technology. The top five were all Chinese companies.

“Autocratic governments would like to be able to predict the whereabouts, thoughts, and behaviors of citizens,” Yang said. “And AI is fundamentally a technology for prediction.” This creates an alignment of purpose between AI technology and autocratic rulers, he argued.

Of all countries, China has by far the largest number of patents in force and also processes the largest annual number of patent applications. Of course, not all patents are equal. Some will result in massive wealth creation and others will simply fade and die out. This is an important distinction that has so far favored the United States in comparison to China. US-based inventors are uniquely adept, and are in fact unmatched anywhere in the world, at translating innovations into large recurring cash flows. Insofar that this conversion from innovation to wealth is not automatic and requires certain conditions that elude a large number of countries, it falls within the third pillar of wealth creation, Society & Governance, discussed further below. That said, China's patent activity confirms a strong impetus for innovation with the possibility of important breakthroughs.

Further, when we talk of innovation, we have to consider not only wealth creation but also military advantage. As noted by ASPI, China may have gained a lead in some military technologies at a time of heightened geopolitical tensions.

In terms of productivity, we focus on education and infrastructure. China achieved a huge leap in literacy during the second half of the 20th century. Its literacy rate had reached a level in the late 1990s that rivaled those of much wealthier nations. According to UNESCO, China's adult literacy rose from 65% in 1980 to 91% in 2000 and 96% in 2015. And female youth literacy (for those aged 15 to 24) surpassed 90% as early as 1986.

In addition, as is widely known, China made very substantial investments in infrastructure, building highways, airports, ports and a high-speed rail network at a furious pace. In some cases, China has overbuilt. Some of its more recent infrastructure projects are at best productivity-neutral instances of malinvestment and "bridges to nowhere." But all stand as symbols of China's aspirations to claim its place as a leading modern nation and a rising superpower.

The malinvestment has gone beyond infrastructure and into residential real estate and manufacturing facilities. In an article titled The China Model is Dead, Michael Schuman writes:

Over time, China developed a more advanced economy, but the state and companies nevertheless kept on building. The growth rate stayed high, but now the economy was generating wasteful excess that undermined its health. Logan Wright, a partner at the research firm Rhodium Group, estimates that China has 23 million to 26 million unsold apartments. That’s enough to house the entire population of Italy. Many of these apartments will never be purchased, Wright conjectures, because they were constructed in towns with declining populations.

China’s automobile industry, figures Bill Russo, the founder of the consulting firm Automobility in Shanghai, has enough unused factory capacity to make more than 10 million cars (sufficient to supply the entire Japanese car market—twice). Beijing boasts about its extensive network of high-speed railways, already the world’s largest—but the state-owned company that operates it has racked up more than $800 billion in debt and posts substantial losses. The Cato Institute once described China’s rail-building bonanza as a “high-speed debt trap”. The Chinese “continue to invest beyond what they can actually absorb,” Alicia Garcia-Herrero, a senior fellow and specialist in Asian economies at the think tank Bruegel, told me. “This is why their model went wrong.

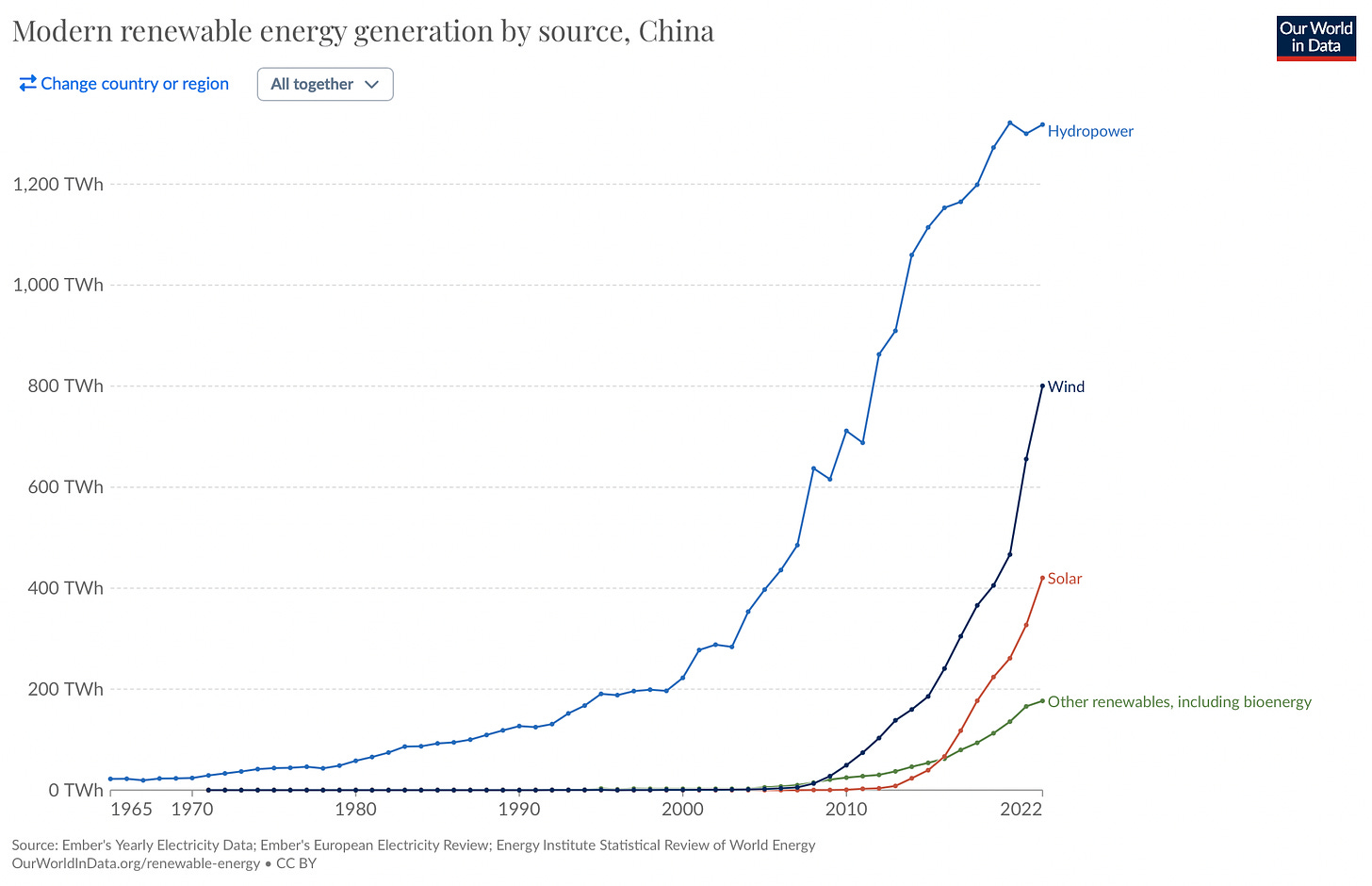

On a more positive note, China has invested heavily in renewable energy (chart below). Here, there is room for additional gains since renewables (hydro, wind and solar) accounted for a total of about 30% of electricity generation in 2022 against 61% from coal. These green investments may or may not add to productivity. But they position China as one of the world's leaders in the energy transition. They also make its automakers’ huge push into electric vehicles less open to criticism that EVs are merely transferring carbon emissions from automobile exhausts upstream to coal plants.

All in therefore, there are still some productivity gains that can be achieved and that would eventually flow to greater wealth creation.

(A 2021 study by Marois, Gietel-Basten and Lutz wraps demographics and productivity together to develop a “labor force dependency ratio” and a “productivity-weighted labor force dependency ratio”. See China’s Low Fertility May Not Hinder Future Prosperity.)

Society & Governance

As pillars of wealth creation, Demographics & Health has now been banked for the most part, while Innovation & Productivity holds great promise of future gains. However those gains hinge mainly on the focus of such innovation. Is it primarily directed at military applications or at private wealth creation? In the former case, will some innovations in military R&D filter through to private enterprises, as with DARPA in the US? And in the latter case, what are the country's track record and prospects for translating those innovations into wealth creation?

A general consensus in the West is that the conversion of innovation into wealth has been inefficient or stunted in China because it is does not operate as freely as in the West. All businesses anywhere have to maneuver within the confines and rules set down by regulators and political leaders. In China, these rules have looked less predictable in recent years, with adverse consequences. Uncertainty is an impediment for investors and entrepreneurs who need a long runway and timeline in order to risk their capital and bring their projects to fruition.

The new uncertainty has already impacted investors’ confidence. If we look at China’s stock market valuation as a barometer of wealth creation (imperfect as it may be), it is lagging those of other large indices around the world. The Shanghai Composite and Hong Kong-based Hang Seng are now trading at levels first reached in 2006-07. Stocks of companies like Alibaba and Baidu have collapsed since late 2021 and trade at deep discounts to their US peers. Data on fund flows shows that foreign investors have lost interest in Chinese equities.

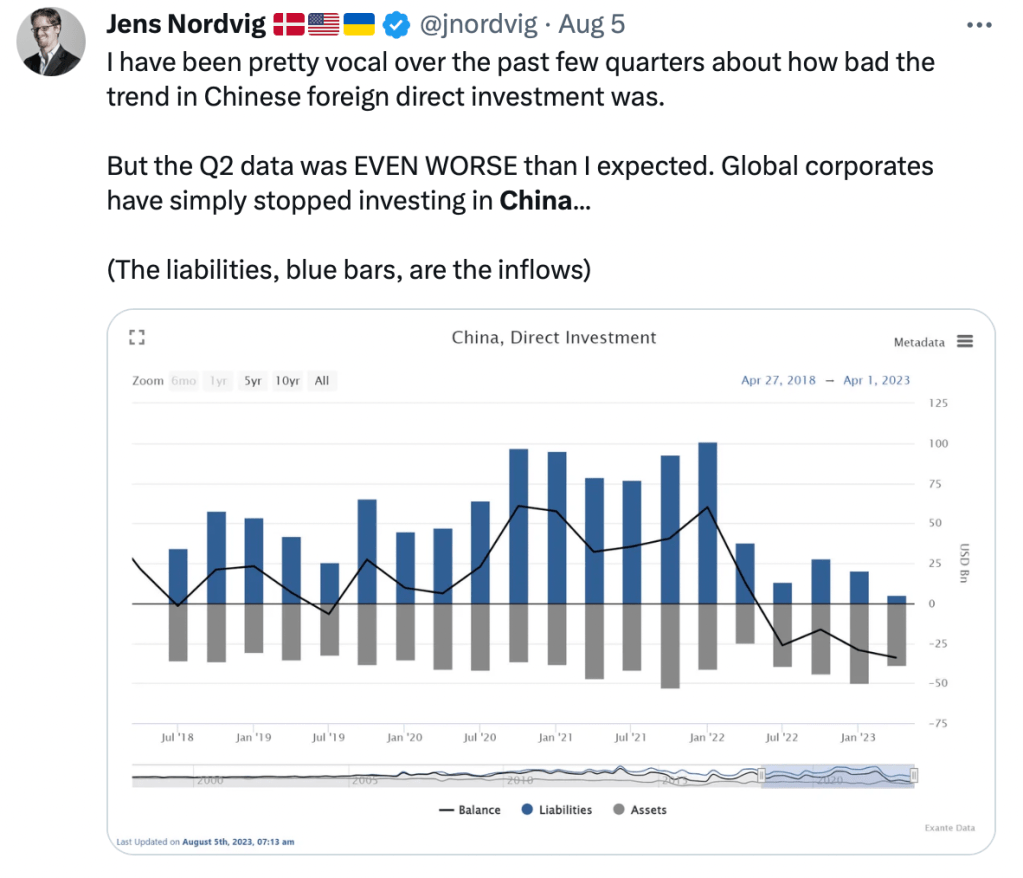

The same exodus can be seen in foreign direct investment (FDI) which has turned negative in 2023 (see the chart below posted by Jens in August). Global corporates are no longer investing in China as an outsourcing destination. China's crackdown on its tech executives and its governance decisions have deterred fresh FDI outlays. And many wealthy Chinese are leaving the country.

The other leg of this transformation is in China’s defense buildup and in its more assertive foreign policy dubbed “wolf warrior diplomacy”.

China is adding to its military capability at a rapid pace. The Chinese navy now has more ships than the US navy. China has maintained warm relations with Russia since the start of the Ukraine invasion and it has become more aggressive about its intention to integrate Taiwan. The Wall Street Journal reported last week:

During one day earlier this week, Taiwan’s military detected 103 Chinese military aircraft in areas around the island, a recent high, including 40 that entered the island’s air-defense identification zone. The next day 55 Chinese aircraft flew sorties near Taiwan, the Taiwanese Defense Ministry said.

China has also released a new 10-dash map in which it claims as its own most of the Southern Sea (aka South China Sea or West Philippine Sea or Eastern Sea). The South China Morning Post recently wrote that “Beijing is using ‘fishing militia’ to assert its claims in the South China Sea”. Beijing is also flexing its military muscle in the sea. Chinese warships have recently massed for a major military exercise near the Philippines.

China’s leadership is clear and straight about its desire to turn the page on the American-led world order. Chinese prosperity is to a large extent the product of globalization but China seems to be turning its back on at least some elements of this globalization, in particular its relationship with the United States. A recently issued Proposal of the People’s Republic of China on the Reform and Development of Global Governance states:

Today, changes in the world, in our times and in history are unfolding in ways like never before. The deficits in peace, development, security and governance are growing. Humanity is once again at a crossroads, and facing a consequential choice on its future. Meanwhile, world multi-polarity and economic globalization keep evolving. Peace, development and win-win cooperation are the unstoppable trends of the times. Solidarity, cooperation and progress remain the aspiration of people around the world.

Internally, China's leadership has consolidated Xi Jinping's hold on power and purged some former leaders. Chinese society has become less liberal. There are more restrictions on citizens, notably with the personal social score, and more initiatives towards indoctrination.

All things considered, China has alienated several of its neighbors (Japan, the Philippines, India) and its most important trading partner the United States while also appearing to prepare for war. These decisions have all moved China in a direction that seems less aligned with Deng Xiaoping’s reforms (see the first post). China may gain a technological edge in weaponry and may even prevail in an armed confrontation. But it may be squandering its ability to create more prosperity for its population. The huge gains made by the Chinese economy since 1990 are now in jeopardy.

In conclusion, China has some actionable levers to overcome its weaker demographics, and to prolong its prosperity. But its most recent decisions have made its economic future more uncertain for its citizens and for foreign investors.

The content in this piece is partly based on proprietary analysis that Exante Data does for institutional clients as part of its full macro strategy and flow analytics services. The content offered here differs significantly from Exante Data’s full service and is less technical as it aims to provide a more medium-term policy relevant perspective. The opinions and analytics expressed in this piece are those of the author alone and may not be those of Exante Data Inc. or Exante Advisors LLC. The content of this piece and the opinions expressed herein are independent of any work Exante Data Inc. or Exante Advisors LLC does and communicates to its clients.

Exante Advisors, LLC & Exante Data, Inc. Disclaimer

Exante Data delivers proprietary data and innovative analytics to investors globally. The vision of exante data is to improve markets strategy via new technologies. We provide reasoned answers to the most difficult markets questions, before the consensus.

This communication is provided for your informational purposes only. In making any investment decision, you must rely on your own examination of the securities and the terms of the offering. The contents of this communication does not constitute legal, tax, investment or other advice, or a recommendation to purchase or sell any particular security. Exante Advisors, LLC, Exante Data, Inc. and their affiliates (together, "Exante") do not warrant that information provided herein is correct, accurate, timely, error-free, or otherwise reliable. EXANTE HEREBY DISCLAIMS ANY WARRANTIES, EXPRESS OR IMPLIED.

Another terrific article, thank you. I wonder, though, does Xi Jinping truly care about the economic standing of his people? I think it would be easy to conclude from his recent actions that he has an agenda, reunification with Taiwan and then becoming the global preeminent power, and all his actions are focused on furthering those aims. the nation's prosperity does not seem to be an important concern at least to the extent that it would gain priority over any of his more urgent goals. the deepening social control seems likely to be his view of how he can protect his 'flank' from an internal uprising. but ultimately, that has to be his biggest concern.

Thank you for sharing. Great article