China's digital currency is a game changer (Part 1)

The pandemic has exposed radical differences in the conduct of monetary policy between China and the rest of the world. This is only the start of the story.

First, a thank you to Jens Nordvig and Chris Marsh for the opportunity to contribute to Money: Inside and Out. I strongly support the founding ethos. The emphasis on analytical independence and flexibility appeals most of all.

My main aim in guesting here will be to unpack the key themes I am interested in as a dedicated stream, as distinct from my weekly column at the AFR. It is also to engage in a conversation, as the issues are complex and evolving, and I certainly do not have all the answers.

My starting point is an assertion: that when the history is written, 2020 will have will have legitimate claims as the inflection point between the fiat and fractional reserve system that has prevailed since the early 1970s, and a new era where digital currencies become a feature.

To build this case, I make three introductory points today.

My first contention is that China is now on a singular path when it comes to the conduct of monetary policy at a large-scale. I am also not sure that this basic point has resonated sufficiently within the global macro community.

It is remarkable, for example, that this time last year, prior to the Phase 1 trade agreement, China was still designated as a currency manipulator by the US. Yet a year on, the PBOC is the only major central bank that did not resort to quantitative easing.

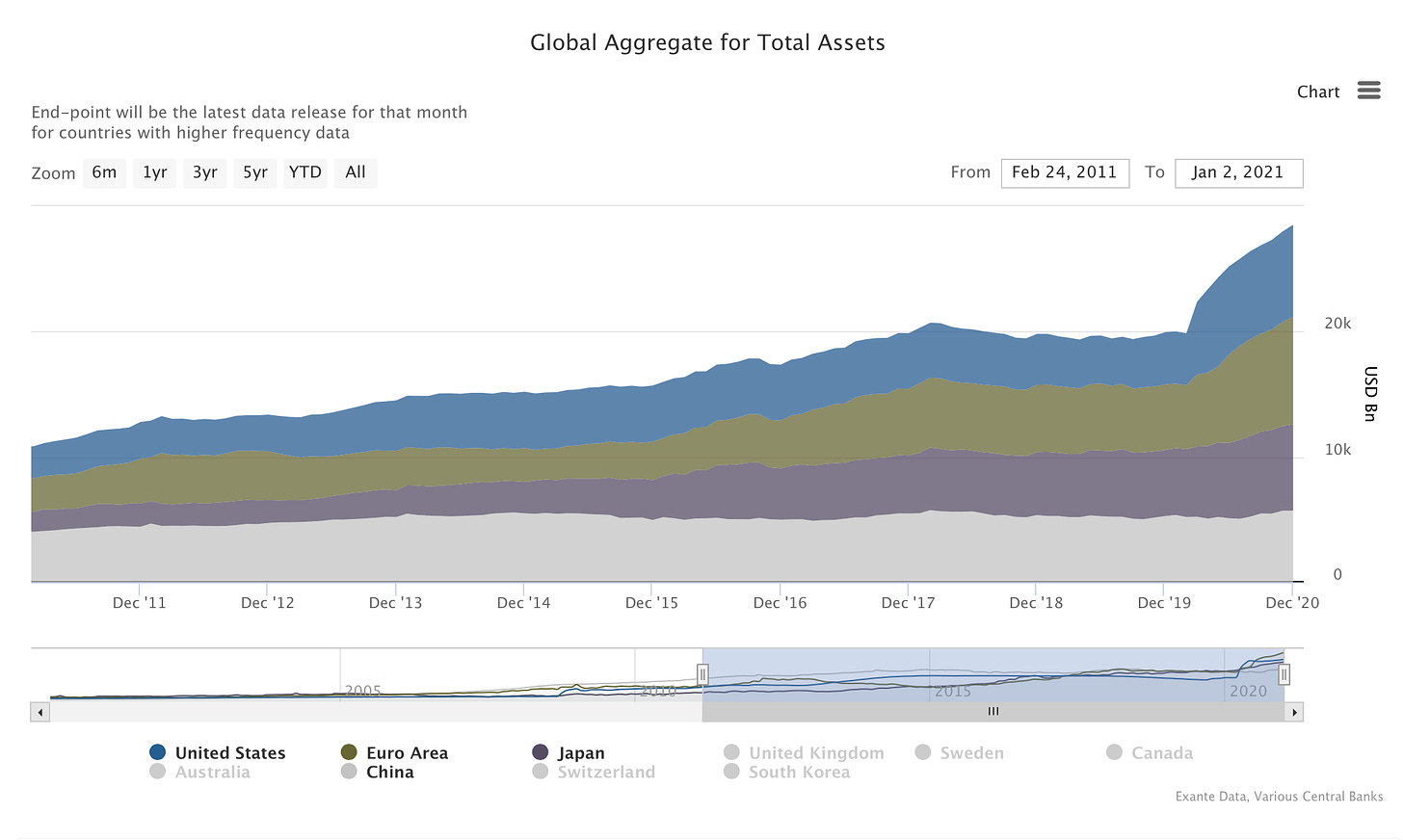

As a consequence, the PBOC has not contributed to the massive ramp in Exante Data’s measure of total assets held by global central banks, shown below (China is the broadly stable area shown in grey). China’s yield curve also looks quite normal, with bond yields stable around 3%, in contrast to the West.

For those wanting to understand the complex modalities of the PBOC’s response to COVID-19, both in terms of price and quantity based measures, I recommend this excellent academic paper, that includes a chronology for the PBOC that can be found here. This article from Zero Hedge is also worthwhile.

This article from mid-year is also helpful in emphasizing China’s focus upon how money is multiplied, rather than the (implicit) Western model of fiscal dominance, intermediated by large-scale quantitative easing.

For those wanting to do the math themselves, the PBOC’s official balance sheet, in English, can be found here. Statistics on monetary base can be found here.

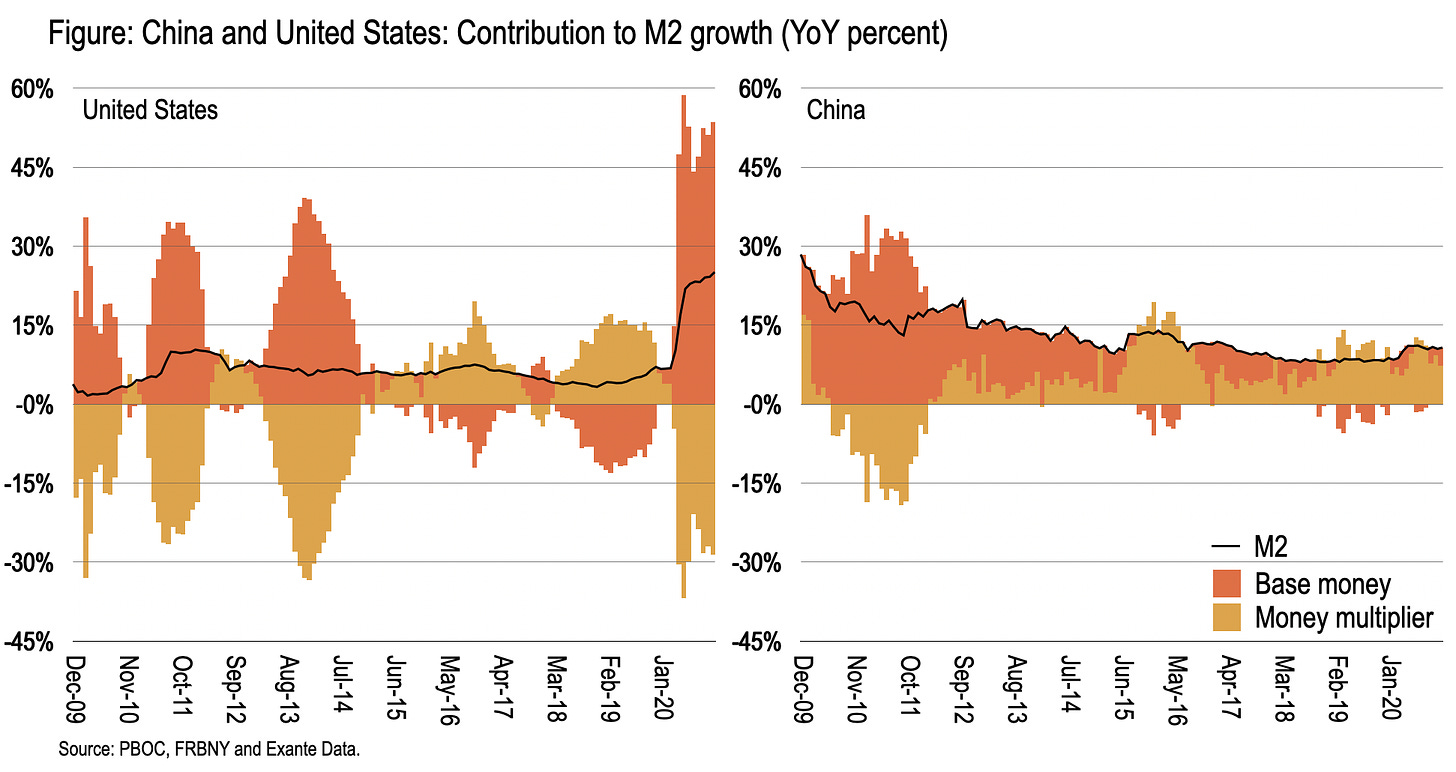

If you put these two sources together it becomes a trivial but nonetheless revealing exercise to contrast the West and the East in terms of the reaction function of monetary policy to COVID-19. Consider the decomposition of M2 growth in the US versus China, where the latter has seen a positive money multiplier and minimal base money growth (panel on the right).

For those wanting to understand the broader context of China’s aversion to quantitative easing, here are some articles to reflect upon: 1, 2, 3, 4, 5.

And to be sure, at Exante Data, we still have reservations about whether the PBOC has been conducting a campaign of stealth FX intervention in foreign exchange markets, see here, here and here.

But this should not detract from China’s emergence as the hard-money capital of the world through in 2020.

The result is a wall of money waiting to enter China, both from the private sector (whether via index rebalancing or discretionary allocations) and the public sector (bear in mind that CNY represents less that 2% of global reserves, versus USD at 60%).

In the meantime, China’s strategic decision to eschew quantitative easing, and to instead pursue highly directed modes of price and quantity based monetary easing warrants much more consideration than it has been given.

The abject failure of Western style (asset swap) quantitative easing to achieve inflation targets (as discussed in a previous Money Inside and Out post), makes this point all the more resonant.

My second contention is that China’s launch of a central bank digital currency (CBDC) is a big deal.

For those following the rollout of DCEP (Digital Currency Electronic Payment), alternatively known as e-yuan, this is not a controversial statement. But it has been lost in the mix somewhat, between the pandemic and Bitcoin (BTC) making new highs every other day.

My emphasis on DCEP is not a slight on crypto. I have been involved in crypto since 2013, and published this analysis way back then, that still has shelf life.

My perspective is principally informed by interactions across the crypto community, and by interactions with regulators, particularly in Australia.

I am also uneasy with some of the cross-over flows seen through Q4 2020, and the claims that are routinely being made in terms of the systemic importance of crypto.

I voiced these concerns publicly in mid-December, whilst acknowledging that crypto was crossing the rubicon:

For crypto-evangelists, the regulatory mindset remains anathema. It runs contrary to founding tenets of Bitcoin, unveiled so ingeniously in Satoshi Nakamoto’s white-paper of 2008. Their libertarian zeal is animated and infectious, and at times, obnoxious. It has resurged over the past couple of months, as crypto signaling (the digital equivalent of virtue signaling) has become a ‘thing’, across family offices, hedge funds, real money and even the corporate sector (where MicroStrategy is the poster-child).

The basic framework I see is this:

We have had, since the breakdown of Bretton Woods, a fiat and fractional reserve system, that has been characterized by a high degree of capital mobility, including across borders, and in large part due to technological innovations in respect of financial actors and instruments, most specifically derivatives. Our system is highly centralized, both in terms of the role of banks (both central and commercial), and the oversight and regulation provided by prudential authorities.

The rise of digital currencies, broadly conceived, does have the potential alter this fifty year status quo. I think it will.

But the most systemic changes will occur via CBDC rather than crypto per se. And China’s project, DCEP, is by far the most systemic of all.

It will take many more posts to substantiate this perspective.

And it will not be popular, as it captures the collision that awaits between the ideals of decentralized finance, and the realpolitik of surveillance and control in the East, and catch-up in the West.

My perspective should not be interpreted as what ought to happen: it is a view on what will happen.

With that said, BTC may well still ‘go to the moon’. The supply / demand imbalance is very real, and we can demonstrate that using Exante Data’s analytics.

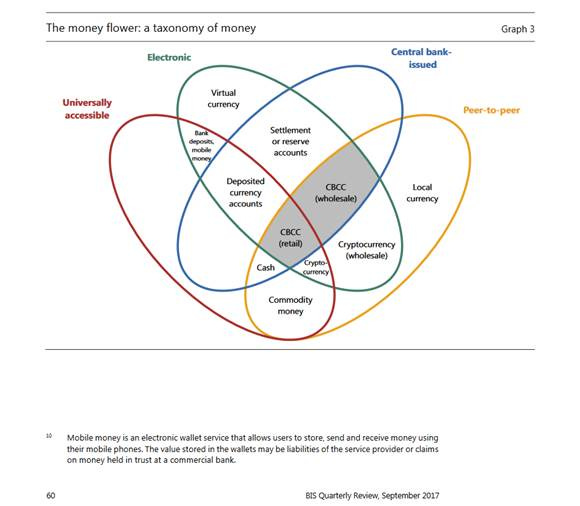

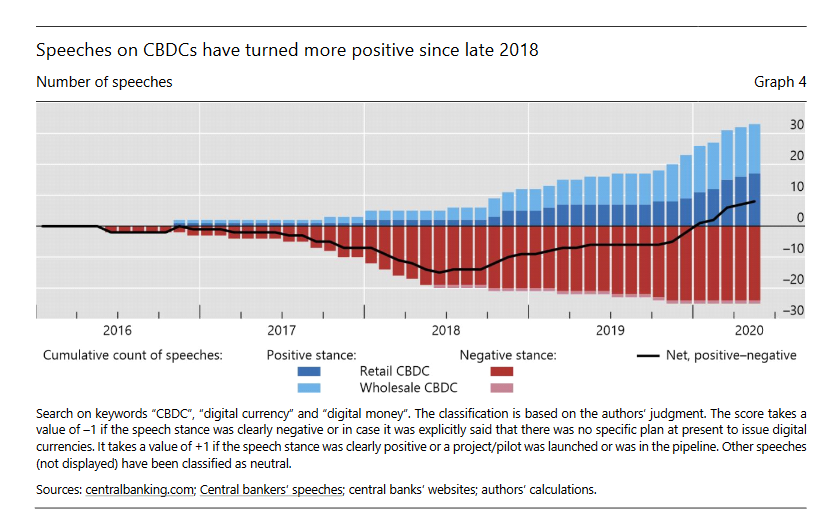

For those seeking to school up, I am suggesting starting with the BIS’ money flower from 2017, here. And then reflect on the seismic change in thinking that has occurred within the global central banking community toward CBDC since Facebook floated Libra, shown below, and here.

Further, this chart, via BIS, also illustrates the changing sentiment towards Central Bank Digital Currency within the official sector.

Then reflect on the BIS fast-tracking its publication of “foundational principles and core features’ for CBDC on Oct 9, here. And then reflect on how different those principles are from China’s project.

And for those looking for much more detail; here are some additional resources on DCEP, both in terms of the technological aspects (1, 2, 3) and the political aspects of rollout itself (1, 2, 3). We will unpack that in future posts.

My third contention flows from the first two: I expect the DCEP project to fundamentally reshape how monetary policy is conceived and transmitted in China over the next decade, both in the mainland and for the Chinese diaspora.

The loftier goals that China has in terms of displacing the reliance its banking system has on SWIFT and CHIPS, as global payment systems, and in terms of the hegemony of the US dollar, will depend as much upon the international reaction, as the push from Beijing.

For this area, let me briefly highlight the extremes, as it is inevitable that the outer perimeters will be explored when a new development comes along, even if it is not the base case.

The most far reaching implication is that the PBOC develops a capability to sidestep the commercial banking sector and is able to transmit monetary policy directly and digitally to households, whilst also incentivizing consumption via negative interest rates or other forms of time decay.

If this sounds unrealistic, I suggest a review the digital airdrops that the PBOC conducted in Shenzhen in October and Suzhou in December. The amounts were immaterial (150,000 citizens at $30 per packet = $4.5m = 0.0001% of the PBOC’s balance sheet).

The amounts were actually so small that is not possible to understand how this fits in to the PBOC’s balance sheet, published monthly.

Yet the precedent opens ‘new vistas’ referred to here, and alluded to this in Twitter thread.

To be sure, there is extensive academic literature on the feasibility, or otherwise, of CBDC solving the zero lower bound problem, and as substituting for large-scale asset purchases. Here are some examples (1, 2, 3, 4, 5).

For today, I am simply highlighting that while the West is talking, the East is doing.

Conclusion

As we turn the year, there is a lot of focus on digital currencies, and much of the hype is deserved; although we believe the hype should be less about the explosive gains in Bitcoin than about the dramatic implications for future monetary policy.

Yet there are various unresolved conflicts as between the ideals of decentralized finance and the regulatory oversight that will be mandated in the West.

In the meantime, China is years ahead in rolling out its own general purpose digital currency, with clear strategic intent.

The battle for the commanding heights is only just starting.

Grant Wilson is Head of Asia Pacific for Exante Data, based in Sydney. He was previously a global macro portfolio manager in Singapore and New York. His full bio can be found here.

hi - yes planning to revisit in Feb. we received a lot of feedback here. lack of near term directional implications is a solid point & a contrast to crypto. hence the hype in crypto, and knowledge deficit wrt CBDC. tku

There are a number of fundamental issues with this note including the assumption made from the decomposition of M2 (US the multiplier can go negative, in China 90% of the banking system is state controlled so money will get lent regardless of market demand thus ensuring the multiplier is steady). But most importantly its the misplaced focus on the PBOC. It's balance sheet simply doesn't matter. China stopped running a fractional system since 2015, since then money supply and system-wide credit creation has been unbridled by central bank base money. As a result the increase in banking assets (and thus M2) so dramatically dwarfs anything seen anywhere else in the world ever. China's domestic banking assets equal 50% of global GDP, which means nearly $50trn in captive domestic assets. That means a wall of money going in the other direction, not waiting to get into China, but waiting to get out! As a share of GDP M2 increased 40ppts in China in the last ten years, whereas the US, even with the recent surge, is only up 30%. That speaks to persistent outflow and depreciation pressure over the long run. As an example, the only country that beats China in terms of M2 growth is Japan and over that period JPY has depreciate nearly 20% in real terms, while the RMB has appreciated. Why? capital controls. They can maintain the status quo as long as they are in place, but don't fool yourself into thinking the flow pressure are in the other direction.