EM capital flows are surging: What can and will policy makers do about it?

The IMF has proposed a new 'integrated' framework, but is that just a new code for 'currency intervention'?

The outlook for emerging markets (EM) will be determined by the combination of global growth dynamics, and the policy response to surging capital flows. Political economy considerations still have an important role to play for EM investors.

In a recent blog post (link) and policy paper (link) the IMF highlighted its latest thinking and advice on how countries can use an "integrated framework" to manage capital flows. The current advice is to draw on various non-interest rate tools such as FX intervention, macroprudential policy and capital flows measures (or as they were called in the old days, capital 'controls').

The advice is not entirely new, though certainly effort has been made to incorporate the academic findings from Chief Economist Gita Gopinath's work on dominant currency pricing. But it is unusually timely, as there has been a 'regime shift' in EM capital flows over the last 6 weeks following the US election and positive vaccine news.

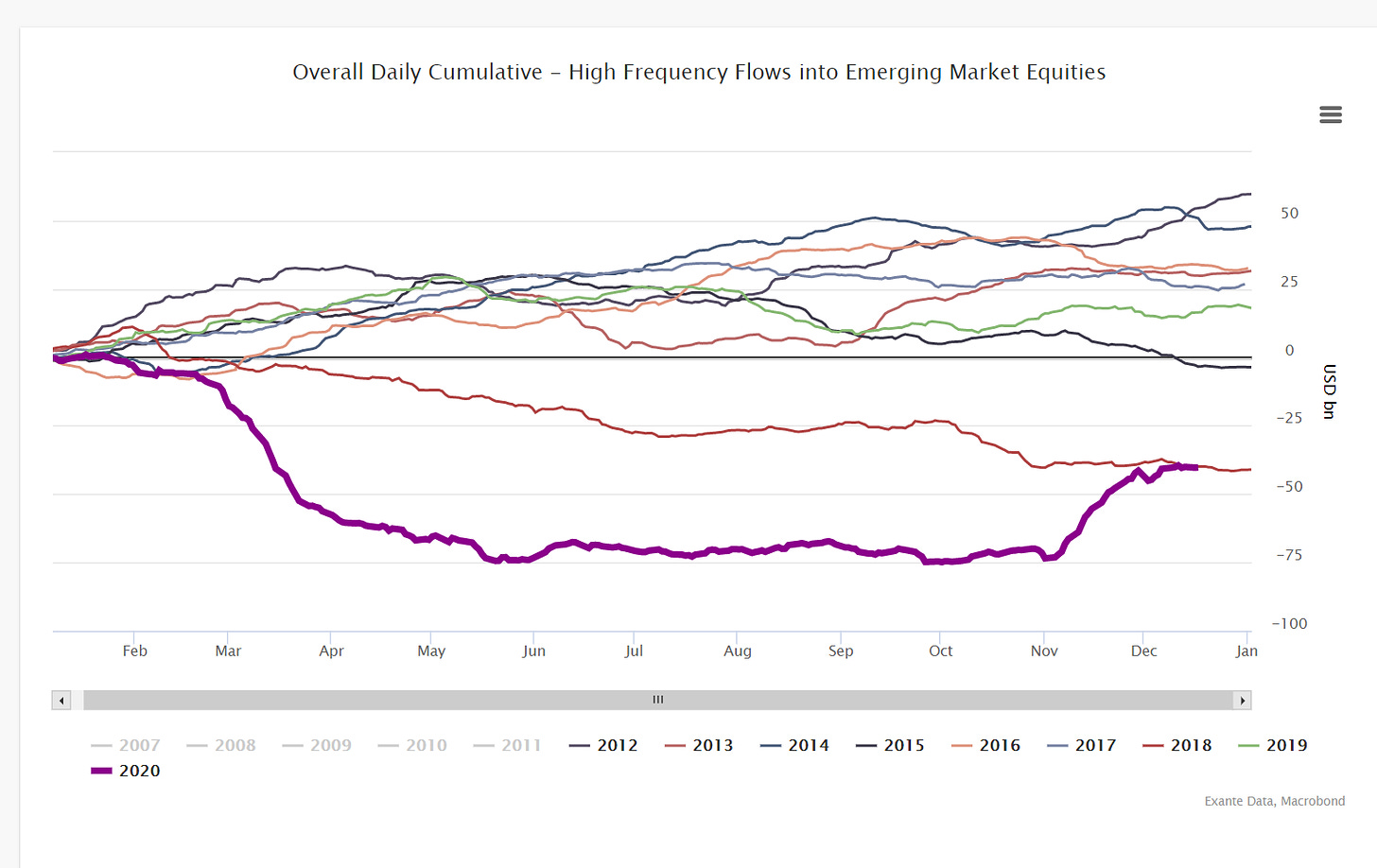

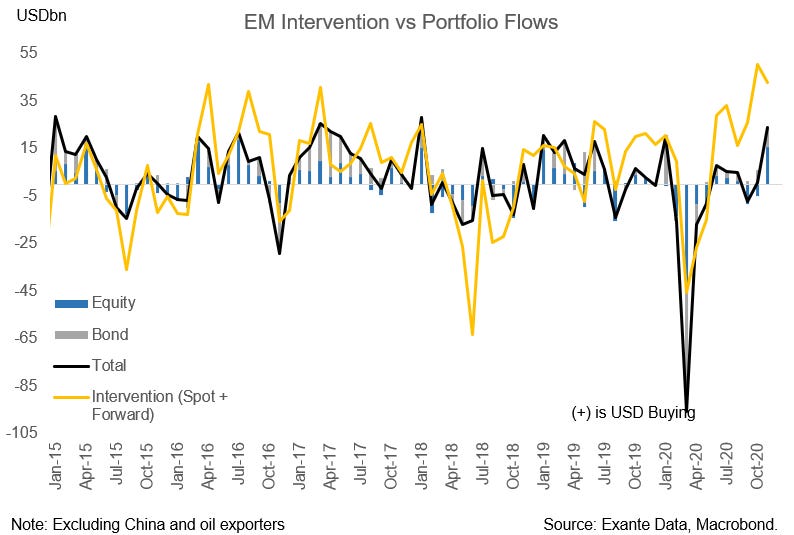

From the perspective of EM portfolio flows, especially equity flows, it was a "November to remember." Exante Data's EM real-time portfolio flow tracker shows roughly $45bn in inflows to EM ex-China split between debt ($15bn) and equity ($30bn).

This is at the very high end of the monthly range for the last decade, and a dramatic turn-around since the EM-crisis like conditions in the spring.

Of course, this shift in momentum in November comes at the tail-end of a truly terrible year for EM portfolio flows up to that point. H1 2020 saw cumulative EM equity outflows of $75bn and debt outflows of $36bn--easily the worst year since the Global Financial Crisis. After the massive outflows in March/April/May, and despite the recovery rally in other risk assets, investor's largely stayed on the sidelines in EM until the recent upturn in November.

The outlook for 2021 generally remains favorable given that investor positioning likely remains underweight following heavy EM selling in the first 10 months of 2020 and relatively weak flows (by historical standards) in 2018 and 2019.

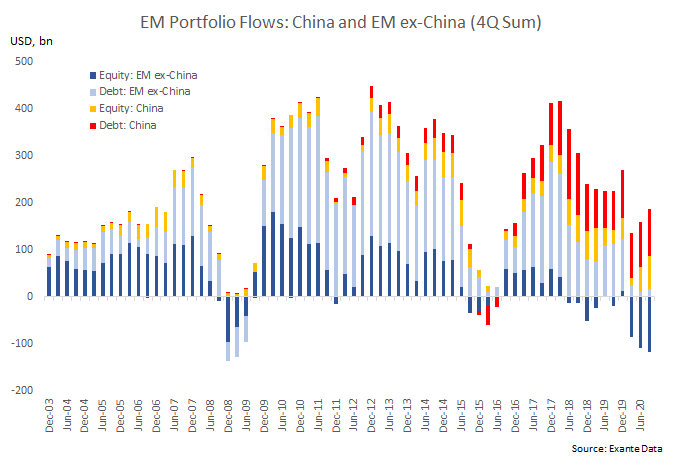

In fact, EM portfolio flows (especially equity flows to EM ex-China) have been weakening for the better part of the last decade, while China's share of total EM portfolio flows (especially debt flows) continues to rise.

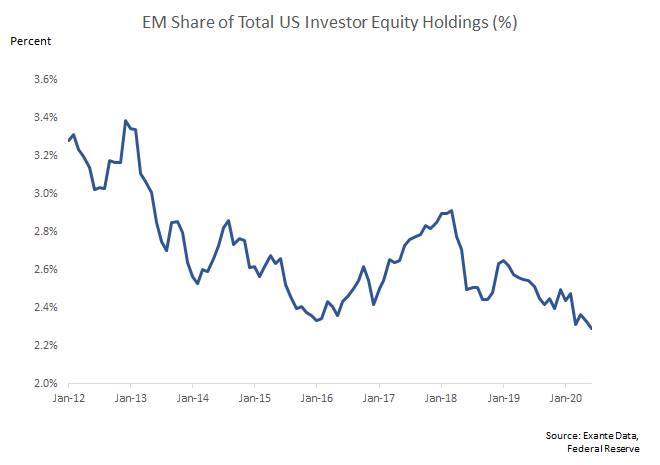

Partly as a result, our estimates suggest US investor's EM equity allocation as of mid-2020 was at the lowest point in almost a decade (admittedly one that has been dominated by US tech outperformance and USD strength).

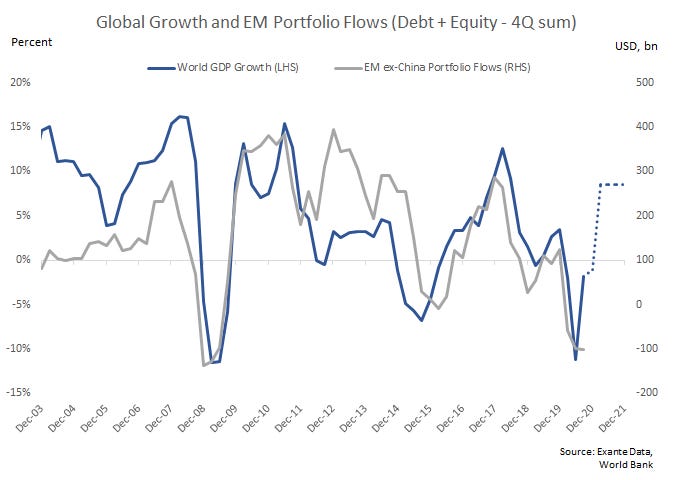

From a near to medium-term perspective then, the question remains how much further could EM portfolio flows run? The answer depends to some extent on EM and global economic growth to which portfolio flows have historically been correlated. Given continued accommodative fiscal and monetary policy and the prospects for vaccine rollout (which itself will act as a powerful form of global stimulus), growth expectations for 2021-22 look reasonably robust. If realized, this should provide a powerful boost for EM portfolio flows over the next several quarters.

Of course, there are some risks to the otherwise favorable EM outlook as investors rotate from growth to value. If vaccines or their rollout fail unexpectedly, or some of the ‘idiosyncratic’ EM stories (ARS or TRY for instance) head south again, there could be some contagion.

A new framework, or good old currency intervention repackaged?

This brings us back to the IMF's integrated framework for managing capital flows.

We have seen a steady acceleration in central bank intervention in EM ex-China in recent months, particularly in EM Asia. In fact, Exante's tracking suggests spot FX purchases accelerated to $44bn in November alongside the pickup in portfolio flows -the highest in a decade.

As the chart below shows, there is a long standing tendency for EM central banks to intervene to offset FX appreciation (depreciation) from portfolio inflows (outflows).

There are a number of important questions for EM in 2021, therefore.

First, can the IMF's "integrated framework" on capital flows distinguish between FX policy aimed at maintaining competitive currency valuations vs smoothing volatility and managing financial stability risks. It is easier said than done.

Second, is China going to be willing to allow greater CNY flexibility than in the past. USDCNY has moved notably lower in H2 2020. But various indicators now hint at fresh intervention.

Third, what is the new Biden-Harris administration, with Yellen as Treasury Secretary going to do on the FX policy front, and with respect to ‘currency manipulation’ in particular.