The Bank of Japan revised up the outlook for CPI last week, though not enough to consider tightening policy just yet;

Japanese CPI remains in deflation territory, though weighed down by exceptional falls in mobile phone charges;

Stripping out such influences, CPI is indeed running at above 1%YoY—but it is not clear if this is anything more than recovery from pandemic-related distortions;

Kuroda’s term ends in April 2022; victory over inflation may take some more time yet.

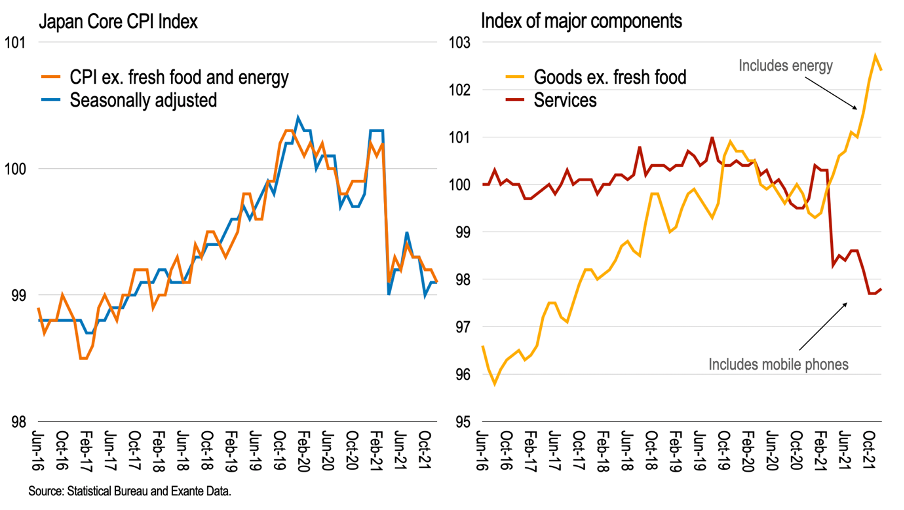

Amongst DM economies, at a time of increasing inflation concerns, Japan stands out as laggard still. Core inflation (defined as CPI ex. fresh food and energy) was only -0.8%YoY in December—continuing the pattern of deflation experienced in Japan so often over the past two decades.

Yet last week the BOJ revised up their inflation forecast for next year and beyond. Why? They note “the rate of increase in the CPI is expected to stay at around 1 percent toward the end of the projection period, due to the underlying inflationary pressure stemming mainly from improvement in the output gap and a rise in medium- to long-term inflation expectations.” They also note that “risks to prices are [now] generally balanced.”

What’s going on?

The remarkable fall of mobile phone charges

Over the past 12 months Service inflation in Japan dropped sharply, while goods (including energy but removing fresh food) increased. But the key driver of this inflation performance over the past 12 months has been the exceptional influence of mobile phone charges on Service inflation, holding down Core CPI.