There has been much discussion of Chinese intervention trends and flows vis-a-vis the United States in Q4, a discussion that is likely to continue in early 2024 as the situation in China remains fluid and confusing.

A data dump

Looking across as much data as we can, we can walk through the contrary signals as follows.

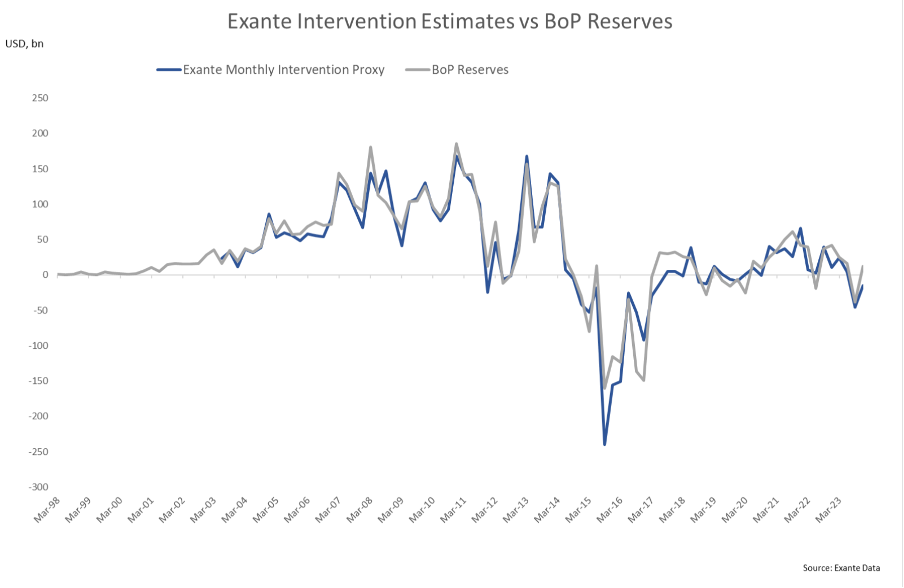

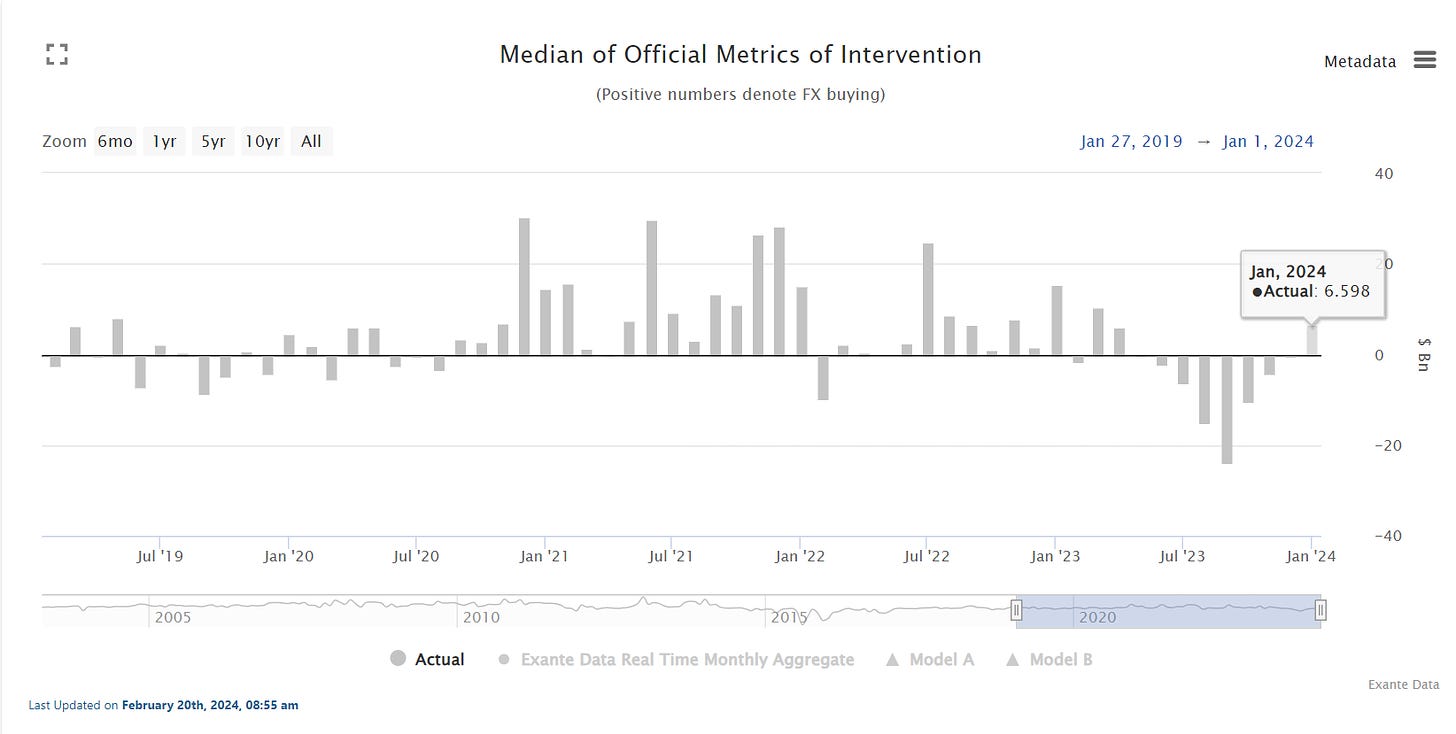

Our intervention tracking via the standard monthly proxies pointed to modest FX selling in Q4 as a whole but the official BoP data suggests modest FX accumulation in Q4.

To be fair our monthly proxies pointed to essentially flat intervention in December after earlier selling. The latest preliminary data for January points to modest accumulation (more details below).

A slowdown in FX selling is somewhat consistent with the narrowing in the fixing errors in Nov/Dec and the price action in US rates and USD following the Nov FOMC. But the fixing errors remained negative which hardly suggests FX buying.

As for the TIC data, it too sends somewhat conflicting signals--at least with respect to December. Overall it suggests China was selling FX in Q3/Q4, but in December the holdings data suggests notable purchases of US securities--after adjusting for valuation effects--while the new (and purportedly more reliable) transactions data was closer to flat.

But all of that is last year's news. As for last month, preliminary estimates based on monthly intervention proxies currently available point to very modest FX purchases. We won't get counterparty data (TIC) for January until mid-March but the signal is at odds with a couple of other pieces of evidence...

First, the fixing errors re-widened in January (see 4th chart above). Second, over the course of Jan CNY moved from a local low around 7.10 back up to 7.20 amid a meltdown in Chinese equities.

Third, the broad dollar trend reversed along with EM ex-China portfolio flows and intervention trends.

Conclusion?

Data from China is increasingly unreliable and inconsistent.

Hence it is important to take a holistic approach and even then the story is uncertain.

But it seems reasonably clear that China (like other EM) was facing significant depreciation pressure in Q3 and into Q4 and this pressure abated in Nov/December but likely resumed in Jan/Feb. Overall the data could be consistent with either modest or little intervention or net purchases/sales of US securities around the turn of the year. But FX selling/sales of US securities seems much more likely than buying. This makes Chinese Q4 BoP data and January intervention proxies showing FX purchases somewhat incongruous with the other evidence.

The content in this piece is partly based on proprietary analysis that Exante Data does for institutional clients as part of its full macro strategy and flow analytics services. The content offered here differs significantly from Exante Data’s full service and is less technical as it aims to provide a more medium-term policy relevant perspective. The opinions and analytics expressed in this piece are those of the author alone and may not be those of Exante Data Inc. or Exante Advisors LLC. The content of this piece and the opinions expressed herein are independent of any work Exante Data Inc. or Exante Advisors LLC does and communicates to its clients.

Exante Advisors, LLC & Exante Data, Inc. Disclaimer

Exante Data delivers proprietary data and innovative analytics to investors globally. The vision of exante data is to improve markets strategy via new technologies. We provide reasoned answers to the most difficult markets questions, before the consensus.

This communication is provided for your informational purposes only. In making any investment decision, you must rely on your own examination of the securities and the terms of the offering. The contents of this communication does not constitute legal, tax, investment or other advice, or a recommendation to purchase or sell any particular security. Exante Advisors, LLC, Exante Data, Inc. and their affiliates (together, "Exante") do not warrant that information provided herein is correct, accurate, timely, error-free, or otherwise reliable. EXANTE HEREBY DISCLAIMS ANY WARRANTIES, EXPRESS OR IMPLIED.