July Market Review: Dual Rally - Stocks and Bonds

Each month, we review macro market themes and moves

US Equity indexes rebounded strongly in July. The S&P 500 rose 9.2%, DJIA 6.7%, and NASDAQ 12.3% on the month. Risk assets were supported by the market further pricing in Fed rate cuts in 2023. Growth stocks rebounded.

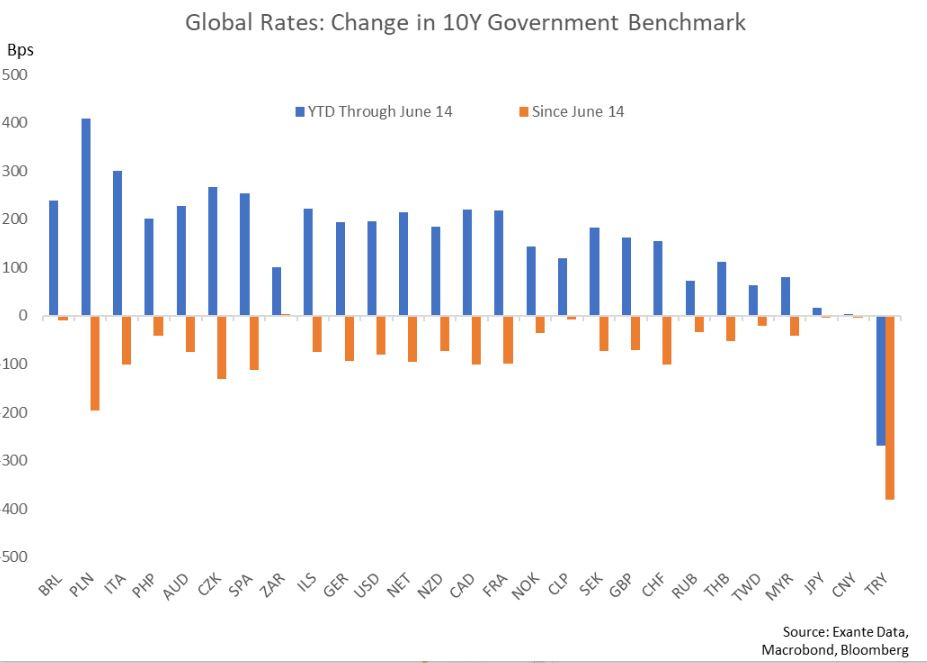

Growth worries continued to dominate inflation worries. The rally in fixed income that started in mid-June, continued through July (chart below). It has occurred despite the fact that there is little evidence that realized inflation has come down. In addition, some central banks in July surprised to the upside with their rate hikes (50bp move by the ECB, and the 100bp move by the BoC).

The FOMC hiked 75 bps in July as expected. In the press conference, Chairman Powell emphasized that the Fed needs to get policy to a moderately restrictive level and will make policy decisions meeting by meeting and "not provide the kind of clear guidance that we had provided on the way to neutral." Powell also stated that "We think it's necessary to have growth slow down...We think we need a period of growth below potential in order to create slack and the supply side can catch up." On the day (July 27th), the SPX rallied on these comments, perhaps anticipating less rate hikes ahead or a quick pivot in 2023 to rate cuts (as is priced).

Chart: Global Rates: Change in 10Y Government Benchmark. Orange bars - since June 14 - July 29.

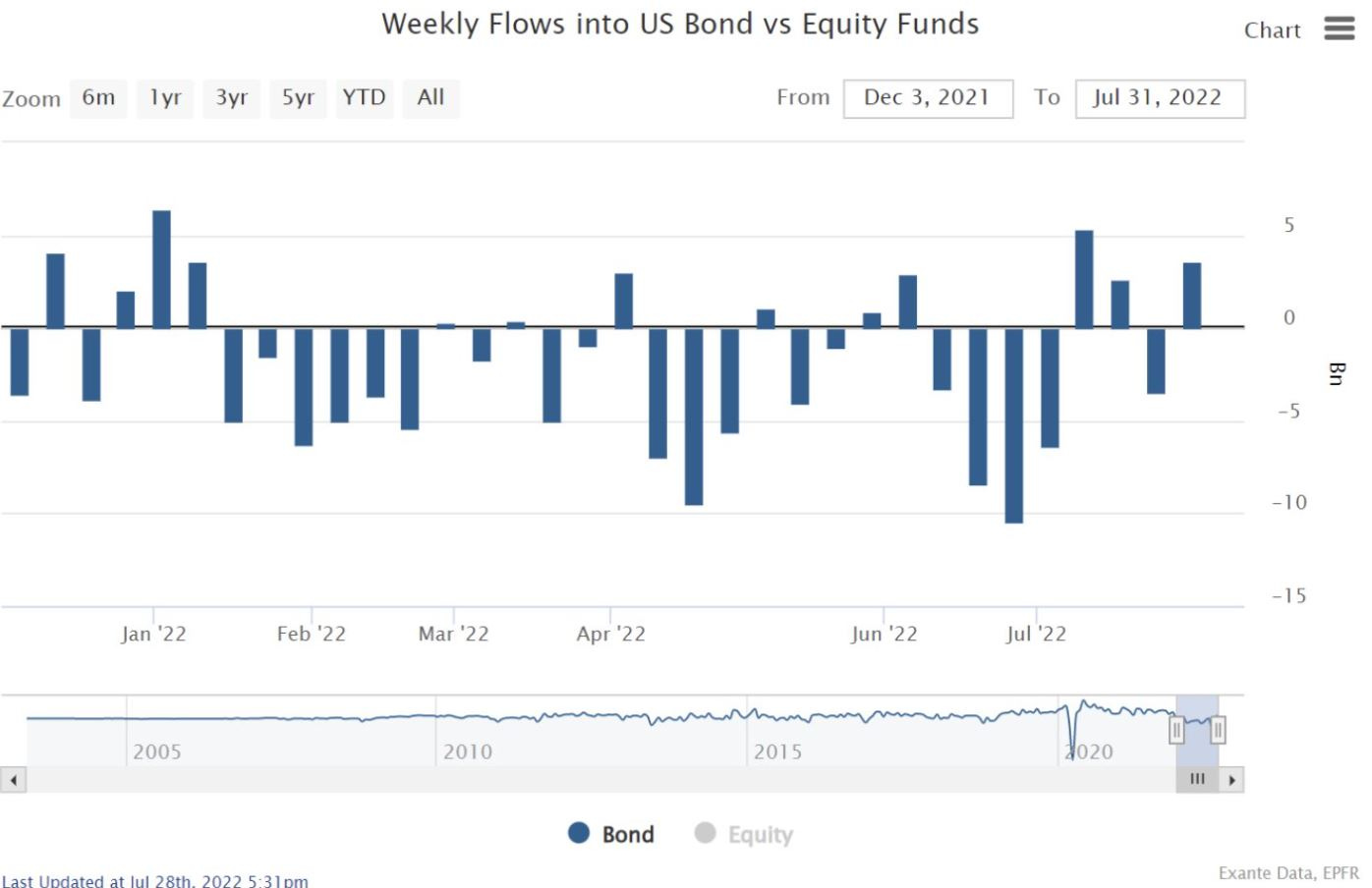

The change in bond flows is one of the themes that stands out recently in our capital flow and alt data time series work at Exante Data. Below is one example from weekly mutual fund and ETF flows. There has been notable US 'bond inflow' for three out of the last four weeks.

On the FX-front:

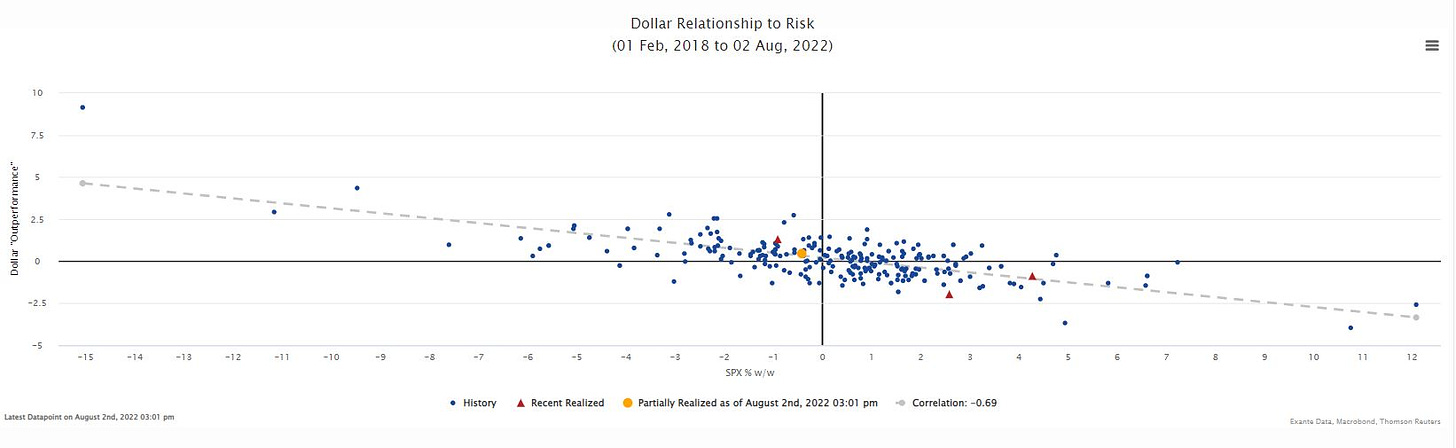

The DXY Index reached a high of 108.63 on July 14th. That day, EURUSD (the DXY's largest component) reached parity for the first time in 20 years and USDJPY made a new high of 138.94 . The shift lower in US longer-dated bond yields weighed on USDJPY for the remained of the month. In general, the USD was on its back foot for the second half of the month, with the DXY Index ending July at 105.40. Also weighing on the USD was the gain in US equity indexes - i.e. risk on sentiment (chart below).

At the time of writing (August 2nd), US equities are lower during the first two trading days in August and the USD a bit stronger, supported by risk-off sentiment due to geopolitical tension arising from US Speaker Pelosi's trip to Taipei, Taiwan. On August 2nd, with the Taiwan issue front and center, the CNY was among the strongest currencies (vs EM and vs G10) . Shown here vs EM.

Turning to EURUSD, in this CNBC clip, Founder Jens Nordvig talks about how the most recent EUR parity differs from 20 years ago. Continuing on the topic of the single currency, July 26th marked the 10 year anniversary of then ECB President Mario Draghi’s “whatever it takes” speech. In this Substack, which is not behind a paywall, Chief Economic Advisor Chris Marsh considers the importance of Draghi's speech/declaration from a long term perspective.

On the topic of Mario Draghi, he resigned as PM of Italy in late July after a vote of confidence in his government of national unity (incl. M5S, Lega, FI, PD) was brought forward in the Senate, only to meet with abstentions from the M5S as well as from the Lega and FI. Draghi remains as caretaker leader until a general election happens in the last week of September or the first week of October.

With some political turmoil and an energy crisis (more below) in Europe, we likely have not seen the bottom in EUR or the high in USD yet.

Chart: USD relationship to risk. USD "Outperformace" vs SPX w/w%. Yellow dot is Aug 2. Red triangles are recent weekly results for end of July - USD weaker as SPX rallied.

European Gas Situation

In July, there was removal of a near-term tail risk in relation to European gas flows. After shutdown for a maintenance period, the Nordstream pipeline resumed flows to Europe on July 21st, though at a reduce rate (chart). In June flows were cut to 40% of capacity. Now, post the July maintenance period shutdown, flows are operating at 29-15% capacity (chart below). Uncertainty is ongoing as there is no clarity on what Russia will supply ahead.

Media and Announcements

Jens Nordvig spoke to Bloomberg Surveillance August 3rd on the Fed-speak push-back re the rates rally.

We are pleased to announce the promotion of Chris Marsh to Chief Economic Advisor, formalizing his central role in mapping out our frameworks for global monetary policy and liquidity analysis.

Chief Economic Advisor Chris Marsh is quoted in this article in The Economist on the tough spot the UK and BoE are in: "Chris Marsh of Exante Data, a research firm, describes rate-setters as 'moving from meeting to meeting and feeling their way'".

The content in this piece is partly based on proprietary analysis that Exante Data does for institutional clients as part of its full macro strategy and flow analytics services. The content offered here differs significantly from Exante Data’s full service and is less technical as it aims to provide a more medium-term policy relevant perspective.

Exante Advisors, LLC & Exante Data, Inc. Disclaimer

Exante Data delivers proprietary data and innovative analytics to investors globally. The vision of exante data is to improve markets strategy via new technologies. We provide reasoned answers to the most difficult markets questions, before the consensus.

This communication is provided for your informational purposes only. In making any investment decision, you must rely on your own examination of the securities and the terms of the offering. The contents of this communication does not constitute legal, tax, investment or other advice, or a recommendation to purchase or sell any particular security. Exante Advisors, LLC, Exante Data, Inc. and their affiliates (together, "Exante") do not warrant that information provided herein is correct, accurate, timely, error-free, or otherwise reliable. EXANTE HEREBY DISCLAIMS ANY WARRANTIES, EXPRESS OR IMPLIED.