Lessons from the Bundesbank

Buba inflation control in the early-1980s hinged on the Taylor Principle—and the ECB knows this

The German experience in achieving inflation control under monetary targeting from the mid-1970s provides a guide for policy today;

But studies suggest that the key to the success of Bundesbank inflation control was the de facto implementation of a Taylor Rule—where policy responded more than one-to-one with inflation developments;

An open question, however, is whether the structure of the Eurozone is robust enough to withstand the blind application of such a policy rule today.

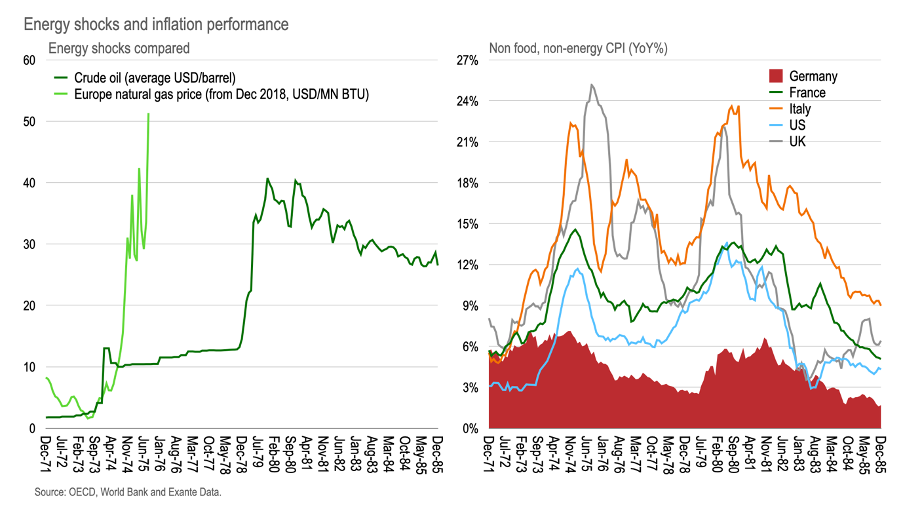

THE BUNDESBANK, Germany’s central bank in the post-war period until euro introduction, was amongst the most successful in controlling inflation in the 1970s and 1980s. In the face of the exceptional energy shocks of the time, inflation performance in Germany was considerably better that other developed market economies (including the US).

After the Bundesbank initiated monetary targeting in 1975, for example, Core inflation remained largely below 6%YoY despite the second oil shock—and was returned to roughly 2%YoY by end-1985. This compares with, say, Italy when Core CPI was still 9%YoY at that time.

A working paper at the ECB described this performance thus:

“The differences between the inflation rates in Germany and the other G7 countries were most marked at the start of the period of floating exchange rates. In fact, in the period 1974-1982 prices increased by 46 per cent in Germany (with an average annual rate of 4.8 per cent). In the same period of eight years, prices almost doubled in the US (with an annual average inflation rate of 9 per cent).”

As well as studying the lessons from Volcker’s disinflation, it is likely that policymakers are also studying this experience for clues to help steer policy today.

But why was the Bundesbank so successful?

Monetary targeting vs. the Taylor Principle

While it is true that Buba initiated monetary targeting in 1975 as an intermediate guide to achieving price stability, a number of studies have suggested that policy in this period can best be described by a Taylor Rule that adhered to the Taylor Principle.

We previously noted the perceived role of the Taylor Rule for Bundesbank inflation-fighting in the late-1970s and early-1980s. To be more precise: