Macro is Back, With a Vengeance

You may not be interested in macro, but macro is interested in you (even if you normally have a focus on single stocks)

A benign backdrop in recent decades encouraged a number of equity investors to view the macro context as fixed and close to irrelevant;

In truth, macro factors were always important drivers of the stock market but the macro context was fixed and supportive;

This is no longer true—and we may be entering a prolonged period in which macro considerations play a more important role in equity investing.

This is a guest post by S. Joseph Karam, who has been an equity portfolio manager for multiple decades, at top fund managers such as Kingdon Capital Management, Soros Fund Management, as well as his own fund Seven Global. Joseph is also active in macro analysis, specifically on topics relating to demographics as founder of populyst.net. His twitter is @sami_karam.

The performance of the equity market in the first half of 2022 was the worst in several decades. The S&P 500 fell 20.6%, its worst first half since 1962. And the Nasdaq Composite fell 29.5%, its worst first half ever. These declines were primarily driven by macroeconomic factors—as as was the surge that took place in 2020-21—a reality that is at odds with the bottom-up approach favored by most fund managers and analysts.

In fact, a generation of fund managers have come of age during a period that was exceedingly favorable to equity investing. The context for investing was very stable: the demographic dependency ratio was falling while the population was growing; US institutions were functioning well; there were no large and imminent foreign threats after the fall of the Soviet Union; inflation was tame and interest rates were falling. And if, as happened every now and then, this ideal equilibrium was briefly disrupted by a crisis that hobbled markets, the Fed was always standing by at the ready to intervene and provide the necessary fuel to reignite the economy's animal spirits.

As a result of this best-of-all-worlds configuration, it became normal for many to view the macro context as fixed and therefore as close to irrelevant to analysis. Prominent investors, pillars of the investment business, encouraged this view by downplaying the importance of macro in their own processes. The great Peter Lynch, the doyen of mutual fund equity investing, famously stated that "if you spend 13 minutes a year on economics, you've wasted 10 minutes." And Warren Buffett was expansive on the subject in a 2014 CNBC interview:

My partner Charlie Munger and I have been working together now for 55 years. We've talked about every business you can imagine, and stocks. We've never had one decision that involved a macro factor. This doesn't come up. If I talk to Charlie about [some companies], we don't get into macro. It just doesn't make any difference... We really don't care whether the Fed is going to increase interest rates 100 bps or 200 bps next week.

These views have been widely adopted by a large percentage of managers over the years. In fact, they have become so deeply ingrained that macro equity investing was sometimes seen as the futile exertion of sophisticates who allow themselves to be distracted by external questions rather than embrace the simplicity of a tried and true process.

Most star managers remain resolutely bottom-up in their approach. For example, fund manager Cathie Wood, whose fortunes soared and fell with the Fed's injection and withdrawal of liquidity in 2020-22, seems to spend little time on macro. She remains confident that her portfolio companies are so promising as disruptors in their sectors that they will rise above the fray and deliver jumbo returns in the years ahead. Perhaps Wood’s ETF will rally in the next few months. But making the right macro call would have avoided or limited the large drawdowns of 2021-22.

A Shifting Mosaic

The unexpected events of the past year have put great stress on the bottom-up never-macro process that is favored by many. Because of the return of higher inflation and the shock of the Ukraine war, macro is once again commanding an important role in the investment process.

In fact, we may paraphrase Leon Trotsky's awful quote about war, “you may not be interested in war, but war is interested in you” by substituting macro for war: you may not be interested in macro, but macro is interested in you.

In particular, macro is very interested in your equity portfolio.

If you look at Berkshire's long-term performance for example, it is quite clear that it has outpaced the S&P 500 by a wide margin. However, it has generally moved up when the market has moved up and down when it has moved down. In addition, Berkshire’s outperformance vs. the index essentially ended with the financial crisis of 2008-09. Since then, its performance has been close to that of the S&P 500. So, while Buffett and Munger have little interest in macro factors, macro has clearly been impacting their portfolio.

As to Magellan's performance under Peter Lynch, it probably did not deviate too much from a synthetic blend of the S&P 500 and a small cap index, an appropriate benchmark given Lynch's propensity to invest in small caps, notably during the late 1970s when they outperformed the S&P 500.

A dismissive attitude towards macro analysis made sense when the general direction of the market was consistently upward, as it has been since the early 1980s (with some important interruptions in 2000-02 and 2008-09). But it can lead to significant losses or underperformance in a prolonged bear market such as we last saw in the 1970s, and such as we may now be facing.

The reality is that macro factors were always important drivers of the stock market, and therefore of funds that are correlated to the market. For many decades, the macro context was considered to be fixed and to be supportive of equities in the long run. But we are now reminded that it is not fixed and may not always be supportive over large time spans.

Macro analysis is complex and multi-layered and deals with factors that are constantly evolving. As a result, no single dominant macro factor can explain the direction of the market. Rather, we should view macro as a shifting mosaic and macro analysis as a form of vector algebra. In this case, the resultant sum of all macro vectors may help predict the direction of the market. We can enunciate the vectors that impact cash flows and that therefore drive equities: interest rates and liquidity, tax rates and regulations, free trade agreements, political risk and geopolitical events, foreign currency exchange rates, and others. In this post, we will only discuss interest rates and liquidity.

An Imperfect Model

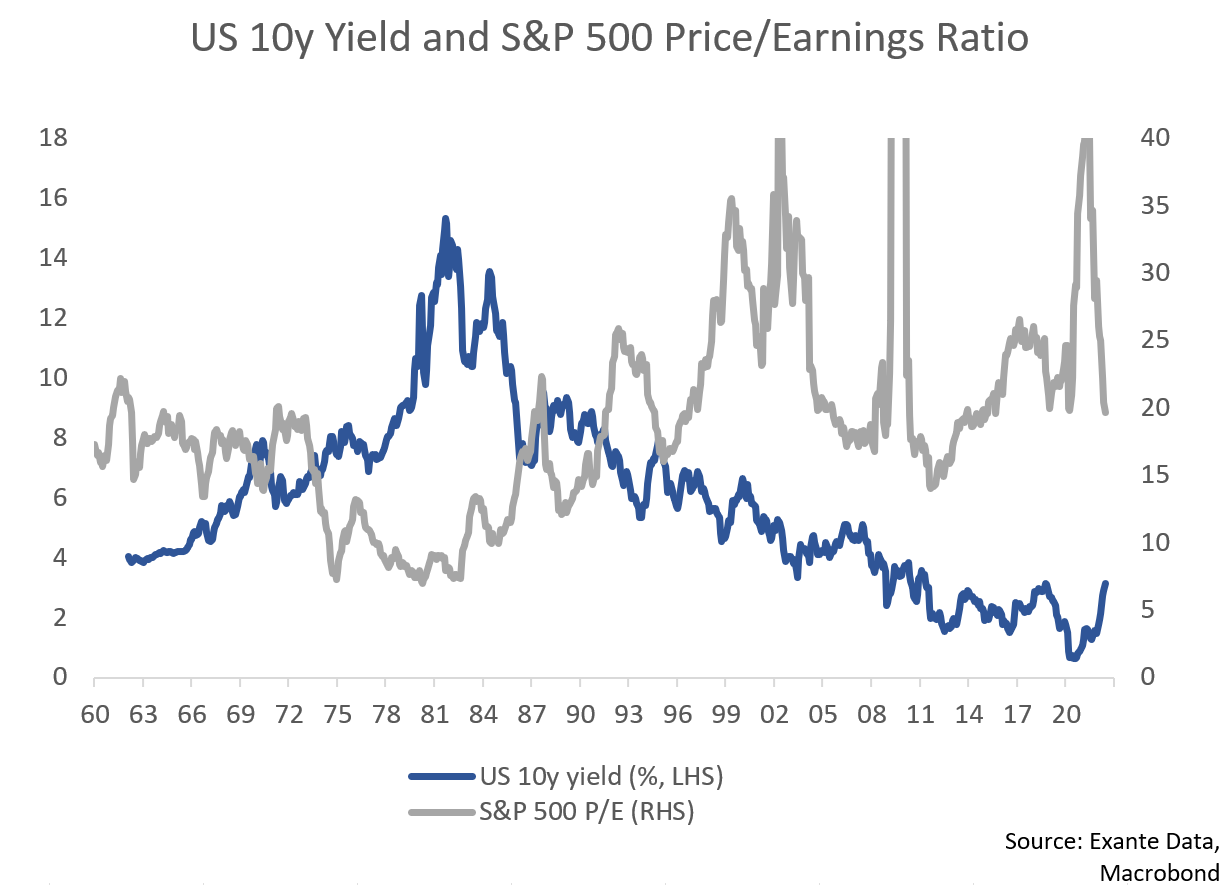

The so-called “Fed model” of years past had identified a correlation between treasury rates and the forward PE of the S&P 500. The lower the rate, the higher the PE and vice-versa. When interest rates were very high in the early 1980s, the PE of the index was in single digits. And when interest rates were very low as in the late 1990s and in recent years, the PE was near its historic highs.

The Fed model has not worked through all periods because it is far from a perfect correlation. If it were, the process of applying macro to equity investing would be straightforward: we would focus on interest rates and ignore other macro factors. Yet the Fed model is one tool, or one vector, that should be considered along with others.

The relation between low rates and high PEs was sometimes complicated by the injection of additional liquidity that boosted the market. In 1999-2000, the Fed was concerned about the Y2K computer bug and it flooded the market with liquidity. In the 2010s, the Fed lowered rates to zero and added more liquidity to the market through several rounds of quantitative easing. And in 2020-21, Congress pumped additional liquidity in the markets through its pandemic-fighting stimulus bills. In all of these instances, the added liquidity propelled market valuations beyond what the Fed model would have predicted, and it created the strong performance of equities during the Nasdaq bubble, in the early 2010s and in 2020-21. Conversely, the withdrawal of liquidity in 2000 and now in 2022 contributed to the market declines in those years.

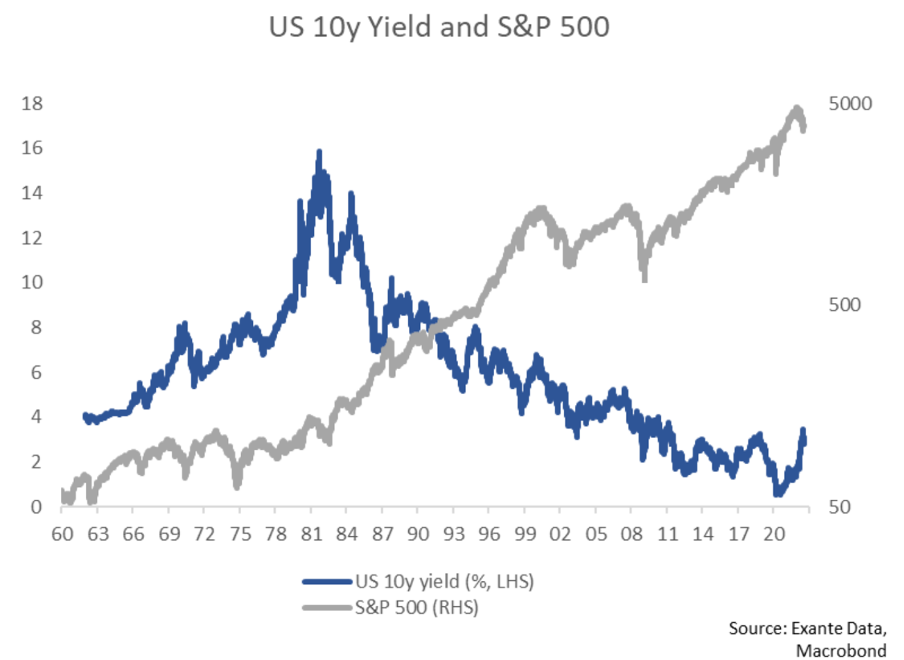

Still, while the correlation of rates and valuations was sometimes thrown off by other factors, it is clear when we look at the long term picture, that the stock market was greatly assisted in the past forty years by the taming of (official) inflation, by the resulting decline in interest rates and by additional injections of liquidity. This is seen in the charts below.

In terms of valuation, it is also clear that the PE is correlated to the 10-year yield (albeit not perfectly), as seen below:

These charts paint an incomplete picture insofar as macro incorporates many other considerations. In future posts, we will examine the other macro vectors influencing the equity market.

The content in this blog is partly based on proprietary analysis that Exante Data does for institutional clients as part of its full macro strategy and flow analytics services. The content offered here differs significantly from Exante Data’s full service and is less technical as it aims to provide a more medium-term policy relevant perspective.

Exante Advisors, LLC & Exante Data, Inc. Disclaimer

Exante Data delivers proprietary data and innovative analytics to investors globally. The vision of exante data is to improve markets strategy via new technologies. We provide reasoned answers to the most difficult markets questions, before the consensus.

This communication is provided for your informational purposes only. In making any investment decision, you must rely on your own examination of the securities and the terms of the offering. The contents of this communication does not constitute legal, tax, investment or other advice, or a recommendation to purchase or sell any particular security. Exante Advisors, LLC, Exante Data, Inc. and their affiliates (together, "Exante") do not warrant that information provided herein is correct, accurate, timely, error-free, or otherwise reliable. EXANTE HEREBY DISCLAIMS ANY WARRANTIES, EXPRESS OR IMPLIED.