Macro That Matters (For Everything!)

Q4 2023 letter from Exante Data Founder and CEO Jens Nordvig

The last six months has been driven by rates. The ups and downs in US rates in particular have been the epicenter of all global macro volatility.

As such, navigating the ups and downs in yields have been instrumental to overall risk taking, including in FX and equity markets.

Here, I will simply highlight three basic points that helped the Exante Data team pinpoint the peak in global rates (we hosted a ‘peak rates call’ on Oct 10, and we made these observations first around that time).

First, long dated yields tend to peak at the same time as short rates. In the last 8 tightening cycles, there has been essentially no exceptions to this basic rule. As such, monetary policy analysis has historically been the dominant force in determining the overall direction of global rates, along the curve.

And this has indeed been the case in this cycle too.

Second, while the fiscal deficits are large, issuance have been skewed towards bills. As such, the worst fears about explosive long-end bond supply have not become reality.

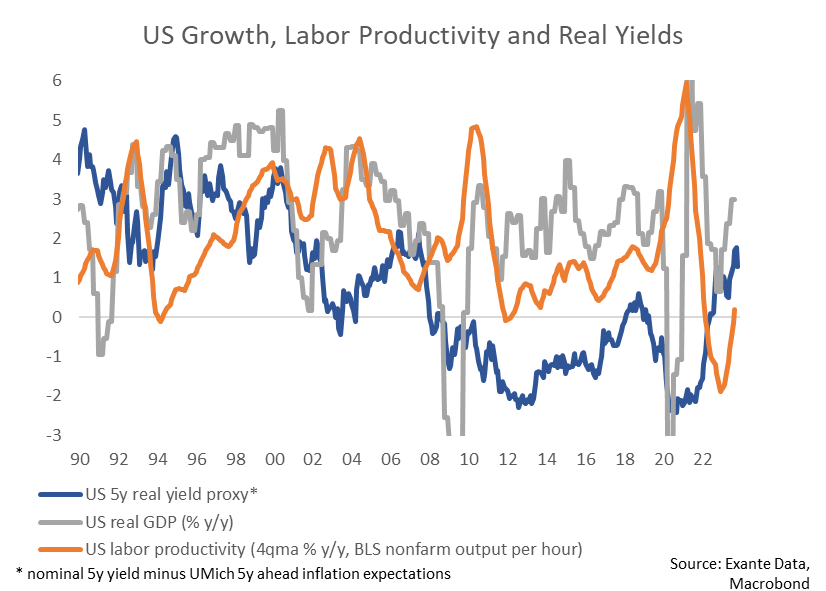

Third, while AI may help push productivity higher (over time), we do not think it will lead to dramatically higher real rates in the near term. In particular, we do not think AI linked effects will feature prominently in Fed thinking in the next few quarters, as also reflected in its stable long-term dots (around 2.50% nominal).

And while real rates have dropped dramatically in recent weeks, they remain historically elevated, at least when comparing to the last 20 years, which still seem the most relevant in the context of the trend-growth and productivity environment we are in.

Looking into 2024, the surprise could be ‘inflation-undershooting.’ Specifically, a number of deflationary forces are now gathering steam. China is exporting deflation (see thread). Credit growth is negative in many important countries (and around zero in the US). Moreover, cost savings linked to AI is likely to push inflation lower too in coming years. There is still a lot of focus on upside inflation risk (fed mistake talk has heated up a lot). But inflation-undershooting is now also a risk to take seriously (see substack and LinkedIn post).

If you are interested in more information about these important themes, including recordings of our recent client video calls on the topic, please reach out to kaye.gentle@exantedata.com, and we will help the best we can.

We are proud to serve the world’s most sophisticated investors. We will continue to push ahead with a combination of proprietary data, human conceptual thinking and AI, which we believe is the superior formula for alpha generation and risk management. And in 2024, we will embed more AI aspects in our service, in cooperation with MarketReader (take a look at the technology here!)

Thanks for the continued support and happy holidays!

All the best,

Jens Nordvig

Founder and CEO Exante Data Inc.

The content in this piece is partly based on proprietary analysis that Exante Data does for institutional clients as part of its full macro strategy and flow analytics services. The content offered here differs significantly from Exante Data’s full service and is less technical as it aims to provide a more medium-term policy relevant perspective. The opinions and analytics expressed in this piece are those of the author alone and may not be those of Exante Data Inc. or Exante Advisors LLC. The content of this piece and the opinions expressed herein are independent of any work Exante Data Inc. or Exante Advisors LLC does and communicates to its clients.

Exante Advisors, LLC & Exante Data, Inc. Disclaimer

Exante Data delivers proprietary data and innovative analytics to investors globally. The vision of exante data is to improve markets strategy via new technologies. We provide reasoned answers to the most difficult markets questions, before the consensus.

This communication is provided for your informational purposes only. In making any investment decision, you must rely on your own examination of the securities and the terms of the offering. The contents of this communication does not constitute legal, tax, investment or other advice, or a recommendation to purchase or sell any particular security. Exante Advisors, LLC, Exante Data, Inc. and their affiliates (together, "Exante") do not warrant that information provided herein is correct, accurate, timely, error-free, or otherwise reliable. EXANTE HEREBY DISCLAIMS ANY WARRANTIES, EXPRESS OR IMPLIED.