Norges Bank should follow in the footsteps of the Riksbank by hedging parts of the FX reserves. By doing so, the kroner will strengthen, and provide necessary support for Norges Bank in fighting inflation.

NOK weakness is contributing to inflation and challenging policymaking in Norway;

One option to support the currency would be follow the example of Sveriges Riksbanken, where efforts have begun to hedge 25% of her FX portfolio;

If Norges Bank begin hedging part of FX reserves, support for NOK would be meaningful, if temporary;

This would buy time for consideration of similar measures for the Oil fund.

I have never understood why it is acceptable to businesses, politicians and Norges Bank that Norway has a currency that fluctuates 10-20% per year, often for reasons few understand.

The moves are predominantly speculative and at the moment have taken the currency to such a weak level that it is fueling inflation, possibly requiring interest rates to be set at a higher level than intended just to prevent the currency from falling further.

Yet if there is anyone with the financial muscle to reduce volatility and stir the currency in a direction that would benefit the country, it is Norway.

Since 2014 I have argued that Norway should borrow money and not use oil taxes or to tap the Oil Fund (“GPFG”) when funding the budget deficit. Issuing more government bonds would make the NOK market bigger, more solid, improve liquidity and reduce volatility in the exchange rate.

For the past two years I have suggested that the Oil Fund should have NOK as an asset class, not to invest in mainland Norway but in the North Sea, especially in upcoming renewable projects.

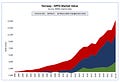

The Oil Fund has grown to a market value this week of close to NOK15,700 billion. That’s four times bigger than Norway’s mainland GDP.

GPFG’s market value is made up as follows: 50% from return on investments, 30% from oil taxes put into the fund, and 20% from a weakening krone.

A weak NOK was never intended as a way for GPFG to make profit. In reality, it has turned out to be an important asset class.

The “fiscal rule,” which limits the use of oil money in the economy to 3% of the Fund’s market value, makes little sense. The worse the economy performs, the bigger deficits and the more the currency depreciates. For Norway this is no problem as it causes an inflated market value of the Fund, which then sorts out the deficit problem!

Looking to Sweden

I have recently suggested that Norway should look to Sweden, who have seen Sveriges Riksbank’s FX reserves grow substantially for reasons of a weak Swedish kronor. A bit like what has happened to GPFG but on a smaller scale.

Sveriges Riksbank wants to “protect” parts of this windfall profit by hedging 25% of the FX portfolio. This means they will sell USD8 billion and EUR2 billion and buy Swedish kronor over a period of 4-6 months. They started at the end of September.

While the SEK has appreciated against the EUR by some 2.5% since Sveriges Riksbank started hedging, one could argue that purchases of SEK 1 billion per day is too small to explain the the appreciation, at least to its full extent, and that expectations for another hike of the policy rate is of equal importance as is asset purchases.

However - I think Sveriges Riksbank here sends a clear message to Swedish pensions funds to do the same. They have huge, unhedged portfolios invested abroad and should they see that the SEK is appreciating from what the Riksbank is doing, they could start doing the same. If so, the SEK could see a substantial appreciation.

I think politicians in Norway, who decision this would be, should consider whether Norway could do the same by hedging parts of GPFG - say 15% to 25%.

The point about not copying the Swedes might be valuable in sports but here I think the Swedes have a very good point.

Regrettably - this likely is a long shot.

If acting on the Oil fund takes time, a quicker and easier way would be for Norges Bank to do do the equivalent with its FX reserves, which are substantial, not least because of the weak NOK.

In the monthly balance sheet presentations from Norges Bank, note 3 Foreign exchange reserves, one can read (emphasis added):

“Norges Bank's foreign exchange reserves shall be available for use as part of the conduct of monetary policy with a view to promoting financial stability and to meet Norges bank's international commitments to the IMF and individual countries. The foreign exchange reserves are divided into an equity portfolio managed by Norges Bank Investment Management, a fixed income portfolio and a petroleum buffer portfolio managed by Norges Bank Markets.”

Now – I am not a lawyer, but when you have a currency which fluctuates 10% to 20% in a year and has taken on such a weak level that it is adding to the country’s inflation problem, I would argue that to strengthen and stabilize that currency is adding to financial stability.

This would be a decision for Norges Bank to make and therefore could be made quickly.

Norges Bank´s FX reserves are a fraction of what Norway´s “real” FX reserves are:

There is substantial market risk for Norway in these reserves and I think it would make sense from sound risk management principles, and to enable stricter budget discipline, if a part of this portfolio was hedged.

Hedging part of FX reserves would likely not be big enough to have a lasting positive impact on the NOK. For that to happen, you would have to include the Oil Fund. But if we start with the reserves, politicians will have time to make up their mind.

However – should the amount and the timeline be communicated, as the Riksbanken did, then I would presume others will follow. If so – the impact could be both substantial and sustainable.

In other words:

To hedge parts of Norges Bank’s FX reserves, say for the total amount of NOK275-325 billion.

The amount is substantial and will provide support to the NOK throughout the period the NOK purchases were conducted — say, over 12-18 months.

By communicating both the amount and the timeline, I would be surprised if other market participants would not do the same and even match the amount.

If so - the NOK will likely appreciate 10-15%.

It would further enable Norges Bank to set the policy rate with few worries about the NOK, making the job of fighting inflation much easier.

It would give politicans more than a year to discuss whether this would be prudent risk management also for parts of GPFG.

The content in this piece is partly based on proprietary analysis that Exante Data does for institutional clients as part of its full macro strategy and flow analytics services. The content offered here differs significantly from Exante Data’s full service and is less technical as it aims to provide a more medium-term policy relevant perspective. The opinions and analytics expressed in this piece are those of the author alone and may not be those of Exante Data Inc. or Exante Advisors LLC. The content of this piece and the opinions expressed herein are independent of any work Exante Data Inc. or Exante Advisors LLC does and communicates to its clients.

Exante Advisors, LLC & Exante Data, Inc. Disclaimer

Exante Data delivers proprietary data and innovative analytics to investors globally. The vision of exante data is to improve markets strategy via new technologies. We provide reasoned answers to the most difficult markets questions, before the consensus.

This communication is provided for your informational purposes only. In making any investment decision, you must rely on your own examination of the securities and the terms of the offering. The contents of this communication does not constitute legal, tax, investment or other advice, or a recommendation to purchase or sell any particular security. Exante Advisors, LLC, Exante Data, Inc. and their affiliates (together, "Exante") do not warrant that information provided herein is correct, accurate, timely, error-free, or otherwise reliable. EXANTE HEREBY DISCLAIMS ANY WARRANTIES, EXPRESS OR IMPLIED.

This was a great article, I can’t lie I’m not all to familiar with Norges Bank or Riskbanken but the policy you bring up makes a great deal of sense to me. Thanks for this article I will certainly be residing up on both CBs

One of the things I have thought most central banks should consider is to wrote FX options on their own currency. for Norway, with implied volatility relatively high, this can be a great transaction, earning them premium while helping moderate market movement. selling a series of at-the-money NOK puts in substantial size would result in a huge damping effect on the exchange rate going forward, and act as an effective hedge as you suggest.

Perhaps you can convince them to consider this action.