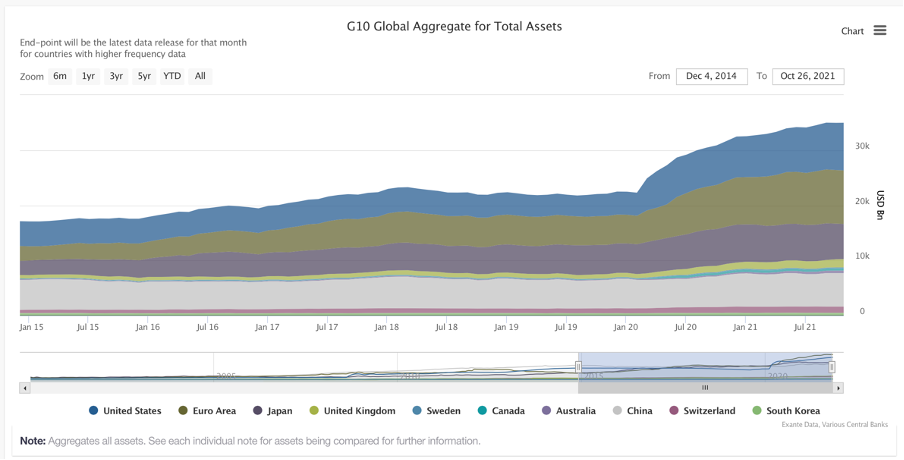

Outstanding assets of G10 central banks levelled out in October at USD34.9 trillion;

Despite continued net purchases, the strong dollar means that valued in USD global central bank assets were flat during the month;

With tapering and continued dollar strength we may have reached the high watermark for central bank assets measured in USD during the crisis;

While much is made of the Fed’s tapering announcement, BOJ balance sheet expansion has been minimal this year; meanwhile, BOE and ECB purchases are also slowing into year-end.

With the announcement by the Fed of reduced pace of asset purchases earlier this month, tapering in the United States is set to actually begin mid-month. However, there has been a stealth tapering of net purchases already in Japan for many months while the UK has been on an automatic tapering path all year; meanwhile, the ECB’s “moderately lower” pace of purchases promised in September has been more aggressive than expected. So tapering of asset purchases by the Fed confirms this as a global phenomenon, but there are differing tapering strategies across major central banks.

We are making this monthly review of global central bank balance sheets available to non-paying subscribers; hereafter this monthly update of global liquidity trends will be behind a paywall—as central bank balance sheet management continues to be a crucial part of the policy mix during post-pandemic normalisation.

Total assets

Total assets held by G10 central banks reached USD34.9 billion at the end of October, up from USD22.3 billion in February 2020, but roughly unchanged—and in fact marginally down—on end-September.

The levelling off of outstanding assets held by major central banks measured in USD occurred despite continued asset purchases—the valuation effect of a stronger dollar weighs on this global measure.

Assets held by the Fed reached USD8.6 trillion in late October, which is somewhat smaller than the Eurosystem balance sheet (USD9.7trn) but larger than BOJ (USD6.5trn) and BOE (USD1.5trn).

G10 central bank balance sheets increased USD12.7 trillion since February 2020, 85% of which is accounted for by the Big 4 central banks; the Fed (+USD4.4trn), ECB (+USD4.6trn), BOJ (+USD1.1trn), and BOE (+USD0.7trn).

While asset purchases will continue over the year ahead, the overall move towards tapering of flows plus a stronger dollar mean we may have peaked at USD35trn in terms of the outstanding dollar value of balance sheets. This will depend on the relative policy monetary policy cycle; with the Fed moving first and driving a stronger dollar cycle then peak global balance sheets may indeed be with us.

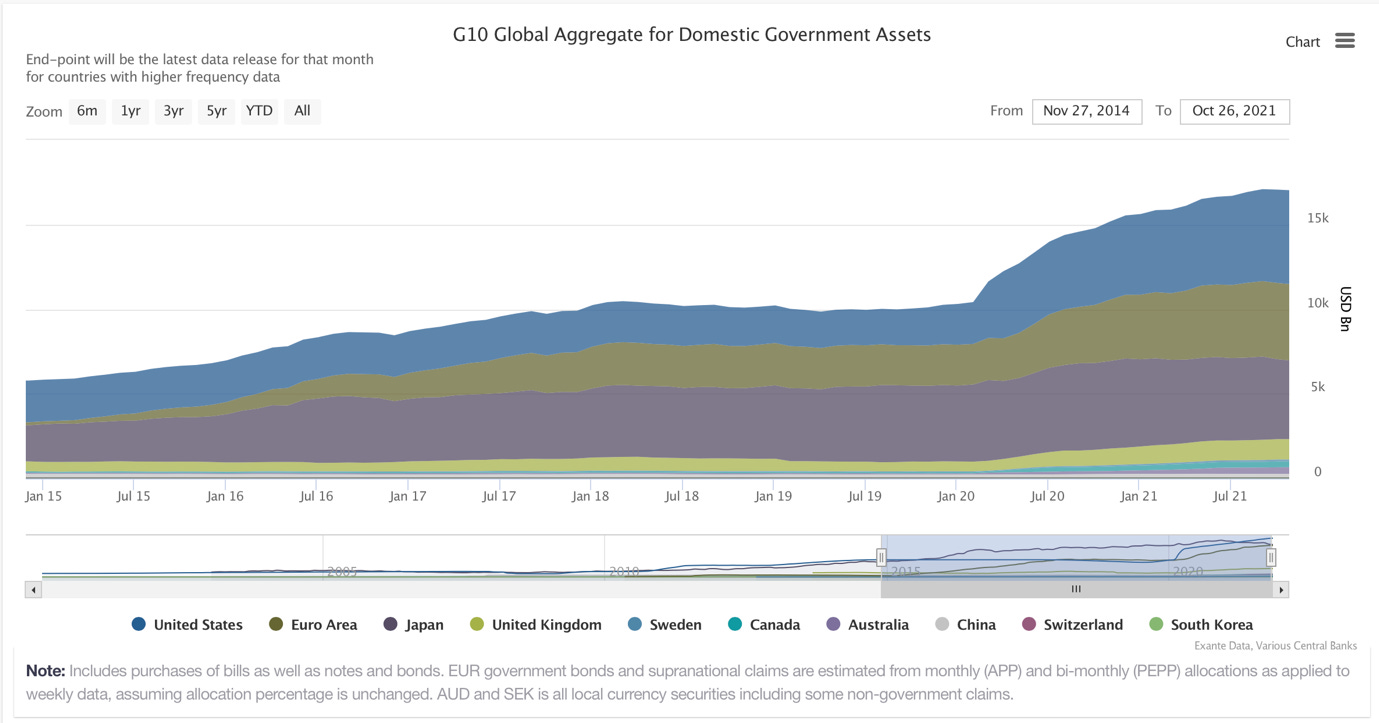

Government assets

Amongst the various drivers of central bank assets, the purchase of local government debt is the most important. And total holdings of government securities reached USD17.1 trillion in late-October—or 49% of total assets.

Holdings of domestic government debt in absolute terms is led by the Fed (USD5.5trn) then BOJ (USD4.7trn) and ECB (USD4.5trn) and BOE (USD1.2trn).

The Eurosystem’s use of Targeted Long-term Repo Operations (TLTROs) provides for a substantial part of the balance sheet expansion in the Eurozone such that domestic government asset holdings (at 46%) of total assets represent a smaller part of total balance sheet compared to the experience in the US (65%), Japan (71%) or UK (87%).

Tapering

While there has been much focus on the recent Fed announcement of USD15 billion tapering per month, a variety of balance sheet management strategies are underway across major central banks—and tapering is a reality in already for other central banks. Focussing on the BOJ, BOE and ECB:

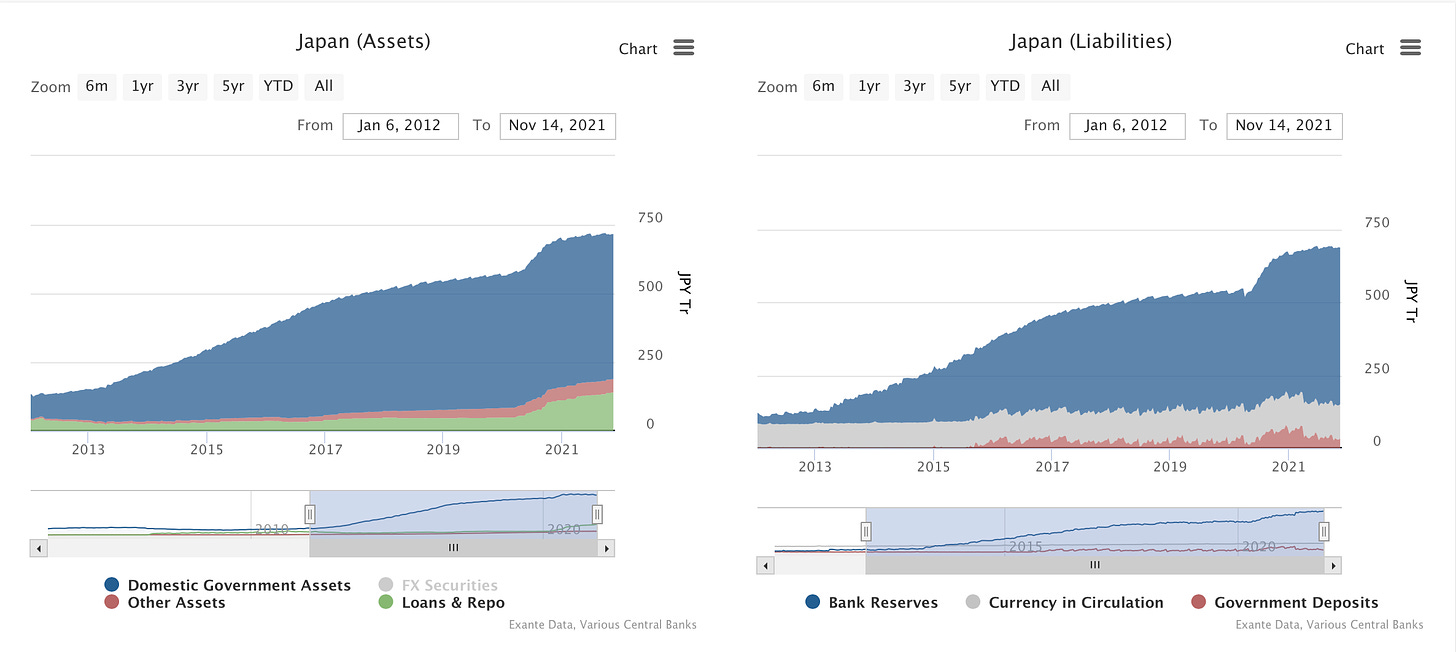

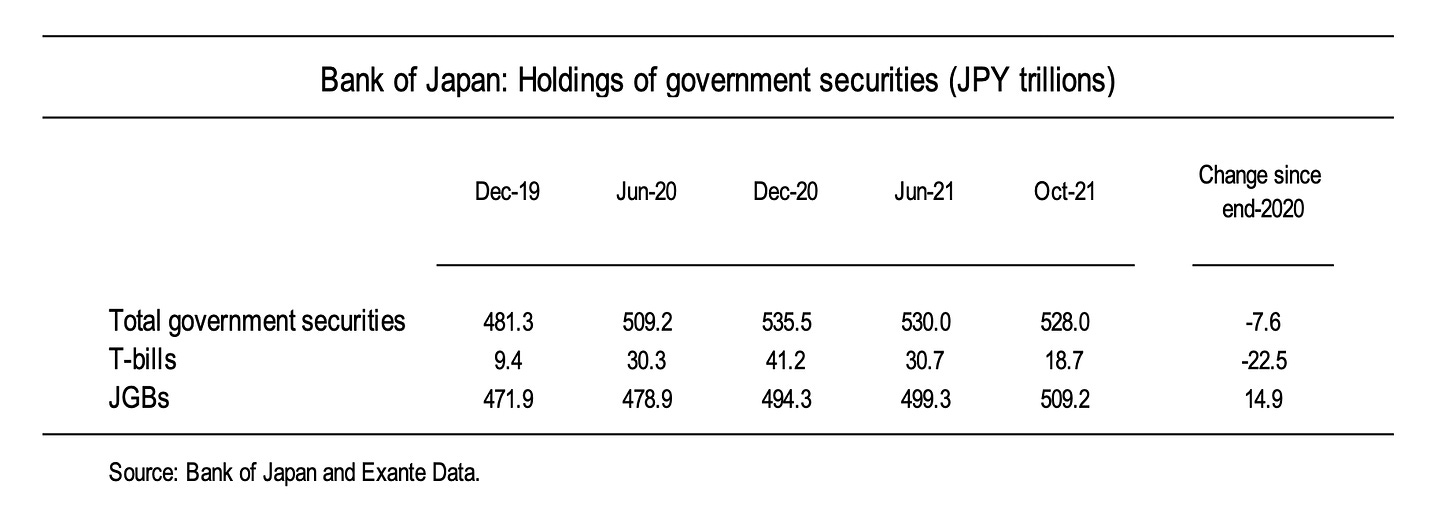

BOJ. The Bank of Japan balance sheet in JPY has been roughly flat for most of this year while net purchases of Japanese government securities has in fact been negative. Indeed, there has been a JPY7.6 trillion decline in total holdings of government securities since December 2020. However, this represents the roll-off of Treasury Bills which were aggressively purchased at the height of the pandemic; the purchase of JGBs continues at a steady pace. So, in a sense the BOJ has achieved a stealth taper this year while continuing to take on duration through JGB purchases—a twist-style operation.

BOE. The UK differs from most other economies since the Bank of England sets an envelope for the Asset Purchase Facility (APF) instead of a monthly flow. And the Bank announced last November APF would reach GBP875bn in gilt holdings (plus GBP20bn in corporate securities) by end-2021 with discretion over the timing of purchases. In practice, APF “over-bought” early in the program, implying a tapering was baked in as the year unfolded. As of last week, the Bank had purchased GBP856.6bn in gilts, meaning there is only GBP18.4bn in purchases remaining over the final 7 weeks of the program—or GBP2.6bn per week. The average weekly flow for the entire program since March 2020 is above GBP5bn, so there has already been a taper in the UK.

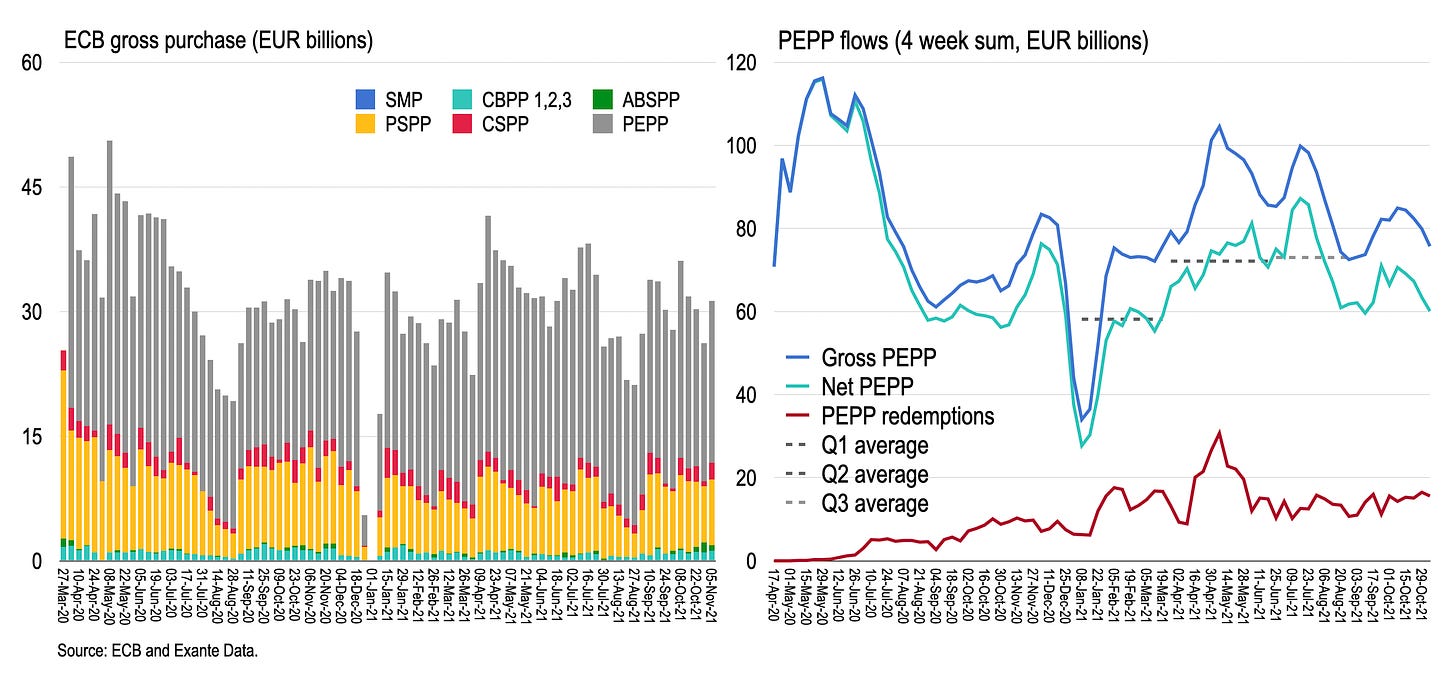

ECB. The ECB announced in September a “moderate reduction in the pace of net asset purchases” under the Pandemic Emergency Purchase Program (PEPP). In fact, the pace of net PEPP purchases have since slowed to about EUR60bn in the 4-weeks through November 5th, which is not so much moderately below the pace in the middle of this year as moderately above the pace in Q1. Whether this is a signal of policy intent or just a feature of the redemption profile and other technicals remains to be seen. But in any case, tapering has also begun at the ECB and is likely to be reinforced in the December meeting.

In short, we have passed peak QE and tapering is now a feature of balance sheet management across all the major central banks.

Going forward, we will do a monthly update on global liquidity trends by looking carefully at balance sheet dynamics of all major central banks. A period of extremely easy global monetary policy is coming to an end (due to the reflationary trends now in motion, as discussed in a recent substack). Hence, there will be plenty of related topics to explore.

The content in this piece is partly based on proprietary data and analysis that Exante Data does for institutional clients as part of its full macro strategy and flow analytics services. The content offered here differs significantly from Exante Data’s full service and is less technical as it aims to provide a more medium-term perspective.

Exante Advisors, LLC & Exante Data, LLC Disclaimer

Exante Data delivers proprietary data and innovative analytics to investors globally. The vision of exante data is to improve markets strategy via new technologies. We provide reasoned answers to the most difficult markets questions, before the consensus.

This communication is provided for your informational purposes only. In making any investment decision, you must rely on your own examination of the securities and the terms of the offering. The contents of this communication does not constitute legal, tax, investment or other advice, or a recommendation to purchase or sell any particular security. Exante Advisors, LLC, Exante Data, Inc. and their affiliates (together, "Exante") do not warrant that information provided herein is correct, accurate, timely, error-free, or otherwise reliable. EXANTE HEREBY DISCLAIMS ANY WARRANTIES, EXPRESS OR IMPLIED.