Globally coordinated base money contraction by the major central banks has not been experienced before;

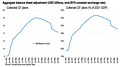

Major central bank balance sheets could contract USD3.5 trillion over the next 18 months—undoing about one-third of the expansion during the pandemic;

The speed and size of adjustment differs across countries; the ECB has the potential for the largest contraction, Riksbank the least;

But we have doubts about some of these plans, and the Fed in particular.

THIS WEEK’S Bank of England (BOE) policy meeting is expected to confirm outright gilt sales as part of their balance sheet management. This follows from the organic balance sheet shrinkage through redemptions since February. Governor Bailey confirmed in his Mansion House speech “we are currently looking at a total reduction in the stock of gilts held by the APF [asset purchase facility], which covers both sales and gilt redemptions, of something in the region of £50‐100bn in the first year.”

Indeed, quantitative tightening (QT) is now a key tool for every major central bank following the massive balance sheet expansion during the pandemic.

Aggregate adjustment

The chart below summarises the total planned balance sheet expansion and planned shrinkage through end-2023 for the Fed, ECB, BOE, Riksbank and BOC, subject to caveats outlined below.