Shifting Eurosystem liquidity

Three drivers of Eurosystem liquidity will interact in unpredictable ways in the second half of this year

Three liquidity drivers are unfolding across the Eurosystem over the summer: TLTRO repayments, accelerated APP, and the run-down of euro deposits by non-resident depositors will interact—the latter meaning QT has not yet started, but will soon;

In total, bank reserves—or liquidity—with Eurosystem will decline about EUR1.5 trillion by end-2024;

This sounds a lot, but reserves will still be about EUR1 trillion above pre-pandemic levels—hardly comfortable for the ECB if core inflation remains persistent.

After years of seemingly one-way liquidity injections into the Eurosystem, the situation is about to change dramatically—with consequences difficult to predict. Three drivers of liquidity in particular are set to combine.

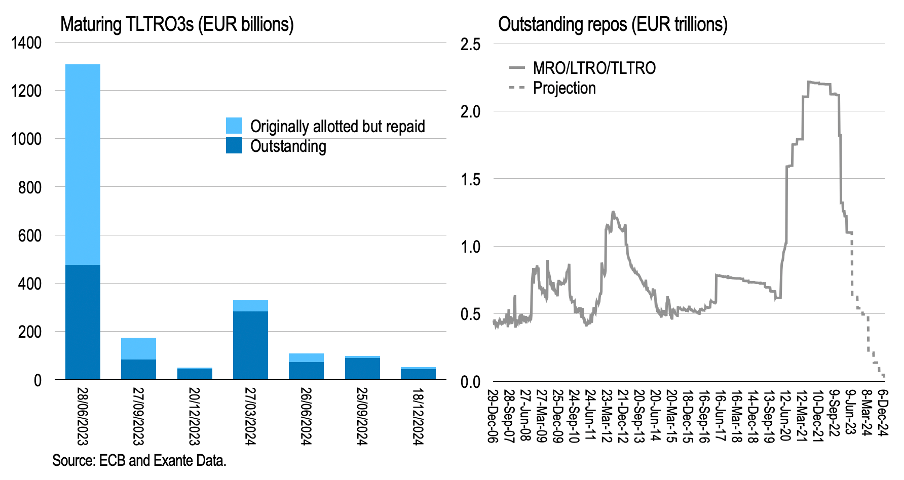

First, the roll-off of TLTROs left over from the pandemic, including the largest repayment this June and continuing to end-2024.

Second, the non-reinvestment of maturing assets under the asset purchase program (APP) from June accelerates the contraction of the Eurosystem balance sheet.

And third, the exhaustion of non-resident euro deposits—reserve manager deposits which were accumulated in the absence of safe assets and which have been an offset to quantitative tightening to date.

We walk through each in turn before projecting bank reserves, or liquidity, through end-2024.

TLTROs

Outstanding TLTROs remain about EUR1 trillion, with about EUR500bn set to be repaid in about a month and the remainder at quarterly intervals, if not before, by the end of 2024. Assuming no additional repo take-up over the projection horizon, total repos outstanding will therefore be virtually nil by end-2024.

Of course, banks might return to the one-week repo facility if needed, depending how overall liquidity conditions evolve—especially since fixed rate, full allotment remains available. For now, we assume full repayment so that EUR1.1 trillion in liquidity evaporates by end-2024.

On the distribution of these TLTROs, the largest concentration is currently in Italy where existing bank liquidity (deposits plus current accounts) is insufficient to repay the maturing amounts. (This uses end-March data; inflows were recorded in the April Bank of Italy reporting, but this doesn’t change the substance of this point.)