The end of Bretton Woods after fifty years

US external accounts adjust to the liquidity needs of the global economy

Inherent contradictions in the Bretton Woods system made it inevitable it would unravel—as it did exactly fifty years ago. A look-back on reserve asset data from the time confirms that shortly after non-gold reserve assets in Europe and Japan—liquid claims on the US—exceeded the available US gold stock, the system was abandoned. Since then, US external accounts adjust to global demand for dollars—or, the dollar and current account adjust to the needs of global finance and not to balance external trade. But what happens next?

Exactly fifty years ago this weekend, officials of President Nixon administration—as well as the President—met secretly at Camp David to decide on the fate of the international monetary system. The price of gold expressed in United States dollar had been, for the previous 25 years, rigidly fixed by international agreement. By Sunday a decision had been made. President Nixon took to national television to announce he had asked Treasury Secretary John Connally to “suspend temporarily the convertibility of the dollar into gold or other reserve assets.”

Efforts to revive the link between gold and the dollar in the next few years were eventually abandoned—and the Bretton Woods agreement, the pillar of postwar monetary settlement, was replaced by a system based on fiat.

Others can retell the drama of the decisions that weekend. Here we ask more simply: What was in the data when these decisions were made? And what happens next?

Gold and the dollar

Writing retrospectively in 1978, Belgian-American economist Robert Triffin summarised the dilemma he promulgated first in 1959, and that later took his name, as follows:

…if the United States corrected its persistent balance-of-payments deficits, the growth of world reserves could not be fed adequately by gold production at $35 an ounce, but if the United States continued to run deficits, its foreign liabilities would come to exceed by far its ability to convert dollars into gold on demand and would bring about a “gold and dollar crisis.”

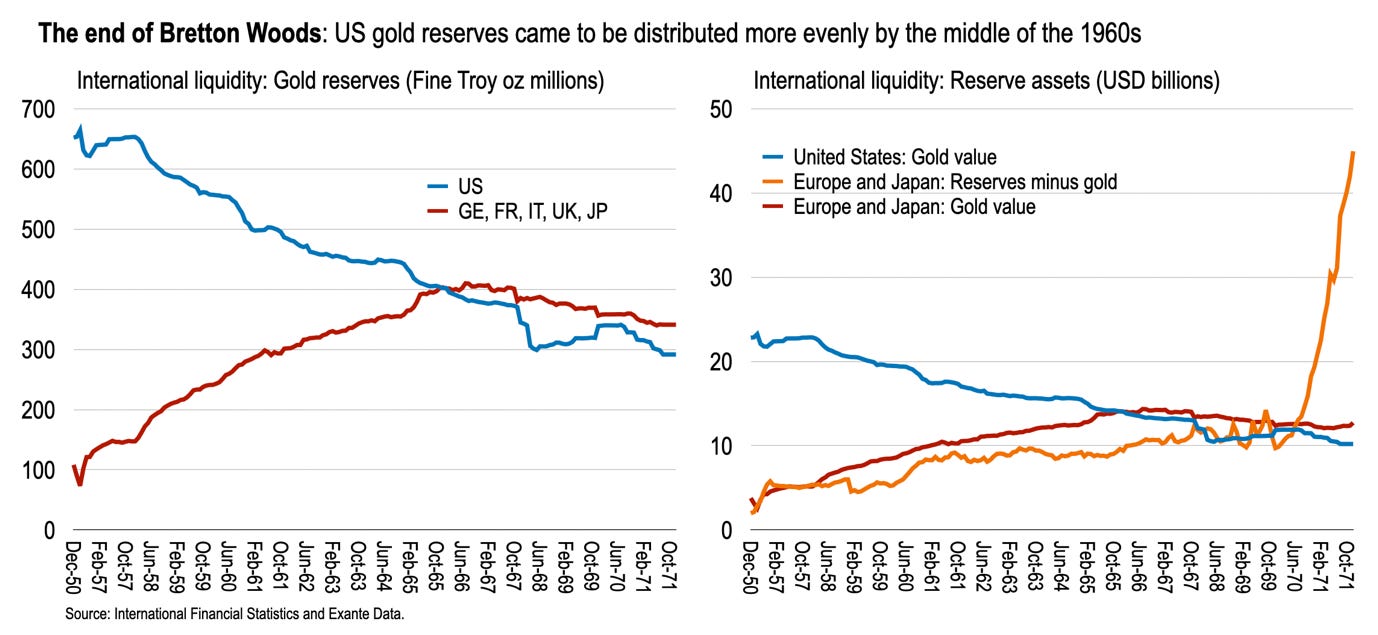

The chart below, left side, shows the volume of gold held as international reserves by the United States and, collectively, by key countries in Europe and Japan from 1950 to end-1971.

Europe is here defined narrowly as Germany, France, Italy, and the United Kingdom. Data is annual for the first 7 years but monthly thereafter.

Until 1953, the United States gained gold of 12 million troy ounces, while Europe and Japan lost 35 million troy oz. Postwar adjustment continued to weigh on the balance of payments outside the US. Thereafter, broadly speaking, the US lost gold while Europe and Japan gained until, by end-1965, the latter surpassed the former for the first time in the postwar period in terms of gold volumes held in reserve.

From only recently exchanging bullets and bombs, our belligerents had come to exchange mainly gadgets and gold.

The right chart also shows reserves measured in nominal terms. As well as absorbing gold, Europe and Japan saw an expansion in international reserves not expressed as gold—such as securities against and deposits in the US—such that by 1968 these liquid claims were equal in size to US gold holdings.

And then, beginning in 1970, non-monetary reserves accelerated sharply to dwarf the value of US gold holdings.

In other words, Triffin’s dilemma stands out starkly in the International Financial Statistics data—played out through the second mechanism he outlined in the late-1950s. Loss of gold by the United States, redistributing liquidity internationally, occurred until liquid non-gold claims by non-resident central banks could exhaust US gold stocks in an instant.

The US ran down gold reserves rather than correct her balance of payments deficit, choosing reflation over deflation. And exactly as Triffin anticipated, this postwar monetary system was internally incoherent, ultimately bringing a gold-dollar crisis.

The US as banker

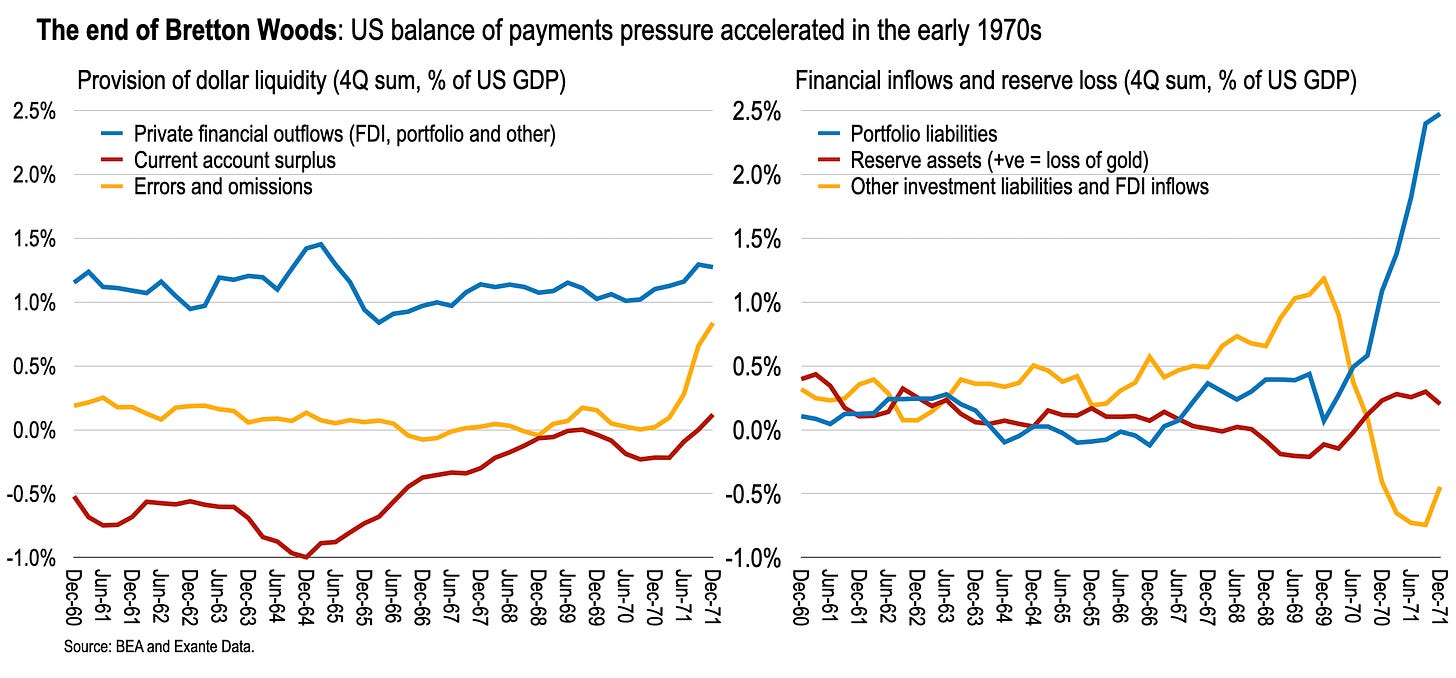

An alternative expression of this postwar predicament is found in the Bureau of Economic Analysis (BEA) external accounts data for the United States—which begin only in 1960. This data is re-organised below such that the provision of dollars globally is shown in the left chart, and dollar “recycling” by recipients on the right.

Private financial outflows (outbound investment) from the US averaged roughly 1.2% of GDP throughout the 1960s—long term investment overseas through FDI or portfolio outflows. This served to finance net exports of US investment goods and a current account surplus, shown as negative here as an offsetting withdrawal of dollars.

Netting these, about 0.4% of US GDP in surplus outward investment was available every year during the 1960s from the US. This surplus was available for current account deficit countries in Europe and Japan to liquidate US gold, replenishing their diminished reserve positive, or accumulate other financial claims on the US—as shown on the right side.

This is an expression of Kindleberger’s observation that the US had become banker to the world:

The United States is not engaged in exchanging real goods for long-term securities, but short-term monetary liabilities for long-term monetary claims. The country, of course, is not the decision-making unit, and no conscious national portfolio-balancing decision is made. But the effect of private and public decisions is the same. Foreign countries as a whole must be added to domestic institutions as financial intermediaries.

The US is the means by which non-resident demand for liquidity be can met; Uncle Sam doesn’t sell widgets so much as dreams—or, at least, promises to pay. In the beginning, United States’ FDI and long-term portfolio outflows were the means by which non-residents could both access US exports (and technology) while fulfilling their collective need for liquidity.

As is also evident above, of course, throughout the 1960s the US current account surplus was gently eroded until, in the early-1970s, registering a deficit. Domestic demand growth ran ahead of production, and the US began to provide dollars globally not only through outward investment but also through an an excess of spending and imports.

At this time non-resident accumulation of portfolio claims on the US—also witnessed in the first chart—accelerated sharply.

And so, on the eve of Nixon’s Camp David retreat, US short-term financial liabilities exceeded her gold reserves by value and were growing fast—and the US was also reliant, for the first time in many years, on external finance for the purposes of spending.

Nixon had both a stock imbalance to manage and a flow imbalance to sustain.

Mussa’s puzzle

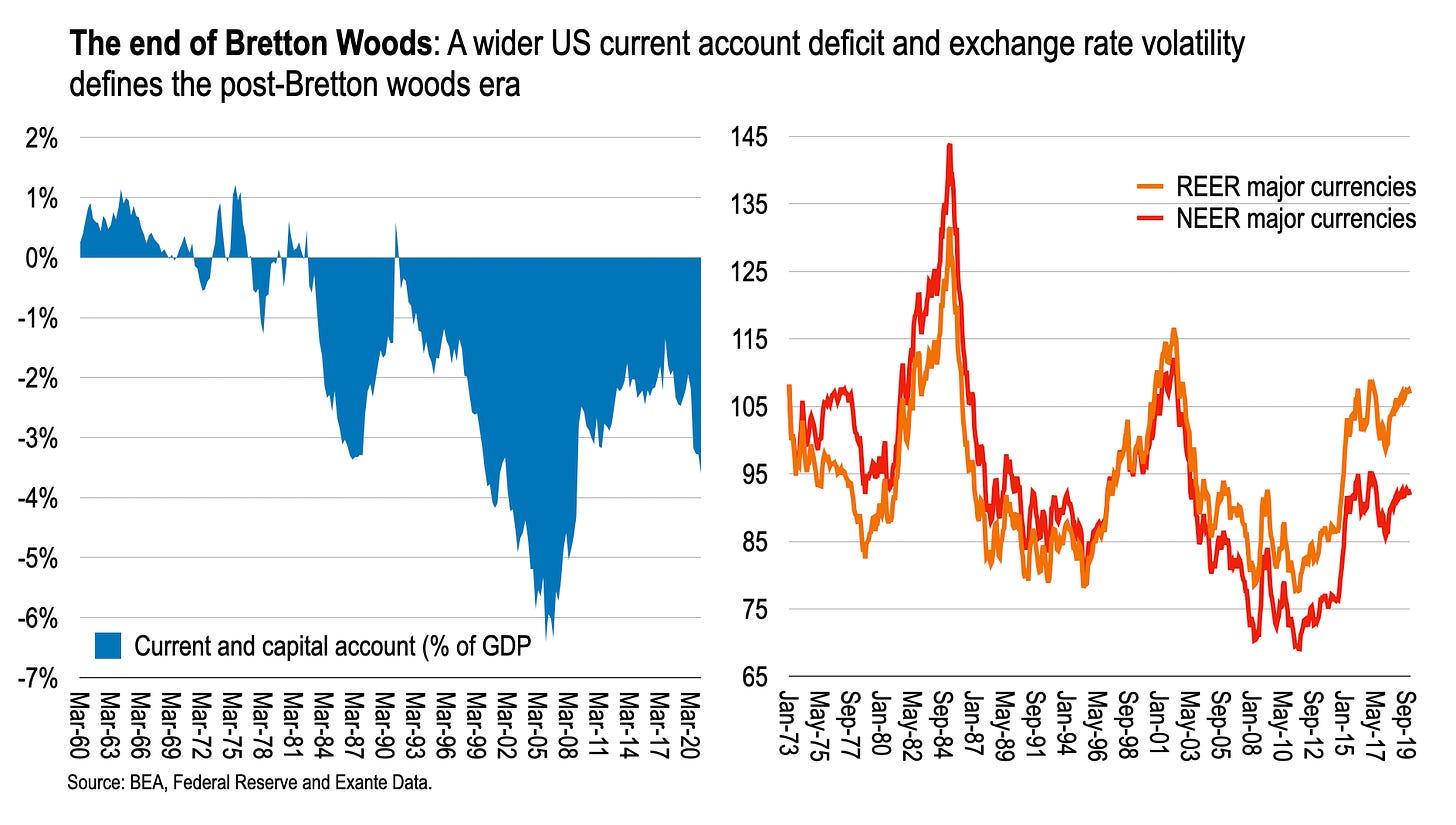

What happened next? To somewhat oversimplify: First, flexible exchange rates post-1971 did not bring about a correction in the US external current account balance—indeed, the US deficit expanded sharply to average 2.5 percent of GDP since 1980 in contrast to the pre-1971 surplus. Second, there was a sharp increase in the volatility of both nominal and real effective exchange rates—a puzzle noted by Mussa.

But once it is recognised that the US external accounts are driven less by relative goods and service demand—that is by real goods and services—and more by global demand for US financial assets and the liquidity they provide, then many things are flipped on their head.

The US current account deficit is a function of the real exchange rate—in turn a function of demand for US financial assets and the yield or safety they offer. US spending has to adjust to global demand for US assets—and not the other way around.

Bring on MMT

If you listen carefully, all of this has echoes in the recent trend of thinking in the United States that has been labelled Modern Monetary Theory (MMT). For adherents to MMT, the fiscal deficit should adjust to the needs of the economy—rather than the economy adjusting to the deficit. This is an expression of Lerner’s functional finance. Meanwhile, for the international monetary system, the US current account adjusts to the needs to global finance.

This raises a curious question: What would happen if this approach to fiscal policy in the US were realised, replacing the the conservatism—balancing the books—that has notionally (if not actually) directed policy since 1971?

Roughly speaking, this would make the US fiscal balance determined entirely by the “needs” of the domestic economy and the current account by the “need” for global liquidity—with the US private sector saving-investment balance caught in some confused dance between the two.

It would likely bring greater dollar volatility, larger US current account deficits, and even more accumulation of dollar claims on the United States by the rest of the world.

Conclusions?

There are no conclusions.

Then again, maybe there are: It’s easier to point to the benefits of reserve currency status than lament the costs and responsibilities it bestows.

Which is why Keynes–having participated in sterling's decline and fall, recommended the Bancor.

Which is why the PBOC has embraced the Bancor or, as we know them, SDRs.

Better to put our heads together with China and the EU, along with Japan and make this happen with a world dollar, let everybody finance the heck out of infrastructure, bring Africa into the fold so they can also bring their living standards up. Make believe? Well, what do you call our deficit? better we all pretend and extend than continue leaving so many out in the cold Especially since the currency and a belief system. Let's all pretend together!