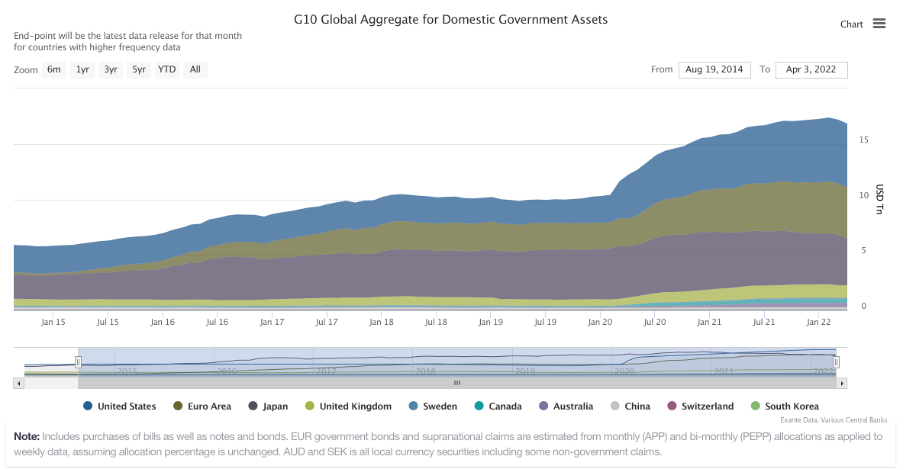

The stock of assets held by major central banks has fallen sharply over the past 2 months—though driven by valuation effects from the strong dollar, against the Yen in particular;

In flow terms, at constant exchange rate, global central bank asset purchases over 3 months have slowed from about USD1 trillion late last year to only USD0.25 trillion today;

This reflects the tapering of policy. Meanwhile, QT has begun in the UK, begins next week in Canada, and will likely be formally announced in the US within weeks.

But no-one really knows how QT will work, and whether it represents additional policy tightening or purely the adjustment of public-private portfolios (it is remarkable how even major central banks seem to disagree on this issue…)

Valuation effects

The value of assets held by major central banks measured in current dollars contracted sharply over the past two months. As shown below, the holding of domestic government debt by the major central banks peaked at USD17.2 trillion in February but has since fallen USD0.5 trillion to USD16.7 trillion.

This is a misleading measure balance sheet contraction, however.

Although quantitative tightening (QT) has taken effect in some jurisdictions, this contraction is largely due to valuation effects. It is a function of the strength of the US dollar—or, more precisely, the weakness of the Japanese Yen. Indeed, the USD value of JGBs held by the Bank of Japan (BOJ) fell from USD4.6 trillion in February to about USD4.2 trillion today despite continued net purchases. As such, BOJ accounts for most of the overall balance sheet adjustment.

Constant dollar flows

To side-step such valuation effects, we prefer to track a constant dollar measure of balance sheets (at end-2019 exchange rates).