Each month we plan to write a note on trends in global capital flows. Sometimes we will zoom in to look at higher frequency data or take a deep dive into a key theme.

But this month we step back and look at the big picture. In doing so we aim to highlight some of the key themes we will explore in more detail in coming months.

The big picture is as follows: The US current account deficit is again widening, and financing is increasingly coming from European equity investors.

So far twin deficits in the US have not proved a major problem for the dollar; bullish US equity market trends have created a virtuous cycle of rising stock prices and increasing international demand. But imbalances continue to grow, and it is unlikely to be a stable equilibrium forever.

The Return of Global Imbalances?

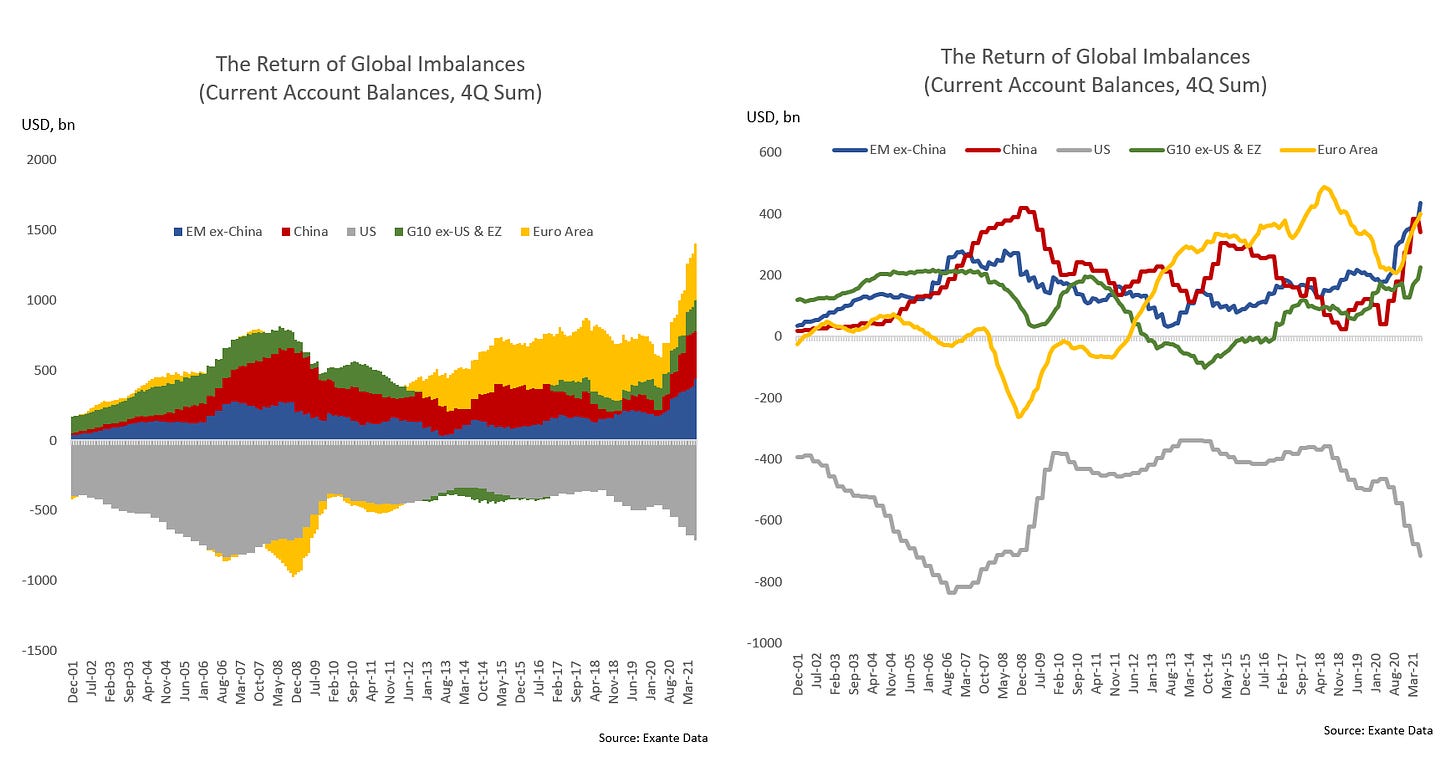

The chart below shows the 4 quarter rolling sum of current account balances across major countries and regions through Q2 2021. The stacked bars on the left clearly illustrate the widening of global surpluses/deficits; the line chart on the right (which is the same data) reveals more clearly that it is not only China which has seen its surplus grow. China, the Euro Area, EM ex-China and G10 ex-US & Euro Area have seen their collective surpluses rise by roughly $400bn (4Q sum) relative to end-2019.