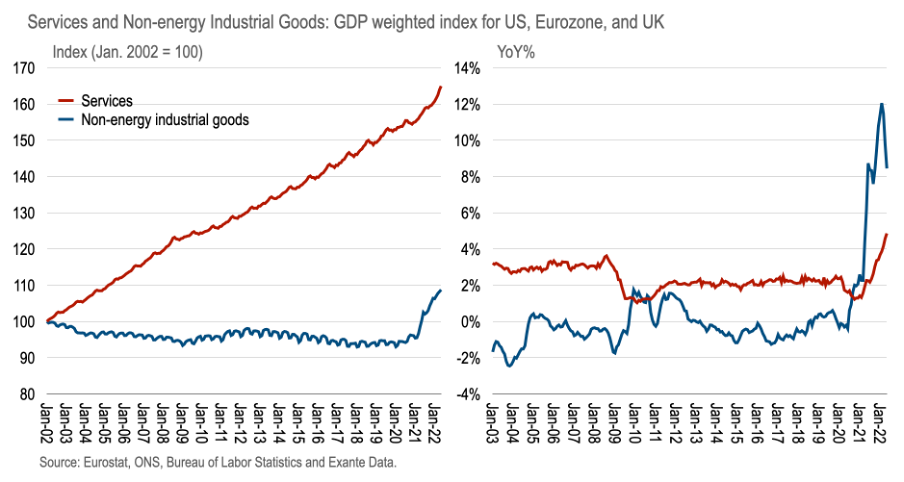

Service inflation has accelerated over the past 6 months, and is catching up with non-energy industrial goods (NEIG);

Moreover, there are signs that NEIG inflation has peaked, meaning the prospects for core inflation will now hinge on service price growth—itself closely linked to wages;

While NEIG inflation is strong compared to historical experience we uncover a close cross country relation between NEIG and service inflation over the past 2 years;

What happens next? That depends:

Will durable goods inflation experience a only cyclical slowdown or outright deflation?

And key for policy setting, how much further will service inflation accelerate?

Last November we noted the revival of traded goods prices as driving the initial increase in global inflation post-pandemic; in particular, within Core CPI we noted the acceleration in prices of “non-energy industrial goods (NEIGs)—durable goods such as clothing and footwear, furnishing and equipment for the home” in contrast to service inflation which had driven inflation since the millennium.

At the time, we pondered how long such traded goods inflation would last and whether service inflation would follow.

Well, the chart below updates the one introduced then. And indeed the past six months reveals a partial answer to these questions. We have witnessed the rise of service inflation such that the weighted average for the US, Eurozone and UK is now running at about 5%YoY, the highest since at least 2003.