Following the latest expansion in the Fed balance sheet over the past week, many observers are screaming that the Fed has moved back to Quantitative Easing (QE). But not all balance sheet expansions are created equal.

In the period 2008-2019 the world saw large ‘asset swap’ balance sheet expansions by central banks around the world, with large impacts on financial portfolios, but limited transmission to the real economy, and inflation.

In the 2020-2021 period, we saw a new form of balance sheet expansion, combined with dramatic fiscal expansion (transfers to households and business) and we have learned that that form of QE is totally different, with historical implications for the real economy and inflation (as we discussed in one of our first posts on this blog back in December 2020).

Now in 2023, we are observing a third type of balance sheet expansion in the US, not driven by central bank action, but by the decisions of commercial banks with a liquidity shortage.

This latest balance sheet expansion represents “inside money,” being simultaneously both an asset and liability of the private sector. And they can be repaid at any time—in the case of the new BTFP in one year at the latest—so should be considered more time-bound. And the implications for credit growth are also totally different from past QE.

What happened to the Fed balance sheet last week?

Following a week of turmoil in the banking system, starting with the tension around Silicon Valley Bank, this week (through Weds. 15th) the Federal Reserve’s balance sheet expanded USD297bn (though still falling USD315bn over the past year).

This is equivalent to offsetting 15 weeks of quantitative tightening (QT) in about half a week—assuming most of this expansion came Mon-Weds.

The balance sheet increase was mainly due to use of the Fed’s primary credit facility (+USD148bn) by banks, expansion of “other credit facilities” (+USD143bn) and the new Bank Term Funding Program (BTFP, +USD12bn).

Credit to “other credit facilities” includes guaranteed loans to the Federal Deposit Insurance Corporation (FDIC) to support their work and does not reflect deposit flight from functioning banks—rather the wind-down of failing institutions. That leaves about USD160bn in liquidity support for other institutions over the past week.

The Federal Reserve publishes commercial bank balance sheet data split into large and small domestic banks—where large banks represent the top 25 banks by assets. As this data shows, the US is particularly susceptible to a credit crunch from smaller banks at the moment, as they have been responsible for about three-quarters of loans and leases over the past 13 weeks.

This is not QE

It is tempting to conclude that the resumption of balance sheet expansion reflects a return of QE.

A brief inspection of the transactions involved reveal this is not the case.

Traditional QE works through the central bank buying fixed income securities from asset managers and banks, who in turn purchase alternative securities with the funds provided—so passing on the hot potato until the reserves created settle somewhere in the system.

Thus, it transmits by removing certain assets from the system, replacing with central bank reserves, reshaping financial sector portfolios but with limited impact on the non-financial private sector claims except through valuation changes.

Balance sheet expansion associated with repo operations, on the other hand, involves banks posting collateral with the central bank (sometimes loans, but often securities) to facilitate the shifting of deposits across the system—and thus de-risking non-financial private sector agents, uninsured corporate depositors in the US today.

Of course the central banks ends up with more assets (collateral) and has issued reserves. So superficially it resembles QE. But the purpose is very different.

In the case of QE, assets purchases and reserves created can be expected to remain in place for an extended period, at the discretion of the central bank. It represents outside money for the private sector, an asset with no associated liability, which cannot be disposed of in the aggregate but to which all must adjust.

Endogenous money and credit

Alternatively, repos represent inside money in being simultaneously both an asset and liability of the private sector. And they can be repaid at any time—in the case of the new BTFP in one year at the latest—so should be considered more time-bound.

As was the experience of the Eurosystem in 2012, the Very Long Term Repo Operations (VLTROs) created in late-2011 allowed for early repayment. Reserves created were endogenous to banking sector behaviour and contracted sharply, beyond the control of policymakers, when early repayment was permitted—generating endogenous tightening of monetary conditions to which the ECB responded eventually with the Asset Purchase Program (APP).

The banking system cannot so easily dispose of reserves created due to QE. They can only attempt to individually pass on the reserves created, but collectively fail to do so.

In other words, balance sheet expansion from repo operations are superficially similar to QE, but operationally very different. And the implications for credit growth are likely to be totally different. We will discuss that in more detail in a separate future post.

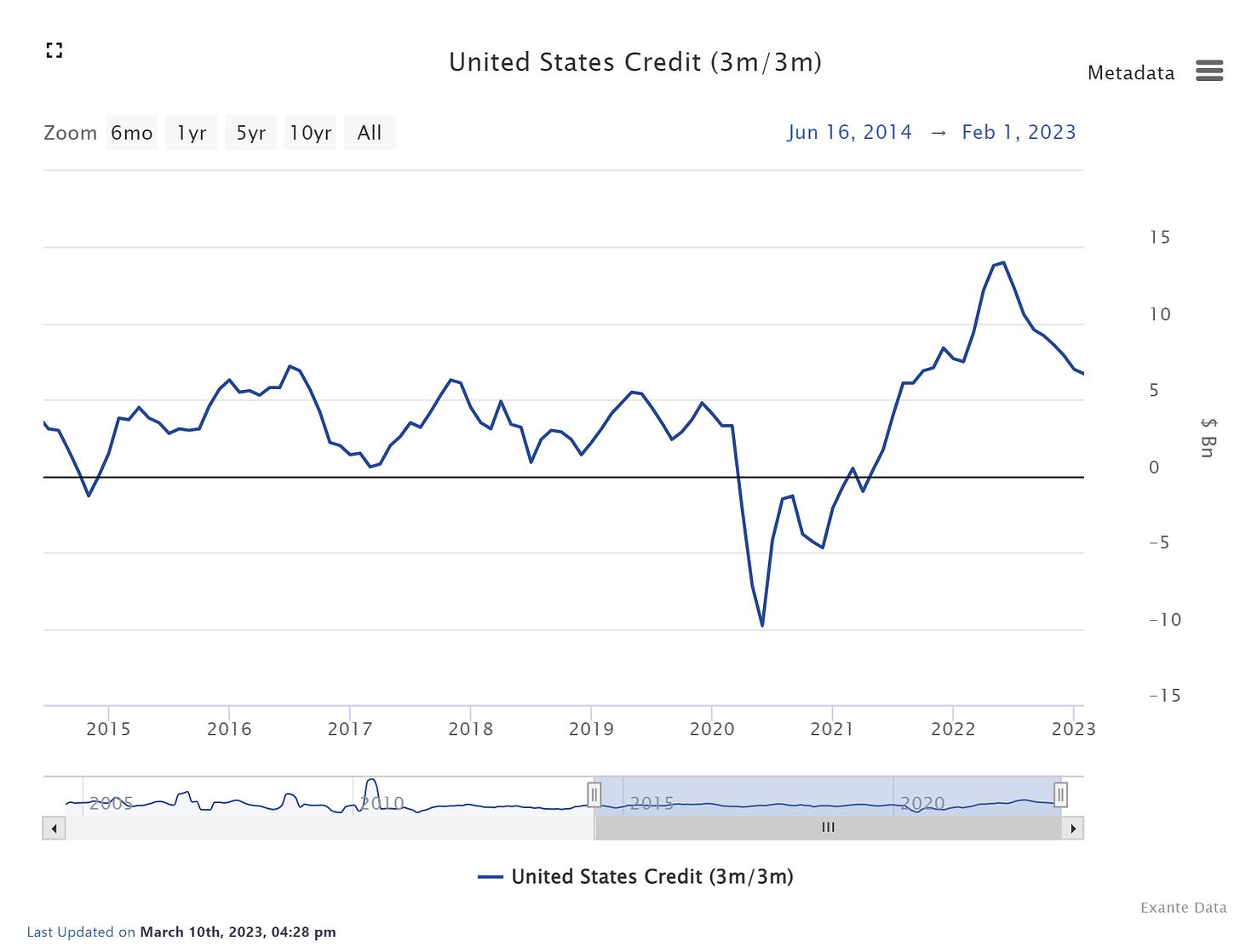

But let us just say that credit is already slowing, and likely to slow further, and the balance sheet expansion, of the type we are observing now, will not change that.

The content in this piece is partly based on proprietary analysis that Exante Data does for institutional clients as part of its full macro strategy and flow analytics services. The content offered here differs significantly from Exante Data’s full service and is less technical as it aims to provide a more medium-term policy relevant perspective. The opinions and analytics expressed in this piece are those of the author alone and may not be those of Exante Data Inc. or Exante Advisors LLC. The content of this piece and the opinions expressed herein are independent of any work Exante Data Inc. or Exante Advisors LLC does and communicates to its clients.

Exante Advisors, LLC & Exante Data, Inc. Disclaimer

Exante Data delivers proprietary data and innovative analytics to investors globally. The vision of exante data is to improve markets strategy via new technologies. We provide reasoned answers to the most difficult markets questions, before the consensus.

This communication is provided for your informational purposes only. In making any investment decision, you must rely on your own examination of the securities and the terms of the offering. The contents of this communication does not constitute legal, tax, investment or other advice, or a recommendation to purchase or sell any particular security. Exante Advisors, LLC, Exante Data, Inc. and their affiliates (together, "Exante") do not warrant that information provided herein is correct, accurate, timely, error-free, or otherwise reliable. EXANTE HEREBY DISCLAIMS ANY WARRANTIES, EXPRESS OR IMPLIED.