Three easy steps to (begin to) restore credibility to the Bank of England

Core inflation above 7% sets alarm bells ringing on Threadneedle Street

What immediate steps could the Bank of England take to help restore credibility and confidence after recent missteps on inflation forecasting and policy?

The last week alone revealed the scale of the challenge.

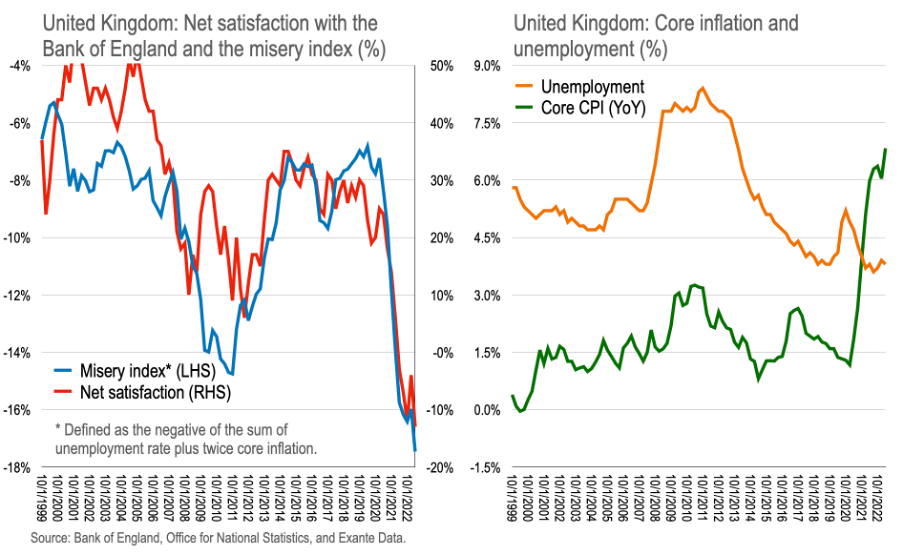

The Chair of the Court confirmed an independent review into recent inflation “forecasting and related processes” was needed. Governor Bailey was unable to offer lessons from recent experience. Incoming External Monetary Policy Committee (MPC) member Megan Greene could not clarify any fresh thinking she will bring. Meanwhile, the Bank’s inflation attitudes survey saw public confidence in the Old Lady (which moves with the misery index) reach an all-time low.

Today’s core CPI print above 7 percent year-on-year provides a further reminder of the sense of drift on Threadneedle Street—while agony is growing for the 2 million-or-so households on fixed rate mortgages due to re-set by end-2024.

Fortunately, there are some quick and easy steps the Bank could take to help restore confidence.

Here are three suggestions, readers will have their own (comments are open to all):

First, fix the target horizon. The MPC’s remit provides for discretion over the horizon their target is met. The Bank could usefully clarify this time frame—and better explain their thinking on when and why. In recent letters to the Chancellor, Governor Bailey has, largely unnoticed, switched this horizon from two years to the “medium term.” This is vague, suspiciously so.

Since real wages will need a period of catch-up to be restored to something close to acceptable to both public and private sectors, feeding stickier-than-ideal core, recent shocks need time to dissipate. Allowing three years for core CPI to normalise would be consistent with successful Bundesbank disinflations—implying a return to target in 2026. This can be made clear and explained to the public.

Second, re-set inflation forecasts. The Bank’s models continually produce inflation forecasts well below target—then tweaked upward by the MPC. This is an awkward fudge.

Such models are a black box, of course. But they are not working when it comes to providing a sensible inflation path.

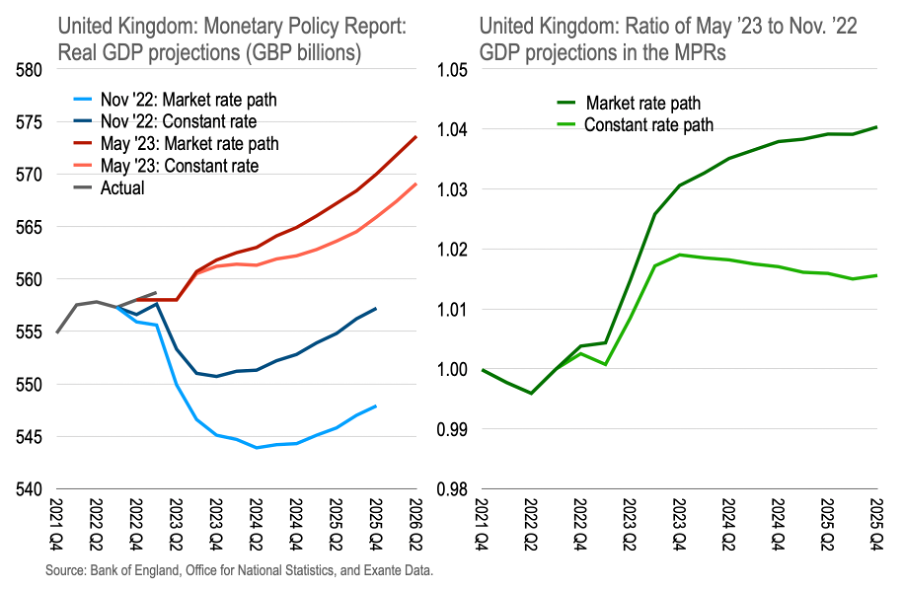

Moreover, turning to real matters, the economy is not a machine—rather an organism continually solving new and old problems to keep resources flowing; real incomes and spending will usually follow. The latest Bank forecasts saw real GDP revised up 4 percent on thinking only 6 months prior—to above pre-pandemic levels. This only weeks after the Chief Economist lamented how we are “all worse off.”

Put another way: a lack-of-faith in the UK economy appears to underpin Bank thinking.

There are ways to open up this black box to scrutiny: the Bank could easily livestream the technical briefings provided by staff to the MPC (though not the deliberations, of course) so anyone can listen in on, and challenge later, how the sausage gets made. A simplified exposition of the Bank’s forecasting suite, and key assumptions, would be welcome. In addition, the Monetary Policy Reports could at little cost provide far more detail on the path for core inflation and other macro variables, including balance of payments flows, presumably already part of existing background analysis.

Third, but most important, clarify the reaction function. The current practice of conditioning forecasts on market pricing provides no anchor for the front end of UK assets—especially rippling through to the long end given QT. A clearer reaction function is needed to do so—spelling out exactly how the Bank will respond to deviations of inflation from target given that expectations remain favourable and stock imbalances are being unwound. The MPC member’s unwillingness to spell out their own conditional rate paths suggests neither personal conviction nor confidence in internal forecasts. Markets have taken note.

Some officials in the United States have used a Taylor Rule to guide their thinking on rates. An attempt to spell out the path for Bank Rate in the UK drawing on past experience and the balance sheet situation—that is, reflecting stock and flow imbalances—is vital.

Once recent shocks dissipate, core inflation will naturally drift lower unless spending is expected to keep accelerating. Inflation expectations are contained, stock imbalances are normalising; inflation in the US shows hints of favourable disinflation. Instead of being reactive, the Bank urgently needs to link present policy with sensible future outcomes, difficult as this is, rather than being reactive to incoming data.

This would then blunt any unnecessary impact on the mortgage and housing markets in coming years—and associated social damage.

The battle to restore post-pandemic credibility is the greatest faced by the Bank since independence in 1997. It will take time. But there are important steps that can be taken relatively quickly.

The content in this piece is partly based on proprietary analysis that Exante Data does for institutional clients as part of its full macro strategy and flow analytics services. The content offered here differs significantly from Exante Data’s full service and is less technical as it aims to provide a more medium-term policy relevant perspective. The opinions and analytics expressed in this piece are those of the author alone and may not be those of Exante Data Inc. or Exante Advisors LLC. The content of this piece and the opinions expressed herein are independent of any work Exante Data Inc. or Exante Advisors LLC does and communicates to its clients.

Exante Advisors, LLC & Exante Data, Inc. Disclaimer

Exante Data delivers proprietary data and innovative analytics to investors globally. The vision of exante data is to improve markets strategy via new technologies. We provide reasoned answers to the most difficult markets questions, before the consensus.

This communication is provided for your informational purposes only. In making any investment decision, you must rely on your own examination of the securities and the terms of the offering. The contents of this communication does not constitute legal, tax, investment or other advice, or a recommendation to purchase or sell any particular security. Exante Advisors, LLC, Exante Data, Inc. and their affiliates (together, "Exante") do not warrant that information provided herein is correct, accurate, timely, error-free, or otherwise reliable. EXANTE HEREBY DISCLAIMS ANY WARRANTIES, EXPRESS OR IMPLIED.

Completely disagree. Democracy works only if all the institutions do what they are supposed to do. The Bank of England role is to tame inflation generated endogenously by excessive risk taking, leverage and easing of financial conditions. It’s not the job of the Bank of England to tackle the inflation generated by two exogenous shocks like covid and the energy crisis. It’s the role of the government to do so and the Bank of England should admit the limited tools at its disposal and point the finger to the Chancellor whose disgraceful policies are at the heart of this mess. The energy cost related to the war should be paid fairly by everyone. The Tory clowns decided to subsidise the entire energy crisis to virtually everyone even those who could afford to pay supporting demand further and pushing inflation higher. Now the Chancellor wants mortgage holders to foot their bills which affects mostly young working families but doesn’t have the guts to steal from their pockets given upcoming elections and wants to blame the BOE. The central bank should be transparent and openly saying what the government is doing but nobody is reporting. BOE stands for Bank of England and not for Boomers of England. They are independent and should have no role in stealing from working families to pay for the money given for free to pensioners and wealthy individuals or if they do so they should tell what they are doing. Instead of the useless monetary policy reports they should publish a termsheet stating what’s causing inflation, why they are raising rates snd who is going to pay for it with their estimates split by households/corporate, age groups and geography. That would trigger a desperately needed debate about who at the end of the day is paying the bills to run the country.

Great piece- thx - You say "core inflation will naturally drift lower unless spending is expected to keep accelerating" ... As rates rise, interest paid on debt rises, thus gov and private spending rises, triggering more rate increases and so on. The question is at what point (debt/gdp) does the inflationary interest expense overwhelm the deflationary credit contraction impacts of rate increases? Pblacque