United States: Is disinflation real?

October CPI was an important milestone, but we aren't yet out the woods

US CPI for October revealed continued disinflation in durables goods and some sign of service sector weakness;

However, medical services distorted service inflation downward—something unlikely to be repeated in coming months.

While the seasonality of other services could also be distorting downward sequential readings;

Overall, it will take more time to be confident that disinflation is real.

The October CPI marked the first truly weak Core CPI reading post-pandemic, with Core at +0.27%MoM (+0.5%MoM expected and +0.6%MoM prior.)

There are a number of signs of disinflation, such as:

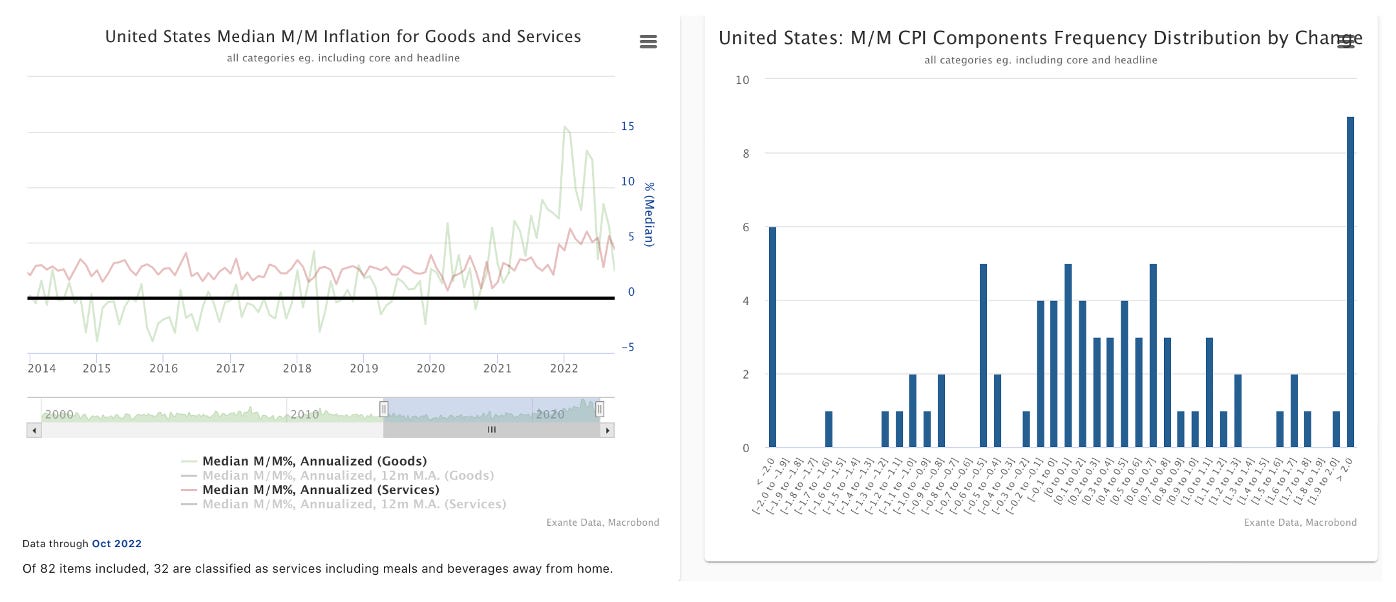

First, the median and diffusion of the full range of 234 product categories (including food and energy) are now well below their 12-month moving averages. The diffusion is about 30% and median 3%MoM (annualized). A diffusion of 30% means roughly two-thirds of categories are seeing sequentially positive inflation over the month (seasonally adjusted) with one-third negative. Though noisy, the diffusion averaged about 20% pre-pandemic and nearer to 40% pre-GFC, making the current reading somewhere between the two.

Second, looking within Core products, the 32 service categories are now running about 4.5%MoMA (with 12-month average of 4.7%) while the 50 non-service core products (durables) are at only 2.5%MoMA (compared to 9.1%MoM on average over the past 2 months.)

In other words, durable goods are disinflating fast, while services remain close to their peak still and well above pre-pandemic norms.