US commercial bank deposits are contracting: What does it mean?

So far, shifts in money market fund behavior is behind the weakening deposit dynamic; not declining credit growth. But what happens during Quantitative Tightening (QT) remains an open question.

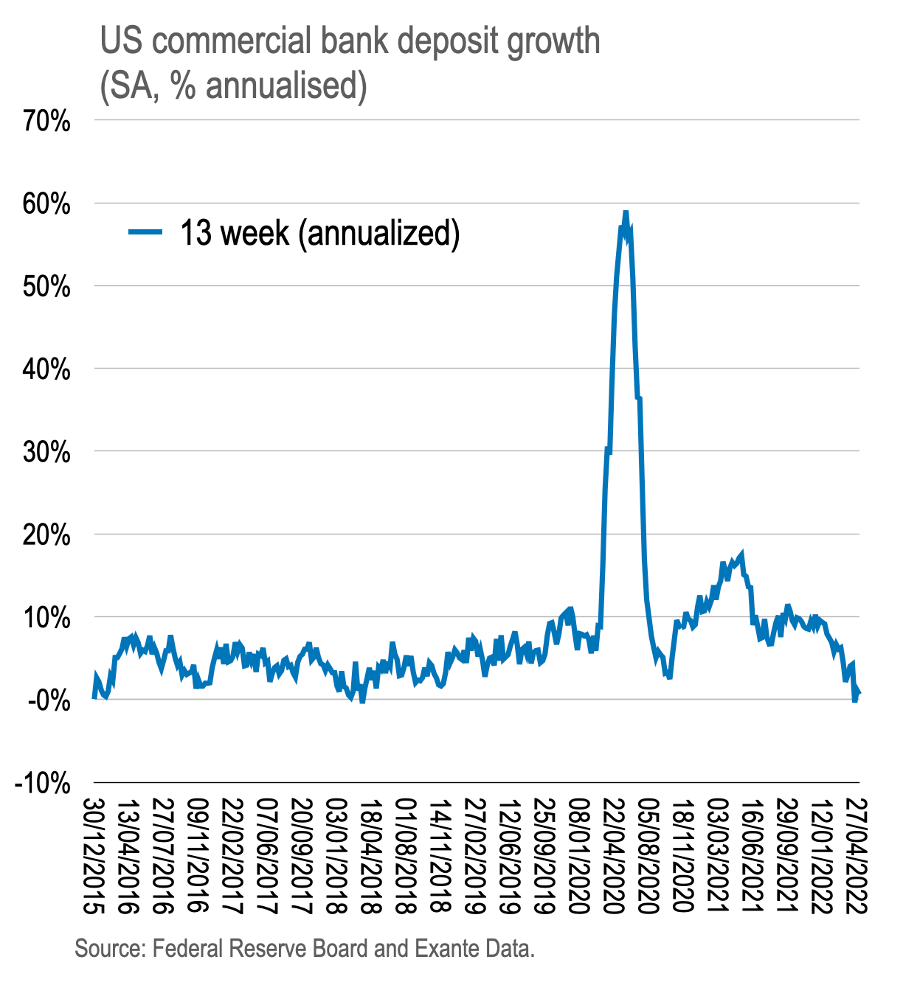

US commercial bank deposits contracted in April for the first time since 2018, which could be a signal of slowing credit creation and a sign of a weakening business cycle;

Fortunately, the observed contraction mostly reflects the migration of bank deposits to money market funds—and the increase in overnight RRP use at the Fed;

But what is happening with bank credit creation? And will QT reverse the flow into ON RRP, or further shrink bank reserves?

Over the 13 weeks through April 20th, United States’ commercial bank deposits (seasonally adjusted) contracted for the first time since 2018. Small though it was, at -0.4%QoQ annualised, this contrasts with the remarkable increase in deposits experienced during the pandemic—and challenges the hope that a growing money stock might underpin a robust economy.

But why are commercial bank deposits contracting? And does it matter?