Walking a tightrope: Italy's sustainability

The latest WEO shows Italy's public debt-to-GDP declining still. Just about.

Global yields have moved a long way since early-August when the IMF’s latest World Economic Outlook assumptions were locked in;

This has made discussion of the latest WEO, and the implied sustainability assessments contained therein, out-of-date;

Looking more closely at the case of Italy shows how debt dynamics only hold together due to assumed future primary fiscal balance adjustment.

The International Monetary Fund (IMF) Annual Meetings in Marrakesh earlier this month brought the Fund’s forecasts for the major economies up to date once more. But as usual, there was the sense that the forecasts were stale before they were published—the debt projections in particular.

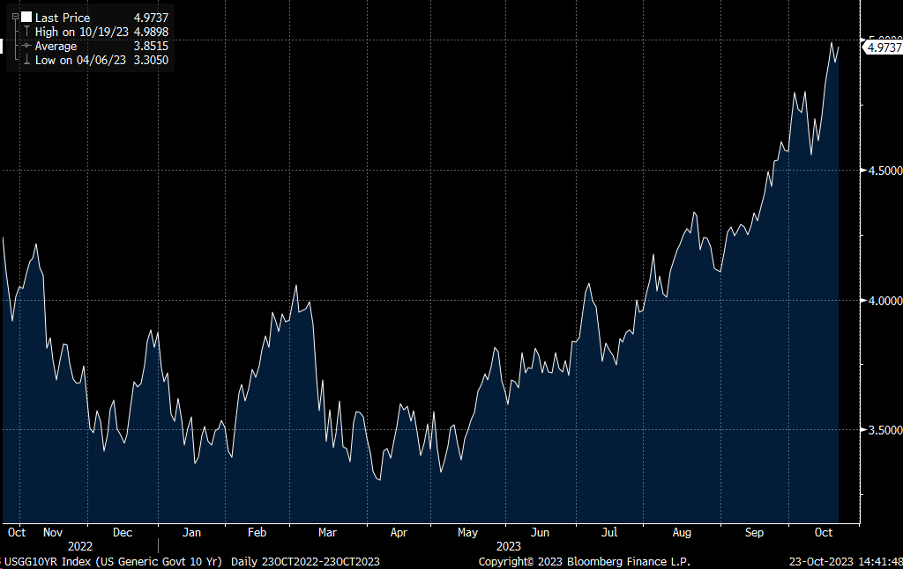

For example, the WEO was produced on the “working hypotheses” that “the 10-year government bond yield for the United States will average 3.8 percent in 2023 and 4.0 percent in 2024.”

Using daily data, this meant holding the 10Y yield constant at 4.0% from early August. Updating for the recent repricing of yields, and assuming no further increase in yields through end-year, the year average for 2023 will be 4.1% and, of course, that for 2024 will be 5.0%.

In other words, the analysis of public sector debt dynamics in the WEO database reflects a cut off for global yields that pre-dates the recent yield curve steepening—thus not reflecting global prospects at the time of the meetings.

All the excited discussion in Marrakesh was backward looking. But where does the latest yield curve move leave us for actual sustainability?

On the move: UST 10Y flirts with 5%…

Italy’s tightrope

Such optimistic assumptions are embedded in the projections of Italian debt-to-GDP, of course.

Begin by contrasting the April 2022 debt-to-GDP numbers with this month’s vintage.

Despite fiscal slippage and a repricing of the Italian yield curve since then, Italian debt-to-GDP is projected to be below that projected only 18 months ago.

Higher nominal GDP helps, of course. Italian GDP as of 2027 is now projected to about 6% higher than in April 2022. But debt dynamics are also supported by a more aggressive adjustment of the primary balance from this year until 2027. Indeed, since last April the baseline builds in about 1.5% of GDP additional primary balance adjustment despite the slippage since.