What caused the surge in post-pandemic inflation?

Evidence for a common global supply shock on goods import prices

We will no doubt be re-litigating the causes of the surge in post-pandemic inflation for many years to come but I have found the work of Mary Amiti et al at the Federal Reserve Bank of New York (FRBNY) to be particularly fascinating.

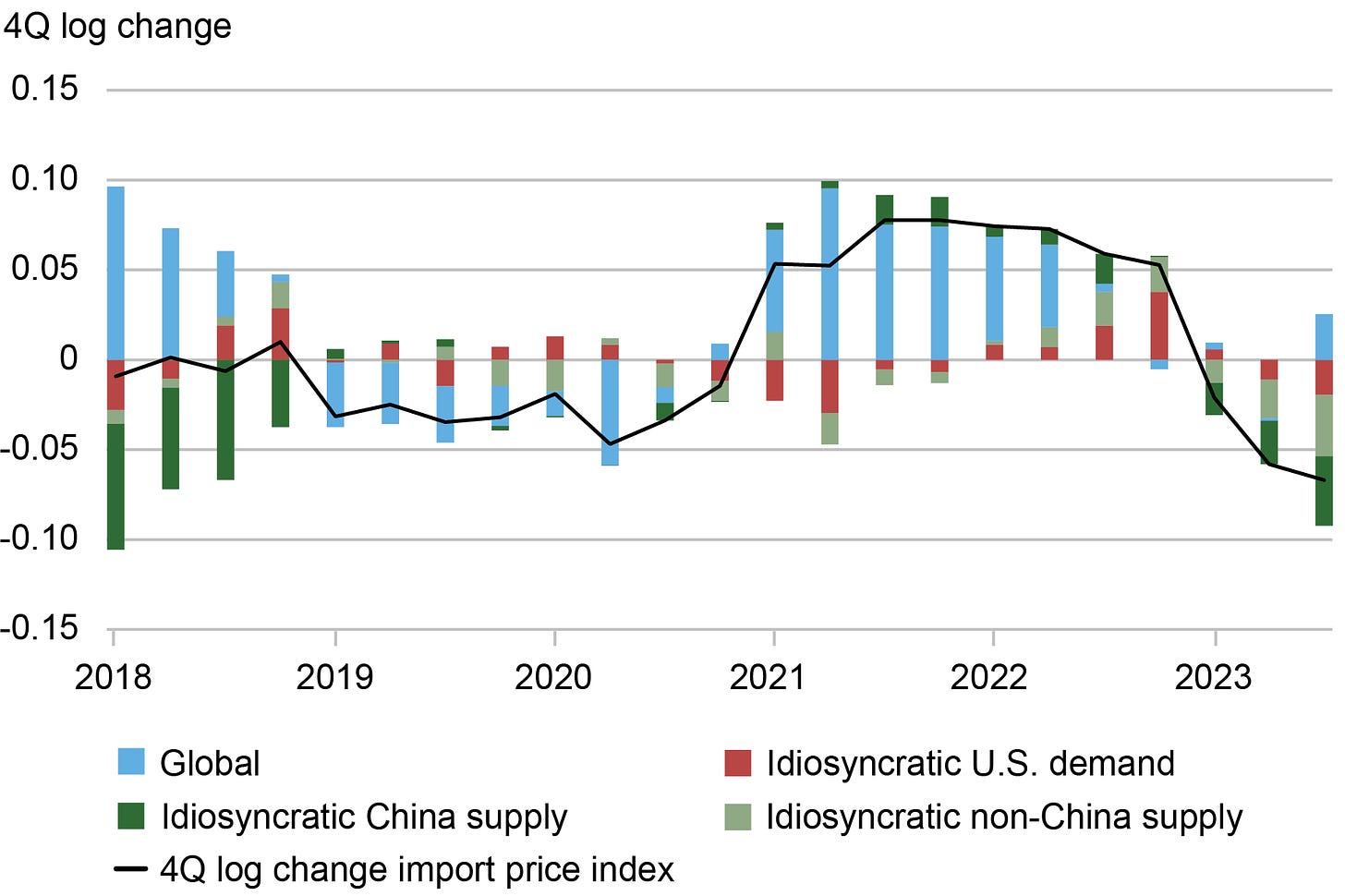

She has a new paper out about the impact of global common supply factors vs idiosyncratic demand and supply factors on driving US import prices. The key conclusion and chart are below:

"In the wake of COVID-19, import prices rose in the U.S. because they rose everywhere and not because of idiosyncratic U.S. demand or decisions made by our leading import suppliers. When U.S. import prices fell in 2023, it was mostly the product of large price drops by China and our other major import suppliers. Some of the decline in the U.S. import prices in 2023 may be due to the relative strength of the U.S. dollar, but we find little correlation between trade-weighted USD and import price inflation over the rest of the sample period."

In earlier work Amiti et al looked at pass through of import price to domestic prices. This is incredibly tricky work given that one can sort of map from IPI to PPI but is not straightforward to map from PPI to CPI/PCE.

What I found particularly fascinating about this earlier work is that while they did find substantially increased pass through from import prices to domestic prices, the portion of domestic prices that could be explained by import prices was fairly modest. Most of the increase in domestic prices is "unexplained."

From 2021: "PPI increases are significantly higher in recent months, consistent with the high headline inflation during that period, and the unexplained part (gray bars) is much larger than in any other period, highlighting that there are also other important, and atypical, forces hitting the economy during the pandemic. In sum, we find that imported input prices have had an amplified effect on U.S. domestic prices in recent months, both because of their substantial rise and because of a higher pass-through rate."

From 2022: “Overall, our results indicate that imported input prices and wages have had a significant effect on U.S. domestic prices in recent months. This large effect stems both from their relatively larger increases and a higher pass-through rate. In addition, prices in the traded sector have become more correlated with foreign competitors’ prices, *most likely because all firms are experiencing the same shocks.*"

I would argue that the "team transitory" school of post-pandemic inflation has largely focused on goods inflation and the role of supply shocks. Team persistent has focused on the stickiness of services inflation and elevated wage growth. But I think a unified approach would also at least partly explain the latter as the result of a COVID induced negative labor supply shock of which immigration is likely an important component.

The bottom line is that decomposing the causes of post-pandemic inflation will be on ongoing debate in the years to come and while the evidence that surging import prices were behind the increase in US consumer goods prices is mixed, there is reasonably robust evidence to suggest that common global supply factors were a major driver of the increase in US goods import prices.

The content in this piece is partly based on proprietary analysis that Exante Data does for institutional clients as part of its full macro strategy and flow analytics services. The content offered here differs significantly from Exante Data’s full service and is less technical as it aims to provide a more medium-term policy relevant perspective. The opinions and analytics expressed in this piece are those of the author alone and may not be those of Exante Data Inc. or Exante Advisors LLC. The content of this piece and the opinions expressed herein are independent of any work Exante Data Inc. or Exante Advisors LLC does and communicates to its clients.

Exante Advisors, LLC & Exante Data, Inc. Disclaimer

Exante Data delivers proprietary data and innovative analytics to investors globally. The vision of exante data is to improve markets strategy via new technologies. We provide reasoned answers to the most difficult markets questions, before the consensus.

This communication is provided for your informational purposes only. In making any investment decision, you must rely on your own examination of the securities and the terms of the offering. The contents of this communication does not constitute legal, tax, investment or other advice, or a recommendation to purchase or sell any particular security. Exante Advisors, LLC, Exante Data, Inc. and their affiliates (together, "Exante") do not warrant that information provided herein is correct, accurate, timely, error-free, or otherwise reliable. EXANTE HEREBY DISCLAIMS ANY WARRANTIES, EXPRESS OR IMPLIED.