This week’s sharp depreciation of TRY underlines the balance sheet weaknesses that have been building in Turkey for many years;

CBRT balance sheet has been used to support currency and make profit transfers to the Treasury, subtly monetising part of the deficit and driving dollarisation;

The sharp shift in demand for hard currency this week revealed CBRT to be out of ammunition—and only a bystander as TRY hit an air-pocket;

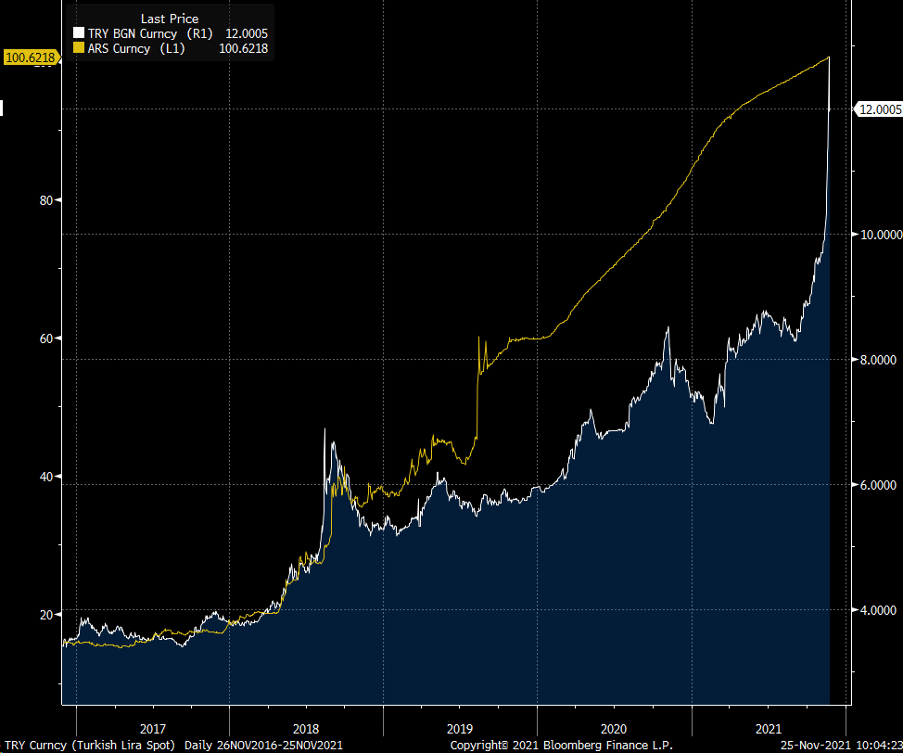

In this respect, Turkey has much in common with Argentina in 2018. But there are also important differences that make an IMF program unlikely for some time yet.

The stand-out move in asset prices so far this week has been Tuesday’s 12.5% depreciation of the Turkish Lira (TRY) from USDTRY11.4 to USD12.8 by end-day and from USDTRY10.5 about a week ago. The move partially reversed yesterday. But for a major EM currency, this was a sobering occurance.

How can we explain the move?

Three factors spring to mind.