“Religious” Views about Good Money

“Money” is a topic that many are extremely passionate about (and this is indeed the reason we have started this very blog).

“Is gold a better form of money that so-called fiat currency?” There is a large group of ‘gold-bugs’ that passionately advocate in this direction.

“Should the government have a say in managing (your) money, or is a decentralized system, such as bitcoin better?” There is a group, partly overlapping with the gold-bugs, arguing in this direction, and increasingly putting money behind the view (in part due to lack of nominal return on traditional liquid forms of money.)

This is again one of those areas (like the debate about money supply and inflation, see link) where many are religious, and impossible to ‘convert’ to a different view.

I do not view myself as a ‘missionary’, but I am into ‘enlightenment’. And the topic of ‘good money’ is closely linked to what has been the focus of my career over the last 20 years, forecasting currency movements (my bio is here, if you are interested in the details).

Good money preserves its purchasing power: inflation and nominal returns matter

In essence: Good money (or good currencies) retain their value better than others. And by “value,” we (typically) mean retaining purchasing power in terms of a basket of consumer goods. In this post, we will focus on this metric (but re recognize that there are alternative metrics, such as the currency value in the foreign exchange market, although they are often correlated).

It is easy to come up with examples of ‘bad money’. Countries with hyperinflation have seen their money rendered worthless. Venezuela is an extreme example of that.

Argentina is another example. Over the last twenty years, the price level has rising more than 15 times, meaning that the currency’s domestic purchasing power has fallen by more than 90% over time period, and it is hard to say if this is an accurate estimate, since inflation statistics have been subject to manipulation.

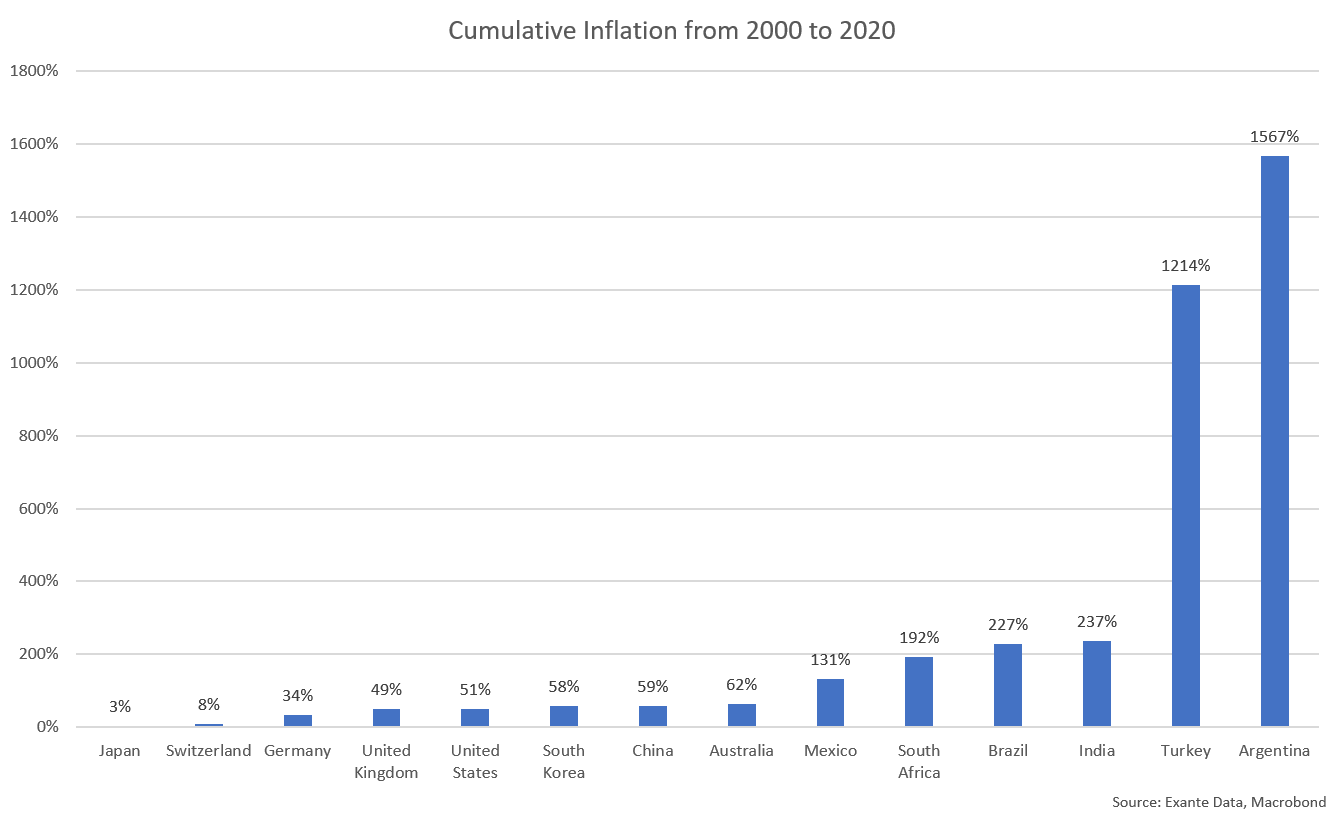

The bar chart below shows cumulative inflation rates over the last twenty years for a selection of G10 and EM countries. There is a clear difference between EM countries and so-called G10 countries

Argentina and Turkey have seen cumulative inflation more than 1000% since 2000. But India, Brazil, South Africa and Mexico have also seen notable inflation, adding up to more than 100% over the period, although far from the level seen in Argentina.

In G10, and China ranks in the middle of that group based on its inflation track record, the cumulative inflation is much lower, from just 3% in Japan to 62% in Australia, with the US in between, at 51% (not this included ‘compounding’).

But there are two main dimensions to whether money can retain its purchasing power (assuming that most money will be held in bank accounts, that can generate interest, as opposed to physical cash with no yield):

First, inflation matters : A rising price level will undermine the purchasing power of a given amount of money.

Second, nominal return matters: The interest paid, such as those on a savings account, CDs (or in some cases a checking account), can help compensate for inflation (and exceed that, if real interest rates are positive).

A caveat is worth mentioning here: not all citizens have access to the same nominal returns. Some households do not have a bank account, and even the households that have bank accounts may not have access to the returns that professional investors will have access to via a spectrum of fixed income investments (government bonds in particular). As such, households will typically not be able to generate a nominal return that is comparable to government bond yields, and typically the return will also be well below the official central bank policy rate.

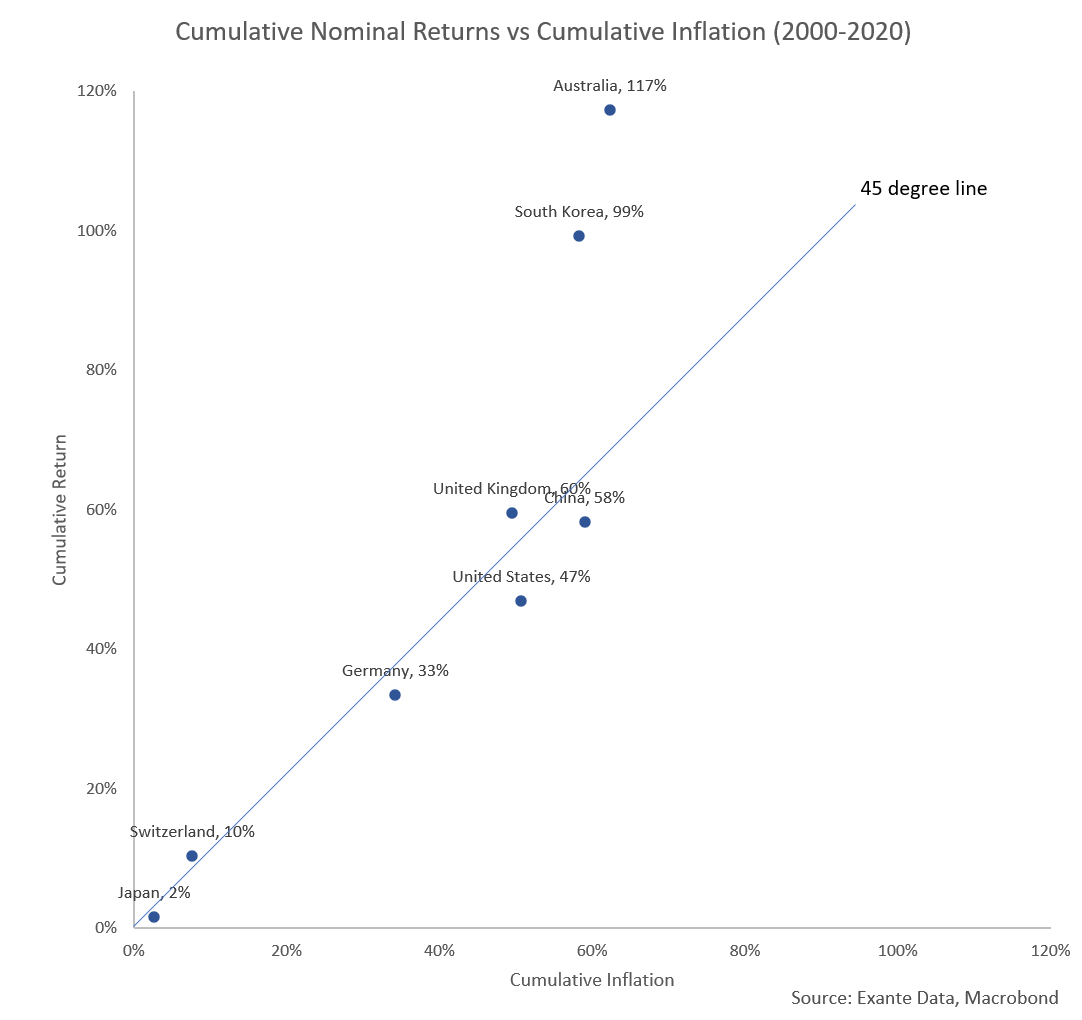

In any case, the chart below illustrates the relationship between cumulative inflation and cumulative nominal returns (using the relevant benchmark short money market rates for each country). We zoom in on the (mostly G10) countries with more developed financial markets, which have reliable interest data going back several decades.

The chart shows that Japan and Switzerland have had by far the lowest inflation in the sample over the last 20 years, barely above 0% on average per year.

The chart also shows that the cumulative nominal returns tend to correspond to the cumulative inflation. For example, the UK and the USA have seen more inflation than Japan and Switzerland. But they have also seen higher nominal returns on money.

Another key point is that the countries with the higher inflation are not necessarily the ones with the ‘worst’ overall proposition in terms of retaining purchasing power, when taking into account both nominal returns from interest paid on deposits and the inflation effect.

In the specific sample below, Australia and South Korea stand out as having had returns exceeding inflation, and hence better ability to retain purchasing power. In other words, there has been a real return on money on those two economies over the last two decades.

Initial Conclusion

Not all money are equally sound, however. Investors in emerging markets have learnt that the hard way, and they would never park all their savings in their domestic currency only.

In major economies it is a bit different. Inflation has generally been moderate, and there has been some compensation from positive interest rates (although that is mostly a function of returns that were generated some time ago). Some, including many central bankers, would even argue that inflation targeting has been ‘too successful’ and that inflation has been too low.

In any case, it is important to stress that ‘good money’ is not necessarily the money with the lowest inflation. Countries with positive real rates will enable savers to retain their purchasing power, even if there is some inflation.

This is the lesson from the last two decades. But obviously the regime continues to evolve, and we now have essentially zero interest in all G10 economies (although not in China). Hence, any inflation will eat more into purchasing power than in the past.

Moreover, the combination of aggressive fiscal and monetary easing (as discussed in a previous post) could create a bigger risk (right side tail if you will) of more severe inflation. This could have implications for what is ‘good money’ in the future.

Future Posts on ‘good money’: How to prudently manage ‘money portfolios’

There is a lot of heated debate about governments’ inability to keep the money safe. But many investors/savers nevertheless have one-sided exposure to their own country’s money. The US is the most extreme example of that, with a large proportion of investors only holding USD assets.

This is odd (and different to how investors handle currency risk in emerging markets). Very few prudent investors would hold a portfolio with 100% exposure to one stock. But at the same time, they are happy (or not sufficiently concerned) about holding a portfolio with just one type of money, such as dollars. This is a particularly risky proposition in a time with historically large fiscal deficits, and increasingly experimental monetary policy.

We will comment more on home bias (lack of diversification) of money/currency portfolios in a future post. Further, we also plan to add a gold/bitcoin dimension to the analysis in future posts, but we left that out on purpose for now.

END.

Hi Jens,

The discussion of CPI based inflation and the return on savings account appear to be a bit 1950s, in my view. For most of the middle class living the developed nations, the daily concerns aren't how much am I paying for a pairs of shoes from Vietnam but can I afford a home and how is my stock portfolio doing.

The central banks' focus on consumer prices, as opposed to adding a higher weight to financial prices, appears to me to be focusing on a portion of households' consumption basket that is decreasing in importance. We don't hear the younger generation protesting about the rising cost of bread but the rising cost of education, capital assets and wage stagnation.

So in this sense isn't the whole debate around what is "good" money based on a metric of CPI inflation moot? What good is talking about CPI inflation if that not a metric that would influence the behaviour of households and businesses to consume or invest?

Savers and investors are not the only stakeholders in a good-money system. Wage earners and employers have an interest in stable, predictable prices but not necessarily zero inflation. A modicum of inflation is, I believe, widely seen as a way to make relative price changes easier to bear. That's not fully rational, of course, but behavioral economics that highlights recency bias probably speaks to this.