Asset Ownership vs Asset Management

Risk management (as opposed to just risk-taking) is what is being rewarded in 2022

We have transitioned from a stimulative policy regime that boosted asset values (and which was possible when inflation was low), to a regime of persistently higher inflation and no central bank “put” in sight.

In the prior regime, asset ownership paid off, almost regardless of which asset you owned. Today, active asset management with a macro component is crucial. It is the only way to generate respectable returns, given the power of the global macro shocks in motion.

Over the last several decades, it has paid off to take risk. Asset owners (pension funds, endowments, family offices) have done well, almost irrespectively of what they owned. Equities did well. Bonds did well. Credit did well, and even new alternative asset classes, from Private Equity to Crypto did very well (up to 2021).

The COVID shock, historically large monetary and fiscal stimulus, and an unprecedented war at the border of the EU, have changed everything, and macro shocks are now dominating market dynamics, for all assets.

Asset ownership has not been rewarded in 2022

The traditional 60/40 portfolio (60% stocks, and 40% bonds) has delivered terrible returns. In the first three quarters of 2022, it is down 21% (which annualized amounts to 27%), its worst annual return since at least the late 1970s.

And asset owners, typically pension funds, and other long-term investors have been hard hit too, because their portfolios often have a flavor like the 60/40 portfolio and because many of them focus on owning assets for the long-term, as opposed to active risk management on a shorter-term basis.

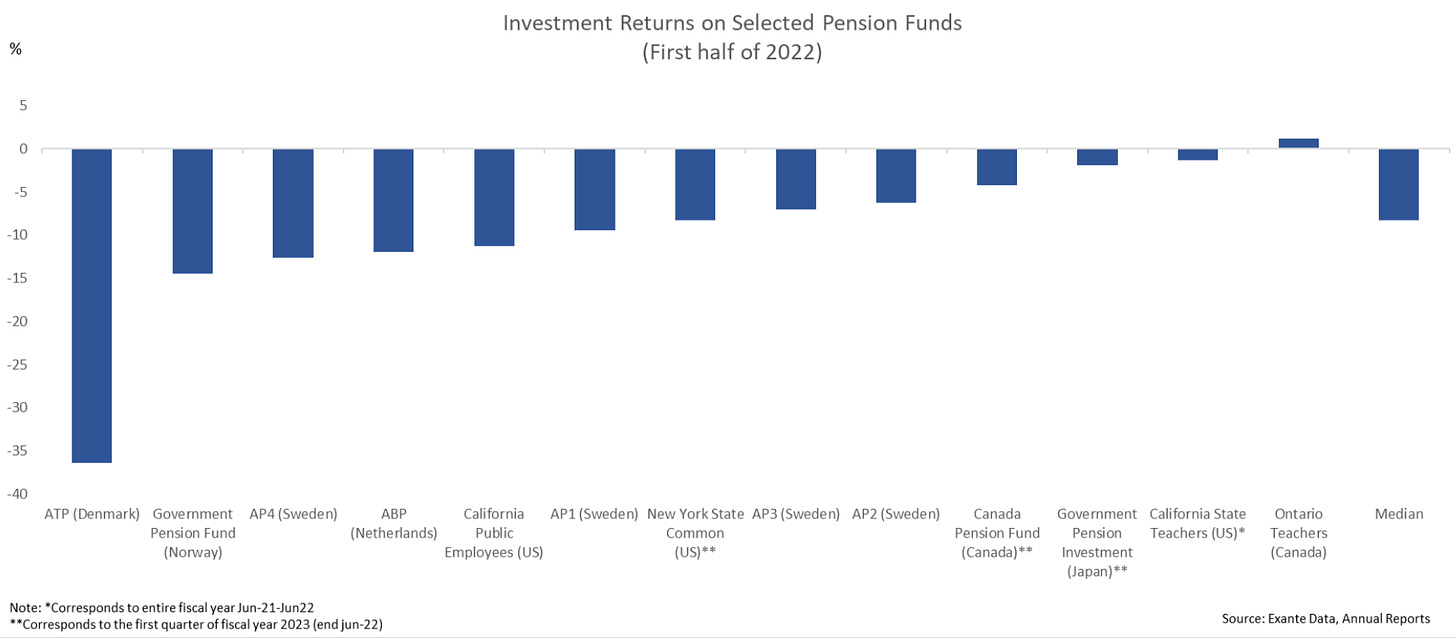

The chart below shows the returns of some prominent global pension funds with large assets under management in H1 2022. These numbers are not directly comparable, as the reporting currency differs, and as the reporting period is not identical for all. But the chart illustrates clearly that the pain was very significant in the first half of 2022, and more pain will be visible when Q3 figures are eventually reported.

False Investment Lessons from Past Decades

The lessons from the last few decades was that risk-taking was rewarded, and that hedging and risk management was not. And this lesson had increasingly been embedded more and more in large institutional portfolios.

In the UK, as many have learnt the hard way in recent weeks, it had even become common to add leverage to pension portfolios, with disastrous consequences for savers. UK pension funds were not included in the chart above. But it is fair to say that when their H2 2022 results are reported, it will not be pretty. As not only have the broader asset environment been tough, they have also been forced into fire-sales of assets to meet margin calls.

Many of the ‘investment’ lessons, that have become so popular (‘always stay invested’ and ‘cash is trash’) also look far less obvious in a year when cash has outperformed most other asset classes dramatically, and when T-bill yields are approaching 5%!

The investment lessons that may have been correct in a world of stimulative central bank policy (and ‘centra bank puts’ protecting asset markets), are no longer valid.

Inflation, regime change & asset management

The broader lesson is that regime change can happen. The world’s first major inflation challenge in 40 years has indeed led to dramatic regime change, including profound changes in asset correlations, which underpinned the asset owner’s complacent attitude to risk management.

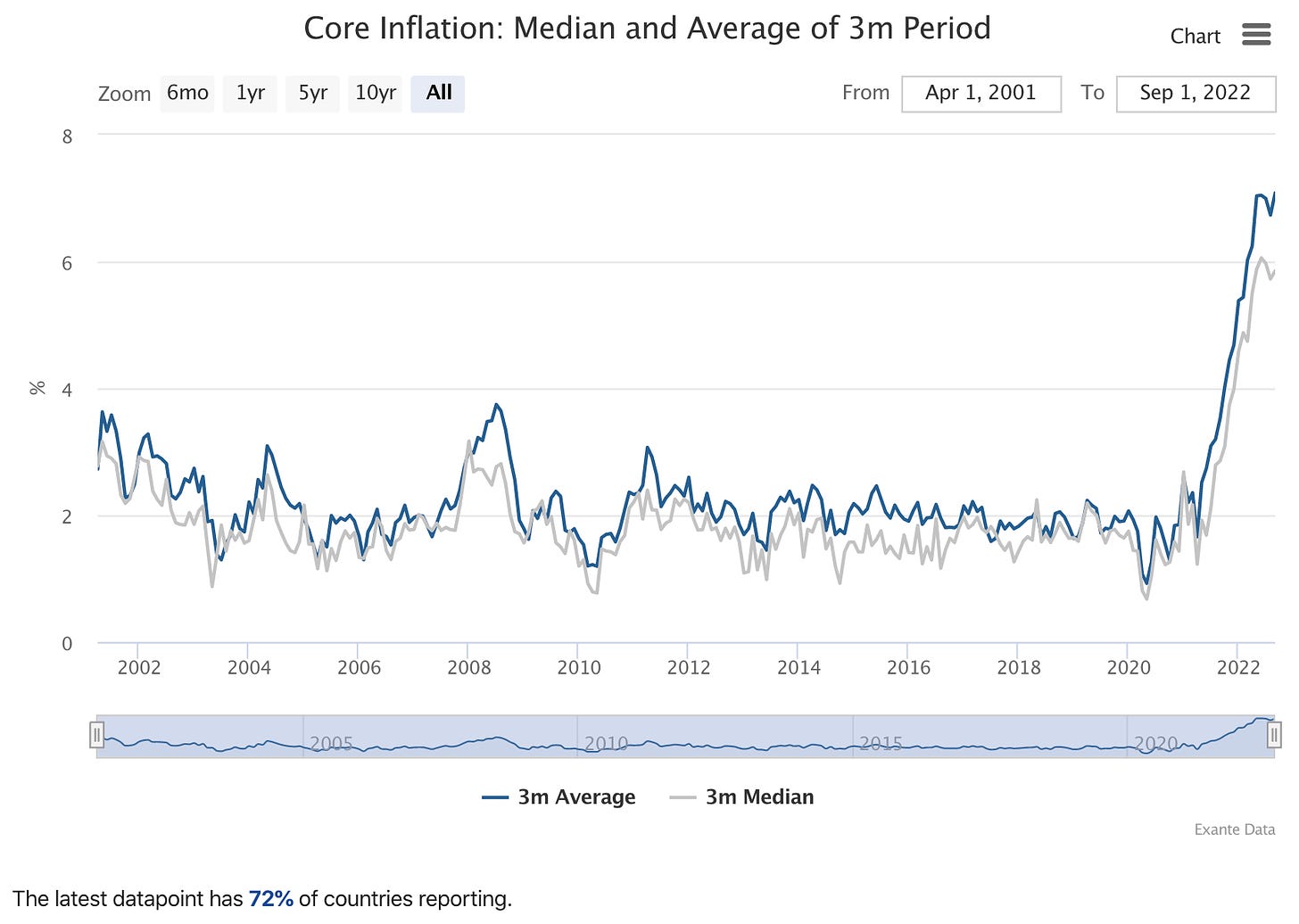

Two charts will illustrate.

First, we show a simple chart of global core inflation using a large sample of both EM and DM countries. This just goes to show have unusual the current environment is, even when you average across a large number of countries, you find much more inflation than we have seen in a very long time.

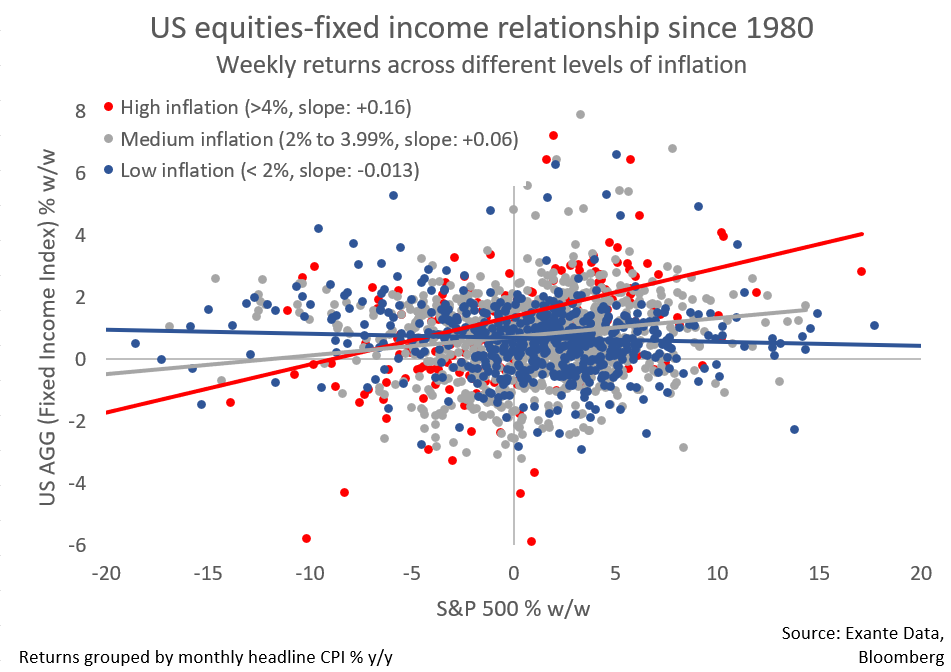

Second, the chart below shows how asset market behave when inflation is low, and when inflation is high.

In the low inflation environment, there is a tendency for bond and equity returns to be uncorrelated (or even slightly negatively correlated). In other words, if equities are down, your bond investments will do much better (these are the blue dots)

In the high inflation environment, there is a tendency for bond and equity returns to be positively correlated. If you lose on your equity exposure, you also lose on your bond exposure (these are the red dots).

Now, risk premia are spiking everywhere. Because inflation is here, meaning that fixed income assets are not generating fixed income in real terms, and because central banks are no longer able to help so readily when financial markets are showing signs of risk aversion.

In an inflationary world, central banks have to focus its work on anchoring inflation expectations, as we have discussed in Lessons from the Bundesbank and Lessons from the Volcker Disinflation.

This means that financial stability concerns, even if they are relevant for the growth outlook, become secondary. This is different from the situation we have been in for the last 20-30 years, when central banks always stepped in, when there was meaningful financial market tension (think the global financial crisis in 2008, the Euro-crisis in 2010-2012, The China Slowdown in 2015, and the COVID shock of 2020).

As such, we have moved to a situation where risk management is key. To put it succinctly, asset management is what is required, as opposed to merely asset ownership.

We have an entire industry of so-called ‘asset managers,’ which really are just asset owners in disguise. But the true asset managers, the ones that can effectively and nimbly navigate a fundamentally changed, and more challenging, macro environment are the ones that are being rewarded now.

For example, in September, the HFRI 500 Macro index jumped 2.75 percent, reaching a year-to-date performance gain of 17.5 percent, according to Institutional Investor (link).

Active asset managers with a macro focus are indeed doing quite well in this environment, outperforming relative to the traditional 60/40 portfolio of by 30-40% so far in 2022.

Relatedly, macro portfolio managers and strategists are in high demand (we can see that in terms of the amount of questions we are getting at Exante Data, and in terms of our clients looking to make new hires in the macro space).

The buy-the-dip mentality is no longer sufficient, and this could become structural.

Inflation changes everything. And while central banks are working hard to get inflation back to targets, one thing is clear. The lesson from the 2000-2020 period, that inflation is dead, has been proved wrong, and this lesson remains relevant even if inflation comes down. The fear of future inflation will remain embedded in asset prices in coming years—even if realized inflation does come down.

We are entering a period in which asset management—meaning smart active risk management—will be rewarded, and the naïve asset owners will be penalized.

In the bigger history, we could even argue that this is how it used to be; it was 1990-2020 period that was the anomaly (when mere asset ownership was rewarded).

Conclusion

Over the last several decades, simply owning assets has been ‘easy’. Bonds were in a structural bull market. Equities were in a structural bull market. And various alternative assets delivered persistently strong returns too.

And when the economy was hit by a negative shock in that regime, central banks quickly came to the rescue. Investors (asset owners) where bailed out of many investments in 2008. Investors were bailed out of almost all assets in 2020. Risk management was a costly affair, whereas full-on risk taking was rewarded.

But the world has changed. This cycle is different. We have a large global inflation shock for the first time in nearly forty years. And simply owning assets has been very costly in 2022.

Those who have employed active risk management, with a macro component, have done very well. Not only have they avoided a big drawdown, but many have generated sizable positive returns. Many market participants (those previously with an asset ownership focus) will be forced to change risk management approach to survive in the new regime we are now in.

The content in this piece is partly based on proprietary analysis that Exante Data does for institutional clients as part of its full macro strategy and flow analytics services. The content offered here differs significantly from Exante Data’s full service and is less technical as it aims to provide a more medium-term policy relevant perspective.

Exante Advisors, LLC & Exante Data, Inc. Disclaimer

Exante Data delivers proprietary data and innovative analytics to investors globally. The vision of exante data is to improve markets strategy via new technologies. We provide reasoned answers to the most difficult markets questions, before the consensus.

This communication is provided for your informational purposes only. In making any investment decision, you must rely on your own examination of the securities and the terms of the offering. The contents of this communication does not constitute legal, tax, investment or other advice, or a recommendation to purchase or sell any particular security. Exante Advisors, LLC, Exante Data, Inc. and their affiliates (together, "Exante") do not warrant that information provided herein is correct, accurate, timely, error-free, or otherwise reliable. EXANTE HEREBY DISCLAIMS ANY WARRANTIES, EXPRESS OR IMPLIED.

GREAT POST JENS!

I am wondering if instead of writing..

"As such, we have moved from a situation where risk management is key. "

you meant to write..

"As such, we have moved TO a situation where risk management is key."