Could there be a Eurosystem liquidity crisis (Part III): A look at declining Bundesbank seigniorage

Could Germany's central bank be the first to need quasi-fiscal support under euroarea unconventional monetary policies?

Bundesbank net interest income in percent of balance sheet has been drifting downwards in recent years as yields on German assets have been driven below zero. At some point unconventional policy could weigh on the Bundesbank’s financial position. Removing such constraints should be addressed as part of the ECB’s monetary policy Strategy Review.

In previous posts, we noted the challenge of unconventional policy to the balance sheets of Eurosystem National Central Banks (NCBs.) See Part I and Part II. In particular, as discussed, there is a hypothetical case where a NCB within the Eurosystem could simultaneously experience losses on their Public Sector Purchase Program (PSPP) portfolio while being required to make monetary transfers to the rest of the system. Both are a possible result of continued unconventional monetary policies in the Eurozone.

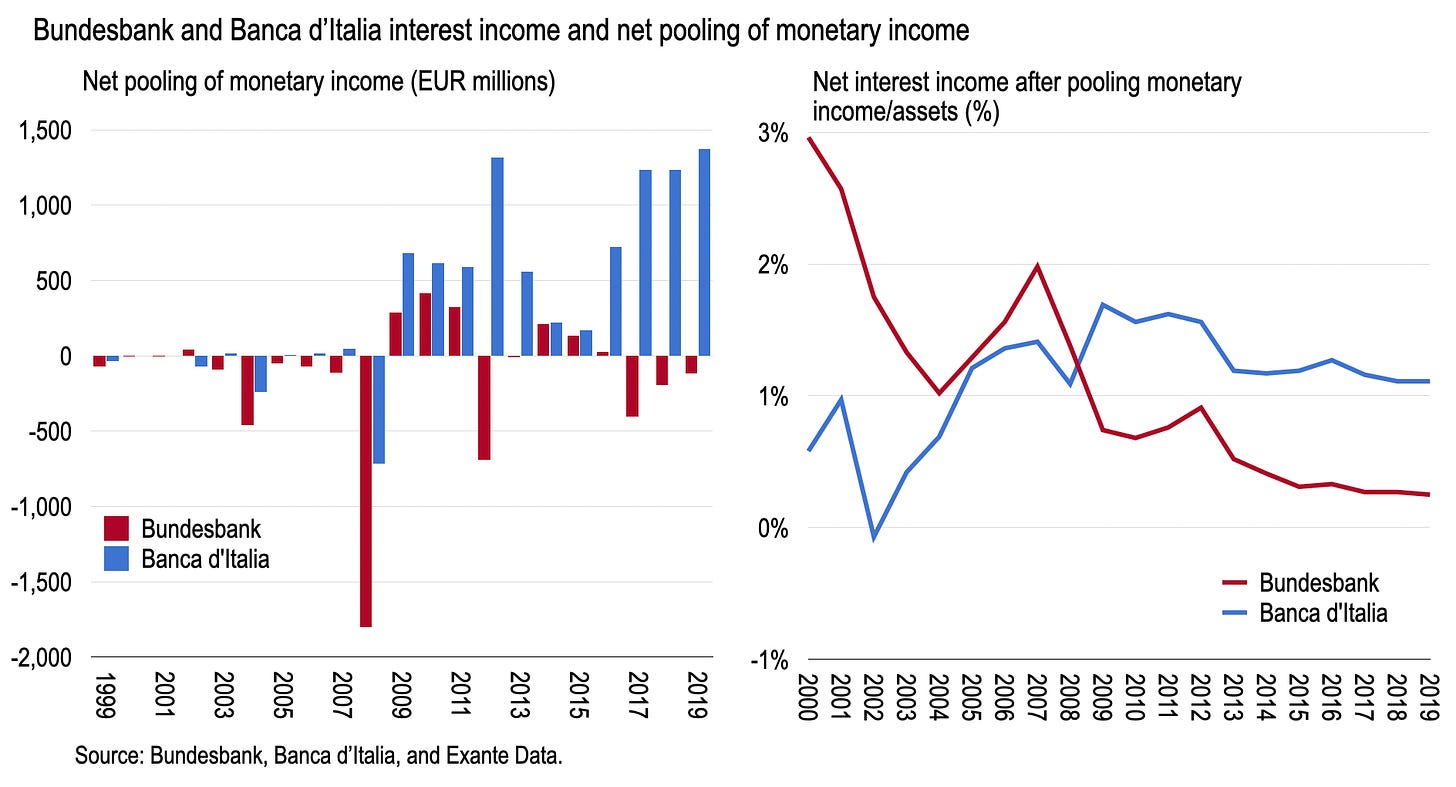

Now, this possibility might seem only hypothetical or at least very distant. Consider some facts surrounding NCB net interest income and monetary transfers. In particular, the chart below digs into the Annual Reports of the Bundesbank and Banca d’Italia since the inception of the euro.

Pooling of monetary income and net interest income

The left chart shows the transfers due to the net pooling of monetary income (in EUR millions). These transfers were small in the early days of the single currency. For example, Bundesbank would make transfers to the system initially, presumably due to additional income on assets related to currency issue, a service for non-residents in which the German central bank is particularly specialised.

Post-GFC, when monetary income increased on growing liquidity, Bundesbank became recipient of monetary income from the rest of the system to pay the cost of surplus liquidity gathered there. More recently, as the deposit rate has turned negative, and given the continued surplus deposits in Germany, Bundesbank has begun to make net transfers to the system again, averaging EUR240 billion over the past 3 years. The negative deposit rate serves as a tax on German banks, some of which is transferred back to the rest of the Eurosystem.

By contrast, Banca d’Italia has received transfers from the system in excess of EUR1 billion per year since 2016 as liquidity in Italy has been relatively slight but Italy’s capital key relatively large. In a sense, the Bundesbank is making transfers to Italy to subsidise cheap loans through the Targeted Long Term Repo Operations (TLTROs) and the like.

Consider, finally, the net interest income of Bundesbank and Banca d’Italia relative to total assets, as shown on the right. Total assets is an (imperfect) approximation for balance sheet size due to unconventional policy in each country. This captures, in part, the impact of coupons on the PSPP portfolio. Net interest income of Banca d’Italia, after a few bad years early on, has levelled off above 1 percent, commensurate with the yields on BTPs in recent years. In contrast, Bundesbank net interest income has drifted ever lower since 1999, from about 3 percent to about 0.25 percent today. With the German yield curve below zero at least as far as the 30 year maturity, eventually Buba will begin making losses on the PSPP as they pay today above par for securities that will deliver a smaller cash return through coupons and principal upon maturity.

Implications for the ECB’s Strategy Review

The refusal by the euroarea core to share risk relating to PSPP purchases in 2015 today means they do not benefit from the higher coupons on peripheral debt. This apparently sensible decision to avoid the cost of possible default will have balance sheet consequences in one way or the other.

We might therefore conjecture it is only a matter of time until the Bundesbank makes losses on her PSPP portfolio. And if monetary policy continues to innovate in favour of loan subsidies, or “dual rates,” driving the overall monetary income of the system negative, then the limits of monetary policy could indeed be tested.

To be sure, the capital and reserves (EUR5.7 billion) together with revaluation accounts (EUR170.4 billion) of the Bundesbank remain substantial, at 7.4 percent of the balance sheet. And central banks can often function perfectly well with negative capital. But political or accounting constraints can bind before macroeconomic ones. And in any case, over a long enough horizon the cost of conducing unconventional monetary policy will begin to weigh on these buffers. At the very least, the Bundesbank might call upon government support to pay the costs of the ECB’s unconventional policy. Perotti, for example, notes that the German Constitutional Court has ruled that Buba should not function with negative capital—even if there is no macroeconomic imperative for this. If so, it is only time until the quasi-fiscal nature of monetary policy in the Eurozone will be laid bare for all to see.

In short, while monetary policymakers don’t like to talk about it, considerations relating to the impact of unconventional monetary policy weigh on NCB capital and possibly decision-making—including the future course of unconventional monetary policy. But if the existing institutional structure of the Eurosystem indeed constrains the future course of policy, then consideration during the ECB’s Strategy Review should address how to free up NCB balance sheets to reach the goals of monetary policy.

END.