El Salvador’s Bitcoin Gambit

With limited seigniorage revenue and ongoing BOP pressures, El Salvador's historic decision to make Bitcoin legal tender reflects macroeconomic fundamentals as much as currency innovation

El Salvador’s decision to legislate Bitcoin as legal tender earlier this month—and ongoing scramble to build the financial infrastructure to make this viable—has created a stir. To be sure, the decision elevates Bitcoin’s status within El Salvador as legal tender alongside the US dollar; it is about co-existing with the dollar and not displacing it. But it represents the first time Bitcoin has received such recognition by a sovereign state and naturally raises the question about whether this could (or should) happen elsewhere.

Of course, not everyone has embraced the decision with enthusiasm. The Bretton Woods twins are not convinced, for example. The World Bank is said to have denied assistance to El Salvador in implementing this new currency arrangement, citing environmental concerns. The IMF, to whom El Salvador has roughly USD0.4bn outstanding and with whom they are negotiating a USD1 billion program, noted with respect to such a move “a number of macroeconomic, financial and legal issues that require very careful analysis.”

Bitcoin Law

As George Selgin notes, the Bitcoin Law promulgated in El Salvador was announced to great fanfare and passed only hours after reaching Congress. Discussion was therefore minimal despite the enormity of the undertaking.

In short, as Selgin explains, Article 2 of the Law acknowledges that the exchange rate between USD and Bitcoin will be established in the market. Prices can be expressed, and taxes paid, in Bitcoin (Articles 3 and 4). More aggressive, per Article 7, “Every economic agent must accept bitcoin as payment when offered to him by whoever acquires a good or service.” As such, the government is now charged with finding the technological means to ensure all residents can access Bitcoin for spot transactions, though Article 12 allows for those without such means to be exempt from Article 7 while such shortcomings are resolved. In addition to spot transactions, all debts expressed in USD can, once the law becomes effective on Sept 6th, be paid in Bitcoin.

Why El Salvador?

Beyond the legal foundation, we might ask why such a move makes sense for El Salvador on economic grounds. To this end, it’s useful to recall the benefits of having a legal tender issued by your own state to begin with. These include having the policy independence that this brings, including exchange rate flexibility—hence the gold standard was eventually abandoned—but also the seigniorage revenue that accrues to the state from the central bank’s monopoly issuance of high-powered money.

In short, the state derives a flow of income from the assets held by the central bank—the coupons on domestic Treasury debt that are the accounting counterpart to the central bank monetary liability—which is transferred back to the government as profit. In effect, part of the government’s debt is converted, via the central bank, to de facto zero coupon perpetual debt owing to the use of currency in face-to-face transactions and by banks in settling payments.

This is in normal times.

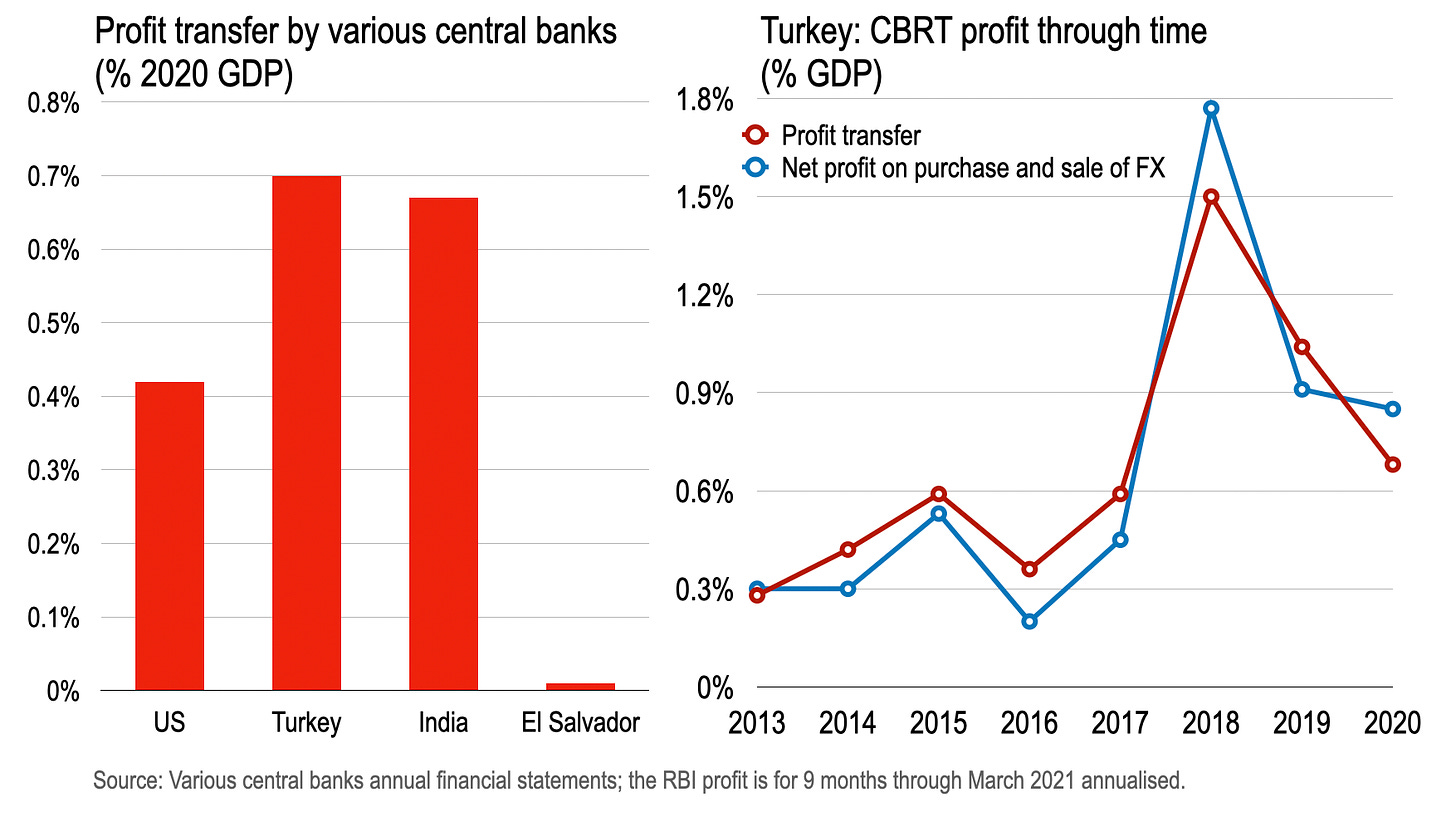

With increasing recourse to QE in recent years, this monetary income continues to be considerable in advanced economies despite record low yields across the world. In the United States, for example, in January the Federal Reserve remitted about USD88bn (0.4% of GDP) to the US Treasury on profits from 2020.

For those countries whose central banks enjoy substantial net foreign currency assets—international reserves, for example—alongside domestic assets, there are also profits to be derived from a secularly depreciating currency. Turkey, for example, made TRY35.4bn in profit in 2020 (about 0.7% of GDP) of which TRY42.8bn was derived from net profit on purchase and sale of foreign exchange. Currency weakness begets a fiscal windfall (although there are likely to be negative balance sheet effects on other FX exposed balance sheets). In Turkey, this profit is transferred to the Treasury in March or April each year, contributing to government revenues—and smaller primary deficit—while impacting local liquidity conditions. In 2019, this transfer to the Turkish government was close to 1½ percent of GDP—certainly not to be sniffed at.

Obviously, El Salvador does not enjoy such a luxury. Having dollarized back in 2001, the IMF’s latest classification notes El Salvador enjoys no separate legal tender: “The US dollar is used as a unit of account and a medium of exchange. The Central Reserve Bank (CRB) must exchange colones in circulation for US dollars at banks’ request at a fixed and unalterable exchange rate of C8.75 per US dollar. Both the US dollar and the Salvadoran colón are legal tender; payments may be made in either dollars or colones.”

Any liabilities the central bank issues is strictly constrained by an equivalent value of foreign assets. Support for the local government bond market is limited. And the net income on such an external position will be limited. In 2020, for example, Banco Central de Reserva de El Salvador (BCR) made USD2.5 million in profit (from about USD3.1 million in 2019. This is about 0.01% of GDP—orders of magnitude below that transferred by the Federal Reserve and CBRT.

But why now?

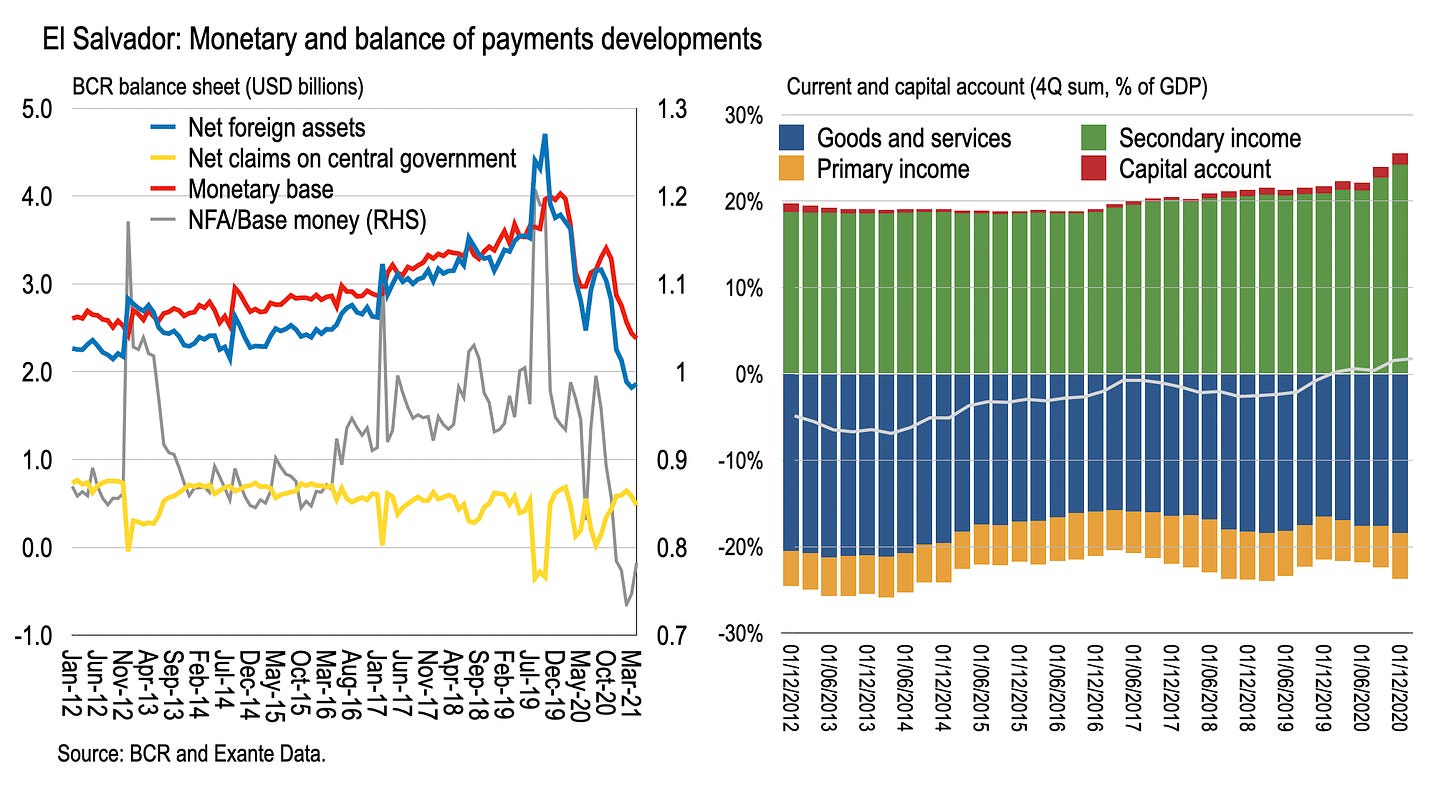

Key items from the BCR balance sheet as well as the balance of payments are shown in the figure below. Central bank net foreign assets (NFA) typically jump when central government deposits increase, implying accesses to external resources which then dissipate when spent. Of most concern, net foreign assets and base money have been on a downward trajectory since mid-2019; the ratio of NFA to base money has dipped below 0.8 for the first time in the past decade. As such, base money coverage has been eroded, implying balance of payments pressure.

Seen from the perspective of the current account, El Salvador has been running a small current account surplus over the past 12 months of about 1½ percent of GDP, a considerable improvement on the 7 percent of GDP deficit in 2014. In this respect, the external flow imbalance is contained. As the economy re-opens, however, import compression will be released, causing an external deficit once more, while any external refinancing pressure will be difficult to meet.

In this light, it is unsurprising that the authorities have requested an IMF program. And the monetary innovation making Bitcoin legal tender looks like an attempt to generate capital inflows. Indeed, the reported “golden visa program for Bitcoin denominated investors” looks like an attempt to generate foreign direct investment as much as reshape monetary arrangements.

The monetary triad on trial

Regardless of the true motivations, El Salvador’s monetary experiment will be worth monitoring closely. There are reasons to be skeptical. But if the authorities are able to nurture a technology that allows residents to transact seamlessly in Bitcoin alongside dollars, while vendors are able to update prices in real time, it is possible that the experiment will have some success.

That said, the volatility of Bitcoin implies it will struggle to meet the characteristics of the traditional monetary triad still. So the challenge is large.

In terms of “store of value,” unless the volatility of Bitcoin drops sharply, there is little hope that it will displace the dollar on this dimension any time soon. But the ease of transitioning into or out of dollars will help on this score (although the speed of the technical arrangement and the government’s ability to provided enough hedge funding may be tested).

Likewise, the “unit of account” function will likely fall to the dollar still, with prices converted only at the last moment into Bitcoin for final transactions. This is already the case in countries with unstable monetary arrangements, such as Argentina and Venezuela at this time, so that is hardly novel.

Meanwhile, it will only become a “means of payment” for those with electronic and financial capacity. Cash dollarization will presumably remain crucial for many; it might be that Bitcoin mainly plays a role in larger transactions such as real estate. But time will tell.

Reserve management and the IMF program

Perhaps a greater challenge initially will be BCR’s balance sheet management in the event that Bitcoin becomes truly embedded in their monetary arrangements. It is unclear if Bitcoin meets the IMF reserve template definition of reserves as “readily available to and controlled by monetary authorities for meeting balance of payments financing needs.” This will have to be reconsidered if Bitcoin use in settling international transactions grow. For now, they will have to innovate.

Likewise, the IMF’s program currently under negotiation will have to somehow adapt to this realty. If a program is agreed, how this new law is folded into quantitative monetary targets will be worth monitoring.

Conclusions

Regardless of true motivations, El Salvador’s Bitcoin gambit provides a rare opportunity for monetary innovation—linking digital currencies to a traditional monetary system for the first time. Admittedly, this is a very constrained existing monetary arrangement—a dollarized economy with little seigniorage to speak of.

But the fact that a sovereign has taken this step crosses a threshold in international monetary affairs. While there are reasons to doubt Bitcoin can replicate the traditional roles of money, technological advances advances mean we should not rule out the potential for success in advance. If so, there may be others willing to follow El Salvador’s lead (although likely not those that derive significant benefit from monetary independence).