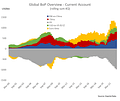

Last year we noted that “global imbalances” were back via a widening of the US current account deficit and the Chinese current account surplus;

Over the last year that process has continued, though the US trade deficit may have narrowed somewhat on the back of recovering exports/export prices and inventories.

But beneath the surface there are major shifts in the composition of external positions underway: Higher energy prices are producing a massive transfer of wealth from commodity importers in the North Atlantic, NE Asia and the rest of EM to OPEC+.

Cross border equity flows have come down in gross terms while banking flows via “other investment” are on the rise again.

A year ago (link) we noted that the pandemic appeared to have brought back “global imbalances” via a widening of the US current account deficit and the Chinese current account surplus.

Over the last year that process has continued, but the picture is changing in some important ways as a result of the global energy price shock: Europe's current account surplus is disappearing. Within the rest of G10, Japan, the UK and other commodity importers are seeing their external positions deteriorate even as those of Norway and Australia improve.