How to fix the NOK

Two parliamentary decisions will fix the NOK depreciation problem, reduce inflation, and support Europe's energy transition

The weak NOK (Norwegian Krone) is not only causing higher inflation but also reducing economic growth;

A solid market for government bonds is critical to the liquidity in a currency; since Norway borrows very little, NOK doesn't have such support;

We suggest two simple legislative changes to turn things around:

First, the non-oil budget deficit should not be paid for by oil taxes - or by the Oil Fund (GPFG) - but instead Norway should borrow the money;

Second, GPFG should continue to be restricted from investing in mainland Norway but not in the North Sea. GPFG could therefore become a huge investor in offshore wind, providing financial support to Norwegian projects, not only backing international competitors as under current arrangements.

What would this mean? Within 7 years, the market for Norwegian government bonds would quadruple;

And should GPFG be permitted to invest USD100-150 billion in North Sea offshore wind, NOK could appreciate 15-20%, contributing to the fight against inflation.

Depreciation that should not have happened… but is easy to explain

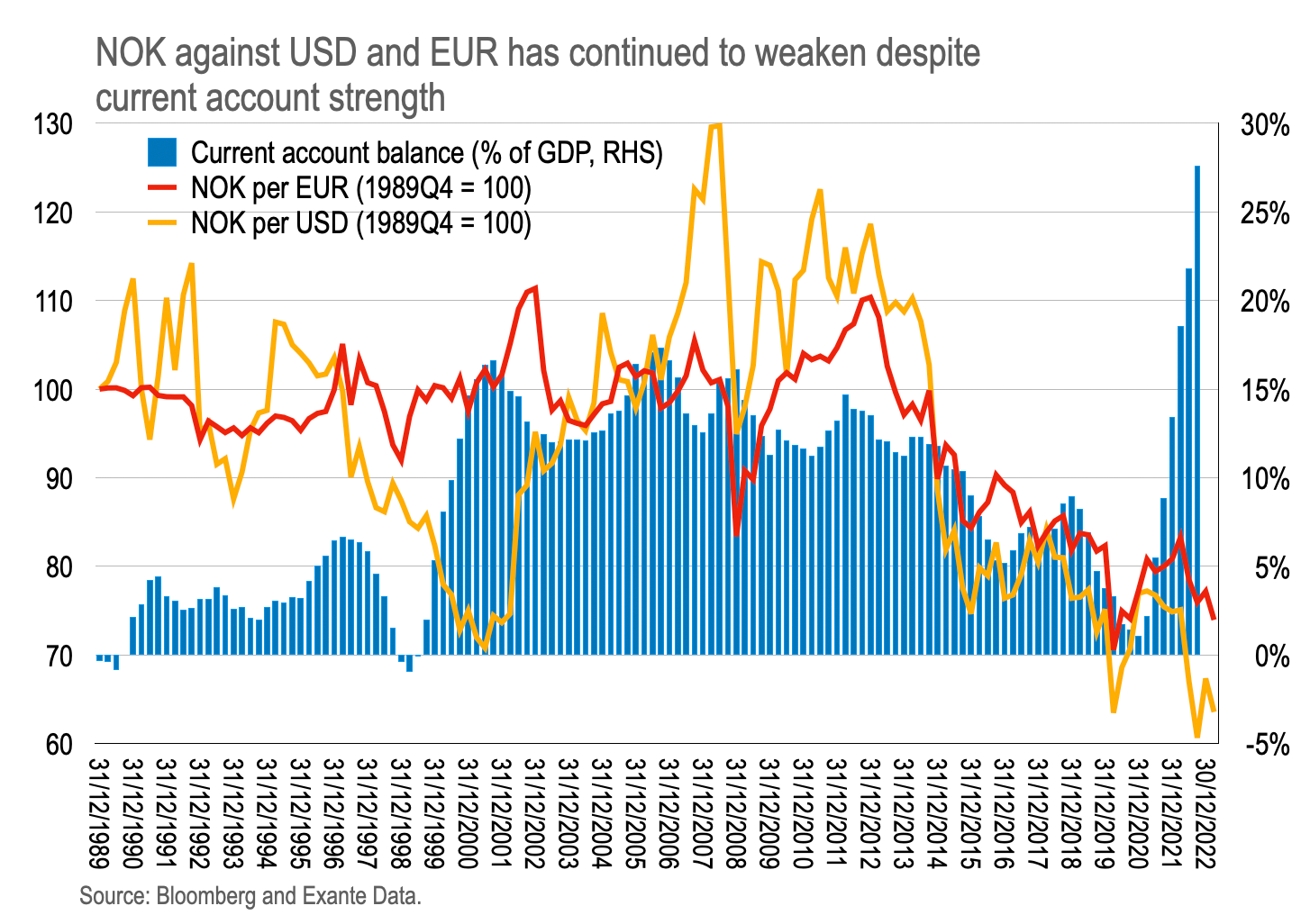

My opening illustration is a “puzzle” to many.

How is it possible for country with a/ GDP growth and current account surpluses exceeding most countries, b/ a growth sovereign wealth fund with assets of USD 1.3 trillion, to see its currency lose around 30% in value over the last 20 years?

EURNOK was 7.85 back in March 2003 and is trading near 11.0 in February 2023, meaning that the EUR appreciated around 40% (and the NOK depreciated around 30%).

Even over last year, when net cashflow from the country's petroleum activities reached levels of insanity, the currency depreciated close to 6%.

Economists would say this is unlikely, if not impossible. But it happened.

Analysts have made numerous attempts to explain the NOK weakness. That includes me, but we should not dwell here on those reasons but instead be bold and set out how the NOK market could be “fixed”—and if done, conservatively cause an appreciation of the currency of 15-20%.

But briefly to the reasons first (no priority listing):

The NOK is a small currency and during certain holiday and festivity periods, the liquidity is very thin;

Foreign funds have had far less interest in buying the NOK over the last ten years compared to the ten years leading up to 2013. I have excluded the NOK foreign banks bought last year, which was a substantial amount, but mainly bought for the purpose of sales to oil companies;

The low interest rate environment seen over the last eight years meant the earlier rate premium NOK enjoyed versus several currencies was not maintained;

Recent inflation developments have caused several central banks to hike their policy rates more than the Norges Bank;

The flows oil companies and NB provide to the NOK FX market makes them dominant participants in the market; throughout 2022, though the flows were substantial there was a timing mismatch between the NOK amounts oil companies bought and the NOK amounts NB sold;

Substantial volatility and fall of global markets caused rebalancing of domestic investment portfolios and purchases of USDNOK.

A weak NOK brings not only an inflation problem for Norges Bank but also slows economic growth

The argument that a weak currency will add to inflation is well understood, but how does it harm economic activity?

We can see the Norwegian economy in three parts:

Mainland

Offshore

GPFG (Oil Fund)

GPFG is included as it is three times the size of the other two combined (in a stock sense).

Norway imports a lot to support mainland and offshore activities.

Retail trade in Norway is also an import industry as much of what they sell are imported goods. Imports are bigger than mainland exports; the lower the NOK, the bigger the trade deficit (offshore exports excluded).

The offshore industry is a USD industry, and their operational activities are to a lesser degree influenced by NOK strength or weakness. In terms of their investments and oil tax payments, the USDNOK exchange rate is of interest.

GPFG only has foreign currency assets and has no concern with the NOK.

Bottom line therefore is that the weaker the NOK, the bigger the trade deficit for the mainland—hence a weakening NOK is negative for the economy.

Judging from the NOK's weakness over the last 5-6 years and the impact this has had on the trade balance, a 15-20% appreciation of the NOK will benefit importers (and the retail trade) more than the losses for mainland exporters.

Lack of liquidity from a tiny market for government bonds

From its wealth and annual cashflows, Norway has no need to borrow money.

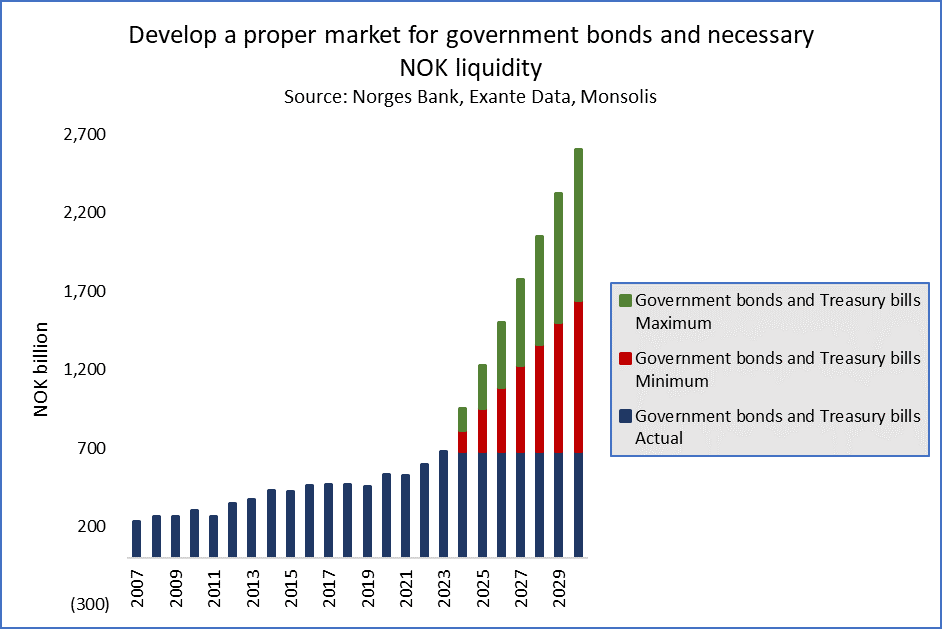

The Kingdom has issued NOK50-70 billion annually of government bonds over the last six years and has close to NOK600 billion of government bonds in the market—AAA rated for the past 30 years.

We have always considered a solid government bond market is a fundamental leg for a currency and NOK is no exception. NOK could regain substantial strength from foreigners investing in the country's debt.

Instead of funding the non-oil budget deficit from oil taxes - or selling GPFG assets - it makes more sense to put all oil taxes and dividends from Equinor into GPFG and instead borrow what is needed to fund the non-oil budget deficit.

In the illustration below, new issues of government bonds are shown to evolve from 2024 to 2030 with two alternative borrowing levels: 1) 50% and 2) 100% of the non-oil budget deficit.

In the 2nd alternative, the outstanding amount of government bonds by 2030 is 4 times today’s size.

GPFG should become an investor in North Sea Wind

Finally, consider the Oil Fund.

GPFG is restricted from investing in Norway—both mainland and offshore. In this proposal we would amend that restriction to be mainland Norway only.

Wind from the North Sea could be a major source of energy for Europe in the future. There is enough wind there - and reliable - to provide electricity to all European households.

Several Northern European countries with a coastline have plans for substantial offshore wind projects. Norway is lagging the others in terms of ambitions and political decisions, despite having the biggest financial resource among all.

It is odd that under current arrangements GPFG can invest in offshore wind projects in Denmark, Germany, Belgium, the Netherlands and the UK, but not in projects by Norwegian companies in the North Sea.

Today, GPFG can support international competitors at the expense of Norwegians!

Investment in offshore wind will require a lot of capital. GPFG could and likely will make substantial contributions.

The restriction on GPFG "not to invest in Norway" should be amended to be "not to invest in mainland Norway." The outcome would likely be that GPFG will invest USD100-150 billion in Norwegian offshore wind projects throughout 2030. Norwegian companies would for the main part be suppliers of goods and services. It would be a big boost to offshore wind projects - and the NOK.

The proposal is a repetition of policies and strategies for the petroleum activities in the North Sea - but now with offshore wind as an output. It requires substantial investment, demand for Norwegian products and services, licensing fees, taxes, dividends and new injections in GPFG.

Summary

My proposal here is summarised in the schematic below.

Norway now has money to invest, which was not the case 50 years ago.

Should the restriction on GPFG be amended as suggested, GPFG would hold NOK assets offshore. Should that be for, say, up to 10% of GPFG's assets, the impact on the NOK would be substantial and likely immediate.

It would make NB's job of curbing inflation much easier.

In addition to the near-term inflation (reduction) impact there would be a positive long-term current account impact—while being supportive of Europe's energy transition and security.

The content in this piece is partly based on proprietary analysis that Exante Data does for institutional clients as part of its full macro strategy and flow analytics services. The content offered here differs significantly from Exante Data’s full service and is less technical as it aims to provide a more medium-term policy relevant perspective. The opinions and analytics expressed in this piece are those of the author alone and may not be those of Exante Data Inc. or Exante Advisors LLC. The content of this piece and the opinions expressed herein are independent of any work Exante Data Inc. or Exante Advisors LLC does and communicates to its clients.

Exante Advisors, LLC & Exante Data, Inc. Disclaimer

Exante Data delivers proprietary data and innovative analytics to investors globally. The vision of exante data is to improve markets strategy via new technologies. We provide reasoned answers to the most difficult markets questions, before the consensus.

This communication is provided for your informational purposes only. In making any investment decision, you must rely on your own examination of the securities and the terms of the offering. The contents of this communication does not constitute legal, tax, investment or other advice, or a recommendation to purchase or sell any particular security. Exante Advisors, LLC, Exante Data, Inc. and their affiliates (together, "Exante") do not warrant that information provided herein is correct, accurate, timely, error-free, or otherwise reliable. EXANTE HEREBY DISCLAIMS ANY WARRANTIES, EXPRESS OR IMPLIED.

Do you think changing the 3% fiscal rule on oil revenue spending could ease pressure on the NOK? Changing it to say 5% would reduce selling of NOK to invest in the GPFG while providing a stimulus to Norway's weakening domestic economy.