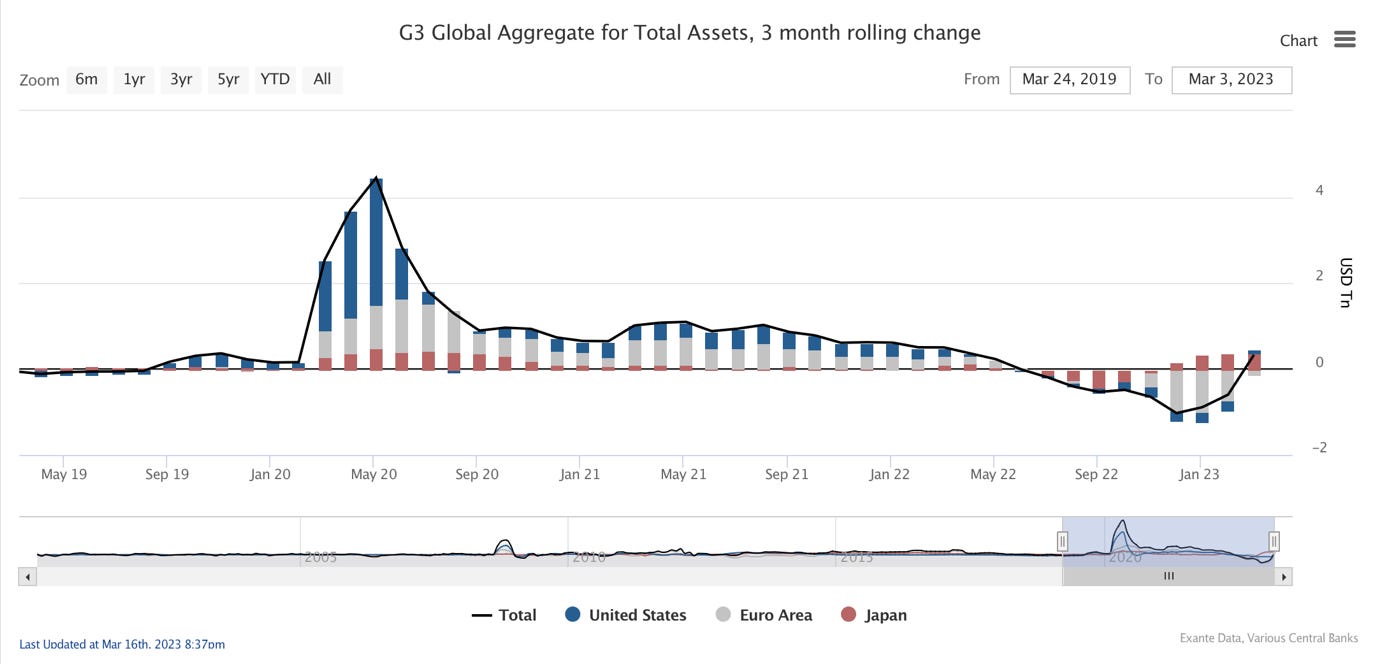

International QE/QT trends

Central bank balance sheet sheets are moving for different reasons, but in the aggregate are not shrinking

The expansion of the Fed balance sheet brings to an end 9-months of balance sheet contraction by the major central banks;

In general, QT continues for most major central banks (through not Japan);

While this is being replaced globally by repo operations, first in China and now in the United States—and potentially other major central banks;

Overall, global central bank balance sheet asset holdings have settled above USD30 trillion; though the composition might be changing, balance sheet size is sticky.

Contraction no more?

G3 central bank balance sheet shrinkage (the Fed, European Central Bank (ECB) and Bank of Japan (BOJ) at constant exchange rate) began last June and lasted 9 months, despite the significant expansion in assets held by BOJ.

But this has now it has come to an abrupt halt.

The sudden expansion of the Federal Reserve’s balance sheet by USD297bn due to use of the Fed’s primary credit facility (+USD148bn) by banks, expansion of “other credit facilities” (+USD143bn) and the new Bank Term Funding Program (BTFP, +USD12bn) discussed previously has reverse this.

So far in March, the G3 central bank balance sheets, over a 3 month look-back, expanded USD0.3 trillion due to the BOJ and now the Fed. ECB contraction continues due to both QE and the repayment of TLTROs.

Further expansion in the Unites States is possible this month with larger take-up of the Fed’s new Bank Term Funding Program (BTFP) which is available on generous terms but the use of which has been so far slight.

Curiously, due to the sudden repricing of global rates, BOJ asset purchases could slow sharply over the period ahead.

QT for most

Looking at a broader group of countries, we alternatively witness the change in holdings of government securities in % of GDP.

Such holdings have increased for most economies except Turkey, Brazil and, of course, Japan. For the major DM economies balance sheet contraction continues, however, though can be lumpy depending on the redemption profile or the QT strategy.

Sweden shows the largest contraction over the past month, Canada the largest over 12 months.

The return of repo

On the other hand, the extension of loans and repos to the banking system by central banks may have bottomed as a result of the emerging banking crisis.

Loans and repos reached a peak of USD6 trillion a year ago and has since rolled off due to the repayment of TLTROs at the ECB as well as loans from the BOJ. But this contraction was interrupt initially by an extension of repos by PBOC late last year and now by the expansion in the Fed’s primary credit facility and creation of the BTFP.