On Oil and Energy into 2023

There are several reasons to remain bullish on the energy sector in the year ahead.

In an earlier post we recalled the recovery of the energy sector in 2022. Here we look ahead to prospects for the oil market in 2023. In particular:

Will we see more of the same, upside for energy stocks?

Or will the energy sector subside again? Or mostly flatline?

In previous times, we could offer some answers to these questions by focusing on market supply and demand for oil and gas products. Today, these market forces are made more complicated by factors that are not solely economic, but also political and geopolitical.

Let us consider the key variables and some scenarios.

Key Factors to Watch in 2023

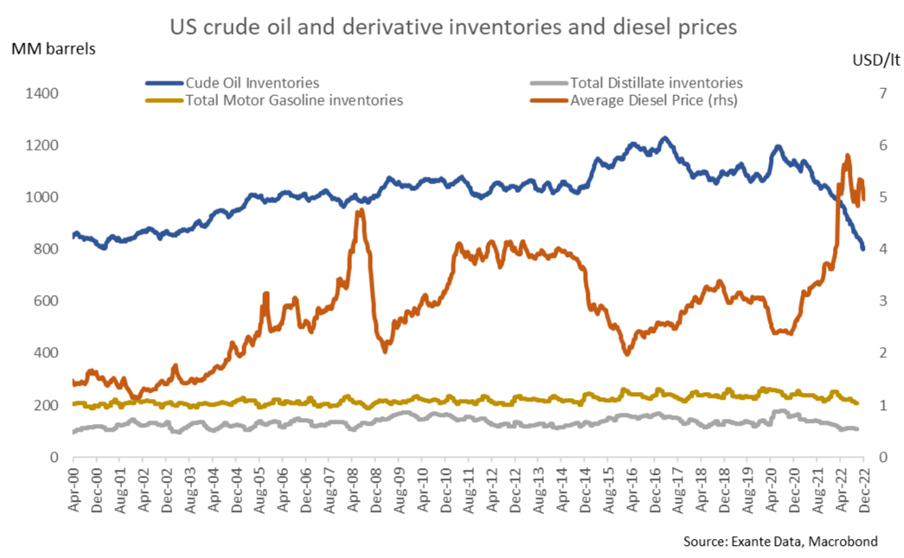

Inventories

Inventories of crude oil and of some oil products now stand near historic lows in the US. This decline was exacerbated by the Biden administration’s sale of oil from the Strategic Petroleum Reserve (SPR) at a rate of about one million barrels per day. These sales have depleted the SPR from a total of over 600 million barrels in March to less than 400 million today, the lowest level since the early 1980s when the SPR was being filled.

However, oil sales from the SPR are expected to stop this month and to eventually reverse when the SPR is replenished. The administration has vowed to rebuild the reserve by buying back when oil is near $70 per barrel. This new buying could create sustained demand for crude in 2023. Although the purchases will not be at the same rate as the drawdowns, the fact remains that one million barrels per week will soon be taken out of the supply and a portion of that will be added to the demand.

Net, net inventory levels and the dynamic surrounding SPR replenishments must be considered directionally POSITIVE for the price of oil.

The market is not as tight for products downstream. There appears to be no real shortage in refined products on a global scale. US refining is holding steady and is producing more now than in the middle of 2022 because some refineries have returned from service turnarounds to normal operations. And China exports of refined products have risen in recent months after the government loosened export restrictions. Having said all that, there were sporadic tightenings in the market on a local basis such as we saw with gasoline and diesel in some US regions in the spring and summer. Further, as the Chinese economy reopens, the global products market could get tighter as the country redirects its production from exports back to domestic usage.

Ukraine war and Russian shipments