Petrodollars: Where are the surpluses? Part 1

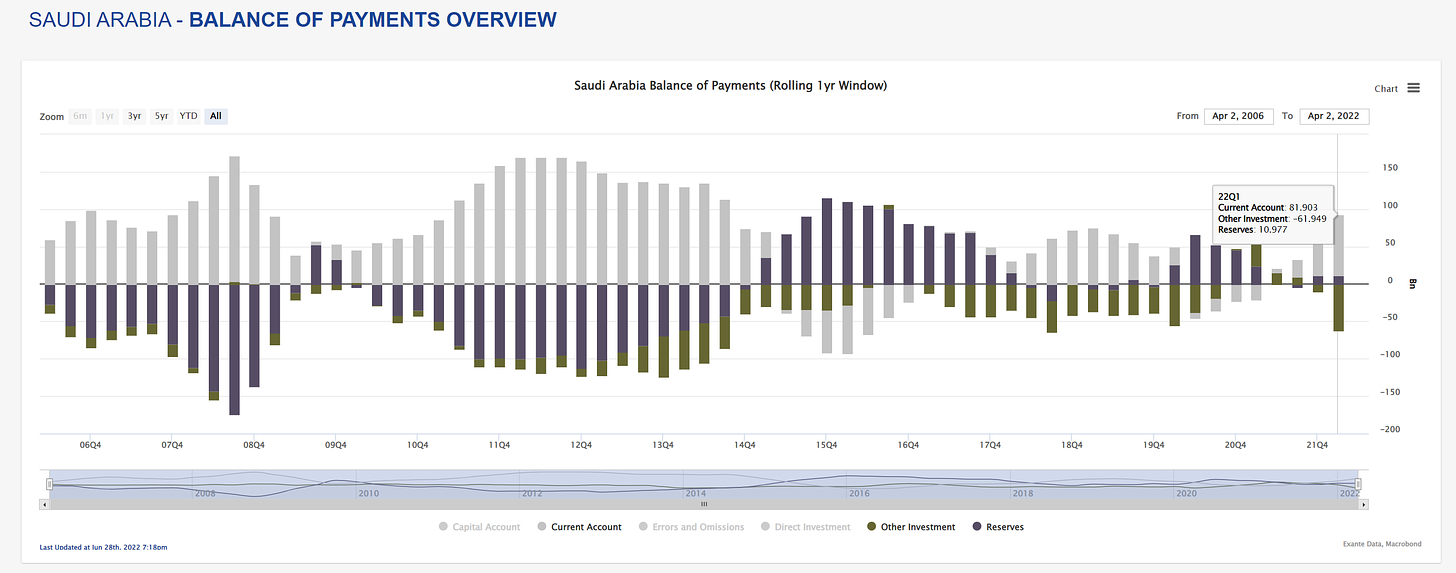

Saudi Arabia is back in the business of dollar recycling (and buying US assets aggressively recently)

Global imbalances are reappearing as a result of both the pandemic shock and the energy crisis. Previously we noted the role of Chinese surpluses/US deficits (link)

Here, we focus on the energy dimension in the wake of the Ukraine war; Oil exporters are likely to see very large trade surpluses as overall deficits are widening in developed markets.

Indeed, the Saudi Arabian Monetary Authority (SAMA) reserve accumulation picked up in June and their Sovereign Wealth Fund is likely to be busy in the months ahead deploying the vast fresh savings from the oil windfall.

Beyond the impact on inflation dynamics, the combination of a global pandemic and energy crisis is having a meaningful impact on global imbalances—with the United States’ external deficit widening and the Eurozone, Japan and Korea all recording trade—and likely soon current account—deficits, in a dramatic turn-around from previous structural trade surpluses.

As such, global balances are shifting once more—a roughly once-in-a-decade event.

A natural question is: Where are the counterpart surpluses to these shifting sands? Russia and China are two obvious candidates—which pose their own data challenges that we will side-step for now and bookmark for future posts.

Here we look specifically at the case of Saudi Arabia before looking at other commodity exporters in a companion piece.

Picking up at last

Starting with the big picture, oil exporters’ (lack of) currency intervention presented something of a puzzle in the first half of this year. With crude prices at elevated levels, historically this would map into substantial FX accumulation by their collective central banks.