Quantitative Tightening

Central bank balance sheet expansion is coming to an end, but what happens next?

There was a sharp slowdown in asset purchases by central banks into the final quarter of 2021 as tapering has become the norm;

2022 is now likely to be defined by central bank balance sheet shrinkage across the major economies;

The Fed will decide on the pace of balance sheet roll-off once rate normalisation begins;

The BOE could move to secondary market Gilt sales towards year-end;

While for the ECB, the early repayment of TLTROs by banks becomes a possibility from June which policy may not be able to prevent.

Tapering update

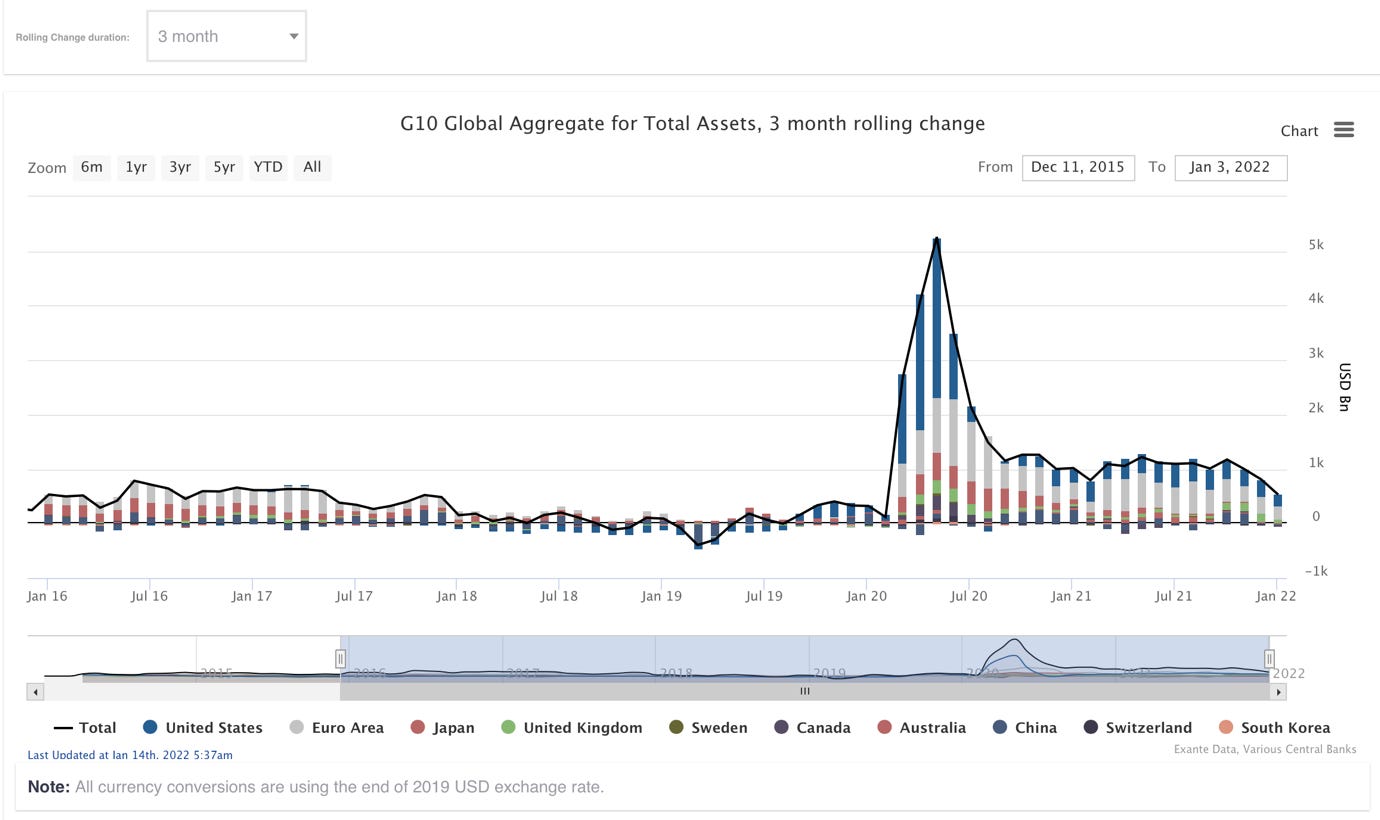

The expansion of central bank balance sheets slowed sharply into end-2021. We previously noted that, measured in USD, the stock of key central bank balance sheets leveled off late last year, marking peak QE. This was partly due to dollar strength revaluing domestic currency assets, of course.

Alternatively, a constant exchange rate measure of balance sheet expansion shows that the 3-month change in global central bank balance sheets slowed from about USD1 trillion per quarter in the middle of the year to only half this pace.

Indeed, tapering of QE is now the norm: