Sustainability reporting is a Copernican Revolution for global financial markets

Sustainability reporting is coming of age. It will fundamentally reshape global financial markets, and even society at large.

In keeping with the founding ethos of Money: Inside and Out, I am commencing a thread today on a topic that is complex and evolving, that is of fundamental importance to global financial markets, and yet which is not well understood.

Sustainability reporting, broadly defined as a requirement for enterprises to disclose positive and negative contributions to sustainable development, is on the cusp of being rolled out on a global basis by the International Financial Reporting Standards (IFRS) Foundation. IFRS is the peak global body for financial reporting and accounting standards.

This will radically reshape the landscape for companies and their stakeholders, broadly defined, and accelerate the retooling of investment frameworks by large institutional investors, thereby altering the very structure of global financial markets.

My overarching thesis is that a fundamentally new era of stakeholder-driven capitalism awaits.

This post proceeds in two steps:

i) I provide some background and resources on sustainability reporting, for those schooling up.

ii) I introduce my view on how global financial markets may come to be reshaped in the decades ahead.

Background

It is important to emphasize that sustainability reporting has been in gestation for a very long time. Arguably, the timeline commences with the Global Reporting Initiative (GRI) in 1997. This is illustrated below, from this academic resource.

For further background, I recommend this submission from Mervyn King SC (not to be confused with Mervyn King, former BOE Governor) to the IFRS Foundation’s Consultation Paper on Sustainability Reporting from September last year.

I am partial to this submission (there were 550 in total, including from many of the world’s largest asset owners, along with key regulators and national accounting bodies), as it provides a helpful lineage, and because I agree with its key justification for sustainability reporting:

I contended that companies acted in the triple context of the economy, society and the environment and yet directors were only reporting on the financial aspects. I believed that a second corporate governance report recommending sustainability reporting was necessary.

This core insight has taken root over the past two decades, yet it became fragmented across five bodies, each now members of the Corporate Reporting Dialogue. These are GRI, CDP, Climate Disclosure Standards Board, International Integrated Reporting Council (which developed the <IR> framework) and Sustainability Accounting Standards Board.

Importantly, as well, in late 2015, the Financial Stability Board, under the leadership of Mark Carney, established the Task Force on Climate-related Financial Disclosures (TCFD), with Michael Bloomberg as chairman.

Whilst not mandatory, the TCFD’s core elements of disclosure, that center upon four categories of Governance, Strategy, Risk Management and Metrics & Targets, have seen widespread voluntary adoption in recent years. There is no doubt that this initiative has had a strongly catalytic effect.

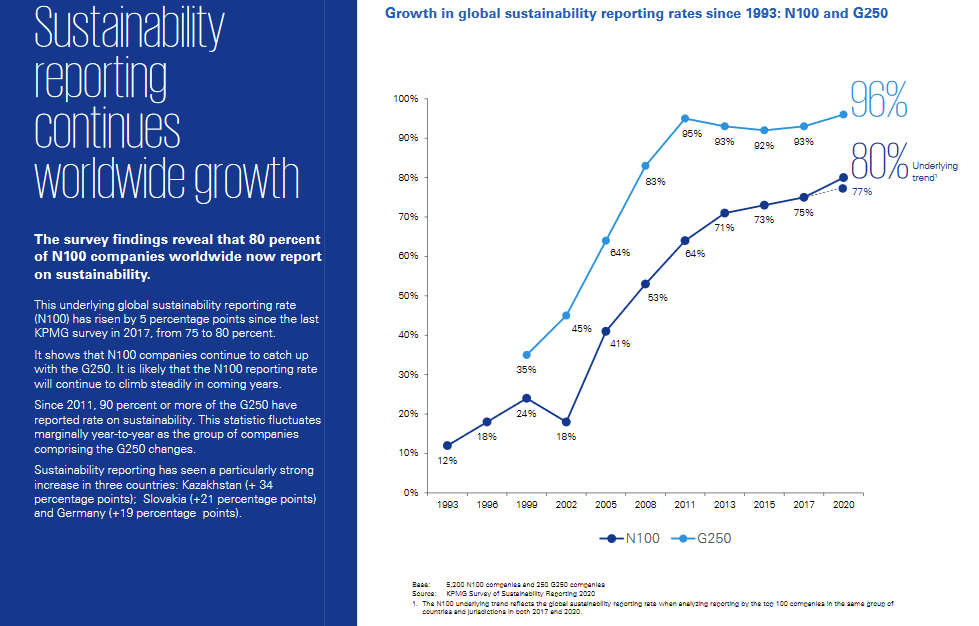

To gauge the state of play on sustainability reporting, including by country and industry, I recommend this KPMG survey from December 2020, from which the next graphic is sourced:

Yet, despite the uptake, fragmentation has been a recurrent problem, as it has prevented harmonization of standards, and has facilitated ‘green-washing’, the practice of presenting an outward image of environmental proactivity, friendliness and compliance.

This year will be a year of change

In late September, the IFRS Foundation made a strategic move on the ‘Group of Five’, in publishing the Consultation Paper referred to above. This was a carefully orchestrated manoeuvre, couched with excessive European modesty. The Group of Five committed to work with each other, and the IFRS Foundation, on the same day.

The implication is that decades of work by the Group of Five will be harmonized via a global peak body, one that has outreach to approximately 150 countries. A new Sustainability Standards Board (SSB) will be created under the governance structure of the IFRS Foundation, akin to the International Accounting Standards Board (IASB).

The SSB will then develop a Conceptual Framework, and beyond that, Sustainability Standards, that can go global. This will all happen with haste, and with a ‘climate first’ perspective (although climate is only one aspect of sustainability).

To provide a sense of what is ahead, the best resource is from the Group of Five itself, that jointly published a prototypical climate-related financial standard in December. This report is heavy going for anyone without an accounting background, but it nonetheless demonstrates the pace of recent developments. Appendix 5 also illustrates how the harmonization of key components is proceeding.

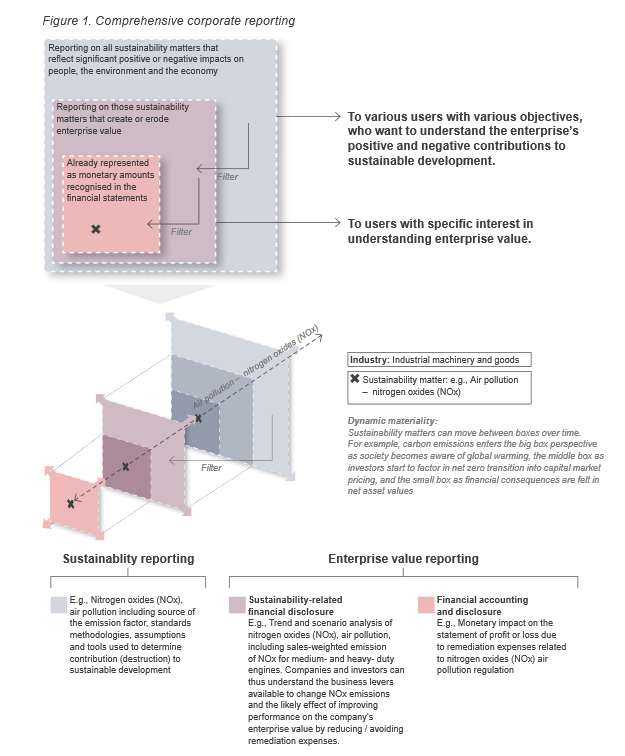

There is a key heuristic to consider, shown here:

The first step is sustainability reporting, which requires enterprises to provide information regarding negative and positive contributions to sustainable development, empowering the assessment and decisions of a wide range of users. The report cites “business partners, civil society organisations, consumers, customers, employees and other workers, governments, local communities, non-governmental organisations, shareholders, suppliers, trade unions, and vulnerable groups”, by way of example.

The second step is sustainability-related financial disclosure. This is a narrower lens, that focuses upon providing information that directly influences enterprise value, particularly on a forward-looking basis. This includes quantitative targets and metrics, along with an assessment of strategic resilience (to climate-related risks, for example) based on scenario analysis.

These steps do not displace traditional financial accounting and disclosure. Rather, they are seen as integrated and complementary, and may well extend to independent third party assurance (i.e., an audit), as part of the governance element. For reference, existing IFRS Standards do not specifically address climate change, but do address related issues under the rubric of ‘materiality’, as helpfully explained here.

My view is that this proposal is now likely to take shape under a newly formed Sustainability Standards Board (SSB), and that it is so far-reaching in terms of its design that it will usher in a new era of stakeholder-driven capitalism.

It aligns corporate reporting with the concept of sustainable development, and thereby transforms the concept of enterprise value. This, in turn, has profound implications for corporate governance, including the structuring of incentives to pursue sustainability. Moreover, harmonization will enable the formation of new and large-scale datasets, that will inevitably come to be reflected in the pricing of financial instruments, as discussed below.

To be sure, this is already happening.

New Zealand became the first country in the world to signal its intention to mandate climate-related financial disclosure in September. The accompanying statement confirmed that this would be based on the TCFD’s recommendations, and would apply across all listed companies, as well as the financial sector (ie asset owners, insurers and banks).

Rishi Sunak, the current Chancellor of the Exchequer in Boris Johnson’s cabinet, followed this up in November, committing to TCFD becoming mandatory by 2025 for the UK. For good measure, the UK will be issuing its first Sovereign Green Bond in the year ahead.

Hong Kong did likewise in December.

These are not isolated incidents, they are part of a broader global trend toward sustainability, that has been bolstered by the pandemic, and strengthened by both China and Japan committing to carbon neutrality late last year. The potentially dramatic descent of Trumpism in the past week can be important as well; although the US, whilst being an IFRS member, applies its own accounting principles (i.e., GAAP).

The reshaping of global financial markets

This is obviously a big topic! Hence, we will only offer some introductory points today, pitched simply as a conversation starter.

First, at Exante Data, we see much greater awareness and engagement with sustainability across our corporate, real money, sovereign wealth and central bank client segments, than we do in hedge fund space. The global macro community and those pursuing systemic strategies, have not been the leaders in this space.

It is different for hedge funds pursuing long / short equities, and otherwise engaged in seeking alpha across the capital structure. But one could argue that it is somewhat ironic that the global macro community is yet to broadly converse with what shapes as arguably the biggest macro thematic of our time: namely, the quantification of the externalities that capitalism, loosely defined, is generating, and the profound market failure that climate change represents.

Second, the principal reason for macro fund ‘disengagement’ is that the ESG movement (ie Environmental, Social and Corporate Governance) is yet to result in significant and identifiable cross-border capital flows. To be sure, inflows to ESG related strategies are booming, even if heavily weighted toward Europe, as this report and chart below from Morningstar confirms. But these are not yet macro-relevant, partly because the cross-border flow implications are very difficult to disentangle. It is nonetheless a vector that we will pursue at Exante Data in the time ahead.

That said, one has to wonder if Tesla’s incredible stock market rally would have been possible, had it not been for Tesla’s credentials as a ‘green’ company. We are noting this simply as a big picture observation, without evaluating the specifics of those credentials.

Third, there is no shortage of anecdotes that support my headline of a Copernican Revolution.

The high-water mark is undoubtedly Larry Fink’s letters to CEOs and clients this time last year, that underpinned Blackrock’s Stewardship Annual Report published in September, and its Stewardship Expectations published in December.

This is the Revolution in action.

It goes beyond ambit claims that “we are on the edge of a fundamental reshaping of finance”, and that “in the near future – and sooner than most anticipate – there will be a significant reallocation of capital”. It goes beyond the profound signaling effects, including to other systematically important asset owners (including the now predominant sector of passive strategies). It also goes beyond the demonstrable impact that Blackrock’s commitment to divest from the thermal coal sector has had over the past year.

The most important insight is that Blackrock committed to “putting ESG analysis at the heart of Aladdin”. This resulted in the unveiling of Aladdin Climate in December, that enables clients to perform climate-based security selection, portfolio construction and enterprise reporting.

This is the plumbing of the global financial system, and it is being radically altered in real-time. Here is the (anecdotal) result.

Fourth, there is obviously a ton of academic interest and literature in this area. The standout project is from Harvard, with its Impact-Weighted Accounts. This has duly received a lot of media attention, here, here, here, for example.

This is a highly ambitious project, with data at its core, that seeks to quantify the impact of publicly listed companies in terms of financial, social and environment performance. It goes beyond the IFRS Foundation’s proposal, described above, in many ways, and is more akin to Danone’s reveal of a carbon-adjusted EPS in February.

It is nonetheless a helpful exploration of the “outer perimeter” of sustainability reporting, if there is one. The publicly available dataset enable simple screens to constructed, such as shown in the next table, that highlights the bottom ten companies in the US, UK and Australia, in terms of environmental intensity as a percentage of revenue.

Fifth, and finally today, my basic view on how financial markets function and evolve is informed by my background with so-called social constructivism, and is sympathetic to Donald MacKenzie’s paraphrasing of Milton Friedman, in (superbly) contending that markets are ‘an engine not a camera’.

The significance of sustainability reporting goes well beyond putting new fuel into the engine. It is that the engine itself is evolving (just as the combustion engine is set to be replaced by an electronic motor).

In time, we may well see a transition from the traditional CAPM model of risk and return, to a three dimensional model that specifically incorporates impact.

To quote Larry Fink, this may happen '“sooner than most anticipate”.

Grant Wilson is Head of Asia Pacific for Exante Data, based in Sydney. He was previously a global macro portfolio manager in Singapore and New York. He is a contributor for the Australian Financial Review. His full bio can be found here.