The mechanics of CBDC issuance

Central Bank Digital Currency (CBDC) could replace cash transactions in coming years, but also has the potential to reshape the process of credit and money creation

“…suppose the monetary authorities issued deposits held by the public in appreciable magnitude, the public regarded these deposits as near-perfect substitutes for commercial bank deposits, and the public regarded monetary authority deposits as near-perfect substitutes for specie. It would … confound categories relevant to analysing the money-holding behaviour of the public.”

Milton Friedman and Anna J. Schwartz, A Monetary History of the United States

Following Grant Wilson’s post on China’s digital currency, we have received a lot of questions on the mechanics of central bank digital currency (CBDC) issuance, and the ‘new vistas’ alluded to.

This shapes as a big conversation, and perfectly suited to the founding ethos of Money: Inside and Out.

A common theme has been the balance sheet considerations that arise from the issuance of CBDC directly held by the general public, how this compares to physical cash issuance, and how this could fundamentally transform banking.

This is the focus today.

As the above quote makes clear, central bank (CB) deposit liabilities held by the public has the potential to transform money-holding behaviour. It could also fundamentally reshape monetary balance sheets. To understand these implications, we conduct a series of simplified thought experiments. First, we recall the process of physical cash creation in a fractional reserve banking system. Second, we explore how CBDC could begin to replace cash. Third, we consider how this could serve to disintermediate the traditional banking system. Fourth, we compare traditional QE with a helicopter drop into CBDC wallets and note the potentially special implications for CB capital.

Baseline

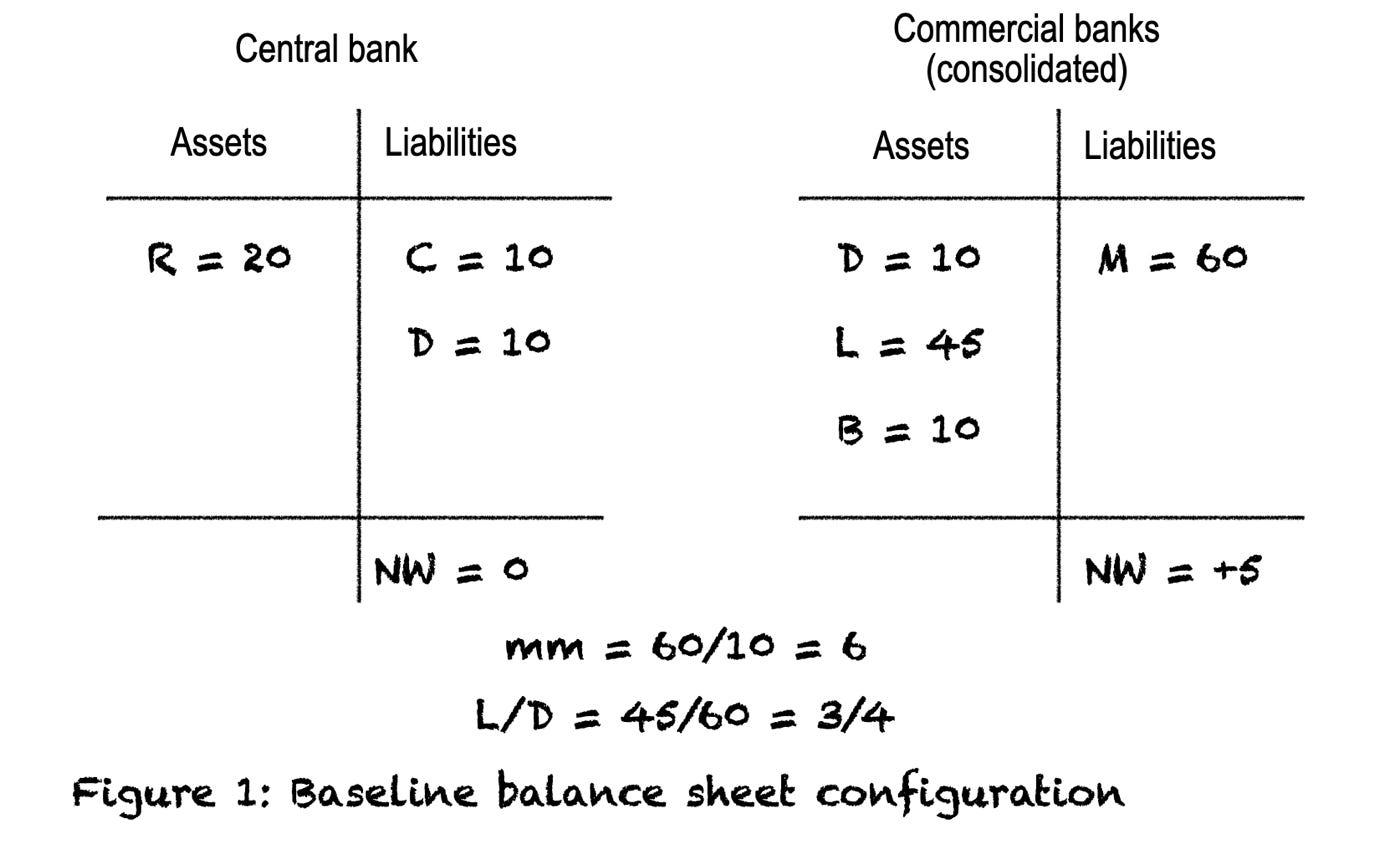

Figure 1 shows a baseline balance sheet configuration for a CB (left) and commercial banks (often called deposit money banks, DMBs) whose balance sheets are consolidated (right.) Consolidation involves netting out all interbank claims, leaving only aggregate claims on other sectors. The “monetary survey” goes further by consolidating DMBs with the CB. Being interested in links between banks and the CB, we do not undertake this extra step here; doing so would, however, reveal the definition of broad money as the sum of cash-in-hand and deposit money.

In our baseline, currency in circulation (C) and bank reserves held as deposit with the CB (D) are each 10 units. D serves as a liquid buffer for clearing payments between the banks and to fulfil reserve requirements. These CB liabilities are backed by prior open market operations or repos (together, R) of 20 units. As well as deposits with the CB, DMBs have a loan (L) book of 45 units outstanding and government bonds (B) of 10 units. Deposits by the public (money, M) equal 60 units of which ¾ represents inside money due to private sector credit outstanding. DMBs have a net worth (capital) of 5 units compared to the initial CB net worth of zero. The money multiplier is 6 and loan-to-deposit ratio ¾. Total monetary claims of the public are 70 units, comprising 10 units of cash and 60 units of deposits.

Creation of physical cash

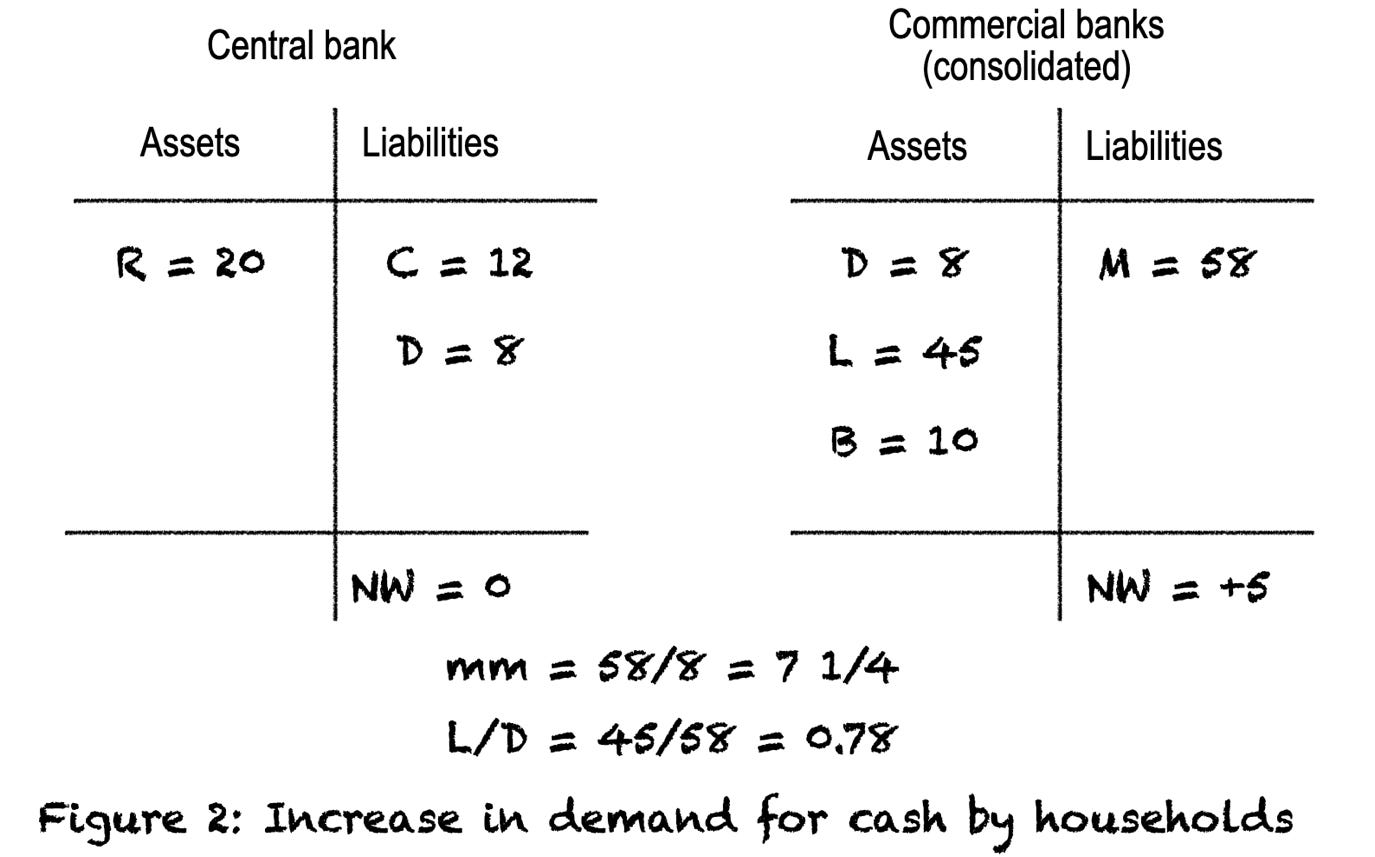

Physical cash is created when the public reallocates their portfolio from deposits with DMBs (M) in favour of cash-in-hand (C). This can be a seasonal phenomenon, around harvests or holidays, or the outcome of a depositors seeking safety from deposits. It’s worth recalling how the Federal Reserve was founded with a view to “furnish an elastic currency” meaning easy conversation of M into C. This is illustrated in Figure 2 with a portfolio shift of 2 units. The process requires DMBs to convert their electronic claims (D) on the CB into cash (C) at the central bank. To meet such withdrawals, banks typically hold “vault cash,” often included in calculations of reserve requirements, but abstracted from here. This simply illustrates the structure of a fractional reserve banking system where DMB liabilities serve as the means of payment, freely convertible into and out of CB cash.

The process of converting bank deposits into cash raises bank deposits-to-reserves at the central bank (the money multiplier, mm) as well as the loan-to-deposit ratio.

If this were a seasonal phenomenon, while reserve requirements are calculated only over a long period (“reserve averaging”), then banks need not be concerned. Cash will be returned to deposits in time, liquidity to the system.

But if this is a permanent portfolio reallocation, banks will need restore their liquidity position to meet reserve requirements in other ways. Banks could call in loans to this end, in the hope that the cash could be returned to deposits. But absent a reversal of the portfolio decision the system as a whole would be frustrated and the macroeconomy upended.

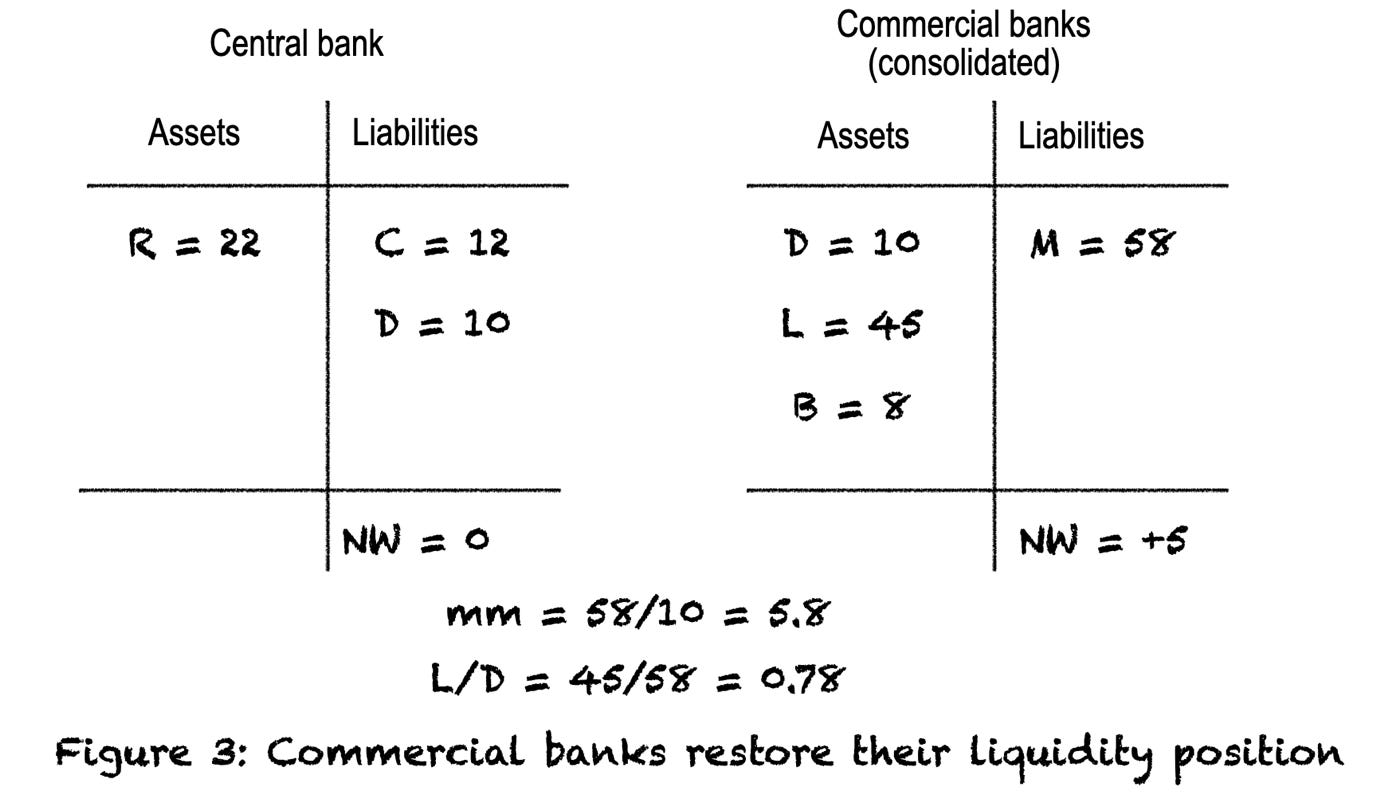

Instead, policy can offset the tighter monetary conditions through OMOs or banks access to standing repo facilities. This is illustrated in Figure 3, where DMBs sell 2 units of government bonds (B) to the CB, restoring their total claims on the CB to 10 units. During this portfolio shift by households, the CB balance sheet has expanded 2 units, DMBs contracted 2 units; banks need not call in loans due to the “elasticity” of money. This completes our stylized account of cash creation.

Creating CBDC as cash substitute

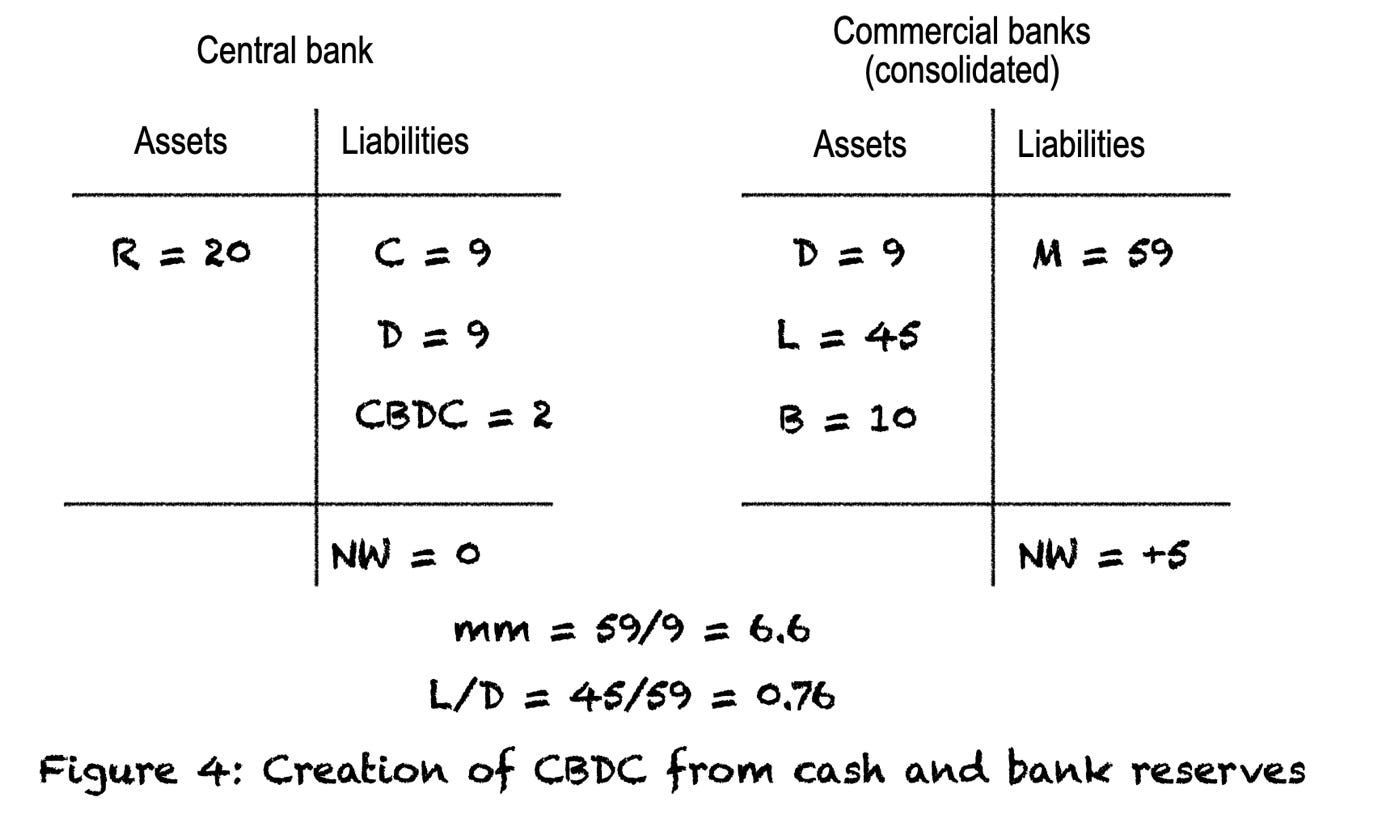

Imagine CB instead creates retail “digital wallets” which imply direct claims on the CB, exactly like cash-in-hand but in electronic form. As with physical cash, these no longer count as bank reserves once drawn upon. This is illustrated in Figure 4 where 1 unit of circulating cash plus 1 unit of DMB deposits is converted to CBDC. Doing so, as with the example above, DMB reserves are drawn down, again pressuring the money market. And as with the case above, DMBs and the CB can reverse any pressure on money markets through OMOs. We do not show this accounting transaction here.

Note, the emergence of CBDC requires the definition of broad money aggregates—the sum of cash and deposits with banks—to allow for these new claims.

CBDC and commercial bank disintermediation

So far, our CBDC only mimics the creation of physical cash in digital form from the perspective of the banking system as a whole. This is not in itself a revolution. But it creates new possibilities. Figure 5 demonstrates one such case.

Any simplicity and convenience of electronic CB claims, not to mention the additional safety implied, could bring a structural shift private portfolios from DMB deposits into CBDC. This would be particularly true in countries where the interest earned on commercial bank deposits is only slight or even negative—especially so if CDBC earned a competitive return.

This raises the prospect of disintermediation such as in Figure 5 where 10 units of DMB deposits are converted into CBDC, depleting bank reserves in full, severely tightening monetary conditions.

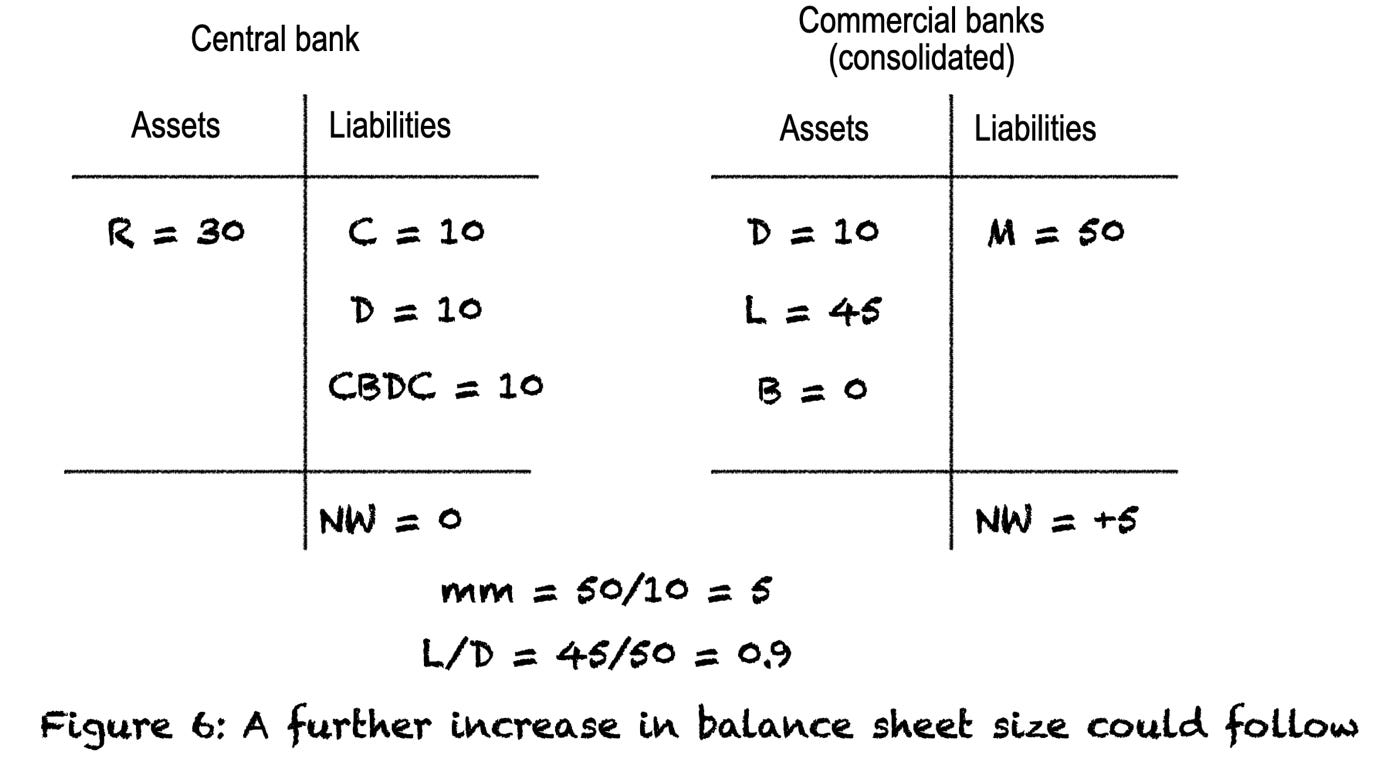

This can be resolved, once again, by further OMOs as in Figure 6. Doing so, our hypothetical monetary arrangement begins to mimic the Chicago Plan in the 1930s, which proposed 100% reserves on demand deposits—only now demand deposits have become central bank reserves.

But this can only happen up to the point where traditional collateral—here government bonds—is still available to facilitate the deposit migration. Once standard collateral runs short, either the CB would have to limit CBDC inflows, bank loans would need to be securitised and purchased for this purpose, or DMBs would be forced to reduce their credit outstanding. The latter outcome could impair the intermediation role of banks, though the emergence of non-bank financial intermediaries could facilitate portfolio adjustment in the manner envisaged by James Tobin and others.

But in the limit, if CBDC were indeed to becomes the preferred outlet for private deposits, central banks could come to hold large implied claims on the private sector. The creation of CBDC would bring credit risk.

Of course, the above implicitly assumes no initial surplus of bank reserves into which CBDC could take a bite. Many developed market banking systems are today characterized instead by excess liquidity as a result of legacy and ongoing quantitative (QE) easing programs. In which case, the introduction of CBDC would simply draw upon excess liquidity without impairing money markets.

This is easier said than done, however. The difficulty of teasing out demand for CB reserves is complicated today by various post-GFC regulations on HQLAs and NSFRs as well as segmentation within money markets. Traditional reserve requirements do not reveal bank demand for reserves. This was witnessed in the United States when, in 2019, the Fed’s quantitative tightening revealed funding challenges despite apparently large excess liquidity still. That is, absent careful management, the ascent of CBDC could still upend money markets despite initial surplus liquidity.

CBDC helicopter drops vs. QE

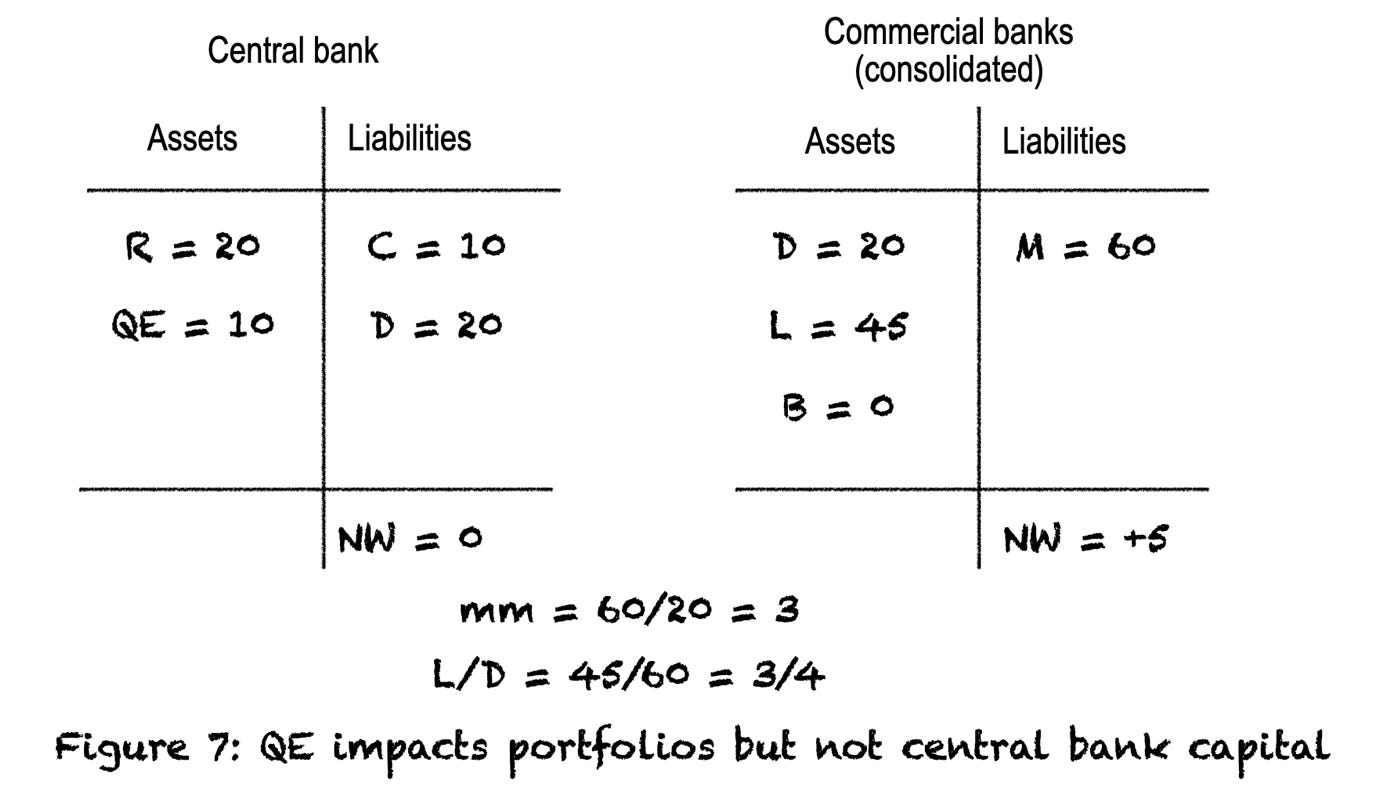

It’s worth recalling how QE impacts balance sheets to contrast shortly with a CBDC helicopter drop. QE is shown in Figure 7, raising excess liquidity and lowering the money multiplier through the purchase of outstanding government bonds. CB balance sheet size increases, impacting private sector portfolio composition, without directly impacting net worth.

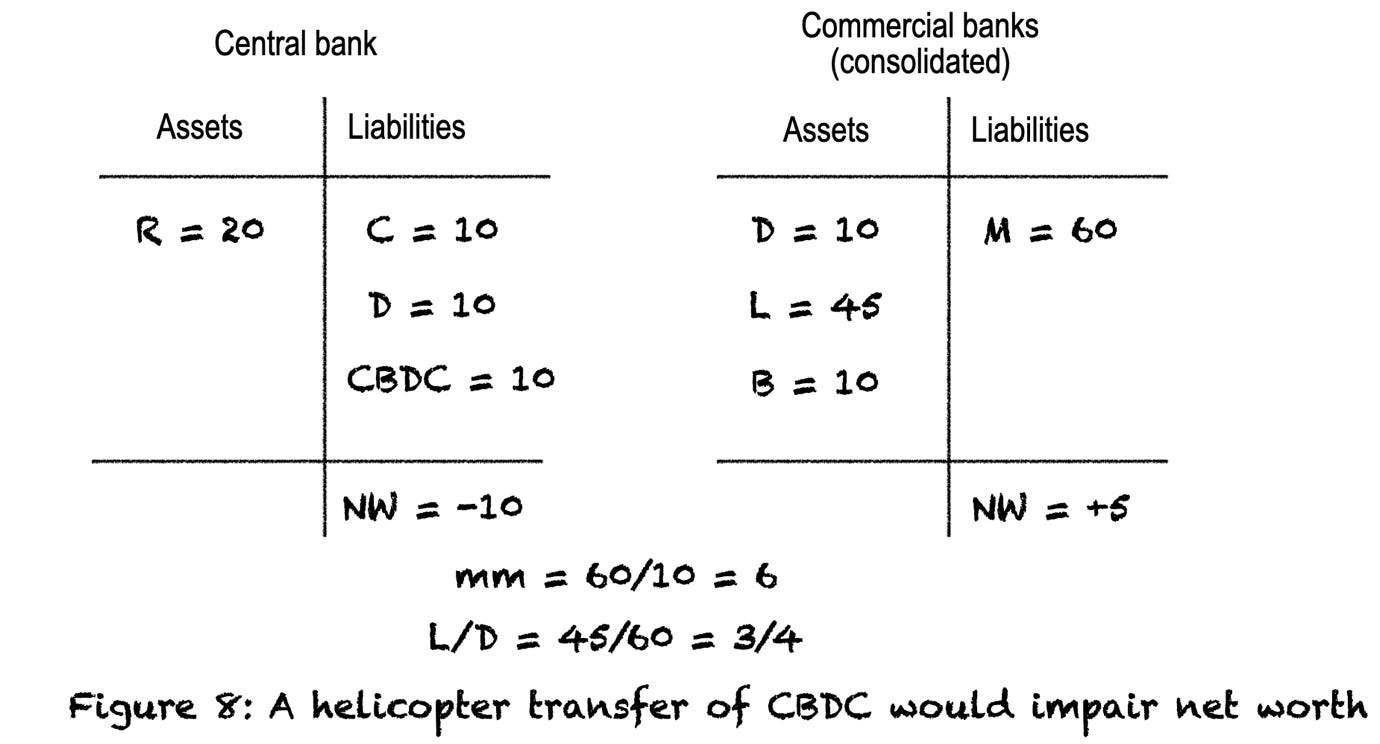

Instead contemplate a CBDC helicopter drop by the central bank into retail digital wallets. This bypasses other financial intermediaries by putting cash directly in the hands of those most likely to spend it, an important policy tool at the ZLB currently lacking. Bank reserves are unchanged, as are bank deposits. But broad money—defined to include CBDC as well as physical cash—is increased.

Unlike with QE, no assets are created in the accretion of CBDC in this way, the CB balance sheet instead registers a negative net worth of 10 units.

Negative net worth here means the CB records negative capital—that is, CB assets are less than liabilities by 10 units. Symmetrically, private sector net worth has increased a corresponding amount.

This private net worth impact of helicopter drop differs from that due to QE. When QE reshuffles portfolios, wealth effects emerge only incidentally—by lowering yields and increasing the price of fixed income securities, private sector net worth improves. This benefit of QE is arguably concentrated in the hands of those abundant in risk assets but short on opportunities to consume out of additional wealth.

QE might also, in the long term, weaken bank profitability and credit creation by flattening the yield curve and lowering the return to banks of maturity transformation. In contrast, a helicopter drop has the potential to steepen the yield curve, improve bank or non-bank profitability, and encourage maturity transformation. So, contrary to the potential damage to intermediation noted above due to the migration of deposits, by underpinning nominal incomes and steepening the yield curve it could breathe life back into traditional banking.

Such CBDC helicopter drops could run into a legal and political problems, however.

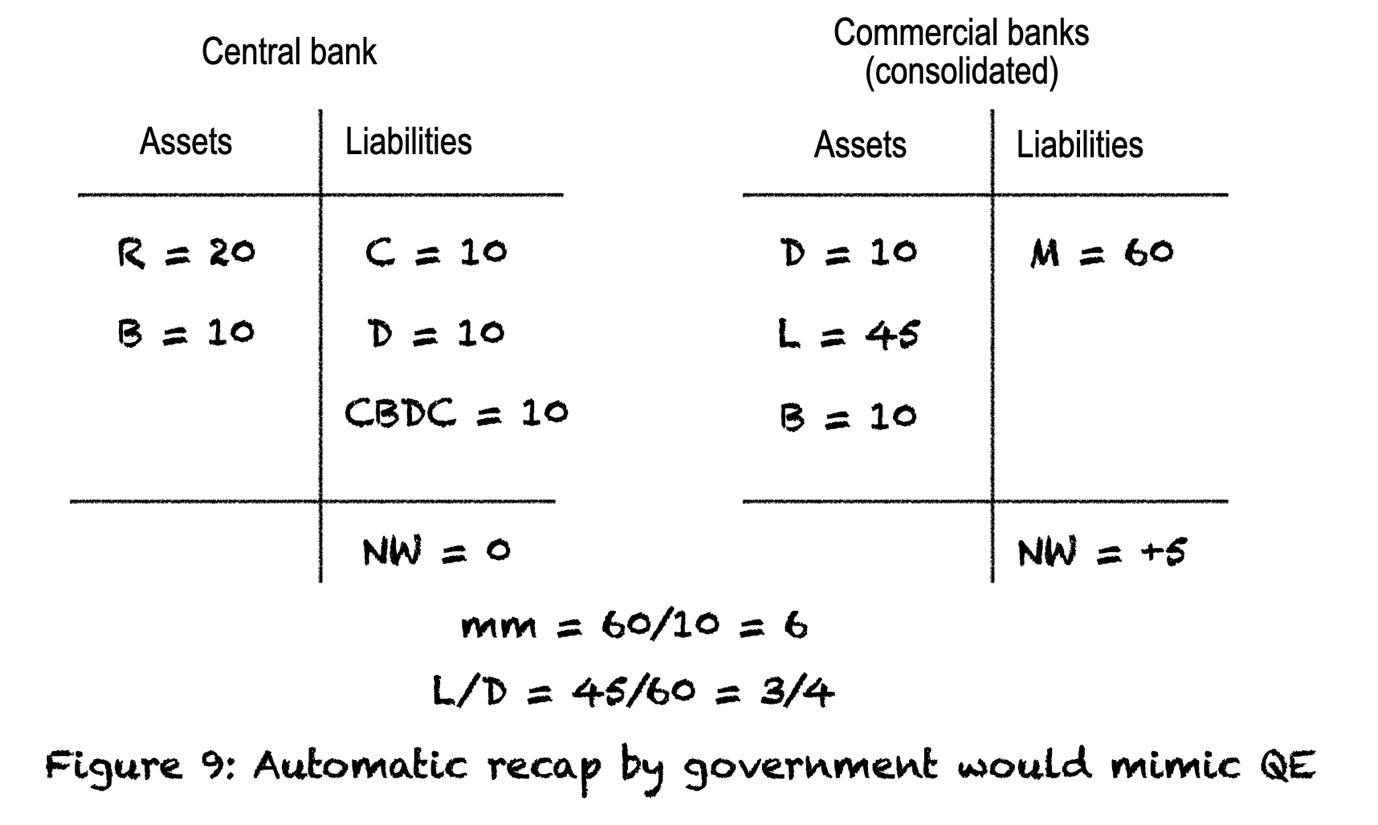

The legal hurdle, which can presumably be overcome with technical understanding, is that central bank laws often mandate a minimum central bank capital. In the event capital is reduced below this minimum, automatic recapitalisation is triggered. Such is the case, for example, in the 2018 memorandum of understanding between HM Treasury and the Bank of England.

These legal constraints today limit room for manoeuvre in the conduct of unconventional policy. This outcome shown in Figure 9, where new government bonds are transferred to the CB to return net worth to zero. This now resembles QE insofar as CB ends up holding 10 units of government debt while net worth is zero. However, government debt is now 10 units greater while the accompanying CBDC liabilities are in the possession of retail actors instead of being held by banks as reserves—or, at least, at this stage. In effect, the central bank has run a deficit financed by the fiscal authorities in making transfers to retail CBDC accounts, raising government debt by the same amount by force of law.

This now illuminates the political problem with this helicopter drop. Whether it triggers an automatic recapitalisation or not, de facto it amounts to CB conducting fiscal transfers. If so, why aren’t elected politicians deciding this instead of unelected pen-pushers? Perhaps the community would be content to grant the CB such powers. But it cannot be taken for granted that these powers will not be abused, meaning central bank accountability would need to be further underlined.

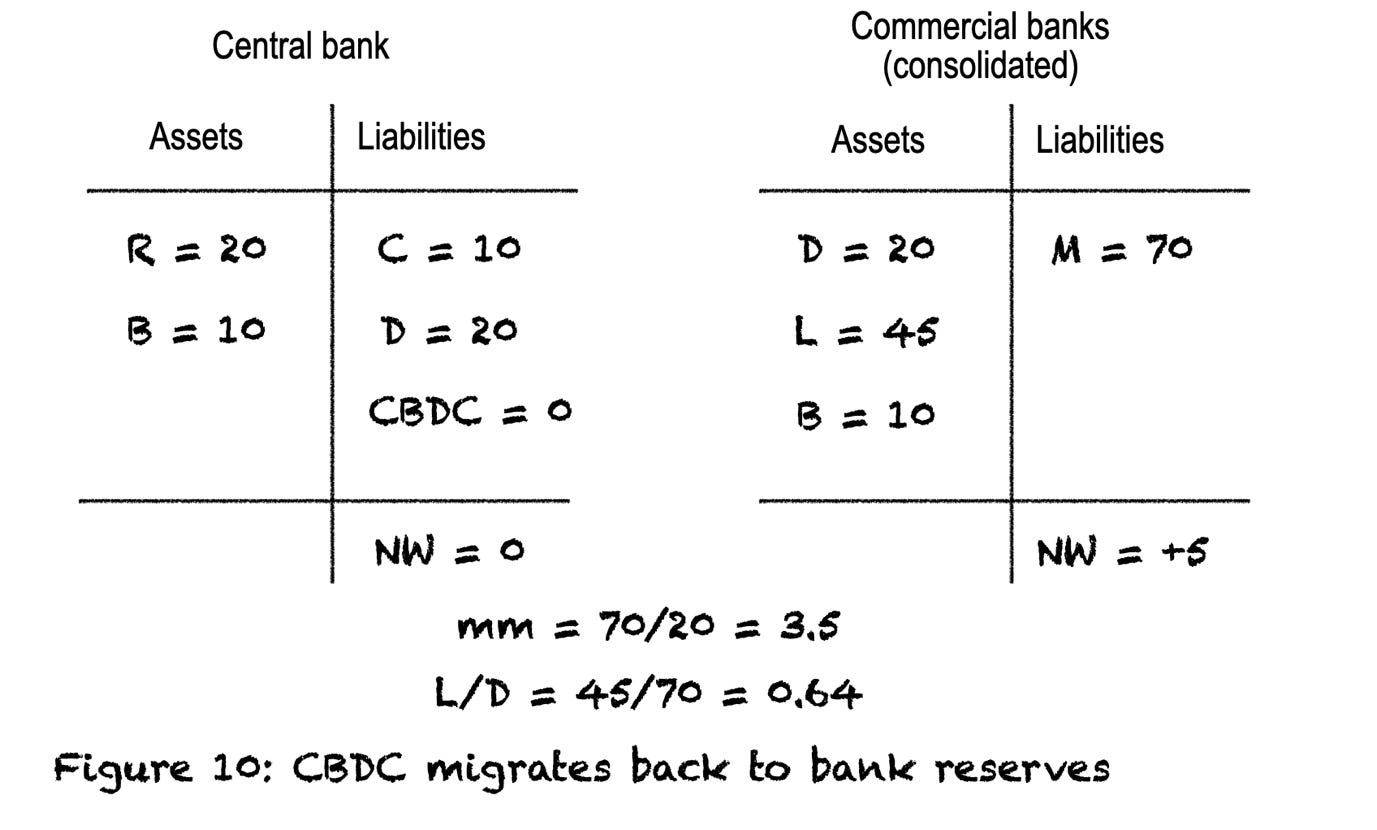

Still, the great benefit from the CB’s point-of-view from the introduction of CBDC in pursuing their mandate is that, rather than simply reshuffling private sector portfolios, it gets purchasing power directly into the hands of those most likely to spend. And once spent, CBDC could migrate into bank deposits and reserve money claims on the central bank, as in Figure 10. It then further resembles the QE outcome of Figure 7 except that base money creation has become broad money once the chain of transactions initiated by the injection of CBDC comes to an end.

The fact that CB is running a deficit here, unlike in QE, results in the corresponding broad money expansion—an expression of private improved net worth.

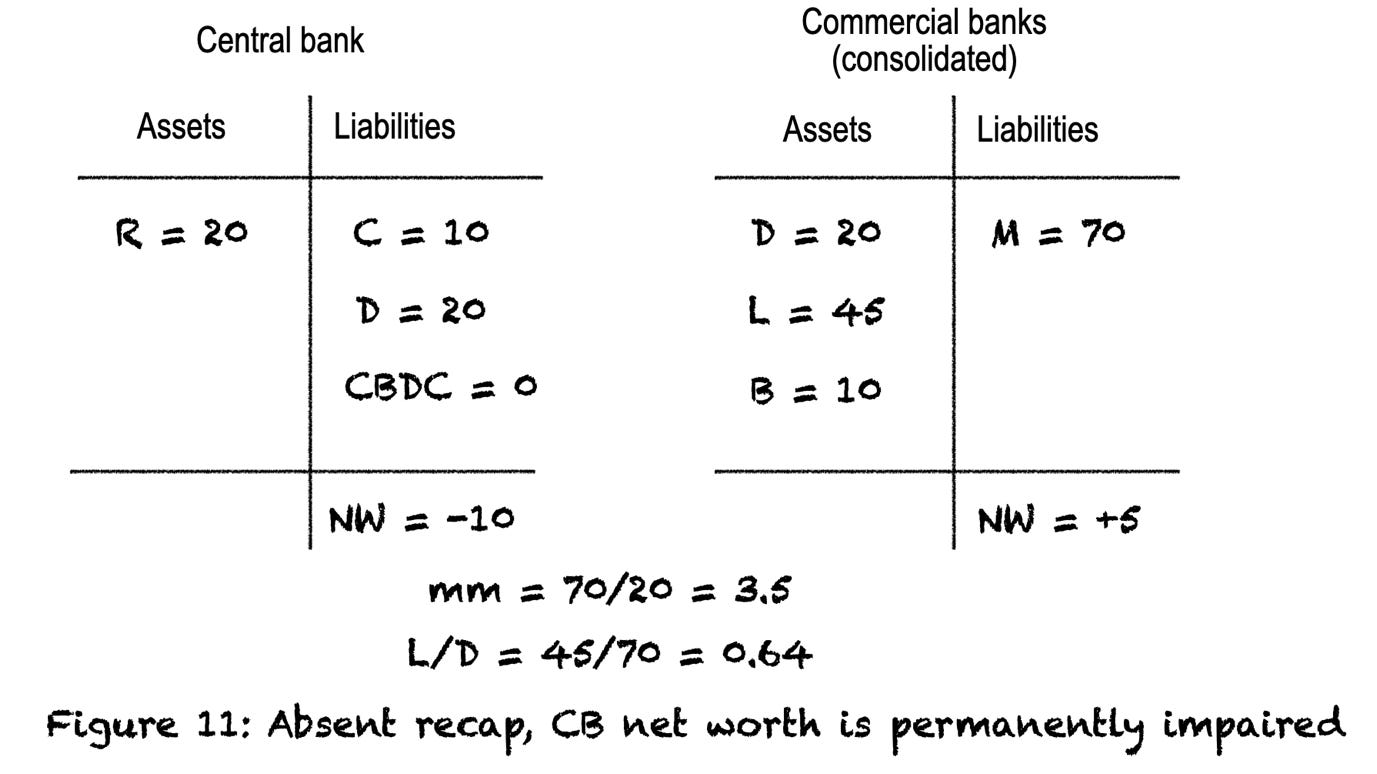

Better to learn to live with negative capital, perhaps? If there were alternatively no recapitalisation, CB might learn to live permanently with negative net worth. Figure 11. In this case, we assume CBDC has again migrated into bank deposits as private sector wealth improves. The CB now has direct rather than indirect control over private sector net wealth and broad money.

To be sure, CBs can indeed live perfectly well with negative capital for long periods. But eventually this could create challenges for monetary control. CBs would lack assets to absorb liquidity. And if they had to pay higher interest on reserves to tighten policy and slow inflation, they could be left short of monetary income and fiscal backing, forcing them to print more money, driving net worth ever more negative and inflation ever higher. While this problem remains distant for many, it is very real in Argentina today with dire social consequences.

It is brave indeed to simply assume such problems will never emerge for today’s developed market central banks. And though inflation sleeps, central bankers remain alert to such possibilities still.

END.

This is a great piece!

A question about figure 9: Where does the bond come from? I understand it is government debt so the treasury added to its liabilities. So essentially the bond is like an overdraft at the CB (which is illegal I guess)?

Of course if so then we are back at a fiscal transfer, from the government to the the private sector just indirectly via the CB.