The US current account deficit is exploding

Stimulus is driving imports higher, and it may matter more for the dollar in this cycle than in the past

The goal of Money Inside and Out is to discuss tricky concepts, and trends that are materializing under the surface. We are generally not planning to report the news.

But we will (partly) make an exception today. On Friday, the Bureau of Economic Analysis reported US balance of payments data, and it showed a further significant deterioration in the current account.

Here is the tweet I sent out from @jnordvig immediately after the data release:

The US current account deficit in Q3 2020 was $179bn, after generally hovering around $100bn per quarter in the run-up to the COVID shock. Relative to GDP, the deficit came from 2.0-2.5% of GDP before the COVID shock, to a level close to 3.5% of GDP in the latest reading.

What is driving the US current account deficit wider?

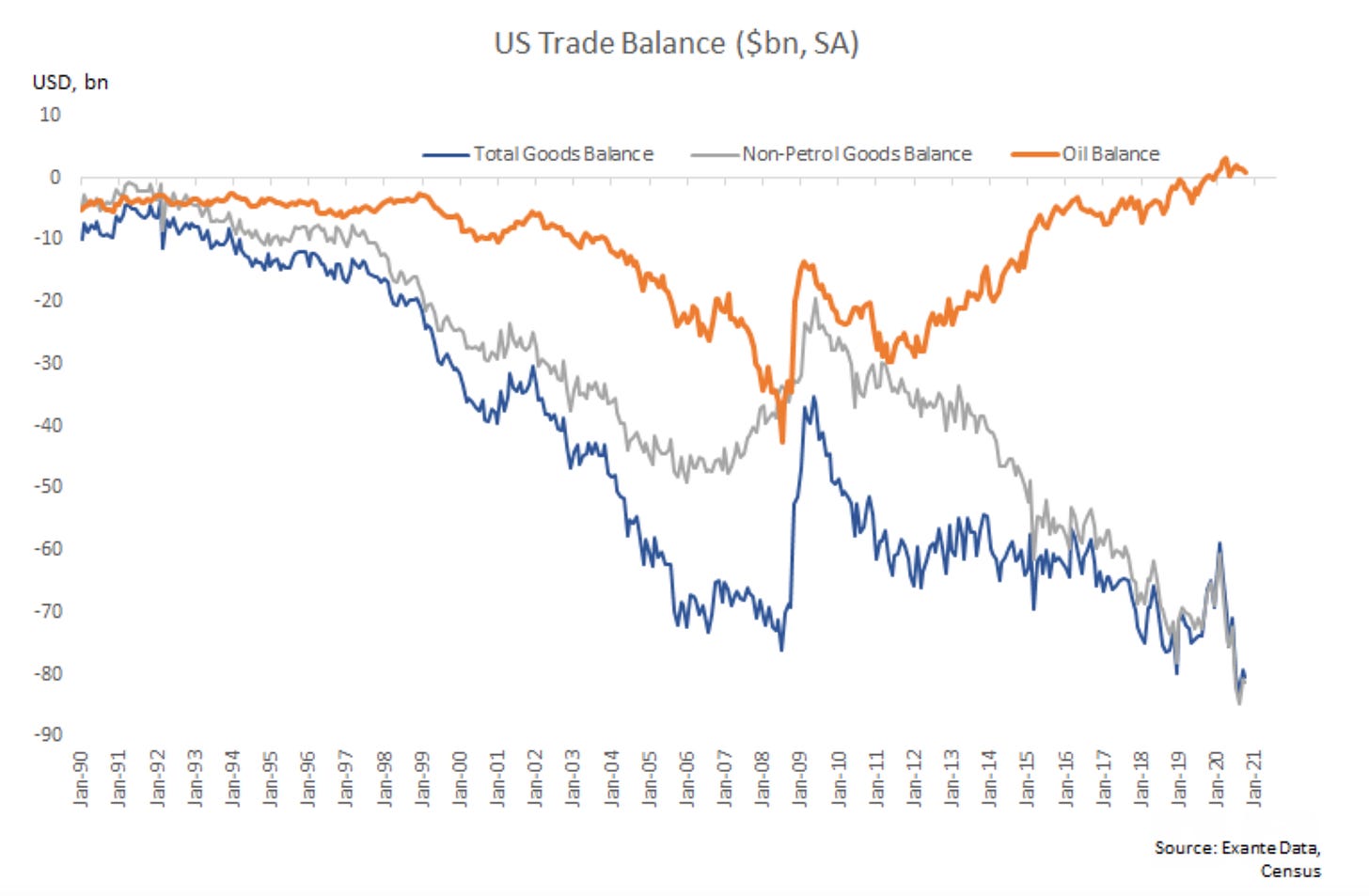

The deterioration has nothing to do with commodity prices. Oil prices (the most important commodity price) have generally been fairly low in 2020, and the US is no longer a big energy importer. The chart below breaks down the trade balance in ‘petroleum’ and the rest, which we can think of as mostly manufactured goods.

Lower oil prices, and greater domestic US production (shale etc) of oil has seen the petroleum balance improve from a significant deficit over the last ten years, to now close to a neutral position. In fact, the US has a slight ‘energy surplus’ at the moment.

But at the same time the ‘non-petroleum’ balance has deteriorated dramatically, and 2020 has seen further deterioration. The monthly deficit on this measure was as low as $20bn/month at the depth of the recession in 2009, but it had widened to around $60-70bn/month ahead of the COVID shock, and now it has risen further to around $80bn/month.

Hence, a big part of the widening current account deficit is simply a function of higher non-petroleum imports (in the region $50-60bn exta per quarter).

There has been additional deterioration in the services balance, linked to a combination of lack of tourism revenue and less income from services, such as eduction, and there have also been special factors at play (such as weak aircraft exports).

What is special about the 2020 cycle?

But sticking to the big picture, two factors really stand out:

First, massive US stimulus, especially in April has seen something unprecedented happen. We had a big economic downturn. But incomes went up! (due to very large government transfers, via stimulus checks etc.)

Second, consumers cannot consume services like normal, but they can consume goods. If they do not want to leave their house, or go to the store, they can order pretty much everything on Amazon, or another online outlet.

The chart below shows consumption of goods (especially durable goods) has quickly bounced back to above the pre-COVID trend, even if services consumption remains depressed.

The chart below then shows consumer spending with a longer historical perspective. It shows how consumption patterns in the COVID crisis are literally opposite what we saw in the Global Financial Crisis (after 2008).

The bottom line is that this cycle is very different from past ones, and with goods consumption now above the pre-COVID trend, this is sucking in imports, leading the overall current account deficit to explode.

Does it matter? How is the dollar impacted?

Over the last few decades it has been popular to link deficits with FX weakness. And there have been cycles in the past were so-called US twin deficits were associated with USD weakening cycles.

But the relationship is complex. If you study the link between current accounts and currency moves in G10 countries over the last 20 years, you will find the perhaps counter-intuitive results that countries with deficits have tended to perform better than those with surpluses. This is especially the case when taking into account carry, and Australia is a prominent example of that (as highlighted in the last post: What is Good Money?)

The explanation is that in the past, it has been the countries with strong growth and higher interest rates, which have had the deficits; and strong growth and higher interest rates is currency supportive. We started to see that for the dollar in 2014-2016, but it a broader pattern globally.

The question is: what regime are we in now? The Fed has promised Average Inflation Targeting, meaning no preemptive monetary tightening, before realized inflation is somewhat above 2%. This means that the Fed will not mess with this pending recovery. They are committed to easy monetary policy for longer, so to say.

This also means that we can have a widening US current account, with no offset from monetary policy. The yield curve, is likely to be more stuck. In fact, that is the Fed’s goal (even if it is not explicitly called yield curve control). And this means that the USD will likely continue to suffer. As such, twin deficits are now actually clearly bad for the dollar, with fewer caveats than in the past.

Post-Script:

We have skipped over a couple of important topics, including a) the bilateral US-China deficit (which is moved very little by the trade war), and b) where the deficit is heading more specifically in 2021. But we will leave those topics to stand alone posts. You will have that analysis delivered directly to your inbox, if you subscribe to Money Inside and Out.

Jens,

There's little surprising in a weak linkage between current account movements and fx movements. One can think of an exchange rate as the relative price of goods or the relative price of assets. FX trades linked directly to trade tiny in relation to overall fx trades. In the case of the USD, 2019 total annual US trade (exports & imports) was about $5.6 trillion. Daily USD fx trades were about $6 trillion. Sure, expectations about trade and factor services flows (the constituents of the current account) can affect expected asset price moves, but interest rate differentials, domestic demand, perceptions about relative risk premia that are not chiefly determined by trade, especially in large, relatively closed economies are likely to play a critical role in exchange rate movements.

Lastly, how would you explain the evolution of the US current account in terms of national savings and investment trends given that the current account is just the gap between national savings and investment? A relative rise in US consumers' spending out of income coupled with a further deterioration in government savings (a higher fiscal deficit)? A surge in investment?

What are your findings for EM current accounts?