An Addendum to China BoP (Part III): Back in the Manipulation Game?

Some observations on "stealth intervention," bank net open FX positions and the mysterious recent surge in Chinese banks' FX reverse repo activity

Everyone is now focused on USDCNY approaching new lows and on intensifying pressure on the PBOC to lend the Chinese banking system a hand in managing the gobs of FX being thrown off by the current account surplus and net portfolio inflows (link link link). Hence, it now seems an opportune time to make a couple of additional observations and highlight a few interesting data points on this topic that have not been discussed elsewhere (link).

Some of this is necessarily more speculative and less conclusive than our earlier posts and we welcome feedback from others who follow these issues closely. We view the Money Inside and Out Substack as a tool for learning, both for readers and writers. As such, this is a pre-emptive warning that some of the stuff below is at the nerdy / wonky and of the spectrum.

Rising Net Open FX Positions: Bank of China as a Case Study

In Part 2 of our series (link) we noted the possibility that instead of “stealth intervention” by the PBOC, banks could simply be taking more FX risk via larger net open FX positions (lower hedge ratios). And since the banking system is largely state-owned, it could still be happening with a degree of government control.

The premise behind the stealth intervention hypothesis is that banks’ growing net foreign/FX asset position has to be “funded” (perhaps off-balance sheet) and thus hedged as banks typically do not like to take much FX risk (as it is usually constrained by regulators). Given the growth of the banks’ net long on-balance sheet FX position, the theory is that the funding could be coming from the PBOC via undisclosed off-balance sheet lending. But this off-balance sheet activity is difficult to observe directly as it typically takes place in FX derivatives markets or in the cross-currency swap market.

We should note however that there is some precedent for using the apparent funding “gap” to infer FX swap activity in this manner (link).

One other way to track some of this activity is through the financial disclosures of specific financial institutions. We have been tracking some of this from Bank of China’s (BoC) Annual Reports for a few years now. And while BoC is just one institution it is a major one, which may have implications (when scaled up) at a macro level.

The chart below shows BoC’s on balance sheet USD assets and liabilities from 2013 to 2020. As we can see, in the years prior to 2016 BoC's on balance sheet USD assets (blue bars) exceeded their liabilities (grey bars). But since 2016 the reverse has been true.

This is also shown in the chart below, which nets the on balance sheet USD assets and liabilities from the chart above (blue bars) and compares them to the net off balance sheet USD position (grey bars). As we can see, BoC went from a net long (short) on balance sheet (off balance sheet) position prior to 2016 to a net short (long) on balance sheet (off balance sheet) position since.

In other words, BoC used to be a net borrower in the FX swap market, but has become a net lender in the FX swap market, especially from 2017.

The orange dots in the chart net the on and off balance sheet positions to arrive at the net open USD position. Notably in 2020, total on-balance sheet USD assets rose by $40bn and total on balance sheet USD liabilities by $28bn. As a result, the net short on balance sheet position was reduced from -$53bn to -$41bn.

However, the net off-balance sheet USD position rose by $6.8bn from long $54.4bn to $60bn.

As a result BoC's net open FX (USD) position rose by about $18bn to the highest level since 2014.

In sum, in 2020 BoC increased on balance sheet lending by more than its on balance sheet borrowing and increased it’s lending via FX swaps.

The point here twofold: One BoC’s balance sheet, which provides a window into both on- and off balance sheet FX activity provides some micro-evidence of the growth in bank net foreign assets we have observed at a macro level. Further, there is some evidence of greater FX risk taking in 2020.

The second point is really about stealth intervention: The stealth intervention hypothesis: There is no reason a priori to assume that the PBOC or other official actors have lent FX to the banks ex ante. Is is also possible that banks have taken (or been allowed to take) more FX risk. Given they enjoy implicit or explicit government backing, there is no reason why banks could not be recapitalized (ex post) if they were to face losses on their open FX positions. In fact there is some precedent for using FX reserves to support bank recapitalization (admittedly in the now distant past - link).

Further as we alluded to in Part 3, the PBOC’s rather opaque “Macroprudential Assessment Framework,” originally announced in 2016, provides a ready means to subtly tweak banks’ net foreign asset and open FX positions (link) in this manner (in addition to FX reserve requirements on currency forwards and changes in FX denominated required reserve ratios - link link).

New Forms of FX Lending Activity

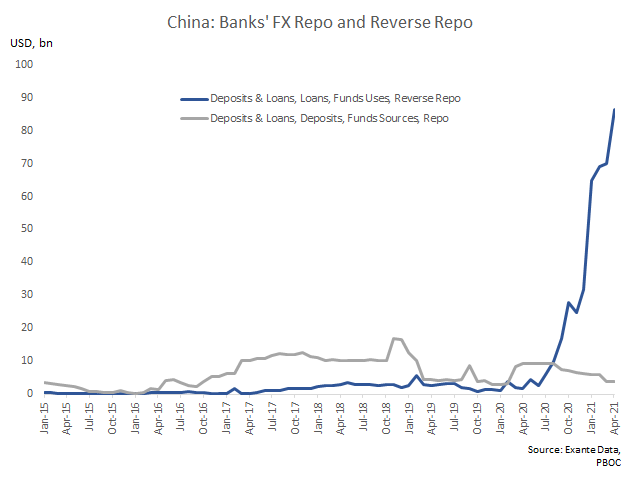

There is another interesting new recent trend in the data on banks foreign/FX asset accumulation that we think deserves more attention.

Data from the PBOC shows that FX reverse repo (effectively collateralized lending) by Chinese banks surged in 2020 to reach close to $100bn in April 2021. Historically Chinese banks FX assets and liabilities have consisted almost exclusively of loans and deposits. But the surge in interbank lending (via reverse repo) in recent quarters is quite stark.

As shown in the chart below the increase in reverse repo lending has been (alongside overseas loans) one of the key drivers of FX asset accumulation over the last year.

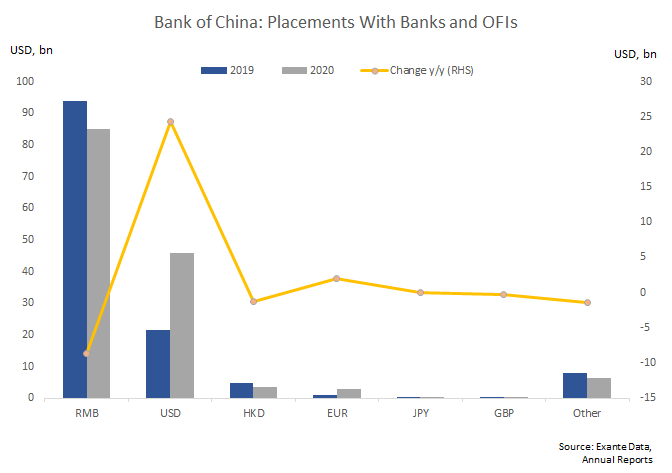

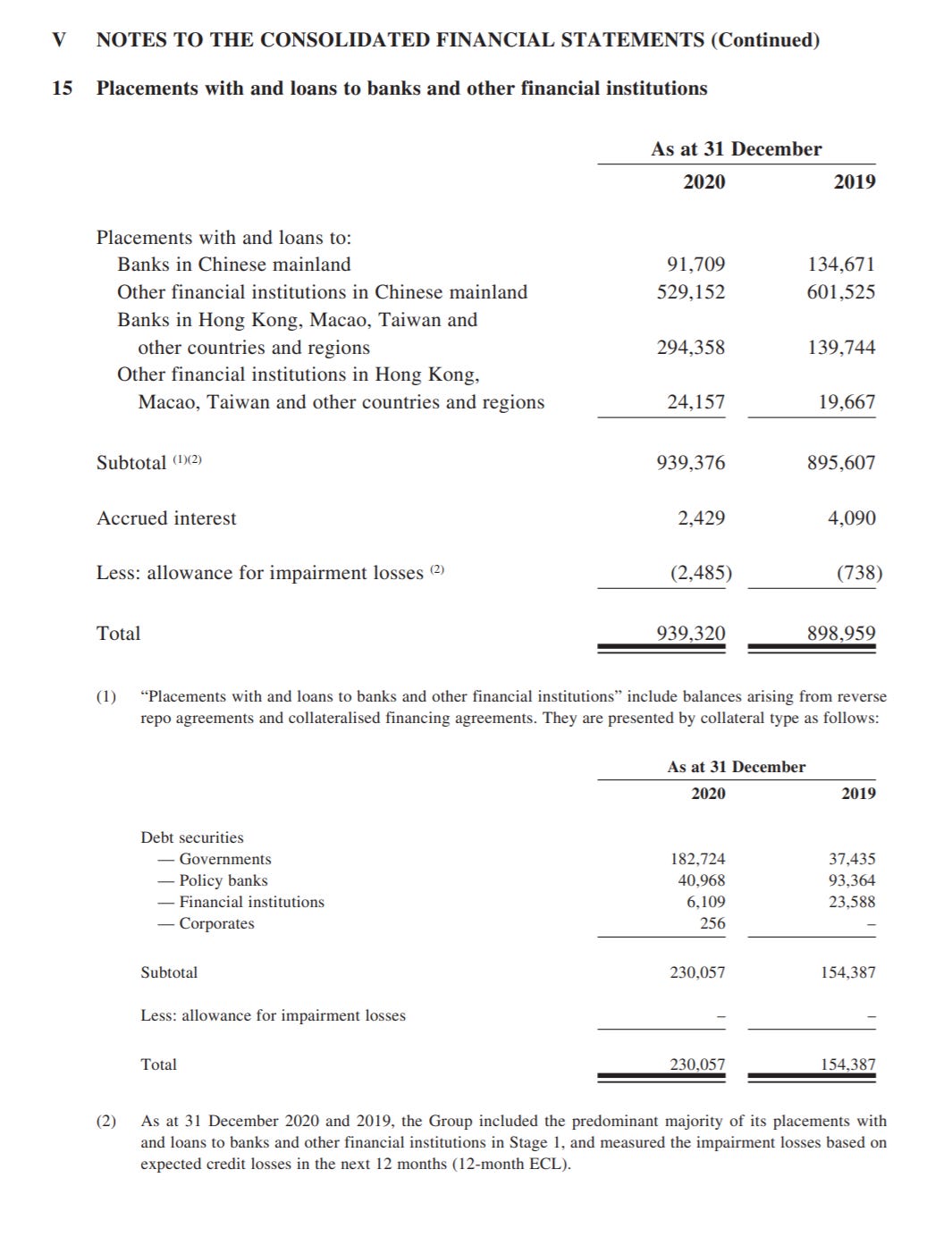

Here too, there are some potentially interesting linkages looking at BOC’s annual reports. Among BoC’s on balance sheet USD assets, the biggest increase was registered by 'placements with banks and OFIs.' This line item increased by $24bn in 2020 (along with balances with central banks).

Looking across currencies, 'placements with banks and OFIs' in RMB remain the largest, but fell by $8.6bn in 2020 while those in USD rose by the aforementioned $24bn.

As for the linkage to repo/reverse in the macro data, BoC indicates in its statement on accounting principles (II.6) that repo and reverse repo transactions are included in placements with/balances due to banks/central banks.

Note V.15 provides a broad geographic breakdown of these placements. Not surprisingly the geographic breakdown closely matches the currency breakdown and annual changes by currency noted above.

In 2020 placements on the mainland (in RMB) of $95bn ($85bn) declined by $11bn ($9bn) while those offshore (in FX) rose by $26bn ($23bn).

In sum, the macro data show a new (and to our knowledge little noticed) trend in the Chinese banking system’s FX lending via very rapid growth in FX reverse repo activity.

Here again, BoC provides some clues: In addition to a larger net open FX position, in 2020 BoC reduced onshore RMB reverse repo lending and increased offshore USD reverse repo lending.

Conclusion: China Remains Deeply Enmeshed Global Dollar Funding Markets

There is currently a strong and justified focus on three trends within the Chinese balance of payments and banking system.

1) China’s balance of payments has been very robust over the last year.

2) Foreign asset accumulation by the banking sector has been a net result of this strength.

3) The resulting appreciation pressure on the RMB has been met with a sequence of intensifying counter measures by Chinese authorities to slow this appreciation.

But as is often the case with China, the issues are complex and opaque and there are some mysteries that remain unresolved:

A) Is the PBOC engaged in “stealth intervention” analogous to that conducted by Taiwan?

B) Could the PBOC really be intervening in derivatives markets (without disclosing it) and providing tens (or hundreds) of billions of dollars in off balance sheet funding to commercial banks?

C) Are authorities simply tweaking macroprudential tools and capital flow measures to enable banks and corporates to take more currency risk by reducing hedging requirements?

D) What should we make of the recent surge in Chinese banks’ offshore FX denominated reverse repo activity?

We do not have conclusive answers to all these questions. But one thing remains clear: China’s remains deeply enmeshed with global USD funding markets even as the channels continue to evolve.

Whereas in the past it was a fairly straightforward, with the PBOC conducting spot FX intervention and buying US debt, since 2015 in particular the dynamics are changing. More recently, the recycling of the current account surplus has happened outside the central bank balance sheet: Through the growth and internationalization of the Chinese banking system. It will be important to watch if this will continue or begin to shift with the development of the onshore asset management industry and progressive liberalization of portfolio outflows.

But it seems likely that so long as China runs a current account surplus (and the majority of its trade is denominated in dollars), and as global investors add more RMB denominated assets to their portfolios, someone somewhere in China is going to have plenty of dollars to lend.

Well done, Alex! One question: Do you know what are BOC's USD assets by type? I mean, equities, bonds and etc? This info is available?

Wauw, thanks for this very insightful article. Although unanswered, those are some very good questions, time will tell..