China BoP (Part III): Back in the Manipulation Game?

Official comments are not the whole story. The data show more direct and indirect intervention (again).

In Part 1 of our series on China's BoP amid the pandemic, we looked in detail at the sources of China's very strong current account surplus (link). In Part 2 we focused on the offsetting capital outflows, including the important role of bank NFA accumulation (and the possibility of "stealth intervention") (link).

In Part III below we look in more detail at recent intervention trends. With USDCNY moving below 6.40 and a flurry of commentary from Chinese officials on the exchange rate, it is a crucial time to evaluate PBOC FX policy. While ‘words’ matter as signaling devises, we pay very close attention to both the ‘direct’ intervention by the central bank and indirect intervention via the banking system.

Based on all the available information, we conclude the following:

First, recent commentary from Chinese officials suggests the debate on how heavily to manage the exchange rate and how much to let it appreciate is ongoing and not finally settled. The communication has been a muddle.

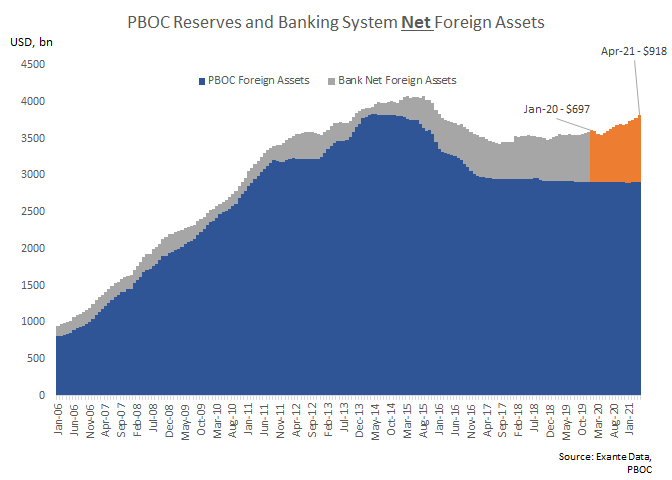

Second, the data tell a clearer story. At about $30bn per quarter, PBOC foreign asset accumulation in Q4 2020 and Q1 2021 has been the highest since 2017/18. And Chinese banks also continue to grow their net foreign assets. These capital flow trends seem designed to “balance” the FX market in lieu of direct intervention.

Third, while policy makers talk about FX flexibility, and even if FX management is increasingly done via asset accumulation outside the PBOC, we are still detecting some ongoing intervention directly by the central bank. Our proprietary model suggests increasing intervention - FX buying/CNY selling - again in May (as detailed in the conclusion).

Muddling the Message

There has been intense and wide-spread pushback from Chinese authorities this week against growing speculation that the RMB will be allowed to appreciate to offset the impact of higher import/commodity prices on inflation.

The debate heated up last week, when Lu Jinzhong, head of Research and Statistics at the PBOC Shanghai branch, said that China should “appropriately appreciate the RMB to deal with imported inflation.” Our impression is that this led some funds to position themselves for further USDCNY downside. But the article (link) was later removed and pushback followed (link, link, link).

Today the semi-official Securities Times noted that “The central bank has basically withdrawn its normal intervention in the RMB exchange rate” (link in Chinese) but as we show below and detailed in Part 2 (link) this does not preclude state-banks stepping in to curb appreciation instead (link).

Amid this muddle, it is important to let the data speak…

PBOC FX Accumulation Highest Since 2017/18

At Exante Data, we track FX intervention very closely.

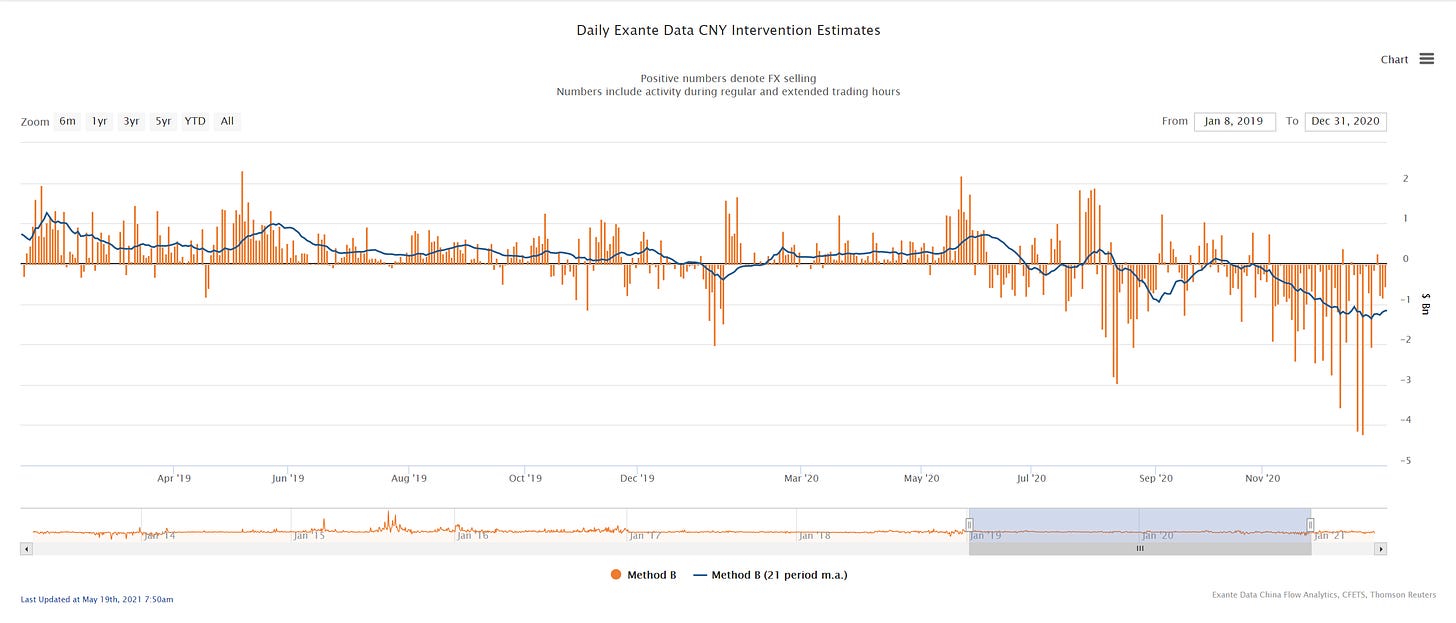

In China's case, our proprietary model is daily and available to us essentially in real-time. Our model alerted us to the acceleration in FX accumulation (shown as negative orange bars below) to multi-year highs in Q4 2020 well before the official data became available. [we cannot show a fully updated version of this model, given its proprietary nature, but provide a hint of recent readings in the conclusion at the end].

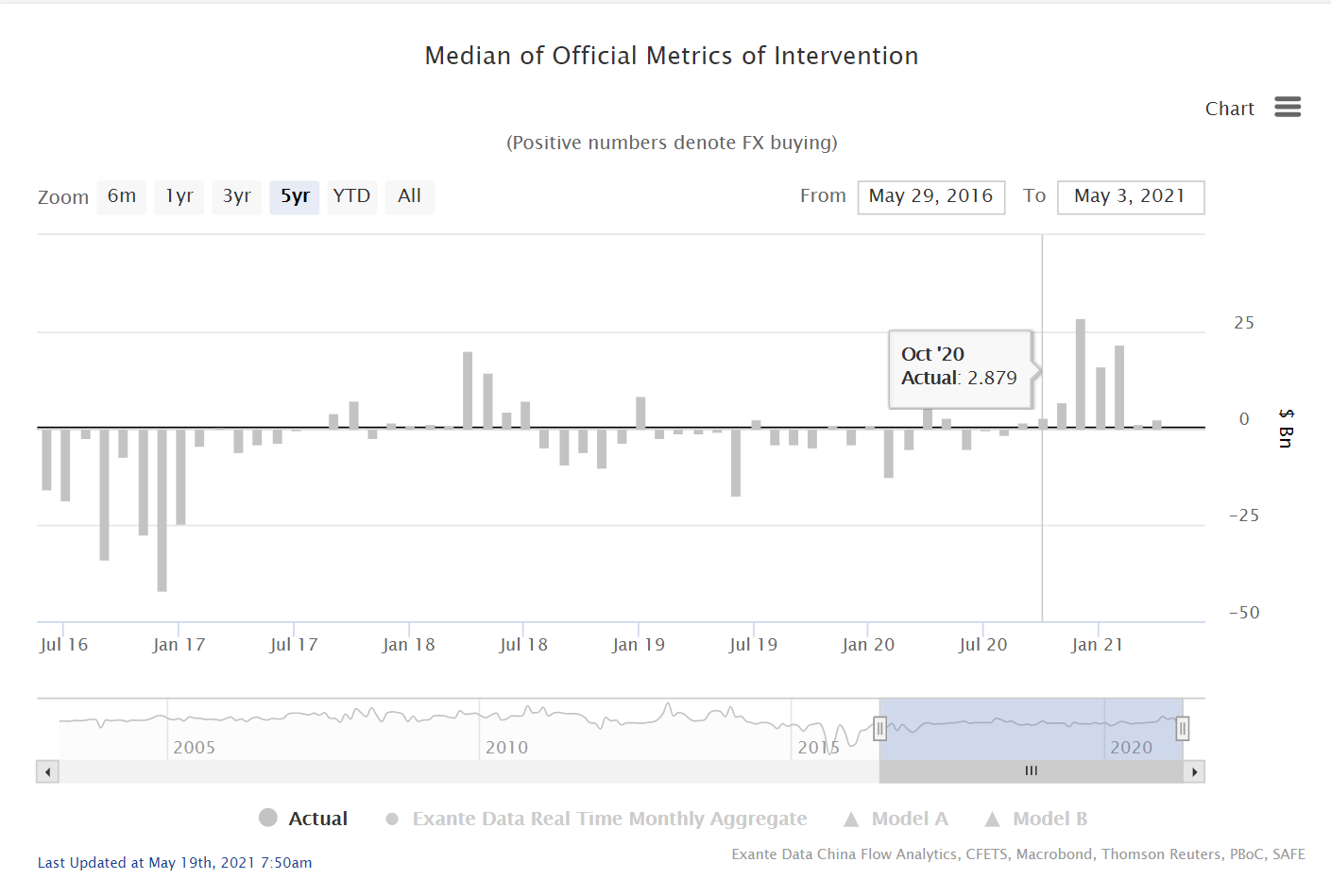

We also track all available monthly data sources from official sources in China (PBOC balance sheet, FX reserves, SAFE data) very closely and indeed these showed a notable pickup in FX purchases from October.

Each of these three monthly intervention proxies has its pros and cons and historically they have generally moved in-line with one another. But since there are sometimes discrepancies between them, we typically take the median as our intervention proxy (shown above). In recent months the discrepancies between the different intervention proxies have been especially stark (chart below). For instance Q4 2020 and at the start of 2021, the signal from the PBOC balance sheet and FX reserves showed no sign of meaningful intervention. But the data from SAFE (dotted yellow line) suggests very substantial FX purchases (totaling about $164bn from September to March).

As the SAFE data includes the banking system (ie not just the PBOC), this discrepancy provides prima facie support for the notion that state/commercial banks were behind a large part of the foreign asset accumulation in H2 2020 detailed in Part 2 (link).

Additionally, we now have quarterly balance of payments data (which we regard as the most authoritative source on intervention) through Q1 2021 and it shows that our intervention proxies remain highly accurate and that indeed reserve accumulation by the PBOC of about $30bn per quarter is the highest since 2017/18.

Indirect Intervention Remains Murky

While the pickup in official reserve accumulation in the BoP in recent quarters is noteworthy, it was nowhere near sufficient to offset the rise in the current account surplus and net inflows via FDI and portfolio debt. As we discussed at length in Part 2 (link) the foreign asset growth of the banking system is a key channel for recycling FX inflows.

This a not a new phenomena. It has been true since roughly 2015—but the pace accelerated notably in 2020 following the COVID crisis.

Data on the PBOC balance sheet, the banking system, the SAFE data cited above, and news reports (link) all point to the same conclusion: PBOC direct intervention may have moderated (certainly relative to pre-2015), but the banking system as a whole continues to accumulate FX assets.

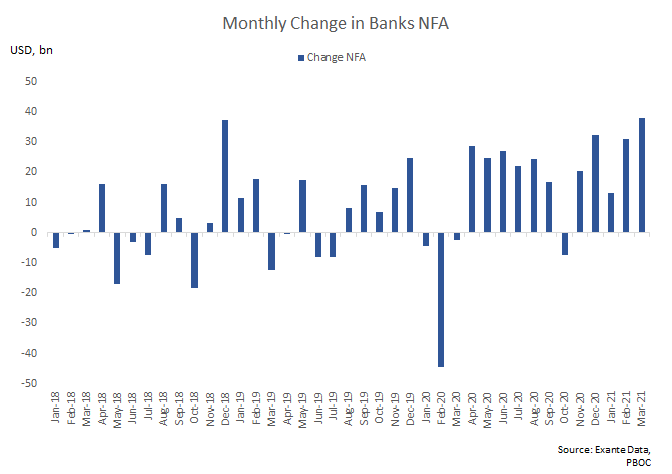

So far, data for 2021 point to continued accumulation of FX assets in the ‘private’ banking system of roughly $20-$30bn per month, with $37bn in April (latest available).

Its is challenging to track the hedging and off balance sheet activity of the Chinese banking and corporate sector in part because Chinese regulators are constantly tweaking macroprudential and capital flow measures related to their cross border activity.

Earlier this year, we saw regulations tweaked to increase corporate lending to offshore affiliates (link link in Chinese) and reduce overseas borrowing (i.e. increase net foreign assets). In February they took aim at foreign banks (link) which drew the ire of the European Chamber of Commerce (link) and now appears to have been reversed (link).

Conclusion

While we cannot show all the details of the most up-to-date readings on Exante Data’s real time intervention model, we can provide some hints:

In recent days our daily intervention model has again pointed to signs of FX accumulation/CNY selling. Specifically, Since mid-April, when USDCNY moved below 6.50 our models shows > $15bn in FX purchases, and the strength of these signals have intensified over the last week with the move below 6.40, suggesting that the current intervention pace is larger than that.

While there are reasons to expect the BoP pressures supporting RMB appreciation to moderate in coming quarters (maybe a topic for Part IV…), for now the main thing standing in the way of the CNY is the PBOC (and the state banks) getting back into the “manipulation game.”

At at minimum, this intervention is likely to slow the appreciation speed. And if China decides to draw a more firm line on the RMB, this could even limit downward pressure on $/Asia and eventually the dollar more broadly.

For more information, please visit www.exantedata.com and follow us on twitter: @ExanteData