Is it to be Diem versus DCEP?

Diem, most typically associated with Facebook, is being pitched as a counterweight to DCEP. This is the start of a big conversation. The systemic implications extend to crypto, CBDC and USD as well.

This post follows on January and February, where I argued that a new era of digital currencies was upon us. The extent of media interest and central bank engagement with the topic since supports this view.

I have highlighted a few times that too much emphasis has been placed on crypto, even if there is no questioning Satoshi’s whitepaper as the genesis.

I have also contended that the most systemic changes will occur via Central Bank Digital Currencies (CBDC) rather than crypto per se. And that China’s project, DCEP, is by far the most systemic of all.

This is still my view. However, it is timely to consider Diem, the digital currency typically associated with Facebook.

There are three steps today.

First, some high-level background on Diem. Second, my view on why Diem is now likely to gain regulatory approval (hint, it is to do with DCEP). Third, some early comments on the systemic implications.

I should add that I am not a ‘friend’ of Facebook. I was publicly critical of the decision to deplatform Australia back in February: here and on CNBC, here.

So, as with DCEP, my perspective should not be interpreted as what ought to happen: it is a view on what will happen.

On background, most will be aware that Diem was initially launched as Libra in mid 2019, before being rebranded late last year. This was partly for optics (to create more distance from Facebook), and partly to reflect the significant changes that have occurred with the project, principally driven by regulatory feedback and commercial expedience.

The Diem Association maintains a comprehensive archive of resources online. For those starting out, I recommend Whitepaper v2.0 (here), particularly Section 4: Economics and the Libra Reserve. For technical aspects, the developer site is best: see here. This hot take from Lopp in 2019 was also widely read: here.

It is also worth reviewing the Novi wallet (here), as this is the means by which Facebook will capture transactions data (Novi is a subsidiary of Facebook, and holds one of six board seats on the Association).

Note that the Association has emphasized that Novi does not have exclusive provenance to Diem, in that alternative Virtual Asset Service Providers (VASP) are encouraged. But the Novi wallet is certain to predominate, and will be available even to those without a Facebook account, or Instagram, WhatsApp, Messenger, for that matter.

The scope of the project is vast.

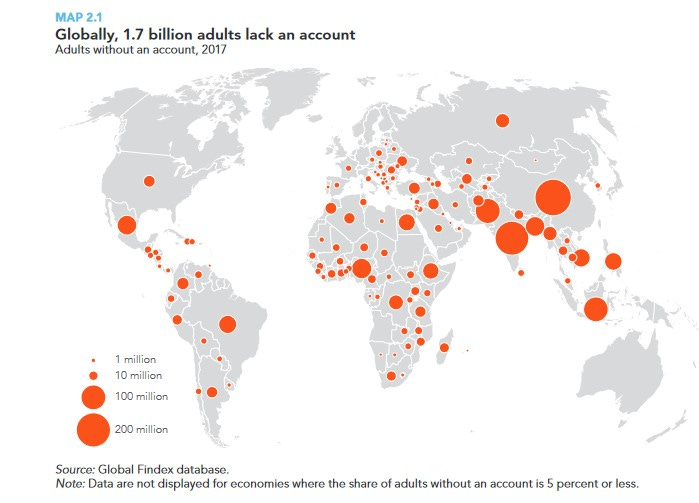

It reflects Facebook’s enormous reach (~2.8 billion monthly users), along with the network effects that brings. Cross border remittances are an obvious use case, and as is targeting the unbanked cohort. The World Bank estimated this at 1.7 billion adults in 2017.

Novi has also confirmed that peer-to-peer payments will support business, and that “additional merchant services” will be added online, in-app, and in-store over time. Facebook’s marketplace will be a natural venue for deployment.

Note that Novi remains coy on fees, and that this is the billion dollar question for Facebook (see below). According to Novi: What you send is what they get. You can add, send, receive, and withdraw money from your wallet without worrying about hidden charges. Novi is cutting fees to help people keep more of their money.

With average costs on remittances often cited in the 5-7% region, the opportunity for monetization is hugely significant, in my view (for more, see here). Moreover, “cutting fees” is distinct from Diem being fee-free. There will clearly be a monetization model.

On the technical side, the main shift from inception was the introduction of fully reserved single-currency stablecoins, as distinct from a multi-currency, SDR-like, basket.

White Paper v2.0 also provides more detail on how the reserves underpinning Diem will be managed, including during periods of market stress. It specifically commits to the development of a regulatory capital framework with “an appropriately sized, loss-absorbing capital buffer”. It also suggests income accruing to the Reserve will be used to cover the costs of running the network.

The first White Paper also envisioned that Libra would evolve into a permissionless system, using proof of stake. This has since been ceded to regulators. Hence, Diem will remain architecturally distinct from public blockchains (ie crypto).

A permissioned system will facilitate more oversight, and also greater throughput than where crypto currently stands. This is typically measured in transactions per second (TPS).

There is much speculation online in terms of how Diem will perform on this basis, including versus DCEP and Visa/Mastercard. There has also been a testnet in place over recent months, that has been materially slower that the 1,000 TPS referenced in the original Whitepaper. For those seeking more background in this area, the following table is from here, and there is various scuttlebutt online.

On timing, I do not know for sure. The project has been held up by the Swiss Financial Market Supervisory Authority (FINMA) over the past year, with the Diem Association seeking a payments system licence.

It makes sense that the Association was set up in Switzerland, as an independent member organization. Switzerland is a crypto-friendly jurisdiction, and obviously has a storied financial history. There is also no equivalent for a payment systems license in the US.

FINMA remains tight lipped per protocol: In accordance with its usual practice, FINMA will neither provide public information on the status of the ongoing procedure nor speculate on when it may be complete.

But the project is clearly progressing, including via various high level executive appointments. You can also find various reports touting an imminent launch, most credibly here.

The broad attitude of regulators was summarized by Mark Carney in 2019, then as Governor of the Bank of England, stating that the project “would instantly become systemic and will have to be subject to the highest standards of regulation”.

This speech in December by RBA Governor Lowe also confirms the “regulatory college” that Swiss authorities put together. He highlighted that the “initiative has raised concerns from governments and regulators in many jurisdictions regarding a wide range of issues including consumer protection, financial stability, money laundering and privacy”.

It remains to be seen how individual countries respond once the payments license is issued. But US authorities will certainly have been at the table.

Note as well that Mark Zuckerberg committed in testimony to Congress in 2019 that: “Facebook will not be a part of launching the Libra payment system anywhere in the world, even outside the U.S., until the U.S. regulators approve”: here. Hence, my working assumption is that once the license is confirmed Diem-USD will launch soon thereafter.

Beyond this, Diem-GBP is the most likely candidate. This partly reflects the less than welcoming reaction in continental Europe (see here, for example), along with the difficulties of managing the Reserve with negative interest rates.

Diem-JPY is possible, but Facebook has a relatively small user base in Japan (see below).

It would be a step too far to involve emerging market currencies early on, even if Facebook has a large presence in many countries, especially India, Indonesia, Brazil and Mexico. The risks of currency substitution preclude this, at least early on.

Finally, note that Facebook has been blocked in China since 2009. Hence Diem-CNY will be off-piste, especially with DCEP in play.

On regulatory approval, I said at the turn of the year that a key question was how long regulators could keep their finger in the dyke: here.

A couple of updates.

First, central banks, including the Fed, are now speaking much more openly about CBDC - see here, for example. This confirms not just the broad trajectory, but an implicit recognition of the threat posed by DCEP.

Second, I highlighted last time this report from the Australia Strategic Policy Institute (ASPI) on DCEP.

This remains the most thorough analysis of the project available in the public domain, and highlights how DCEP, fully conceived, has the scope alter the strategic balance as between the US and China. Here is the executive summary:

I also noted last time that this report was funded by a grant from Facebook. So I am not drawing a long bow in suggesting that part of the Association’s pitch to regulators will have been to highlight the multiple threats posted by DCEP, and offer up Diem as a counterweight.

I should mention as well that no Western central bank will be in a position to launch a CBDC any time soon. This extends beyond the technological and implementation challenges. In Sweden, for example, where the transition toward a cashless society is most advanced, commercial banks have been pushing back hard against the Riksbank’s proposal on an E-Krona: see here.

Net, my read is that we have come full circle.

When Libra landed central bankers around the world, including at the PBOC, reacted by accelerating the development of CBDC. Now, the Association, in part by iterating the project to address the concerns of regulators, and especially due to China’s aggressive rollout of DCEP, can make a cogent strategic policy case in favor of approval and launch.

I will not be surprised to see this occur in Q2. If it does happen, it will confirm my public stance that Diem is a “bad idea, whose time has come”: here.

On the systemic implications, it is too early to say, but not too early to speculate. Here are three early calls.

First, for Facebook, this could really change the game. Bear in mind that most technology analysts view Facebook as under-monetized versus their global network. Its dominant source of revenue remains digital advertising, in its various forms.

Diem potentially opens an entirely new and scalable revenue source, most of which will flow through to the bottom line.

Facebook’s net income is around $20 billion, on revenues of around $70 billion. You can do the math. But is it unrealistic to expect say 100 million users, not out of the gates, but over time? Is it unrealistic to expect these users to part with, say $100 per year, however structured, for a faster, cheaper, stable and more integrated payments mechanism? I would say no and no.

If the largest social media company in the world by some distance is able to commandeer a chunk of the global payments system I expect it will make a lot of money.

Diem may additionally add value to Facebook’s ad-tech to the extent that users opt-in to merging their social and financial identities. This is a hot button issue for privacy advocates. Facebook has said the two will remain separate, and perhaps in many cases that will hold. But the history of big tech is hardly encouraging in this respect. Nor is the tendency for users to prioritize convenience over privacy, and digital hygiene more generally.

Second, there will be much discussion of what Diem means for crypto.

Unsurprisingly, evangelists are both critical of Diem as centralized, but also broadly of the view that it will spur further digital adoption, and is therefore a bullish development. This is consistent with “bitcoin always goes up” view of the world: see here for example.

One aspect to flag is that the Association, currently comprised of 27 members, does have some notable crypto representation, including Coinbase, Blockchain Capital and Paradigm – here. So we can expect the pro-crypto narrative to be pushed, and for interoperability to become a feature.

The big question is whether these on-ramps, say from USD to Diem to BTC, actually become off-ramps either to USD and verified fiat more generally, or to store value / build applications in Diem.

In this context, parallels will inevitably be drawn between Diem-USD, and stablecoins such as Tether (USDT), USD Coin (USDC) and Binance USD (BUSD). The market capitalization of these is pushing $50 billion, with USDT still in the lead, despite recent controversies. These coins, along with DAI, are heavily integrated in the crypto architecture, including decentralized finance. The use case for Diem-USD is much broader, as are the potential network effects as well.

To be sure, I am not suggesting that Diem will be the development to crack the crypto rally. But it will certainly be important to watch the reaction at the time.

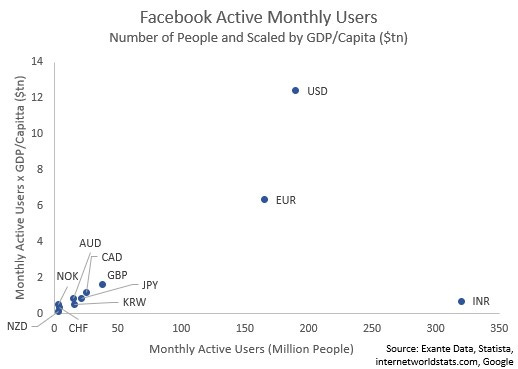

Third, on flows from fiat, again, we will have to wait and see. But it is helpful to visualize Facebook’s user base (see here and here), as this will be the most likely source of early adopters.

Rather than raw numbers it makes sense to income adjust these data, even if using a crude measure such as per capita GDP. In doing so we have aggregated users within the euro area. So the Y-axis in our charts represents a proxy for the annual income of users in US trillions.

The first chart is zoomed out, the second zoomed in, and the third is by major currency.

The key points here are:

the US has the second largest number of users, and is clearly the largest when adjusted for income;

India has the largest number of users, but only eighth when adjusted for income;

the euro area has a large number of users in aggregate and with high incomes;

the UK ranks next, then Canada, Brazil, Mexico and Japan.

While only a proxy, this illustrates the potential of macro-relevant flows from EUR to USD to Diem. Bear in mind that Diem-USD is a digital dollar in disguise. If Europe does not have the same, I expect the ‘across the pond’ narrative will start to build.

Finally, note that we will also have a new macro indicator to play with, that could evolve into a key indicator for the USD more generally. The Association has said they will publish the Reserve daily. Give it some thought:

The administration of the Reserve will be transparent to the public. The Reserve will be audited on a regular basis by independent auditors. The results of those audits will be made publicly available to demonstrate that all Libra Coins in circulation are fully backed by matching assets comprising the Reserve. The Association will publish on its website on a daily basis the then-current composition of the Reserve and the then-current market value of the assets.

Conclusion

Diem could be launched at any time now. And it will be a big deal when it does.

I am not suggesting that “would instantly become systemic”. It is more likely that the project rolls out gradually, and that it iterates along the way, as it navigates jurisdictional and technological headwinds.

But Diem clearly has the prospect of becoming systemic, including as a counterpoint to DCEP in many markets, as a de facto digital USD.

While I do not have all the answers today, the conversation is an important one, and worth having early.

This an outstanding piece Grant, thanks

So, interesting.

I'm thrilled that CH gave me an introduction to you and so your newsletter.

Great articles on CBDCs (and Diem as a proxy).

DCEP, a market event with so many implications.

If no Western central bank is ready with an alternative and Diem stands in place, it is time to consider all the ways that "my" market expands to the entirety of the FB (monthly) user base, becoming an economic block orders of magnitude larger than simply the contiguous USA.