China's digital currency is a game changer (Part 2)

We have received an enormous amount of feedback on China's digital currency project since January. We will be writing each month here as a consequence. This is our update for February.

In early January I argued that a new era of digital currencies was upon us. I highlighted the importance of framing the conversation beyond crypto, so that central bank digital currencies (CBDC), and other systemically important initiatives, such as Facebook’s Diem, were included.

More controversially, I contended that the most systemic changes will occur via CBDC rather than crypto per se. And China’s project, DCEP, is by far the most systemic of all.

Chris Marsh and Alex Etra have chimed in with some great posts since, on the mechanics of CBDC issuance and the evolution of China’s balance of payments through the pandemic.

I have also contributed on point via a segment with CNBC, here, with WisdomTree’s podcast, here, and through my regular column at the Australian Financial Review, here.

Over the intervening period there have been a couple of key developments:

i) On Feb 3 it was reported that Ant Group had reached a deal with Chinese regulators to restructure as a financial holdings company with capital requirements. The next day, it was reported that Ant Group would divest Sesame Credit, its consumer-credit entity, that was profiled in depth by Wired in 2019 here.

ii) On Feb 10 it was reported that the PBOC had commenced a joint venture with SWIFT, the dominant cross-border financial network.

iii) Meanwhile, the PBOC continued with its digital currency (DCEP) lotteries, including in Shenzhen over the Lunar New Year. Interestingly, this iteration required that residents spend e-yuan within city limits, providing a disincentive to travel, mindful still of COVID-19 (showing some of the additional ‘functionality’ of the e-yuan).

For today’s update, I introduce an important resource from the Australian Strategic Policy Institute (ASPI). This is the most comprehensive article available online, in terms of how DCEP is set to intercede upon geopolitics, and even national security agendas.

I then provide a technical point of distinction as between DCEP and CBDC more broadly conceived, that is currently not well understood.

I then add some context to recent developments, and look ahead to March.

To start, when I wrote back in early January I was blissfully unaware of the hard-hitting report from ASPI in October titled ‘The flipside of China’s central bank digital currency’, here.

This runs to nearly 9,000 words, so it is not for the feint of heart. But it is a critically important contribution, that was meticulously researched and that illustrates first hand how DCEP is resonating through the upper echelon of defense and strategic think tanks in the West.

For reference, ASPI is the preeminent right-leaning think tank in Australia, with close links to the Department of Defense. That context is important to understand, as is the signoff, that notes the report was funded by a grant from Facebook. While this does not detract from the scholarship, it does serve to highlight the competition I previously alluded as between DCEP and Diem.

Here is the summary take on CBDC:

This is heavy stuff, but ASPI backs it up. It is a compelling read, that I fully recommend.

Second, on DCEP itself, there is still a lot we do not know. But there is also a key misunderstanding to address at this early stage.

In mid-December Zhou Xiaochuan, who is without doubt China’s foremost monetary technocrat, having governed the PBOC between 2002-2018, made an important contribution of his own via the China Finance 40 Forum, here.

This is also a must read, in terms of how DCEP has been conceived, including in terms of its near term implications for duopoly payment providers Alipay and WeChat Pay / QQ Wallet (market share is ~94%).

The most surprising claim is that DCEP is not a form within the CBDC system. And relatedly, DCEP and CBDC are built on different ideas.

Let me be clear that while this is technically accurate, there is no escaping that DCEP will broadly be perceived as a CBDC, including by citizens, who are being pitched an e-yuan.

The basic argument that Zhou makes, whereby DCEP is not a formal liability of the PBOC, and that the design is akin to how note issuing banks in Hong Kong operate, is fundamentally sound. But as ASPI highlights, these are nuances when viewed from the systemic level. Indeed, it is likely advantageous from a strategic point of view, to present DCEP in these terms.

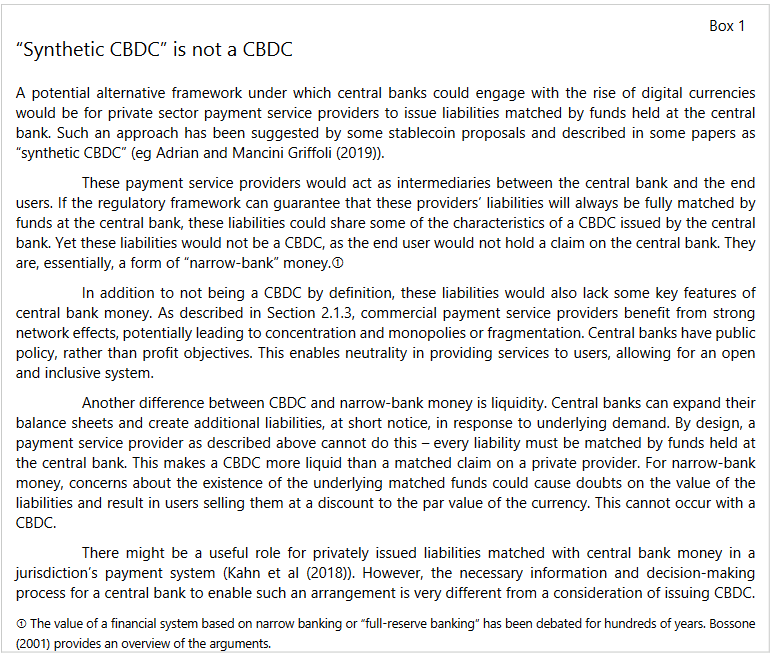

To be sure, the BIS agrees with Zhou, at least at the technical level. In their collaborative report from September, ‘Central bank digital currencies: foundational principles and core features’, here, the BIS included the following carve-out regarding ‘synthetic CBDC’:

Yet this is again a semantic exercise. Even if DCEP is more accurately described as a synthetic CBDC, it will continue to be viewed as CBDC from the bottom up and the top down.

There is no escaping this.

Third, as far as recent developments go, these serve principally to illustrate the CCP’s commitment to the project, in my view, including via coercive tactics.

In respect of Ant Group, the restructuring announcements dovetail almost perfectly into the template provided by Zhou, and specifically in terms of including third-party online payment platforms within the ‘second layer’, and thereby requiring them to have sufficient capital to cushion risks.

In keeping with the CNBC segment above, my view remains that the long-run strategic objective is to displace Alibaba and Tencent, in terms of their control of the domestic payments system. This will facilitate an integration of DCEP into the social credit system, and beyond international borders as well.

Here is a neat visual representation of the choice that awaits consumers.

In respect of the SWIFT tie-up, some were surprised when this was announced, as it appears to represent cooperation with respect to DCEP, if even DCEP represents a threat to SWIFT. The better read comes courtesy of the Global Times, Beijing’s populist mouthpiece, here, attributed to SWIFT, as follows:

We have been part of China’s financial markets for more than 30 years, connecting it to the global financial system by facilitating payments and securities flows across borders, and, as we do everywhere we operate, we make adjustments as necessary to remain compliant with regulatory requirements.

Make of it what you will.

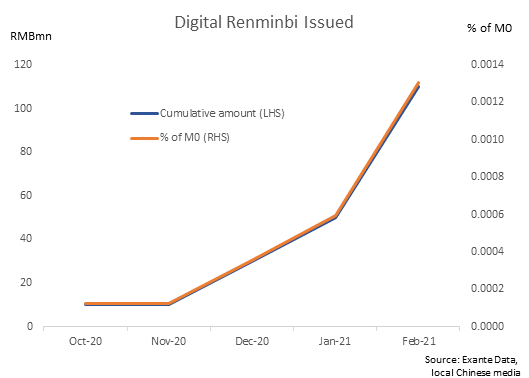

In respect of recent digital lotteries, it is full steam ahead.

Our first chart captures the lotteries in Beijing and Shanghai in January, and then Shenzhen in early February. While the amounts remain irrelevant from a macro perspective (shown in terms of M0), the ramp is clear and will continue to accelerate.

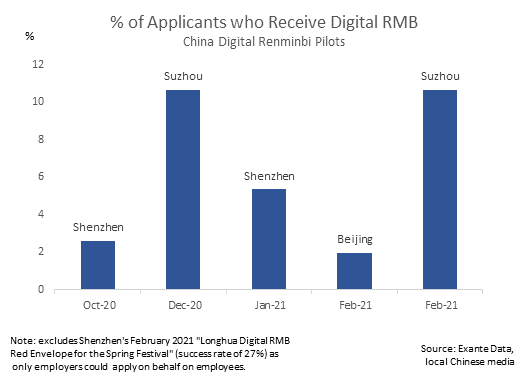

Our second chart highlights, as best we can, the strong uptake of the lotteries, in terms of over-subscription.

While these data are hard to come by, this is not a surprise.

As I mentioned last time, DCEP has been designated as legal tender by the PBOC, and is literally giving money away (while requiring it is spent in good time).

Those suggesting that DCEP will face difficulties in terms of adoption should reflect.

Conclusion

In this update I have highlighted a key analytical resource from ASPI for those looking to go deep on DCEP. The report confirms our first take in terms of the immense strategic importance of this topic.

I have pushed back against semantic attempts to reclassify DCEP as anything other than CBDC. Whilst there are technical arguments in favor of this, it is important see DCEP for what it is, rather than facilitating a trojan horse.

I will follow up again in March.

For those expecting anything other than a highly kinetic CCP sponsored advance in this area, including across the various stakeholders described above, prepare to be disappointed.