Saudi Arabia's PIF and the new petrodollar recycling

The 2022 annual report for the Public Investment Fund provides some clues as to just where all the money went

The re-cycling of petrodollars has become harder to track since they no longer accumulate mainly as central bank reserves;

Sovereign Wealth Funds are one outlet for such funds. Where are they invested?

We have previously written extensively about the impact of the surge in energy prices over the course of 2021 and 2022 on global imbalances (link) and the surpluses of OPEC+ (link link).

But one of the perennial mysteries has been how and where the surge in petro-dollars has been recycled. As The Economist noted earlier this year, drawing heavily on our work on this subject (link), the answer has been a mix of strategies including:

Lower accumulation of formal FX reserves held by central banks in traditional reserve assets (i.e., developed market bank deposits and sovereign bonds);

Repayment of external debts accumulated during the decade of low oil prices from 2014;

Transfers of FX to sovereign wealth funds (SWFs) for currency and asset class diversification (i.e. a greater tilt towards equities and ‘alternatives’ such as private equity and credit;) and

Geopolitically motivated bilateral external lending to weaker regional peers in need of balance of payments support.

In the case of Saudi Arabia, the Public Investment Fund (PIF) has been central to these efforts (especially (3) above). Hence the recent release of PIF’s 2022 Annual Report provides an opportunity to reflect on the role of one of OPEC’s newer and more enigmatic SWFs.

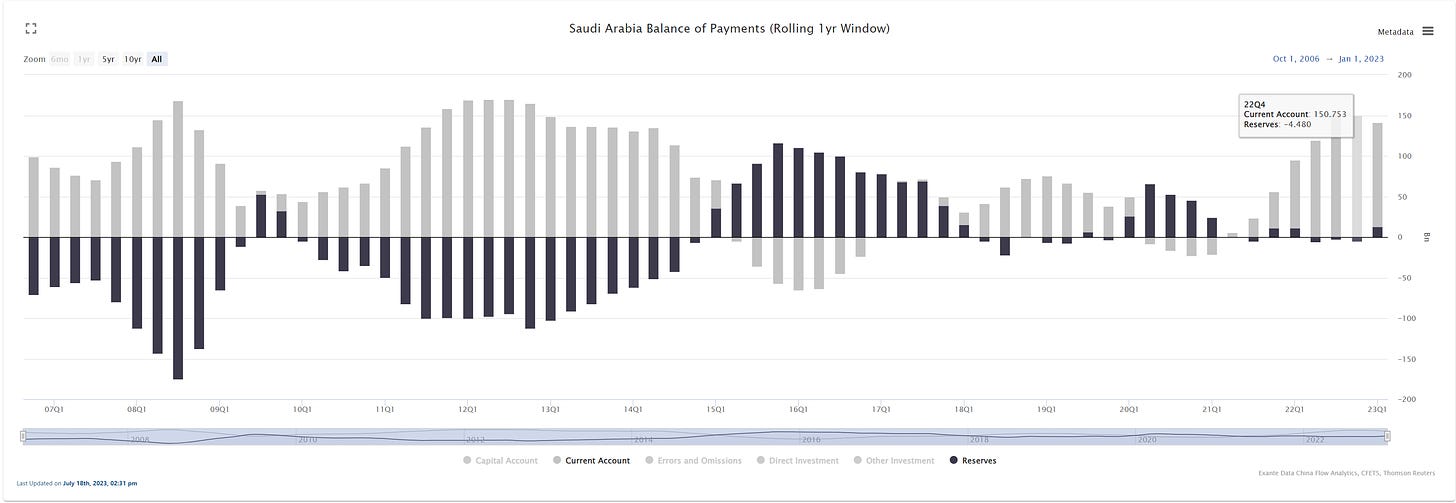

Official BoP data shows limited accumulation of official reserves in 2022

Saudi Arabia’s official balance of payments (BoP) data shows the Kingdom enjoyed a current account surplus of $150bn in 2022, which was the highest since 2012.

Since the BoP has to balance, this means Saudi Arabia’s net international position rose by $150bn—a process that can be accomplished either/both by reducing liabilities to non-residents or increasing holdings of foreign assets.