To catch a falling knife: US Treasuries and the Fed (Part 3)

Financial plumbing: help or hindrence?

In Part 1 we noted how financial plumbing has always been a central concern to US monetary-fiscal interactions, and that the US Federal deficit in 2021, despite private attempted dissaving, will still be largely met by domestic private sector saving as incomes accelerate. Part 2 noted this year’s deficit financing will be different, however, as the Treasury is issuing more price sensitive financial liabilities, meaning markets are being asked to absorb greater duration risk into a reflationary backdrop—making Treasury auctions trickier to navigate. Here, in Part 3, we ask how financial plumbing helps absorb this deficit?

The uncertain issuance outlook for US Treasury securities this year is compounded by a series of subtle financial plumbing issues.

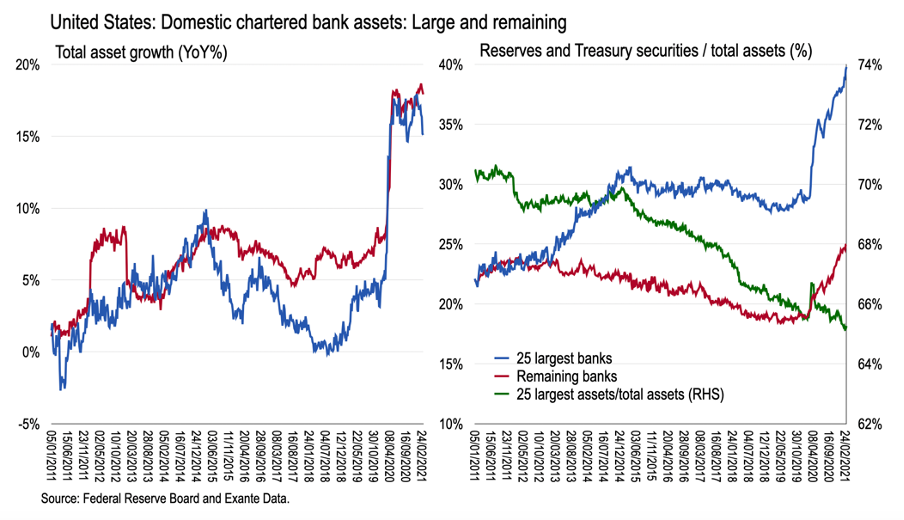

If US banks were able to increase their balance sheets sharply, as in 2020, then any financing concerns would be ameliorated as commercial banks intermediate household savings once more. Such was the logic of the SLR relief introduced last April—SLR being the ratio of their Tier 1 capital to on and off balance sheet exposures (not risk weighted). For smaller banks SLR is set at 3 percent, for G-SIBs at 5%.

Earlier this month, however, the Fed confirmed the SLR relief applied to banks’ holdings of reserves and Treasuries will expire as originally planned at end-March 2021. The market response to this news from the Fed was a 5bps spike in yields that quickly reversed, suggesting little concern about expiry for now.

This matter is not completely resolved, however, since the Fed also invited public consultations on possible SLR modifications:

“because of recent growth in the supply of central bank reserves and the issuance of Treasury securities, the Board may need to address the current design and calibration of the SLR over time to prevent strains from developing that could both constrain economic growth and undermine financial stability.”

But did the SLR really bind? Total bank assets (not adjusted for off balance sheet exposures) for the largest 100 banks reveals Tier 1 capital easily exceeds assets at about 8 percent. JP Morgan, the largest bank with about USD3 trillion in assets, had a ratio of Tier 1 capital to unweighted assets of 7.7 percent as of 2020Q4. Adjusting for various off balance sheet exposures, SLR falls to 6.9 percent; further excluding Treasuries and reserves on which temporary relief is applied, this falls further to 5.8 percent. So expiry of this relief did not immediately mean that the 5 percent lower bound on SLR is binding. This was likely true for other banks too. There was no reason for banks to shed balance sheet. Hence expiry of the relief was something the Fed could contemplate and the market reaction was not significant.

What limits banking system size?

But this is not the only concern for banks. As Zoltan Pozsar, the “king” of financial plumbing, has argued (see this excellent Bloomberg podcast) banks also wish to avoid G-SIB surcharges and to achieve a reasonable return on equity for investors. Continued balance sheet expansion into low-risk but low-return assets (such as reserves at the Fed) is inconsistent with adding shareholder value, therefore. In short, rapid bank balance sheet expansion, as happened in 2020, is unlikely to repeat with or without SLR relief.

Indeed, as Pozsar and Fed Guy have emphasised, large banks have been applying greater charges and pushing away the their least desirable deposits such as “wholesale unsecured deposits and non-operational deposits.” This effort to shed deposits will accelerate as the the Treasury further draws down TGA balance and Fed asset purchases continue to create new reserves.

Re-directing the pipes of the financial system

But where will these deposits go? Well, some will migrate to smaller banks. But many will seek non-bank financial intermediaries, such as Money Market Funds (MMFs), as an outlet for their savings. The problem is that MMFs prefer to hold T-bills and other low duration assets of which there is an increasingly limited supply given the Treasury funding planned a decline in the outstanding stock of T-bills from USD5 trillion to USD4 trillion by mid-2021. With cash flowing into MMFs and a growing shortage of money market instruments the yield on Treasury bills is being pushed to zero or beyond.

Presumably in anticipation of this challenge, on the margins of last week’s FOMC meeting the Fed “directed the Open Market Trading Desk (the Desk) at the Federal Reserve Bank of New York to conduct overnight reverse repurchase agreement (ON RRP) operations with a per-counterparty limit of USD80 billion per day [from USD30 billion], effective March 18, 2021.”

The ON RRP facility can be accessed by 16 banks, 15 GSEs (inc. FHLBs) and 90 MMFs. By increasing the counterparty limit, the FOMC has provided headroom for the expected expansion in the AUM of non-bank financial intermediaries, and MMFs in particular, in place of traditional commercial banks.

Indeed, in recent weeks, as TGA deposits at the Fed have been drawn down (due to transfers to the general public as part of Biden’s stimulus efforts), MMF assets have begin to increase with ON RRP bids accepted by the Fed have reached above USD100bn for the first time since the period of financial stress as the pandemic emerged. For now, the Fed’s plan regarding the plumbing of reserves is working.

What about duration issuance?

This works for cash saving by the public. But what happens if Treasury plans to substantially increase both the weighted average maturity of government debt (as they suggested they would in February) are realised?

If banks will not absorb this issuance, then someone else will have to do so. Among residents, households can hold claims directly on the government or via bond or pension funds. Alternatively, non-residents may look to take advantage of rising yields in the US.

If so, there will be a hand-off from rapid money supply growth in 2020 to the expansion of non-bank intermediaries in 2021, reminiscent of the Fed’s very early years when recycling of Liberty Bonds from bank balance sheets to the public was an objective to counter inflation pressure.

How fast will this happen? Much will depend on the pace at which the Treasury attempts to lengthen the maturity of new issuance throughout the year. If they slow the pace of planned T-bill roll-off, they can limit the pressure on duration assets and provide more money-like instruments. This would avoid an unnecessary steepening in the yield curve driven by purely by technical considerations potentially inconsistent with the Fed’s AIT framework.

Curiously, although Secretary Yellen no longer works at the Fed, her potential influence on the yield curve today could be even greater than it was when she was Fed Chair. And it may indeed be the case that the Treasury will have to respond dexterously to the demand conditions it observes in coming months, to avoid pockets of excess supply and unwanted yield curve volatility.

Back to the beginning

This brings us full circle back to the early days of the Federal Reserve System. As noted previously, under the influence of the real bills doctrine, it was then accepted wisdom that the extension of credit by banks to the government, by expanding the money supply, was inflationary. In issuing Liberty Bonds directly to the public they hoped to affect a disintermediation, limiting the money supply to head off this inflationary threat.

The situation is very different today, of course. We have moved on from a simplistic quantity theory view of money and the price level. Today’s banks are close to exhausting their willingness to absorb Treasuries and Fed reserves on purely profit grounds, and new government financing has to find expression instead through non-bank financial domestic intermediaries or non-residents (the mix of which will matter to the dollar).

But just as in the 1910s, financial plumbing and monetary-fiscal interactions remain crucial to policymakers and financial markets. Not out of fear of inflation, however. Rather simply to arrange the financial setup in a way that doesn’t create disruptive asset price volatility.